The native tokens of move-to-earn lifestyle application STEPN thrown greater on news they could be open to trade on Coinbase, a U.S.-based crypto exchange.

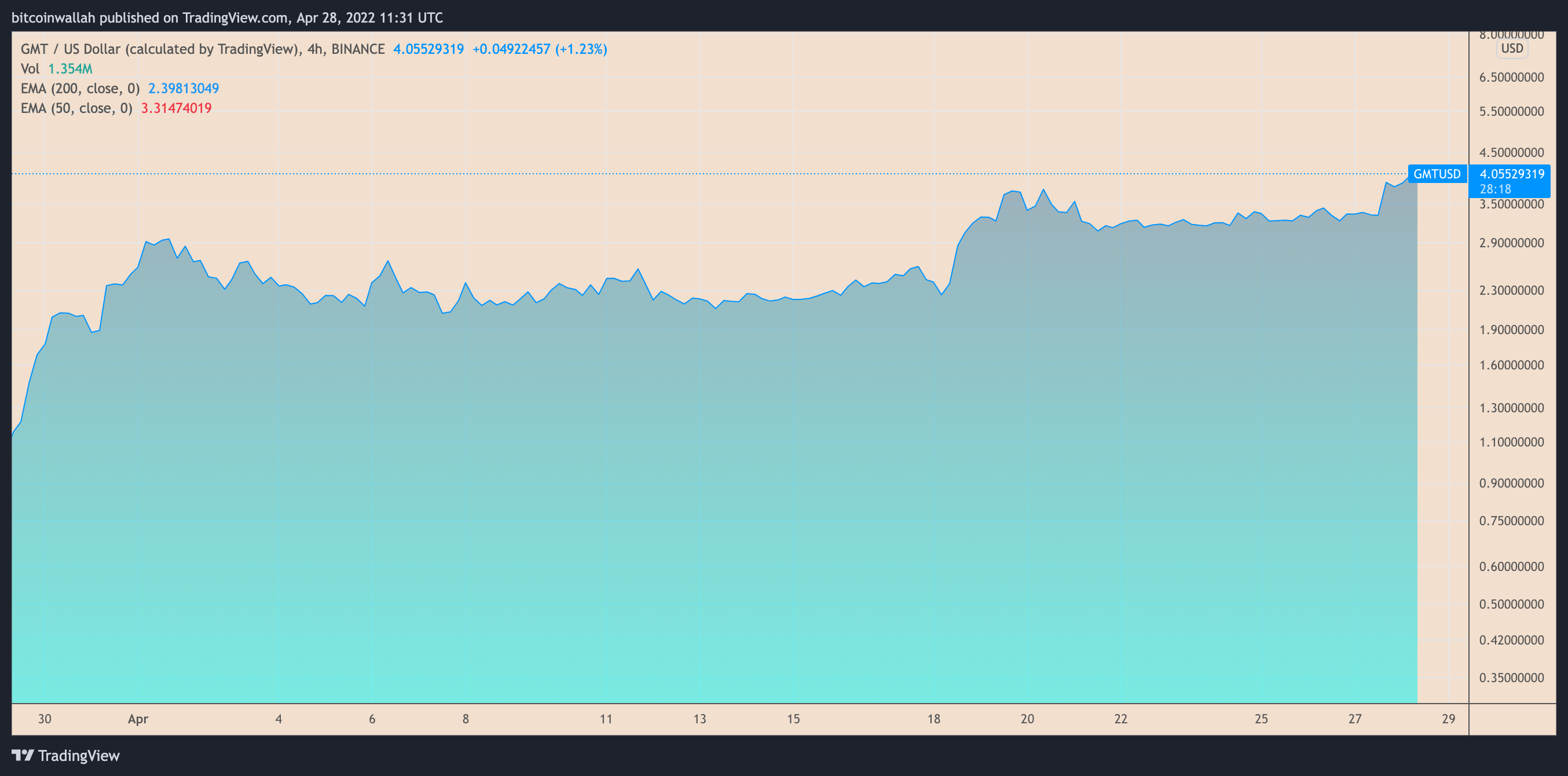

The cost of STEPN’s governance token Eco-friendly Metaverse Token (GMT) rallied by nearly 20% to achieve over $4 previously 24 hrs, hitting up to $4.50, its best level up to now.

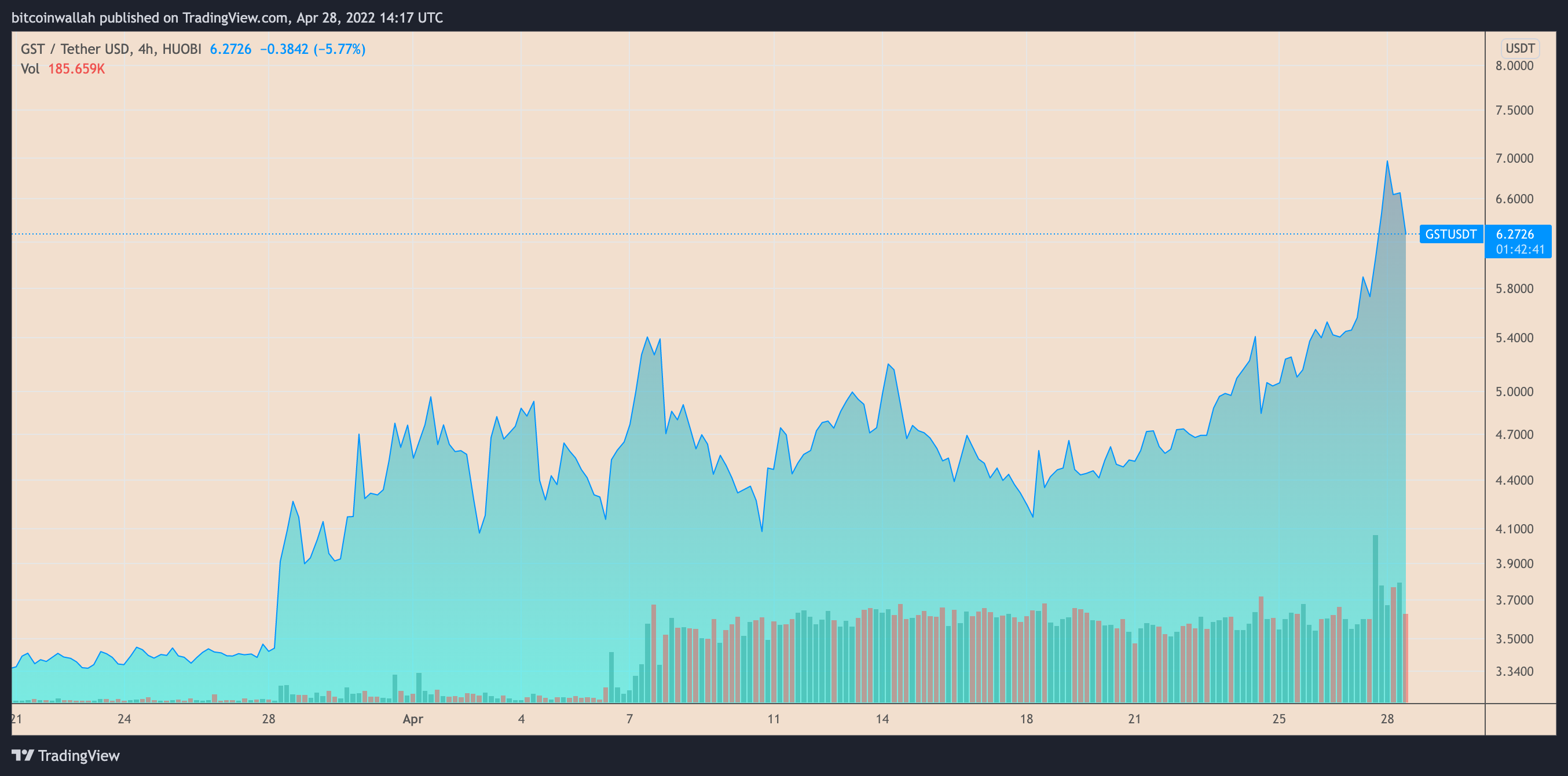

Similarly, another STEPN token, known as the Eco-friendly Satoshi Token (GST), which players earn after walking, jogging and running outdoors with STEPN’s “NFT Athletic shoes,” acquired 6.5% to around $6.25 on the 24-hour adjusted time-frame with a brand new record a lot of $7.20.

STEPN ecosystem grows

The intraday rallies in GMT and GST markets are members of a wider upward trend that began at the begining of March 2022. The growing hype round the so-known as move-to-earn market is boosting the need for these tokens, that are rewarded to active players.

Move-To-Earn Token FITFI on Avalanche has achieved a 50x increase within the cost of DAOMaker IDO ($.0049) after it had been launched on OKX and Bybit today. The general public offering will release 10% following the launch. The mechanism is comparable to Stepn. https://t.co/KVRVb1kDvL

— Wu Blockchain (@WuBlockchain) April 26, 2022

Particularly, STEPN’s economic model, that involves selling nonfungible token (NFT) footwear and taking advantage of the proceeds to purchase back and burn GMT tokens, likely attracted speculators that visit a lower supply-greater demand structure as bullish. GMT has a supply cap of 6 billion.

Stepn $GMT nearly 2x since last tweet. Up 40x since first mention. I’m up a great deal and Stepn application makes me money too. What well worth the cost https://t.co/CgheKBoMib

— MURO – will not DM, watch out for scam (@MuroCrypto) April 28, 2022

Meanwhile, GST, which posseses an limitless supply cap, finds bullish cues from the underlying use-cases.

Particularly, STEPN players make use of the token to mint, repair and gain levels their NFT athletic shoes — or perhaps sell them around the app’s marketplace. Consequently, if the amount of STEPN users increases, it can lead to players restricting GST’s downside prospects from it being an in-game currency.

Players happen to be discussing screenshots of the STEPN profiles, which feature their activities and also the GST rewards they earned for doing them. Meanwhile, leading NFT marketplace OpenSea has added STEPN’s athletic shoes collection, supplying more avenues for STEPN NFT proprietors to re-sell their digital footwear.

How do you obtain a $STEPN activation code?

— KSICRYPTO (@ksicrypto) April 27, 2022

The hype for move-to-earn tokens seems similar play-to-earn projects for example Axie Infinity (AXS), which skyrocketed this past year.

GMT climbing triangular

GMT’s cost eyes coming back to $4.50 in front of this week’s close, in line with the “climbing triangular” setup on its shorter-time-frame charts, as proven below.

Climbing triangles appear once the cost consolidates from a horizontal upper trendline along with a rising lower trendline. They resolve following the cost breaks out in direction of its previous trend, and rise up to the utmost distance between your triangle’s lower and upper trendline.

Related: STEPN to new highs? GMT cost painting first ‘bull flag’ toward $5 target

Interestingly, the triangle’s upside target near $4.50 also coincides using the 1.618 Fib type of the Fibonacci retracement graph attracted from $3.82-swing high to $2.75-swing low.

GST climbing down triangular

Unlike GMT, GST is showing indications of breakdown because it forms a climbing down triangular pattern after topping out at $7.20.

GST’s cost continues to be trending lower from a falling upper trendline along with a horizontal lower trendline, that is considered bearish reversal following a strong upward trend. That stated, the STEPN token now risks breaking underneath the triangle’s lower trendline, as highlighted below.

If the occurs, GST’s cost will risk falling up to the triangle’s maximum height when measured in the breakdown point, inducing the bearish target of $6.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.