Solana (SOL) dropped on May 26, ongoing its decline from the day before among a broader retreat over the crypto market.

SOL cost pennant breakdown going ahead

SOL cost fell by over 13% close to $41.60, its cheapest level in almost two days. Particularly, the SOL/USD pair also started of the items seems to become just like a “bear pennant,” a vintage technical pattern whose occurrences typically precede additional downside moves inside a market.

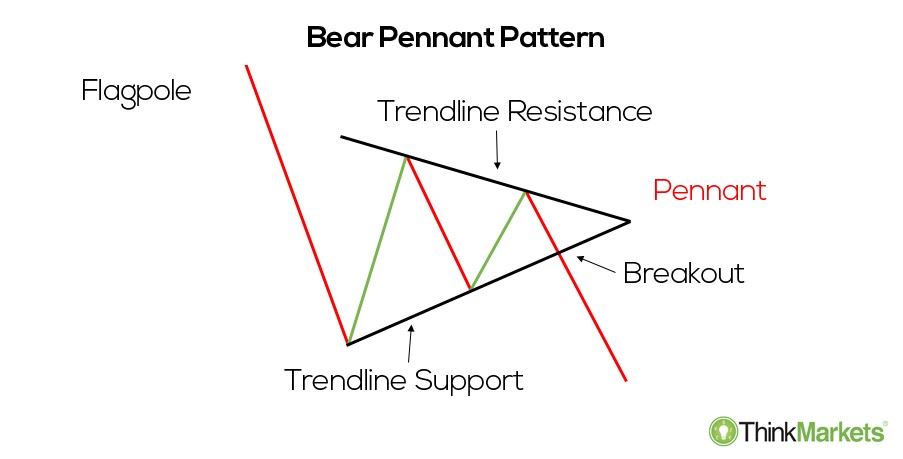

At length, bear pennants appear once the cost trades in the range based on a falling trendline resistance and rising trendline support.

These patterns resolve following the cost breaks underneath the lower trendline, supported by greater volumes. Usually of technical analysis, traders decide the pennant’s profit target after adding the size of the prior’s leg lower (known as “flagpole”) towards the breakdown point.

SOL continues to be having a similar breakdown after closing below its pennant’s lower trendline on May 25, as proven below. Theoretically, Solana’s profit target involves be near $23, lower about 45% from May 26’s cost.

Nevertheless, SOL’s bear pennant breakdown seems with no spike in buying and selling volumes, suggesting that traders aren’t fully convinced using the move. That could prompt the token to retest the pennant’s lower trendline as resistance.

Furthermore, a effective retaking from the trendline as support risks invalidating the bear pennant setup while getting the 20-day exponential moving average (20-day EMA the eco-friendly wave) near $57.59 in closeness because the next upside target.

On the other hand, a pullback can keep SOL’s near-$23 profit target because, with $35.50—the May 12 cost floor that preceded a clear, crisp rebound—serving as interim support.

Solana cost support confluence

SOL also trades near an assistance confluence, comprising multi-month horizontal and rising trendlines.

The horizontal trendline near $45.75 offered as resistance throughout the April–August 2021 session and then flipped to get support between The month of january 2022 and March 2022. Concurrently, the increasing trendline continues to be capping SOL’s extended bearish attempts since March 2021.

Related: Presuming Bitcoin plays nice, greater time-frame analysis suggests $90 Solana (SOL) cost

Because the two trendlines converge, they might be a mental access point for investors having a lengthy-term upside outlook. That will mean SOL rebounding towards its next upside target near $79, that also coincides having a multi-month falling trendline resistance.

However, a ongoing selloff within the Solana market might have SOL risk another massive decline, as discussed within the bear pennant setup above.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.