A current cost rally within the Solana (SOL) market ran from steam halfway as traders’ attention now use crypto-focused hedge fund Alameda Research’s insolvency rumors.

Alameda Research insolvency rumors affect SOL

On November. 7, SOL’s cost stepped nearly 6% to around $30.50. The intraday selloff came as part of a wider pullback trend that began on November. 5 when SOL peaked around $38.75. Between now and then, the Solana token is lower over 20%.

The start of SOL’s plunge coincided with reports that Alameda Studies have liabilities worth $8 billion but might not have liquid assets on its balance sheet to satisfy individuals obligations.

Interestingly, the need for all individuals assets stepped synchronously previously 48 hrs — including SOL, in addition to FTX Token (FTT), Serum (SRM) and Oxygen (OXY) — on fears of cascading liquidation if Alameda Research becomes insolvent.

1. low liquidity tokens

$4.6bn from the assets have been in low liquidity tokens:

⚰️ $SOL

⚰️ $SRM

⚰️ $MAPS

⚰️ $OXY

⚰️ $FIDAapart from SOL there’s not a way to liquidate all of those other holdings without completely crashing the markets

the final 4 out there are highly dillutive too!

— otteroooo (@otteroooo) November 7, 2022

Google partnership, NFT growth

Nonetheless, traders demonstrated curiosity about holding SOL’s cost above $30, a tech support team level, on November. 7. One good reason might be a flurry of positive news that emerged over the past weekend, such as the launch of smartphones, DApp stores, along with a Google Cloud partnership.

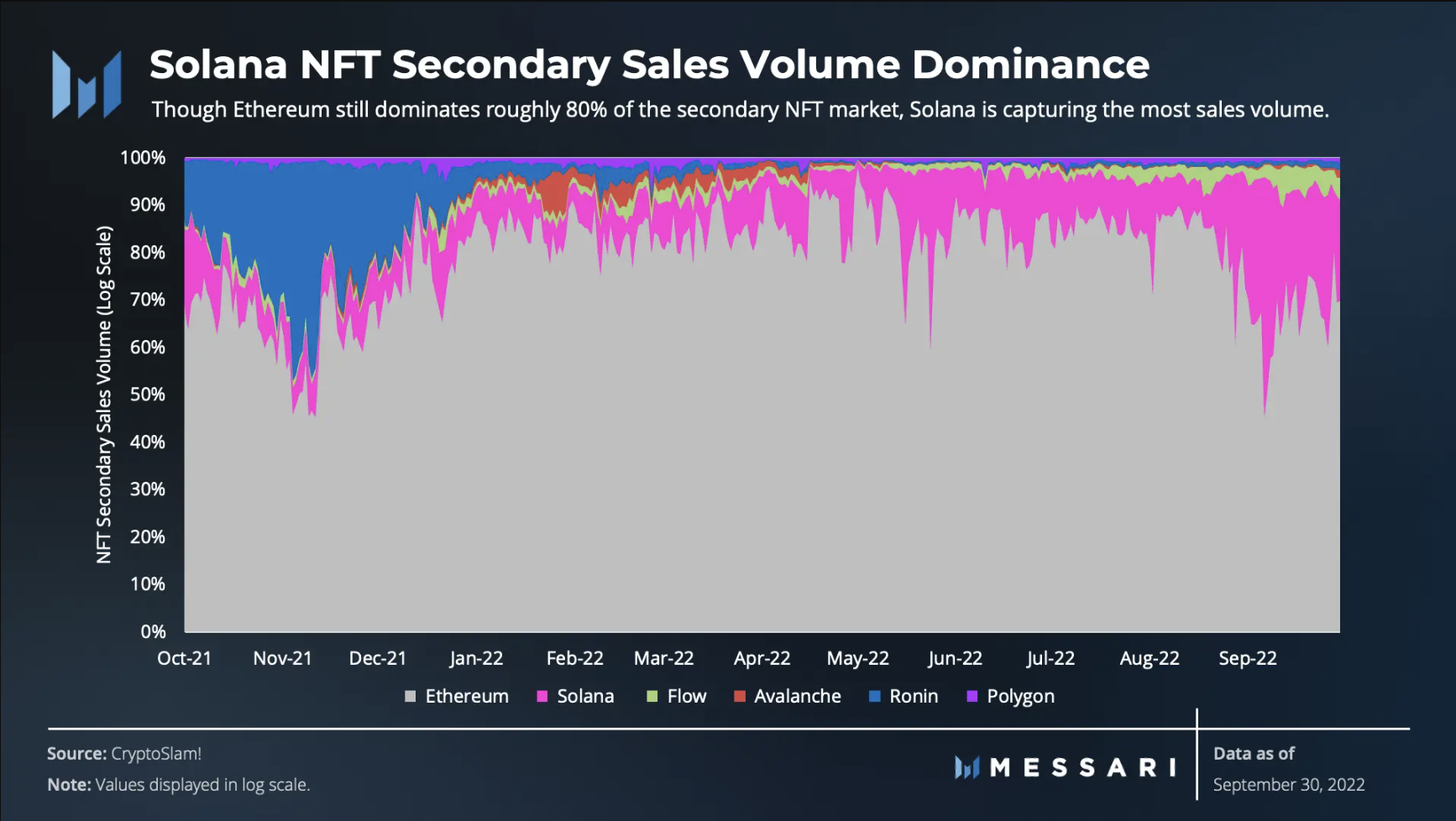

Additionally, Solana continues gaining greater traction within the nonfungible token (NFT) sector. For example, the entire quantity of NFTs released around the Solana blockchain expires 19.3% quarter-over-quarter to achieve over 8 million in Q3 2022.

“Several developments across Solana’s NFT sector permitted it to keep a powerful position in accordance with a peer number of the very best L1s by secondary NFT product sales,” noted James Trautman, investigator at data resource Messari, adding:

“Secondary product sales were able to eclipse Ethereum at the begining of September. A lot of the activity in that period required put on Magic Eden V2.”

On November. 2, Instagram added support for Solana-based NFTs, enabling users to produce, sell and market their most favorite digital arts and collectibles.

50% SOL cost rebound?

As pointed out above, the SOL price’s correction demonstrated indications of exhaustion if this retested $30 since it’s support level on November. 7.

Since August 2022, two rebound moves out of this support line saw SOL recovering to almost $37, excluding once once the cost tucked toward $27.75 in October. The same cost ceiling, along with a multi-month climbing down trendline resistance, was instrumental in capping the Solana token’s cost rally within the week ending November. 6.

Related: Solana’s co-founder addresses the blockchain’s reliability at Breakpoint

A rest over the $37 resistance line might have SOL test the $44.25-47 range after that, or perhaps a 50% cost rally when measured from current cost levels, by December 2022

On the other hand, a long selloff underneath the $27.75-$30 support area risks delivering SOL’s cost close to $19.50, or about 40% less than today’s cost.

The $19.50 level offered as support between March and This summer 2021, as proven within the chart above.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.