A brand new and comparatively unknown DeFi token known as BarnBridge (BOND) has rallied over 800% to achieve $20 on This summer 26.

The Text cost surge comes greater than a month after bottoming out around $2.19. Compared, top coins, Bitcoin (BTC) and Ether (ETH) only have rebounded by 18% and 54% within the same period, correspondingly.

Another pump and dump?

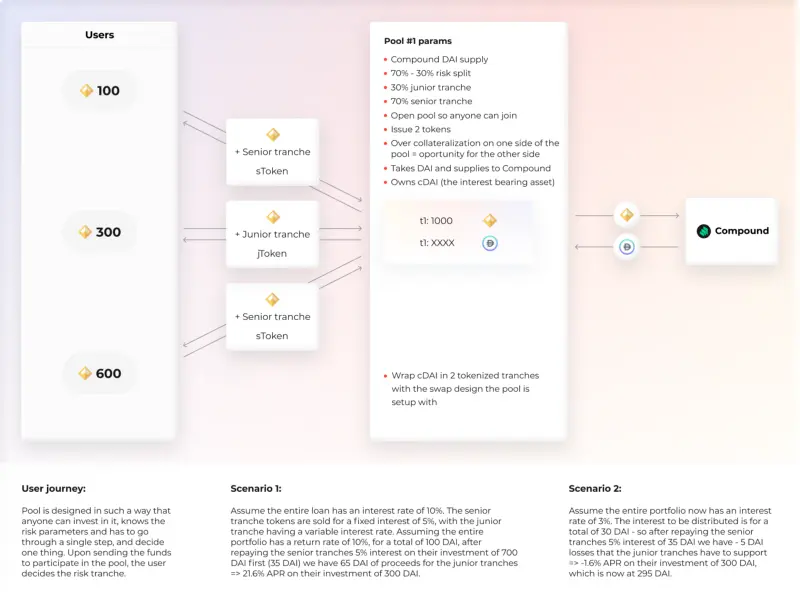

BarnBridge is a mix-chain risk management protocol that offers a suite of composable DeFi products for investors to hedge against rate of interest fluctuations and cost volatility.

Examples include SMART Yield — something that enables investors to secure fixed interest rate yields in the debt pools of other projects for example Aave, Compound, Cream, or Yearn.finance — and SMART Exposure, that provides investors tools to rebalance portfolios.

BarnBridge’s latest product, SMART Alpha, enables investors to hedge against cost fluctuations and offers them leverage for bullish theses. Meanwhile, BOND works as a governance token towards the Ethereum-based DAO representing BarnBridge.

At first glance, the most recent BOND cost pump should reflect an excellent curiosity about risk-trenching protocols, mainly when many projects within the DeFi sector have unsuccessful. However the token’s gains appear largely speculative if a person concentrates on its buying and selling volume concentration.

Particularly, greater than 50% of BOND volumes have originated at Binance previously 24 hrs, according to data tracked by CoinMarketCap. Simultaneously, the daily buying and selling activity from the benchmark BOND/USD pair continues to be declining throughout the cost pump, as proven below.

The cost-volume divergence shows that less investors happen to be behind the text cost pump, growing the likelihood of a clear, crisp correction within the future or days.

Next BOND cost targets

Drawing a Fibonacci retracement graph from BOND’s swing a lot of $37.50 to the swing low of $2.18 churns out a string of potential support and resistance levels, as proven within the weekly chart below.

BOND continues to be retreating after testing $24 since it’s interim resistance, and today anticipates to endure a long correction toward $15.60, lower 17.5% from This summer 26’s cost. An additional breakdown risks crashing the cost to $10.50, or perhaps a 45% decline.

Related: Institutional ETH sentiment turns positive after 11 days of outflows

On the other hand, a rebound above $24 might have BOND test $30 since it’s next upside target. Another breakout move could shift the prospective to $37.50, up 95% from current cost levels.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.