Solana (SOL) tumbled on June 16 among a wider retreat over the top cryptocurrencies, brought through the Federal Reserve’s .75% rate of interest hike each day before.

Solana cost rebound fizzles

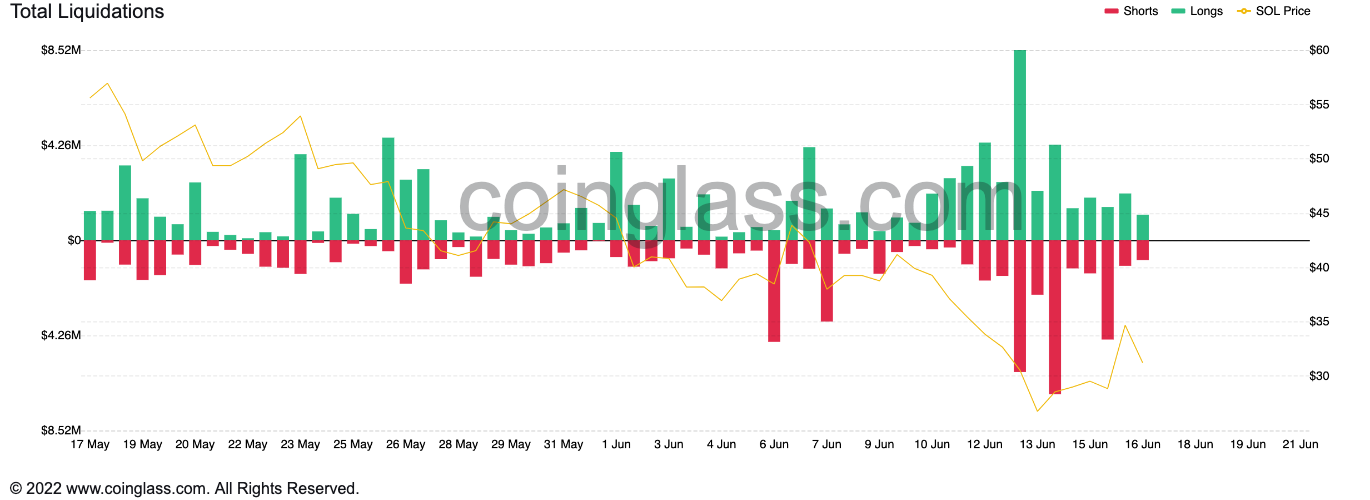

Particularly, SOL/USD stepped nearly 17% to $30 an expression, eliminating the majority of the gains from yesterday. The SOL cost volatility liquidated almost $ten million price of contracts previously 24 hrs across multiple crypto exchanges, data from Coinglass shows.

The most recent declines be extra time to SOL’s broader correction, where it came by greater than 90% after peaking out near $267 in November 2021. SOL also fell to the cheapest level since This summer 2021 near $25.

Additionally, a greater rate of interest atmosphere and also the collapse of high-profile crypto projects like Terra have strengthened SOL’s downside prospects.

SOL paints “climbing triangular”

Solana’s pullback move ahead June 16 started after testing a horizontal trendline resistance near $34 that constitutes what seems to become an “climbing triangular” pattern.

Climbing triangles are continuation patterns, i.e., they have a tendency to transmit the cost in direction of their previous trend. Usually, breaking from a triangular pattern inside a bearish market, for instance, transmits the cost lower up to the structure’s maximum height.

If SOL breaks below its climbing triangle’s lower trendline then your bearish profit target can come below $22.50, as proven within the chart below.

Solana’s downside target is all about 25% below June 16’s cost and is achieved through the finish of June. Nevertheless, if SOL bounces after testing the triangle’s lower trendline as support, it might eye the $34–$36 range since it’s interim upside target.

Massive SOL exit

Over 27 million Solana tokens have exited it’s good contract ecosystem since June 13.

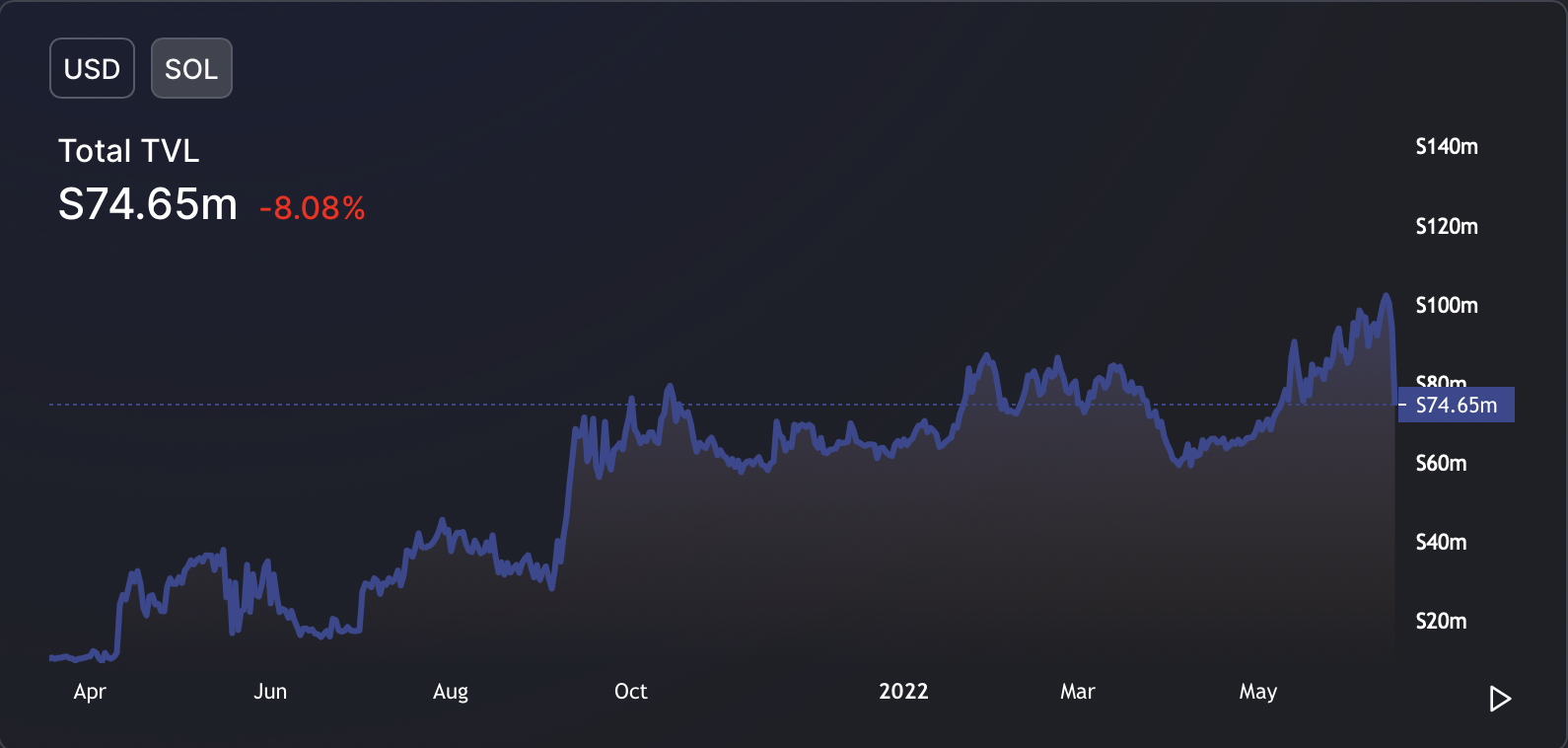

The entire value locked (TVL) inside Solana smart contracts dropped to 74.sixty five million SOL (~$2.25 billion) on June 16, lower 27% within the last 72 hours, according to data tracked by DeFi Llama. That comes down to nearly $840 million of withdrawals in the ninth-largest blockchain ecosystem by market cap.

Solend, a lending platform functioning atop the Solana ledger, observed a 26.5% loss of its TVL within the last 72 hours and it was holding 9.66 million SOL (~$290 million) by June 16. Nonetheless, it continues to be the leading platform by TVL inside the Solana ecosystem.

Related: Liquidity provider asks platforms to freeze 3AC funds to recuperate assets after litigation

The outflows indicate that depositors don’t want to maintain their SOL kept in DeFi protocols, a sentiment common over the sector after Terra, an “algorithmic stablecoin” project, collapsed recently.

Contagion, another yield ponzi going lower.

Seriously get the coins off anything like Celsius and BlockFi before they are not your coins any longer.

LFG, 3AC, Celcius etc all spread risk to one another and also you spend the money for cost for this https://t.co/cemFCvAeAz

— Pentoshi Powell Junior (@Pentosh1) June 16, 2022

Therefore, Solana’s road to least resistance remains skewed towards the downside soon, particularly without any improvement when it comes to macro and fundamentals.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.