Solana (SOL) has been around a stable downtrend within the last three several weeks, however, many traders believe that it could have bottomed at $26.80 on March. 21. Recently, there h been lots of speculation around the causes for that underperformance and a few analysts are going to competition from Aptos Network.

The Aptos blockchain launched on March. 17 also it states handle three occasions more transactions per second than Solana. Yet, after 4 years of development and huge amount of money in funding, the debut from the layer-1 smart contract solution was rather unimpressive.

It is important to highlight that Solana presently holds an $11.5 billion market capital in the $32 nominal cost level, ranking it as being the seventh largest cryptocurrency when excluding stablecoins. Despite its size, SOL’s year-to-date performance reflects a lackluster 82% drop, as the broader global market capital is lower 56%.

Unfortunate occasions have negatively impacted SOL’s cost

The downtrend faster on March. 11 following a leading decentralized finance application around the Solana Network endured a $116 million hack.

Mango Markets’ oracle was attacked because of the low liquidity around the platform’s native Mango (MNGO) token which is often used for collateral. To place things in perspective, the hack symbolized 9% of Solana’s total value locked (TVL) in smart contracts.

Other negative news emerged on November. 2 as German data center operator and cloud provider Hetzner began blocking crypto-related activity. The business’s tos stop customers from running nodes, mining and farming, plotting and storing blockchain data. Still, Solana nodes produce other cloud storage providers to select from, and Lido Finance confirmed the risk for his or her validators have been mitigated.

A potentially promising partnership was announced on November. 2 after Instagram integrated support for Solana-based nonfungible tokens (NFTs), allowing users to produce, sell and showcase their most favorite digital arts and collectibles. SOL immediately reacted having a 5.7% pump in fifteen minutes but retraced the whole movement within the next hour.

To obtain a more granular look at what’s going on with SOL cost, traders may also evaluate Solana’s futures markets to know if the bearish newsflow has affected professional traders’ sentiment.

Derivatives metrics show a unique amount of indifference

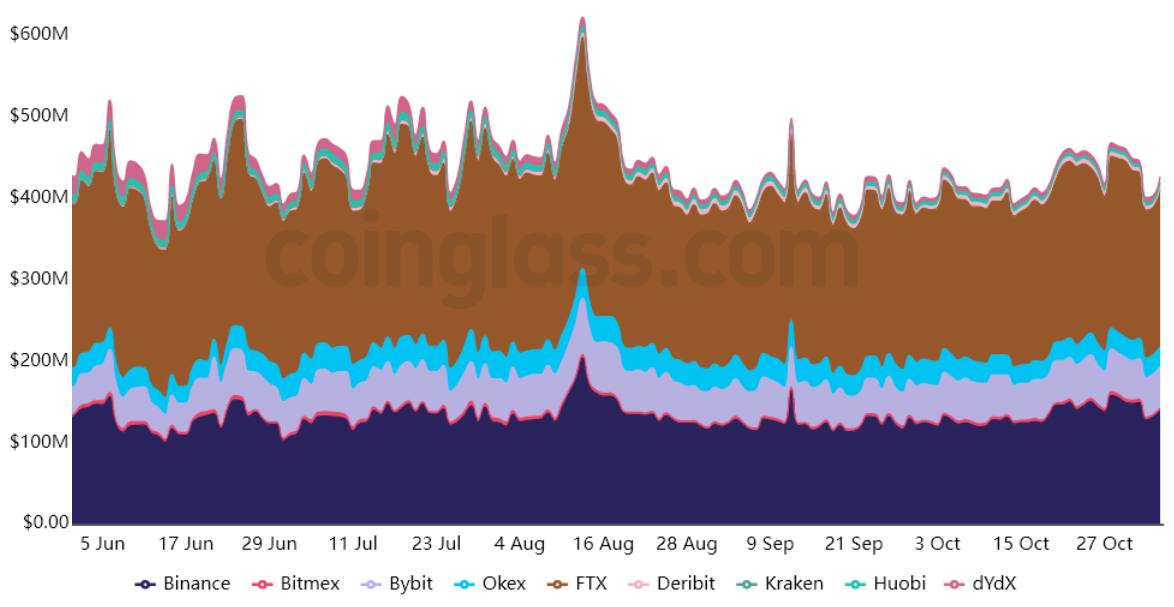

Whenever there’s relevant development in the amount of derivatives contracts presently in play, it always means more traders are participating. In futures markets, longs and shorts are balanced whatsoever occasions, but getting a bigger quantity of active contracts — open interest — enables the participation of institutional investors who are required the absolute minimum market size.

Previously thirty days, the entire open interest on Solana continues to be reasonably steady at $440 million. Like a comparison, Polygon (MATIC) aggregated futures position soared to $415 million from $153 million on March. 3.

BNB Chain’s token, BNB (BNB), displayed an identical trend reaching $485 million, up from $296 million on March. 3.

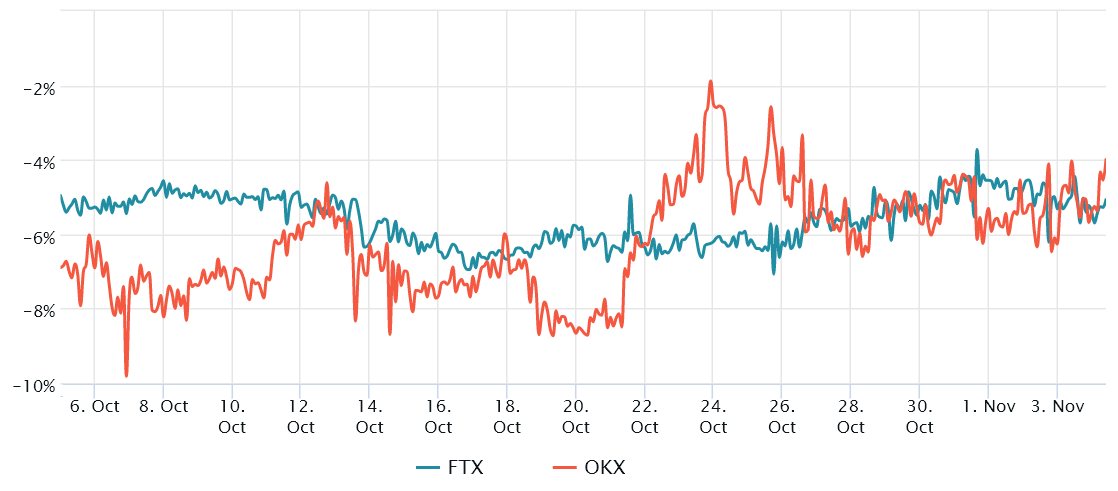

With this stated, open interest doesn’t always imply that professional investors are bullish or bearish. The futures annualized premium measures the main difference between longer-term futures contracts and also the current place market levels.

The futures premium (basis rate) indicator should run between 4% to eightPercent to pay traders for “locking in” the cash before the contract expiry. Thus, levels below 2% are bearish, while figures above 10% indicate excessive optimism.

Data from Laevitas implies that Solana’s futures happen to be buying and selling in backwardation within the last thirty days, meaning the futures’ contract cost is gloomier than regular place exchanges.

Ether (ETH) futures are buying and selling in a .5% annualized basis, while Bitcoin’s (BTC) is 2%. The information is sort of concerning for Solana because it signals too little interest from leverage buyers.

Rumors about Alameda Research could create more pressure

It’s difficult to pinpoint the reason behind a lot indifference about Solana as well as the entire dominance of leverage short demand. Much more curious is Alameda Research’s affect on Solana projects. Alameda may be the digital asset buying and selling company spearheaded by Mike Bankman-Fried.

Lately, trader and Crypto Twitter influencer Hsaka elevated concerns about if the firm continues to be suppressing SOLs cost despite bullish catalysts emerged.

Entire market catching an offer meanwhile Sol aimlessly meandering after two hyper bullish catalysts such an atmosphere.

Alameda washed up. https://t.co/FuGQvMfRcF

— Hsaka (@HsakaTrades) November 4, 2022

It’s most likely highly unlikely that market participants will truly discover Alameda Research’s effect on SOL cost. Still, the idea elevated by Hsaka could explain the rather unusual steady interest in leverage shorts and also the negative basis rate. The arbitrage and market-making firm might have used derivatives instruments to lower their exposure without selling SOL around the open market.

There aren’t any signs that short sellers using SOL futures instruments are nearing liquidation or exhaustion, so their upper hands remains before the broader cryptocurrency market shows indications of strengthening.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.