Solana (SOL) cost rallied by roughly 75% two several weeks after bottoming out in your area near $25.75, however the token’s splendid upside move is vulnerable to an entire wipeout because of an ominous bearish technical indicator.

A significant SOL crash setup surfaces

Dubbed a “mind-and-shoulders (H&S),” the pattern seems once the cost forms three consecutive peaks atop a typical level of resistance (known as the neckline). Particularly, the center peak (mind) involves be greater compared to other two shoulders, that are of just about equal height.

Mind and shoulders patterns resolve following the cost breaks below their neckline. By doing this, the cost falls up to the space between your head’s peak and also the neckline when measured in the breakdown point, per a guide of technical analysis.

It seems SOL continues to be developing an identical bearish setup on its longer-time-frame charts.

Around the weekly chart, the token continues to be developing the best shoulder from the overall pattern, suggesting a correction toward the neckline at $27 throughout the other half of 2022. Meanwhile, a failure below $27 could cause a long correction toward $2.80.

Quite simply, a 95% cost decline through the finish of 2022 or early 2023, a setup also forecasted by pseudonymous analyst “PROFIT BLUE.”

I’ll leave this here, since it appears better.. #Solana pic.twitter.com/w03Y4Ffl8o

— PROFIT BLUE (@profit8lue) August 14, 2022

Is that this a bear market rally?

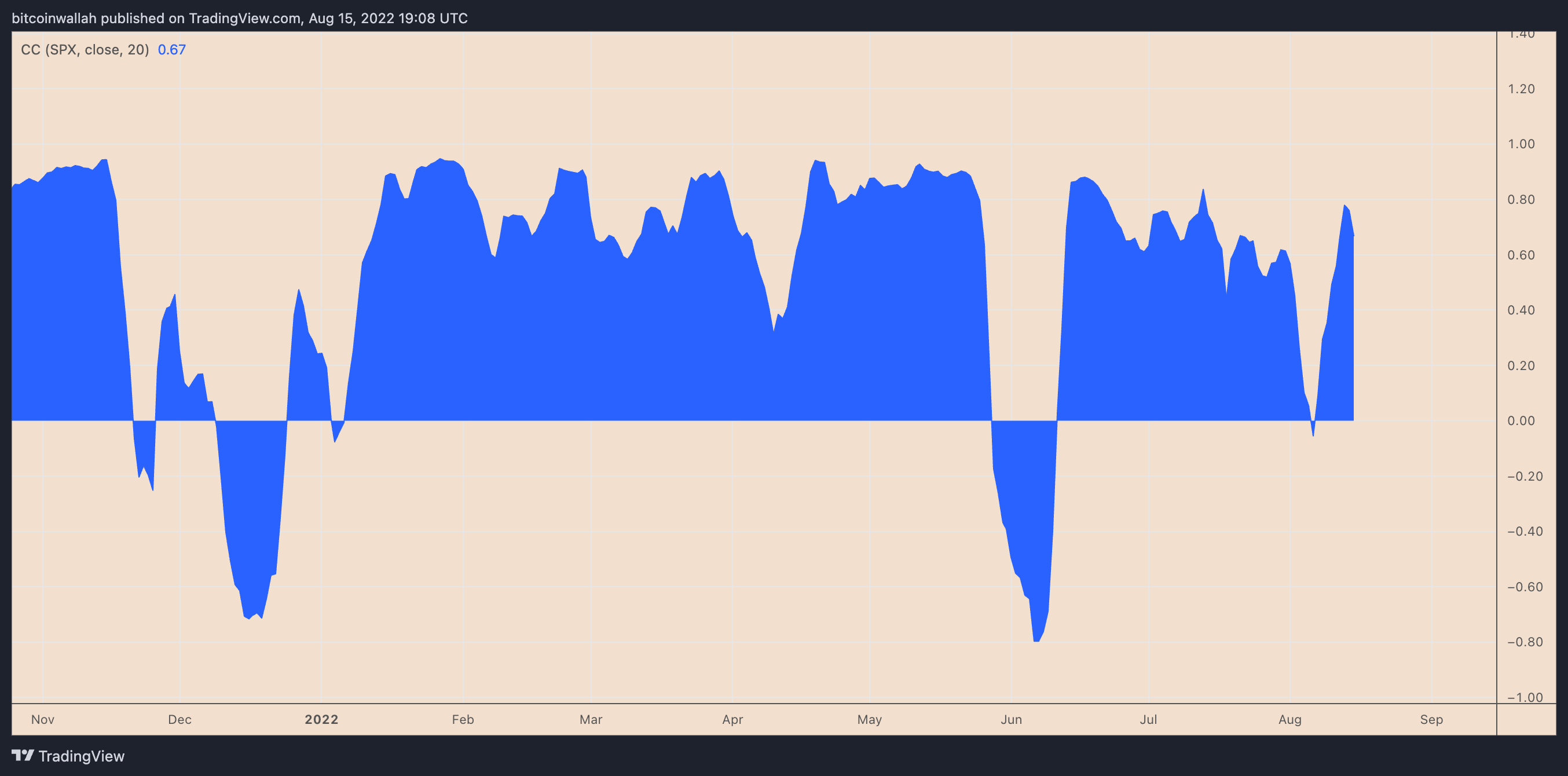

Solana’s very eerie bearish setup seems because it carefully tails trends across risk-on markets, mainly driven through the Federal Reserve’s hawkish response to inflationary pressures.

For example, SOL closed a few days ending August. 14 in a 10.5% profit, much like Bitcoin (BTC) and also the benchmark S&P 500 index. These markets reacted to a softer-than-anticipated U.S. consumer cost index (CPI), raising options the Given would slow the interest rate of their rate of interest hikes.

However, many analysts have cautioned about these ongoing cost rallies within the dangerous corners from the market, citing bits of historic proof of similar bear market bounces. So, SOL’s 75% rebound risks are a fakeout if it is correlation with riskier assets remains positive.

From the fundamental perspective, Solana also faces extreme FUD because of its recurring network outages and rumored centralization. However, the project’s backers have introduced new upgrades to repair these problems, as Cointelegraph discussed.

But then, a 95% cost crash is simply too “wild,” suggests market analyst IncomeSharks, stating that this means Solana is really a rug pull project like Terra (LUNA) — now Terra Classic (LUNC).

Related: Fallout from crypto contagion subsides but no market reversal at this time

The following big drop might have SOL explore bounce possibilities near a multi-year climbing support trendline, as proven below.

Quite simply, SOL’s bearish continuation could last until its cost hits $20, lower over 55% from August 16’s cost.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.