The entire crypto market capital continues to be buying and selling inside a climbing down funnel within the last 29 days and presently displays support in the $1.17 trillion level. Previously seven days, Bitcoin (BTC) presented a modest 2% drop and Ether (ETH) faced a 5% correction.

The June 10 consumer cost index (CPI) report demonstrated an 8.6% year-on-year increase and crypto and stock markets immediately felt the outcome, but it isn’t certain if the figure will convince the U.S. Fed to hesitate later on rate of interest hikes.

Mid-cap altcoins dropped further, sentiment continues to be bearish

The generalized bearish sentiment brought on by weak macroeconomic data and uncertainties concerning the Federal Reserve’s capability to curb inflation has seriously impacted crypto markets.

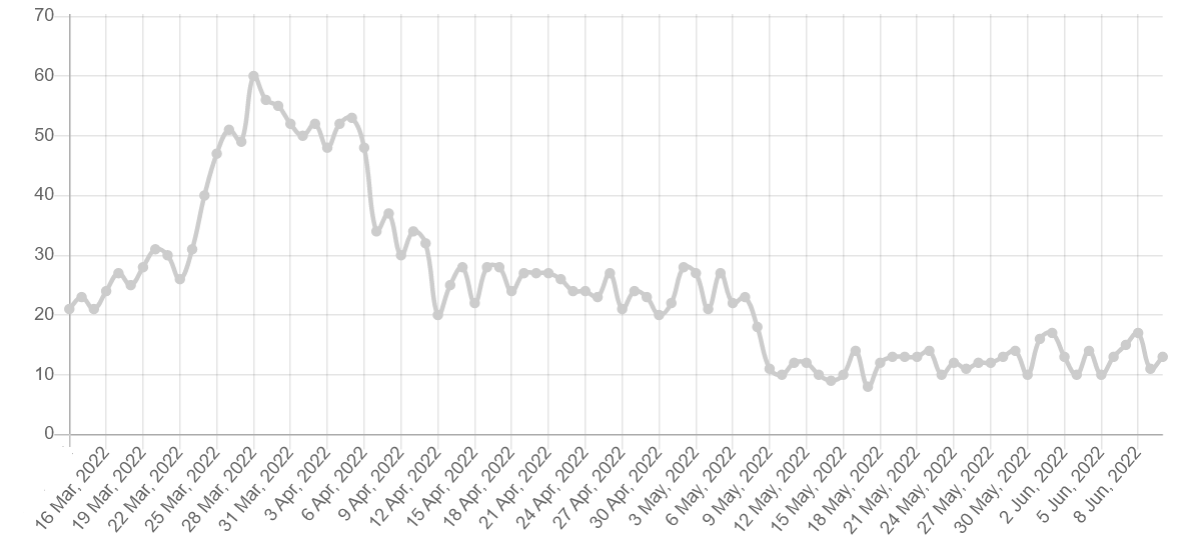

The Worry and Avarice Index hit 11/100 on June 9, and also the data-driven sentiment gauge continues to be below 20 since May 8.

This persistent “extreme fear” studying signifies that investors are involved but, simultaneously, it supposedly presents a buying chance.

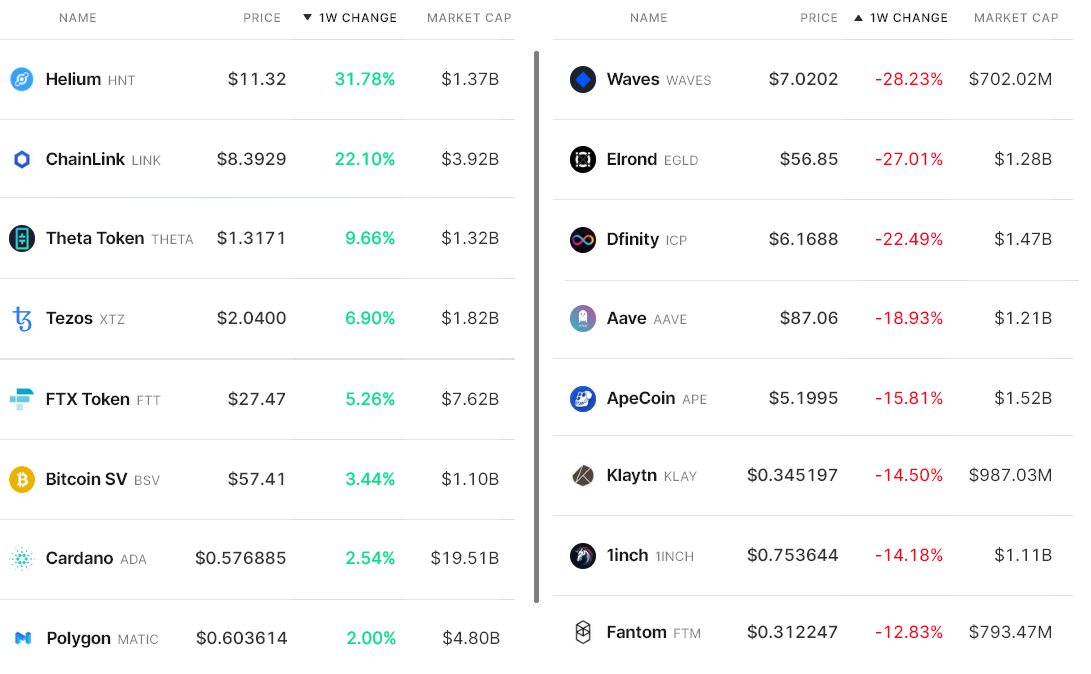

Here are the winners and losers in the past 7 days. As the two leading cryptocurrencies presented modest losses, a number of mid-capital altcoins declined by 14% or even more.

Helium’s (HNT) community approved the HIP-51 proposal, since the economic and technical constructions needed to aid new users, devices and various kinds of systems, including cellular, Virtual private network, and Wireless.

Chainlink (LINK) rallied 22% following the developers released a revamped Chainlink 2. roadmap, including native token staking.

Theta Token (THETA) acquired 9.7% because the network announced livestream support using API technology which enabled instant and simple link with apps and websites.

WAVES lost 28% following the $1,000 daily withdrawal limit for stablecoins in Vires Finance were carried out to avoid further pressure around the Neutrino Protocol Stablecoin (USDN).

Data shows traders are less inclined to market in the current levels

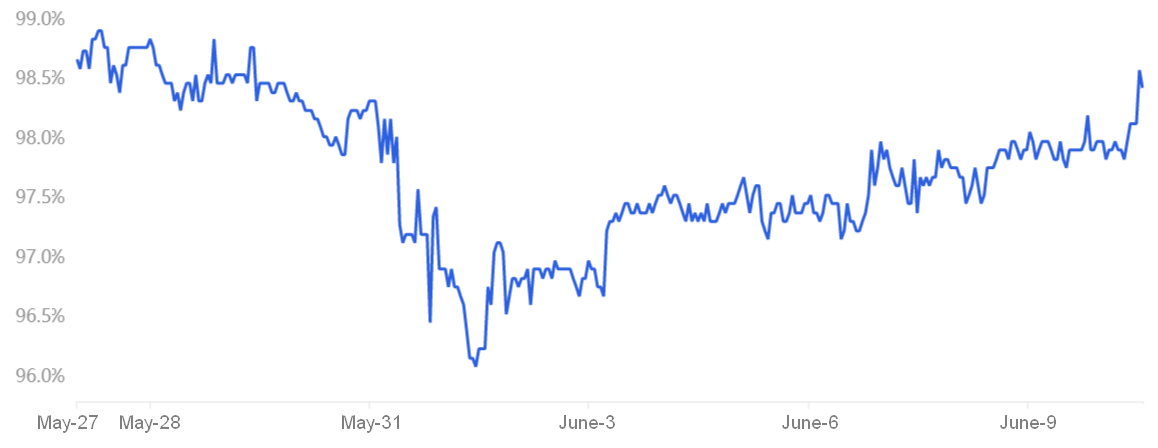

The OKX Tether (USDT) premium is a great gauge of China-based retail crypto trader demand. Its dimensions are the main difference between China-based peer-to-peer (P2P) trades and also the U . s . States dollar.

Excessive buying demand has a tendency to pressure the indicator above fair value at 100%, and through bearish markets, Tether’s market offers are flooded and results in a 4% or greater discount.

On May 31, the Tether cost in Asian peer-to-peer markets joined a 4% discount, signaling intense retail selling pressure. Strangely enough, the problem improved on June 10 following the indicator gone to live in single.5% discount. Despite remaining negative, the metric shows investors’ readiness to purchase the dip because the total crypto capital dropped below $1.2 trillion.

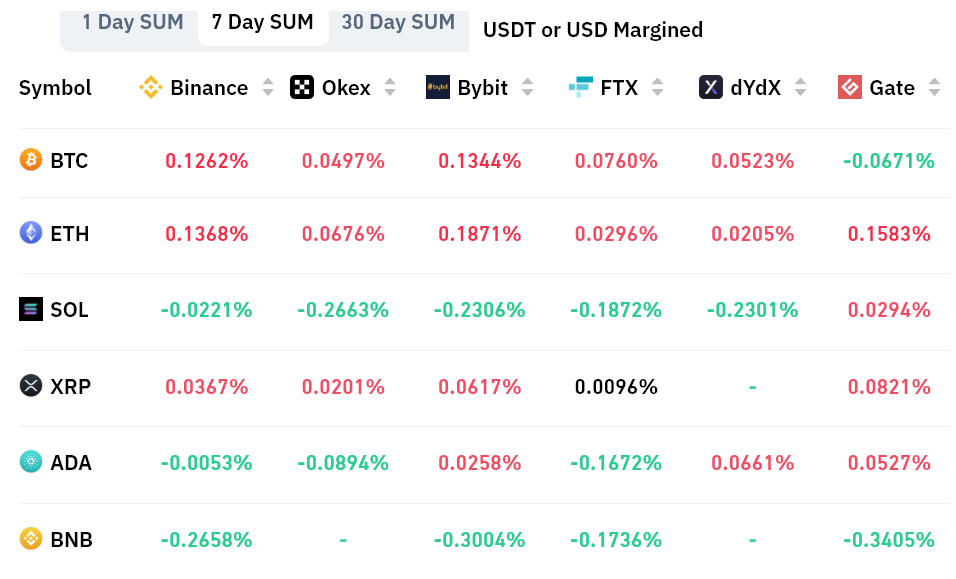

To exclude externalities specific towards the Tether instrument, traders should also evaluate the cryptos futures markets. Perpetual contracts, also referred to as inverse swaps, come with an embedded rate that’s usually billed every eight hrs. Exchanges make use of this fee to prevent exchange risk imbalances.

An optimistic funding rate signifies that longs (buyers) require more leverage. However, the alternative situation takes place when shorts (sellers) require additional leverage, resulting in the funding rate to show negative.

Perpetual contracts reflected mixed sentiment after Bitcoin and Ethereum held a rather positive (bullish) funding rate, but altcoin rates were negative. For instance, BNB’s negative .20% weekly rate equals .8% monthly, that is generally not really a concern for derivatives traders.

Any recovery depends upon macroeconomic data stabilizing

Based on derivatives and buying and selling indicators, investors are less inclined to lower their positions at current levels, as proven through the modest improvement within the Tether premium.

The positive funding rate for Bitcoin and Ether futures displays traders’ growing appetite for leveraged lengthy positions because the total crypto capital broke below $1.2 trillion.

Unless of course the standard markets and macroeconomic scenario deteriorates, there’s need to believe crypto investors expect an optimistic cost move soon.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.