Layer-2 scaling solution Synthetix lately collaborated with liquidity provider Curve Finance to produce Curve pools for Synthetic Ether (sETH)/Ether (ETH), Synthetic Bitcoin (sBTC)/Bitcoin (BTC) and artificial U.S. dollar (sUSD)/3CRV, allowing investors to cheaply convert synths for example sETH to ETH.

Because of the investors’ readiness to carry tokens rather of synths, the protocol tallied up over $1.02 million in buying and selling charges — overshadowing Bitcoin’s (BTC) daily performance by five occasions.

Synthetix, Ethereum-based decentralized finance (DeFi) protocol, produced a buzz over the crypto ecosystem after witnessing an abrupt rise in buying and selling activities as well as an unparalleled comeback of their in-house token, SNX, throughout an unforgiving bear market.

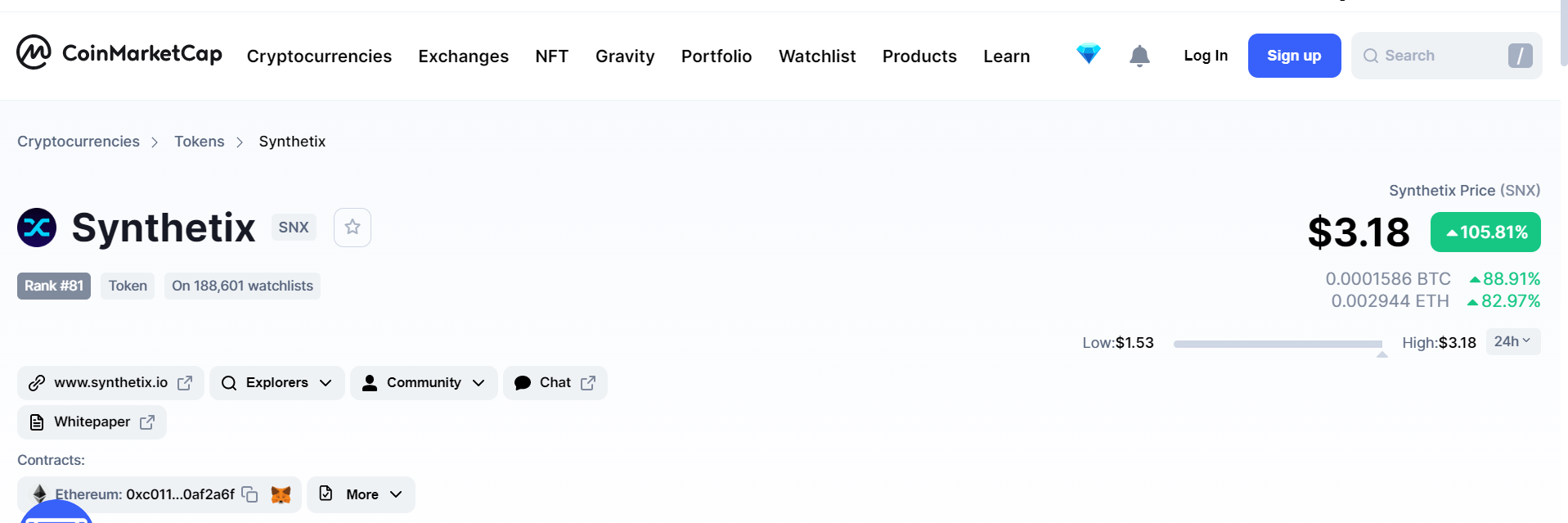

As a result of the huge buying and selling volumes, the SNX token, too, observed a momentary rush of 105%, getting up its value to in excess of $3.00, according to data from CoinMarketCap.

Discussing his ideas around the development, Synthetix founder Kain Warwick, also known as kain.eth, released your blog publish that highlighted the problem of DeFi protocols to soak up Bitcoin’s volatility when the cost drops even more:

“This is crucial to know, Synthetix is definitely an over-collateralised crypto-backed suite of stablecoins, it may implode.”

However, he attributed Synthetix’s recent success towards the responsiveness from the community to difficult conditions along with a readiness to test out novel mechanisms to supply stability.

On May 31, the entrepreneur says SNX tokens lead to 99% of his overall liquid portfolio.

Around this morning my liquid crypto portfolio is 99% SNX.

— kain.eth (✨_✨) (@kaiynne) May 31, 2022

Around the flipside, on-chain metrics revealed the intentions of shorting the SNX token across numerous exchanges. Napgener from Crypto Twitter disclosed that 15 million SNX tokens conserve a short position on popular exchanges including Binance, FTX, ByBit and OKX. While only 20 million SNX tokens exist on exchanges, the thought suggests an oncoming cost hike, that might see SNX breach something of $10.

15m $snx is brief now.

only 20m exist on exchanges

this factor could powder keg to $10+$sirin / $unfi style pic.twitter.com/b0LM8zs5x5— napgener 0xDONE (@napgener) June 20, 2022

The Twitter user also alleged the Celsius network is providing a 300% apr (APR) to users for shorting their SNX holdings.

Related: El Salvador president addresses bear market concerns with Bitcoin hopium

With Bitcoin prices falling below $20,000 over the past weekend, El Salvador President Nayib Bukele shared a bit of positive suggestions about Twitter.

I observe that many people are involved or anxious concerning the #Bitcoin market cost.

My advice: stop searching in the graph and revel in existence. Should you committed to #BTC neglect the is protected and it is value will hugely grow following the bear market.

Persistence is paramount.

— Nayib Bukele (@nayibbukele) June 19, 2022

In the tweet, Bukele advised fellow investors to “stop searching in the graph and revel in existence.” He reassured investors about Bitcoin’s inevitable comeback, proclaiming that:

“If you committed to #BTC neglect the is protected and it is value will hugely grow following the bear market. Persistence is paramount.”