Tether (USDT), the greatest stablecoin and also the third largest digital currency by market capital, continues losing its market price among the present market downturn.

On June 16, USDT’s market cap dropped below $70 billion the very first time since October 2021. The drop adopted a cascade of repeated declines soon after the USDT market price arrived at its all-time high above $80 billion in May.

During the time of writing, Tether USDT’s market capital stands at $69.3 billion, up around $300 million in the multi-month low, based on data from CoinGecko.

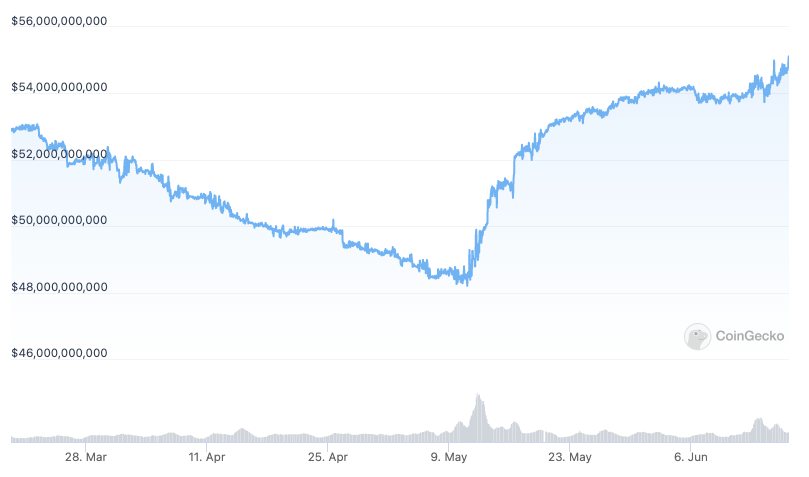

Tether’s greatest rival, USDC, may be the second-largest U.S. dollar-pegged stablecoin supported by the peer-to-peer payments technology company Circle. The stablecoin arrived at $50 billion market cap in Feb and it has never beaten Tether’s in market cap to date.

While Tether continues to be losing its share of the market in the last couple of days, other stablecoins such as the USD Gold coin (USDC) happen to be gaining value lately. As a result, USDC market cap surged from about $48 billion in mid-May to $55 billion in mid-June.

Tether’s shrinking market cap comes among the continuing market panic and uncertainty, using the market capital of cryptocurrencies shedding below $1 trillion the very first time since Feb 2021.

Related: Total way to obtain stablecoins dropped dramatically for brand spanking new ever in Q2

Tether firm continues to be positively posting statements to make sure investors that the organization is not impacted by the continuing crypto lending crisis. On June 13, Tether asserted that issues round the crypto lending platform Celsius had nothing related to the firm and wouldn’t impact USDT reserves.

Tether subsequently announced intends to eliminate commercial paper backing for that USDT stablecoin on June 15. The firm didn’t react to Cointelegraph’s request comment.