The cryptocurrency market overall suffered a poor summer time on back-to-back bits of not so good news, varying from Terra’s (Luna) —now renamed Terra Classic (LUNC) — collapse towards the Celsius Network’s liquidity crisis. However, many tokens have bucked the downtrend and also have really seen their valuations increase within the summer time.

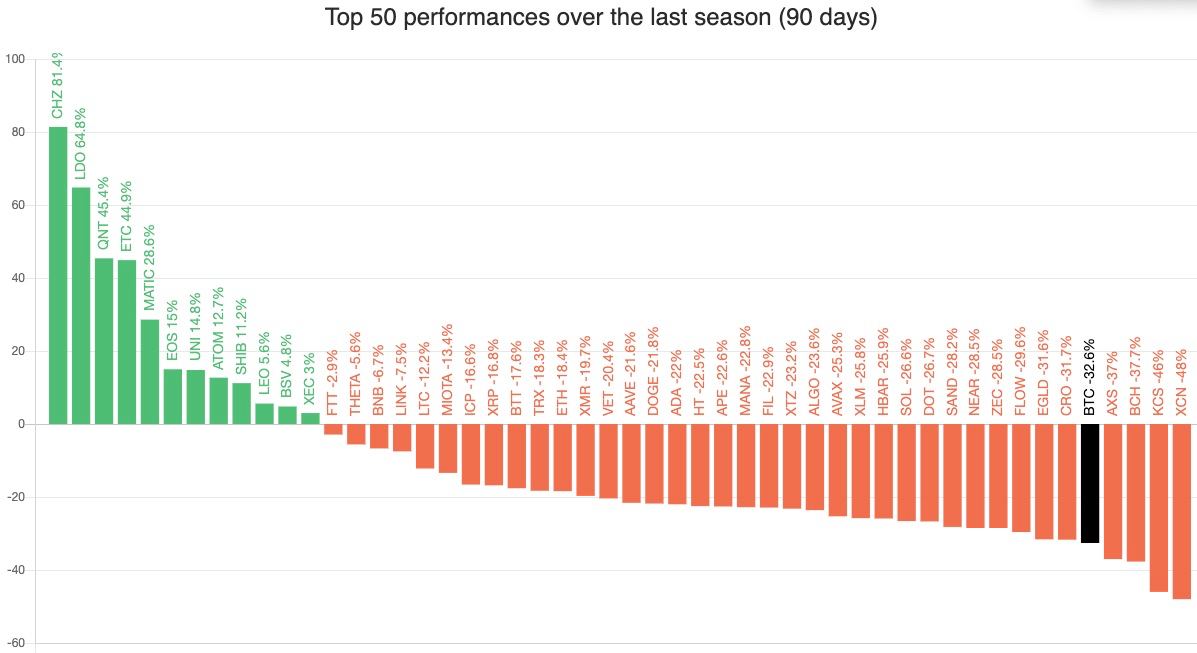

Particularly, the final 3 months have experienced these so-known as alternative cryptocurrencies, or “altcoins,” outperforming top coins like Bitcoin (BTC) and Ether (ETH). Listed here are three included in this:

Chiliz (CHZ)

Chiliz’s (CHZ) return within the last 3 months involves be above 80%, the greatest one of the top-cap cryptocurrencies. Furthermore, CHZ is lower only 26% year-to-date in contrast to BTC and ETH losing 57% and 60%, correspondingly.

Around the daily chart, CHZ’s cost arrived at $.20 per piece on August. 29, and it was searching to shut the month in profit. On the other hand, theoretically speaking, the Chiliz token stares in a potential 55% correction to $.09 in September, in line with the setup proven below.

Initially, the CHZ cost rally began among a rebound observed over the crypto market. But ts upside move selected momentum on the flurry of positive updates, together with a partnership with crypto exchange Huobi Global along with a nearly 25% acquisition of FC Barcelona’s Barça Studios.

FC Barcelona announces the purchase of 24.5% of Barça Studios to the organization https://t.co/SkC8g62KY4 for 100 million euros to accelerate the club’s audiovisual, blockchain, NFT and Web.3 strategy.

Additional information https://t.co/0sM9grct3L pic.twitter.com/5xcLWYg440

— FC Barcelona (@FCBarcelona) August 1, 2022

Chiliz also taken advantage of the hype around its back-to-back network updates because it tries to eliminate Ethereum and launch its very own chain CHZ 2..

Lido DAO (LDO)

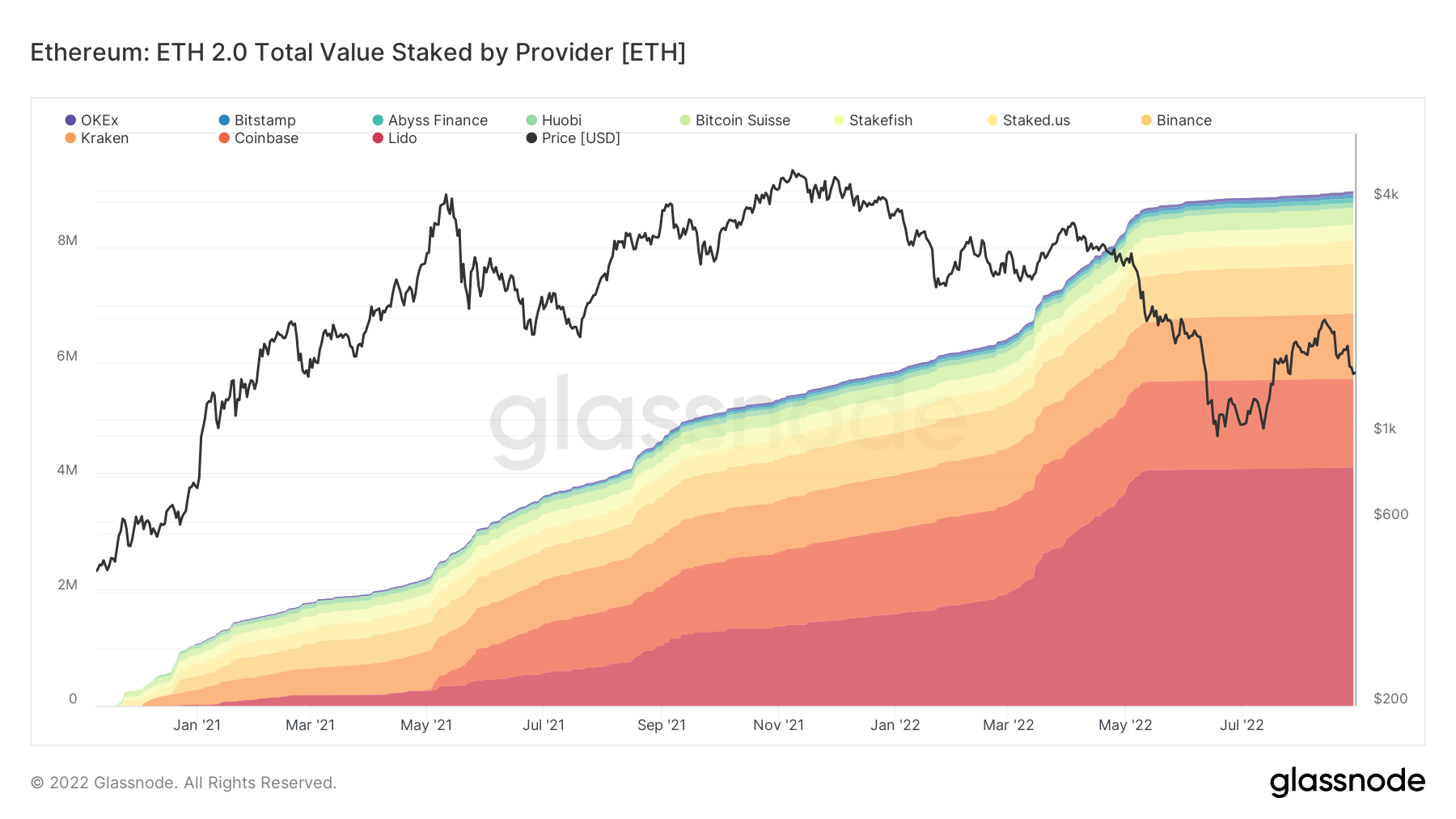

Lido DAO (LDO) has rallied around 60% within the last 3 months mainly because of the excitement around “the Merge,” Ethereum’s lengthy-anticipated network transition from proof-of-try to proof-of-stake in September.

Related: US dollar hits new 20-year high — 5 items to know in Bitcoin now

Lido DAO helps underfunded users to get stakers on Ethereum’s approaching proof-of-stake chain. It will so by collecting users’ Ether funds right into a pool of 32 ETH—as needed through the Ethereum network—and depositing them in to the Merge’s official smart contract.

The prospects of Lido DAO attracting more users dads and moms resulting in after the Merge have triggered buying within an otherwise bear market.

But like Chiliz, LDO’s cost risks plunging lower by 20% to $1.31 in September as proven within the setup below.

The $1.31-target can serve as the support within the consolidation area marked in red, given its historic performance.

Quant Network (QNT)

Quant Network (QNT) rose by greater than 40% within the last 3 months, initially driven greater with a broader crypto market upward trend but picking momentum on speculations their interoperable blockchain protocol would find adoption across governmental and regulatory physiques.

⚔️ Group 2 — Financial Action Task Pressure (FATF)

Quant Chief executive officer @GVerdian has labored diligently to help keep Overledger in compliance with all of existing and forthcoming rules, such as the FATF’s framework for VASPs (see image).☑️ Gilbert’s #FATF hashtag from 2019 states everything. ⬇️ https://t.co/0hvTDqAESh pic.twitter.com/F3Txe8rWPr

— Greg Lunt (@GregLunt27) This summer 8, 2022

But theoretically speaking, QNT risks a 40% cost decline from the current cost level because of the development of the mind-and-shoulders setup on its daily chart having a $57 target by September, as proven below.

Other winners

Ethereum Classic (ETC) has additionally surged by greater than 40% within the last 3 months hoping it would supply a secure haven for Ethereum miners following the PoS upgrade.

WhilPolygon (MATIC) has rallied by 27% within the same period, adopted by Uniswap (UNI), that is up 13%.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.