Bitcoin (BTC) starts a pivotal week on the firm footing as bulls flourish in eliminating days of losses.

After closing the most recent weekly candle at $21,800, its greatest since mid-August, BTC/USD has returned around the radar like a lengthy bet.

The finish for an longer timeframe of downside interspersed with sideways cost action now seems firmly in an finish, with volatility expected to create a major theme within the future.

Actually, couple of days in Bitcoin’s history happen to be as hectic because this one will probably be.

Additionally towards the Ethereum Merge on Sept. 15, the U . s . States inflation trend can come under scrutiny on Sept. 13 using the discharge of August Consumer Cost Index (CPI) data. The recipe for unpredictability can there be.

How can Bitcoin weather the storm? As the macro picture looks muddy for risk assets because the U . s . States dollar surges, on-chain data is constantly on the indicate a cost bottom already within the making.

Additionally, Bitcoin’s network fundamentals are poised hitting new all-time highs now, underscoring miner resilience and recovery, together with conviction over profitability.

Cointelegraph analyzes some of the primary areas to look at as Bitcoin gives “Septembear” a run because of its money.

Solid weekly close boosts short-term BTC bets

The most recent weekly close provided some much-needed relief for Bitcoin bulls.

After days of miserable performance, BTC/USD finally were able to seal a convincing week’s gains, even staying away from a final-minute correction in to the candle close, data from Cointelegraph Markets Pro and TradingView shows.

As a result, just above $21,800, the Sept. 11 event created a good foundation for any week because of deliver considerable volatility.

During the time of writing, that much cla is developing a consolidation zone, coinciding by having an important trendline by means of Bitcoin’s recognized cost. According to on-chain analytics firm Glassnode, this presently sits at roughly $21,770.

BTC/USD has yet to tackle higher bear market levels lost as support recently, chief included in this the 200-week moving average, that is now near $23,330.

An increase to $22,350 on Bitstamp overnight nevertheless caught traders’ attention, furthering existing requires upside to carry on.

“This just was preliminary supply at 22300,” popular Twitter account Il Capo of Crypto authored in one of many recent updates:

“Still thinking 23k is probably. Only then do we see reversal.”

An additional tweet nevertheless cautioned that “major resistances” are actually entering play across Bitcoin and altcoins.

“In my estimation, we have seen a final advantage of 5-7% soon, then ltf distribution, then nuke. Prepare,” it mentioned.

In an indication of the approaching volatility beginning, fellow trader Cheds noted that Bitcoin tagged its upper Bollinger Band on daily timeframes, the bands now gradually distributing to create method for a broader buying and selling range.

Inbound CPI combines with dollar nosedive

Among the two primary speaking points for that week in BTC cost action develops from a familiar source: the U . s . States Fed.

CPI information is due for August, and hopes are sitting on the decreasing inflation trend ongoing after July’s print demonstrated an optimum getting created.

Massive week approaching

– CPI Data, which will likely provide a direction for the Given.

– $ETH merge is approaching, which is among the greatest occasions in blockchain previously years.

– Climax on strength from the $DXY potentially approaching.

Fire.

— Michaël van de Poppe (@CryptoMichNL) September 12, 2022

Should that function as the situation, it will likely be a benefit for risk assets suffering heavily as a result of a surging U.S. dollar.

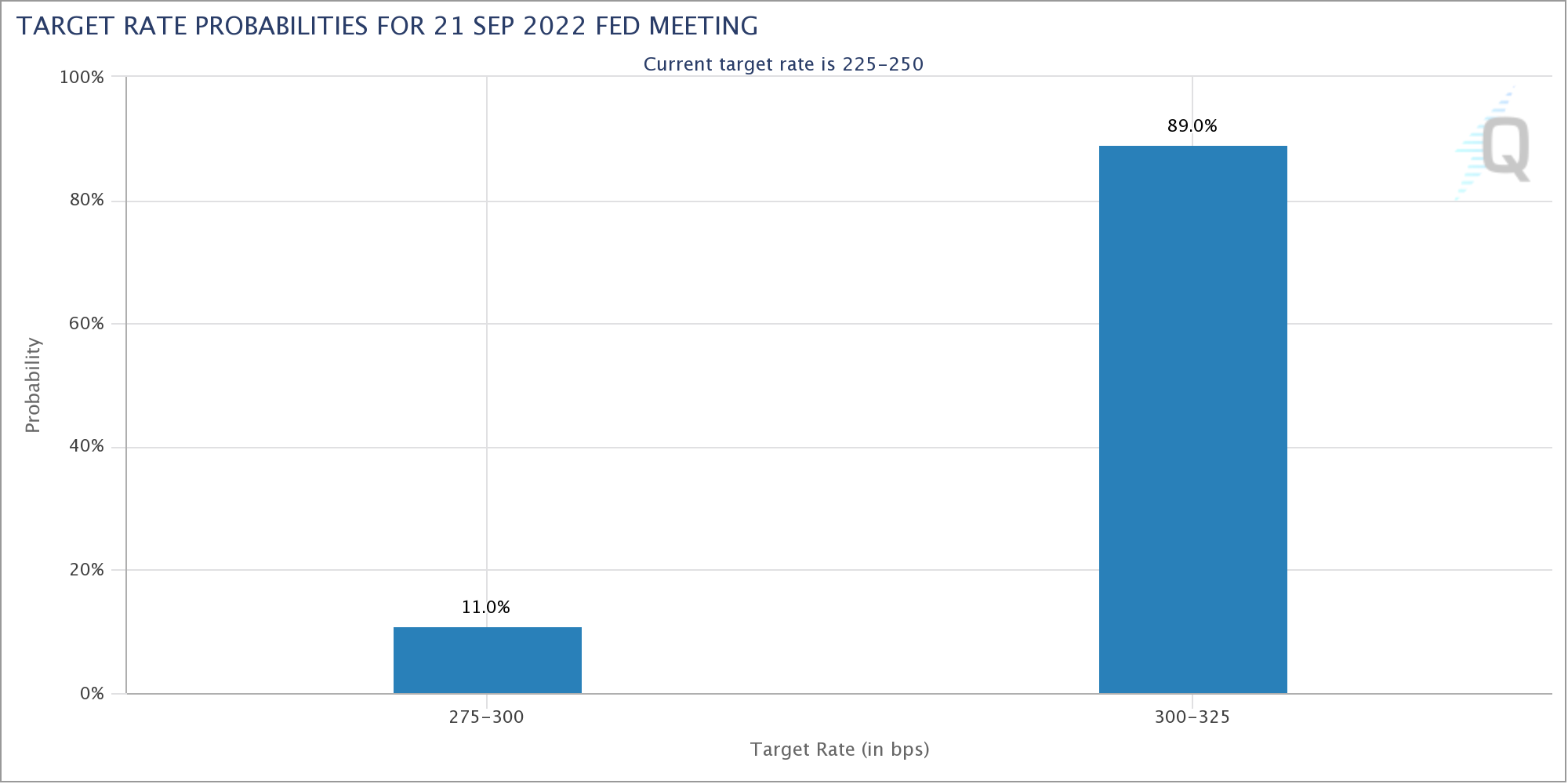

According to CME Group’s FedWatch Tool, the Fed’s Federal Open Markets Committee is nevertheless likely to set up a repeat 75-basis-point rate of interest hike at its September meeting in a few days.

For dollar watchers, however, there’s already need to think that the danger asset comeback should cement itself within the future.

The U.S. dollar index (DXY), fresh from twenty-year highs, has fallen nearly 2.7% in only four days.

My calculator cannot count the amount of negative comments I received after tweeting the $DXY Sell Signal. https://t.co/ENGqkgkb1v pic.twitter.com/r4VlfIVvSR

— Trader_J (@Trader_Jibon) September 12, 2022

“One factor making me doubt my downside bias for Bitcoin & Crypto generally publish the ETH merge even, is DXY,” analyst Mark Cullen, creator of buying and selling resource AlphaBTC, revealed:

“We see possibility of 3 drives of [bear] divergence created around the RSI & the Sept FOMC is next Get married. I question when we see $DXY break the parabola & push risk assets up.”

Phoenix Copper executive Jesse Pond, meanwhile, known as the USD and DXY chart “the most significant available.”

“The dollar is way too strong atm, and it has been killing anything else,” he tweeted at the time.

“It’s dropped rapidly over last couple of days, but continues to be inside a strong upward trend. No sustainable bounce for markets until trend breaks.”

The Merge is here now

Complementing the encouraging inflation information is a purely internal cost trigger — the Ethereum Merge — due around Sept. 15.

The big event, now set to become reality after several weeks of uncertainty, sees Ethereum like a network transition from proof-of-work (Bang) to proof-of-stake (PoS) since it’s hashing formula.

Hype continues to be building on social networking and beyond, and today, analysts are pondering exactly what the immediate aftermath is going to be — particularly, whether investors will “sell the news” and produce markets lower immediately when the Merge completes.

Huge week for that #Ethereum and #Crypto community using the approaching Merge

These occasions have a tendency to create more liquidity, that you can use towards the whales advantage via engineering certain moves and appears

Don’t hurry into positions in case your not already in a single ‼️

— Crypto Tony (@CryptoTony__) September 12, 2022

everybody larping about when they should lengthy the merge or short the merge

seems like one of these simple games in which the best move isn’t to experience

— Udi Wertheimer (@udiWertheimer) September 12, 2022

Inside a dedicated update released on Sept. 10, buying and selling platform DecenTrader stressed the requirement for caution and avoidance of the “up-only” mindset.

“It is remember this there are multiple potential headwinds that may turn things towards the bears, namely bugs within the Merge code, a substantial proportion from the Ethereum network relocating to a fork taking market price by using it, in addition to Macro headwinds in the US August CPI data in a few days,” it authored:

“It’s also remember this that overall, there remains macro and geopolitical systematic risk that might halt probably the most bullish narrative for ETH. Lets find out if cost holds, publish merge.”

DecenTrader came comparisons towards the hard forks of Bitcoin, which happened within the other half of 2017 and then. Now, as then, the chance of distraction remains.

“Long term, the Merge has fundamental changes which we’re interpreting to be bullish for Ethereum, however the actual event will unquestionably end up being volatile because the market wrestles between narratives,” the update concluded:

“Be very cautious about scams, fork tokens etc, we’ve already seen multiple round the Merge and ETHPoW forks.”

ETH/USD trended lower for any second straight day during the time of writing, eyeing $1,760 after hitting local highs of $1,790.

Difficulty, hash rate tackle all-time highs

Bitcoin’s network fundamentals happen to be not bearish recently, which week, that trend is constantly on the new heights.

Both Bitcoin’s mining difficulty and hash rate have either hit or result from hit new all-time highs within the coming 48 hrs by Sept. 12.

According to estimates from monitoring resource BTC.com, difficulty increases by 3% in the next automated readjustment, delivering it further into unknown territory with as many as 31.91 trillion.

That follows the prior jumbo readjustment of 9.26% two days ago, this developing the biggest increase since 2021 in addition to serving as a strong signal that miner levels of competition are healthier than ever before.

Indeed, since their latest “capitulation” phase ended recently, according to on-chain data, miners happen to be racing to include hashing capacity to their operations. This really is exemplified through the hash rate — the believed combined hashing power the Bitcoin network — itself spiking to levels never witnessed before in recent days.

According to MiningPoolStats, that spike came on Sept. 5 and involved a short visit to 298 exahashes per second (EH/s). The hash rate presently hovers just under 250 EH/s.

Analytics platform TheTIE, meanwhile, noted that the rise in hash rate had moved the timing for the following Bitcoin block subsidy halving event forward.

“As Bitcoin Hashrate increases as much as in history highs, likely to important second order effect to keep in mind: The Halving. Before, it had been expected for 2024, however the forecasted date for the following $BTC halving continues to be gone to live in Q4’23,” it commented alongside a hash rate chart.

Extreme fear proves sticky

As bullish because the data and analysis appears to become, the general crypto market still can’t quite shake a feeling of foreboding.

Related: Crypto traders eye ATOM, APE, CHZ and QNT as Bitcoin flashes bottom signs

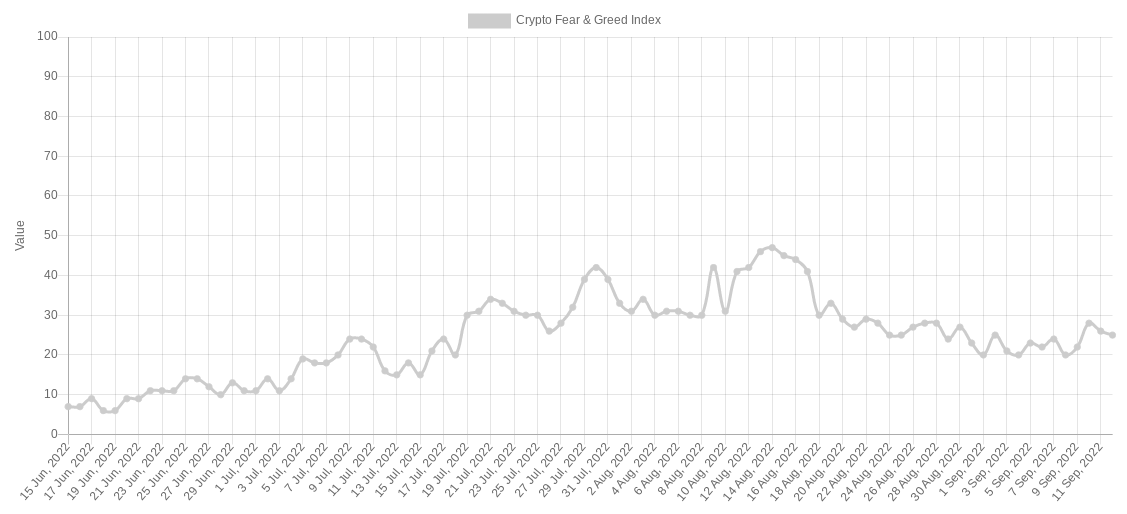

The Crypto Fear & Avarice Index, following a brief escape greater, has returned in “extreme fear” by Sept. 12 inside a sign that the definitive change of trend has yet to go in.

“Extreme fear” is how the Index has spent a lot of 2022, including its longest-ever consecutive stint lasting over two several weeks.

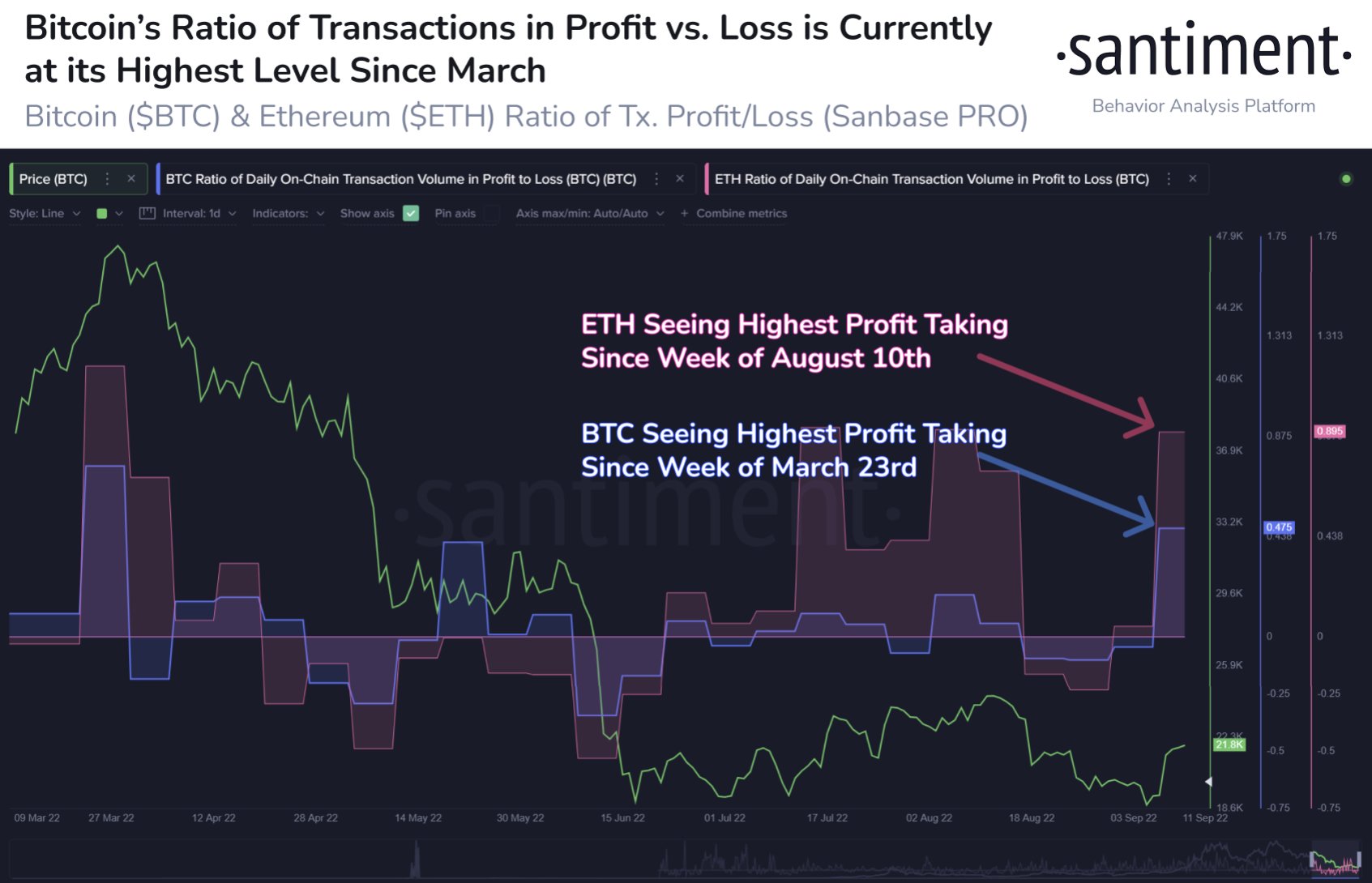

For Santiment, a platform focused on case study of crypto sentiment, there is need to be careful, because of the profit-taking activity on Bitcoin and Ether.

“Bitcoin has rose back above $22k today the very first time in over 3 days,” it summarized:

“$BTC’s ratio of transactions in profit versus. loss reaches its greatest since March, also it seems that lots of have viewed this mild bounce because the trigger to trade again.”

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.