Solana (SOL) has lost 60% of their market price per week because of its contact with the now-defunct crypto exchange FTX, that could still haunt the “Ethereum killer” well to return.

FTX/Alameda exposure hurting Solana cost

FTX and it is sister-firm Alameda Scientific studies are prone to have total control 50 plus million SOL, based on Solana’s statement released on November. 10.

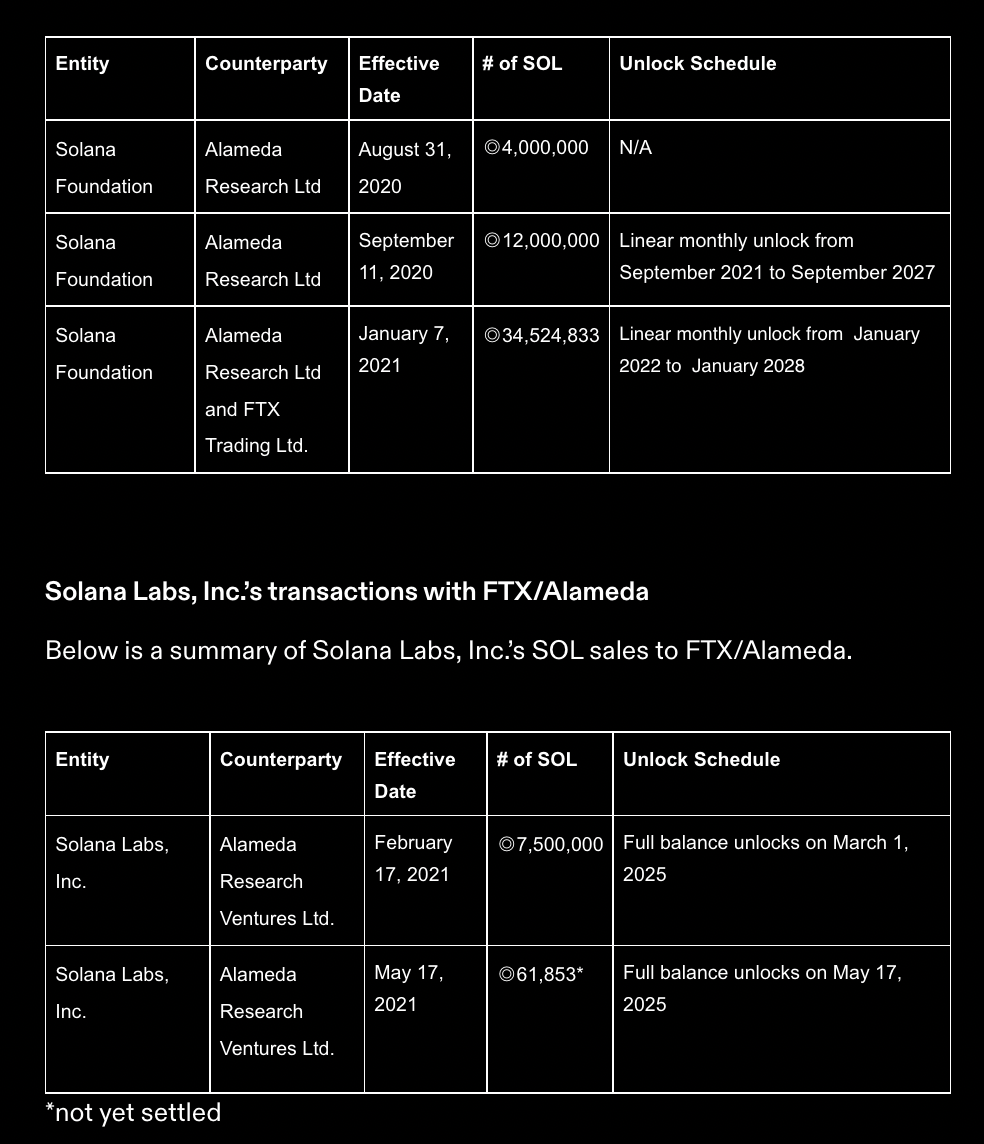

The FTX entities received 4 million SOL in the Solana Foundation on August. 31, 2020. Additionally they began getting a part of 12 million SOL from Sep. 11, 2020, and nearly 34.52 million SOL from Jan. 7, 2021, via a “straight line monthly unlock” mechanism.

In addition, the FTX entities began receiving servings of a 7.5 million SOL reserve from Solana Labs on February. 17, 2021. Particularly, a transaction worth 62,000 SOL between your same entities stands unsettled.

Most SOL tokens guaranteed to FTX/Alameda are vested, meaning the firm doesn’t yet ask them to in child custody but is prone to receive them with the straight line monthly unlock mechanism. The last of those unlocks will occur by The month of january 2028.

That leaves the marketplace with interpretations by what can happen towards the SOL tokens after they are unlocked, given FTX’s personal bankruptcy filing that’s prone to place a freeze on all remaining funds.

my prediction may be the bky trustee will sell everything OTC to obtain funds to repay creditors

— DeFiNanner v2 (@ZekesMommasKid) November 14, 2022

Also, the firm apparently has $9 billion in liabilities versus a $1 billion balance sheet, that could prompt its trustees to liquidate its SOL holdings to pay back debtors.

To prevent this type of scenario, Solana might make technical changes to the token economy, reducing FTX’s impact. One recent governance proposal posted on November. 13 presented a couple of options that may be up for grabs, including:

- The errant allocation is burned.

- Increase the lock to ten years around the errant allocation.

- Airdrop all SOL token holders’ additional SOL, except for that party holding the errant allocation.

- A mix of the above mentioned.

SOL cost relief bounce?

Theoretically speaking, Solana shows indications of bullish divergence between its cost and relative strength index (RSI).

A bullish divergence materializes when an asset’s cost forms lower lows nevertheless its momentum indicator form a greater low. Traditional analysts view it like a buy signal, which may lead to a brief-term SOL cost recovery on its daily chart.

SOL/USD could rise toward $18, its range level of resistance, in case of a brief-term recovery. Quite simply, a 20% rebound.

Related: Liquidity hub Serum forked by developers after FTX hack

But on longer-time-frame charts, SOL often see further decline toward $2.50, or perhaps an 80%-plus drop, in 2023, with different giant mind-and-shoulders setup proven below.

Interestingly, the token’s downside target falls in the most voluminous range, per its Volume Profile Visible Range, or VPVR, indicator.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.