The Ethereum Merge has finally happened. It’s over, and fortunately it went easily with no major hiccups. As predicted by many people, the big event switched out to become a “buy the rumor sell the news” style event, or possibly, the warmer-than-expected consumer cost index print on Sept. 12 was the actual catalyst that pressed the marketplace in the current direction.

Whatever the causes of this week’s downturn, the Merge has ended as well as in its wake, bulls remain holding a great deal of nothing. It’s likely a brand new bullish narrative will have to emerge, or analysts will have to keep an eye on smart money to determine what assets they want to rotate into.

Significantly improved it’s over, what is the new narrative? Surge, verge, purge, or splurge? Maybe dirge?

— Galois Capital (@Galois_Capital) September 15, 2022

Remember, “The Merge,” based on a lot of “smart” people, was intended to be a bullish event that will possibly send Ether cost greater and also the treasure chest of hardfork ETH Bang tokens was designed to magically materialize multi-vast amounts of dollars in liquidity which may likely inflow to Bitcoin which help the ailing focal point in get out of its current range.

Well, none of this happened. It’s not saying it won’t happen, however the current the truth is an industry colored inside a vibrant shade of red. Bitcoin’s Sept.15 drop below $20,000, caused an industry-wide correction leading to double-digit losses for most altcoins and right now, there isn’t an effortlessly graspable story for investors to interpret as bullish.

Not things are dumping

There does are actually an outlier, and it is name is Cosmos (ATOM). Towards the surprise of some, it’s among the couple of eco-friendly assets around the charts on Merge day. Presently, the altcoin reflects a 9.4% gain and contains rebounded strongly off its Sept.14 low at $13.19.

Previous analysis discussed how ATOM cost trades inside an climbing funnel, riding over the 20-day moving average and recommended that dips to and underneath the moving average reflected good purchase possibilities. An easy technical analysis of ATOM’s cost action would concentrate on:

- ATOM cost is constantly on the make greater lows and greater highs while buying and selling inside the trendlines of the climbing funnel.

- ATOM cost saw a short bull break outdoors from the funnel, tapping the 200-day moving average after which correcting to the funnel midline and 20-MA to verify each as support.

- After testing support, cost started again the upward trend and today trades in the top current range and will probably retest the 200-MA so that they can switch the amount to aid.

Let’s briefly investigate a couple of from the possible reasons for ATOM’s bullish momentum.

Related: Crypto traders eye ATOM, APE, CHZ and QNT as Bitcoin flashes bottom signs

Protocol migration, liquid staking, an increasing TVL and the potential for IBC

Numerous protocols pivoted from Terra after its implosion and re-launched around the Cosmos Hub SDK. In September, analytics firm and protocol builder Delphi Digital also announced it had selected Cosmos since it’s primary blockchain to construct new projects on.

When projects develop Cosmos Hub, value accrual to ATOM frequently results because DeFi protocols along with other DApps will have fun playing the network’s interchain home security system which fits over IBC. Inter-Blockchain Communication protocol (IBC) is essentially an “internet of blockchains” along with a bridge that enables the mix-chain change in tokens and secure interoperability between different blockchains.

Typically, the DApps, AMMs and DeFi-style platforms built on blockchains offer staking and also the charges produced by this are oftentimes shared among stakers.

Staking ATOM presently provides a 17.75% APY and based on Staking Rewards, 66.75% from the available circulating supply has been staked. Cosmos is placed to produce liquid staking, a phenomenon that when deployed in other DeFi platforms on other blockchains led to elevated buy pressure around the ecosystem’s native token(s).

Data also shows a stable rise in the amount of unique delegation addresses within the network.

Multiple Cosmos ecosystem platforms, including COMDEX, are going to launch their very own stablecoin (CMST), which is likely that assets locked and staked inside the platform will “back” the $1 peg of stated stablecoins. Because of the structure from the Cosmos Hub and IBC, it appears likely that ATOM is going to be one of the greatest assets utilized in the “minting” process.

Obviously, the entire value locked (TVL) inside the Cosmos ecosystem collapsed as DeFi and also the wider crypto market was a victim of the bear trend. This figure has yet to recuperate inside a notable way, however the chart below shows notable inflows within the last 7-days. This is an amount to keep close track of, alongside ATOM’s cost.

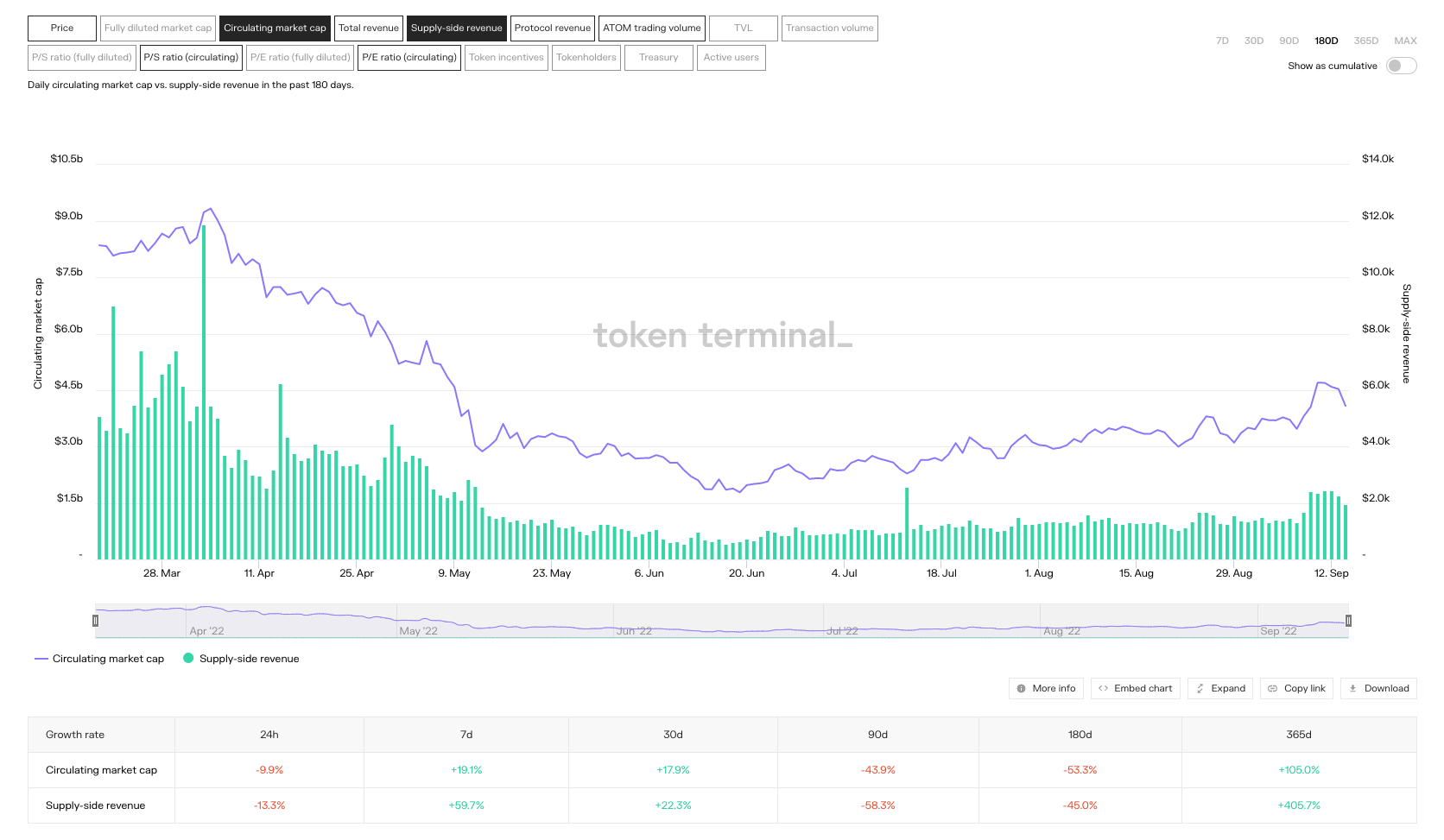

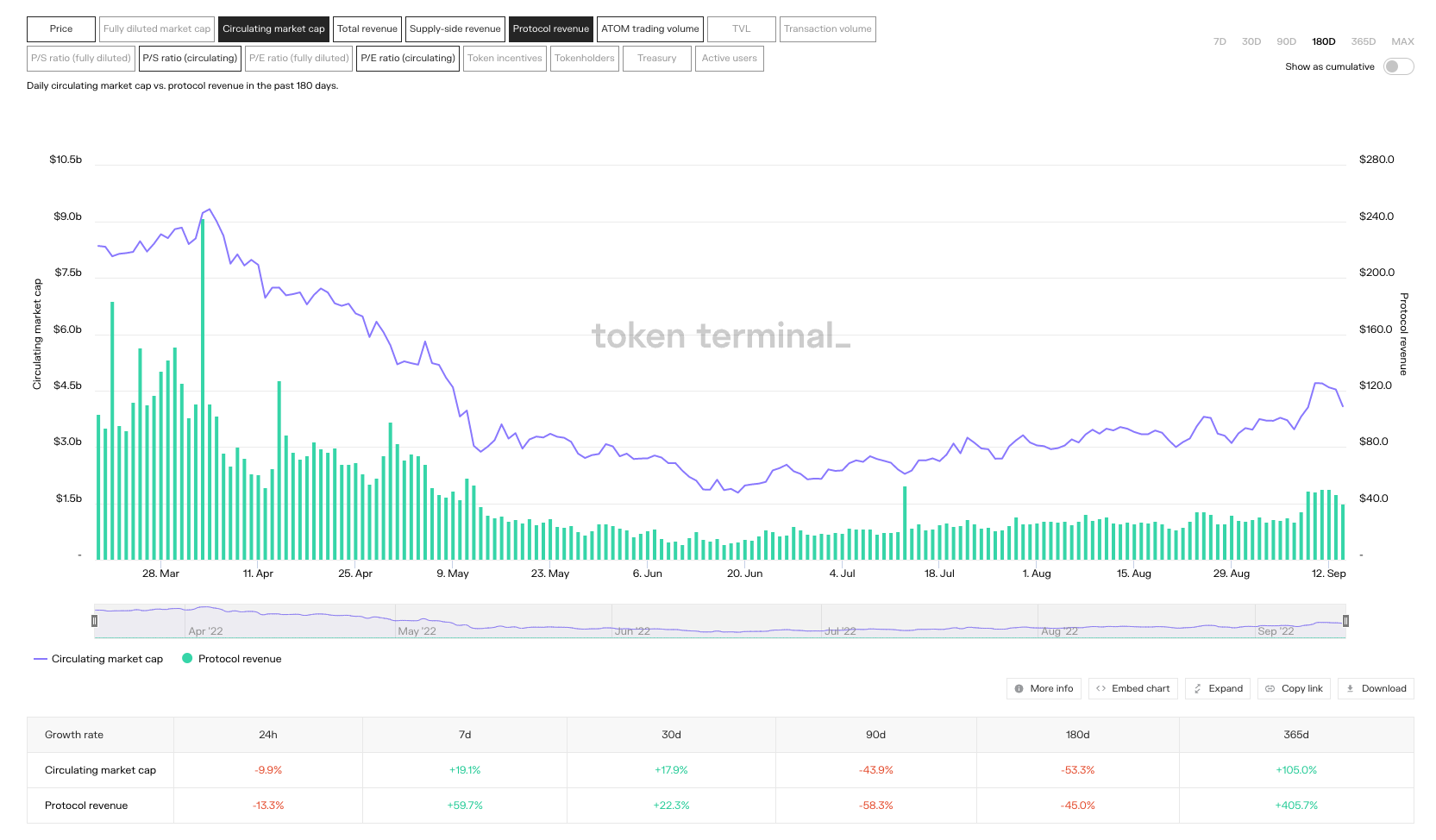

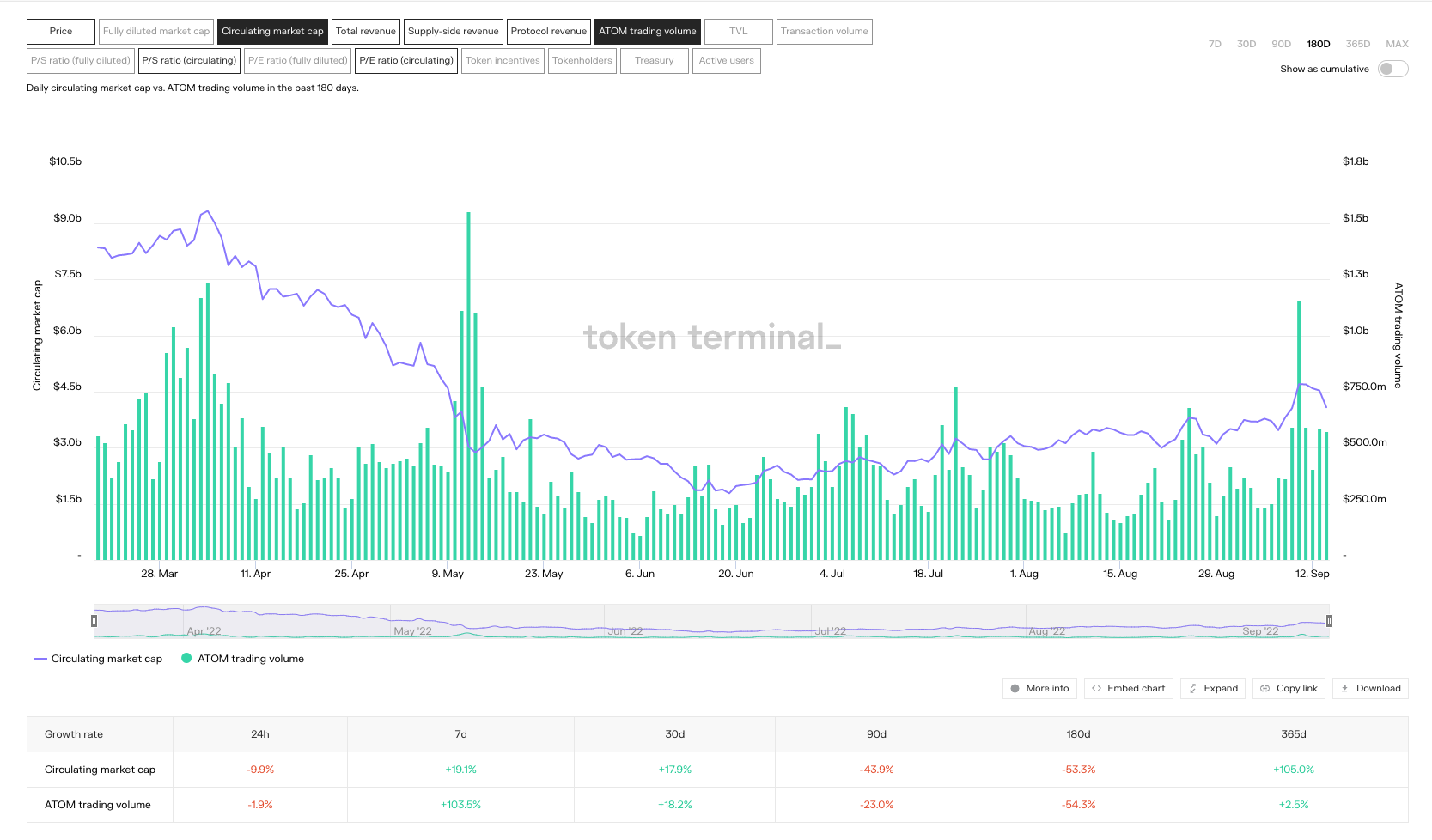

Additional growth metrics which should raise investors eyebrows are Cosmos’ 180-day supply side revenue, protocol revenue and daily buying and selling volumes.

Supply side revenue reflects the quantity of transaction charges which are used on validators while total revenue may be the total transaction amount compensated by protocol users.

Protocol revenue, however, is the quantity of transaction charges which go to protocol, who’re holders of ATOM and perhaps discussing some of the revenue with platform users and stakers.

Basically, what we should see is Metcalfe’s law essentially. Because the ecosystem grows, the network grows, total value locked increases, liquid staking gives additional utility to staked assets, that also enter a cycle to be purchased, staked, minted to stablecoin or IOUs after which used inside the ecosystem to fuel additional growth.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.