BNB, the native token of Binance’s BNB Chain , has bounced 66% from the $183 lower in mid-June. The move consolidates its position because the third-rated cryptocurrency (when stablecoin market caps are removed) and reflects a $50 billion market capital. BNB has outperformed the broader altcoin market capital following a devastating 73% correction that started in November 2021.

The above mentioned chart displays how this smart contract blockchain network endured throughout the recent market collapse and just how similar movements happened over the altcoin market. Since BNB cost has arrived at $300, let’s check out the way the asset lies when compared with This summer 2021 if this traded for the similar cost.

Is BNB’s market cap and valuation justified?

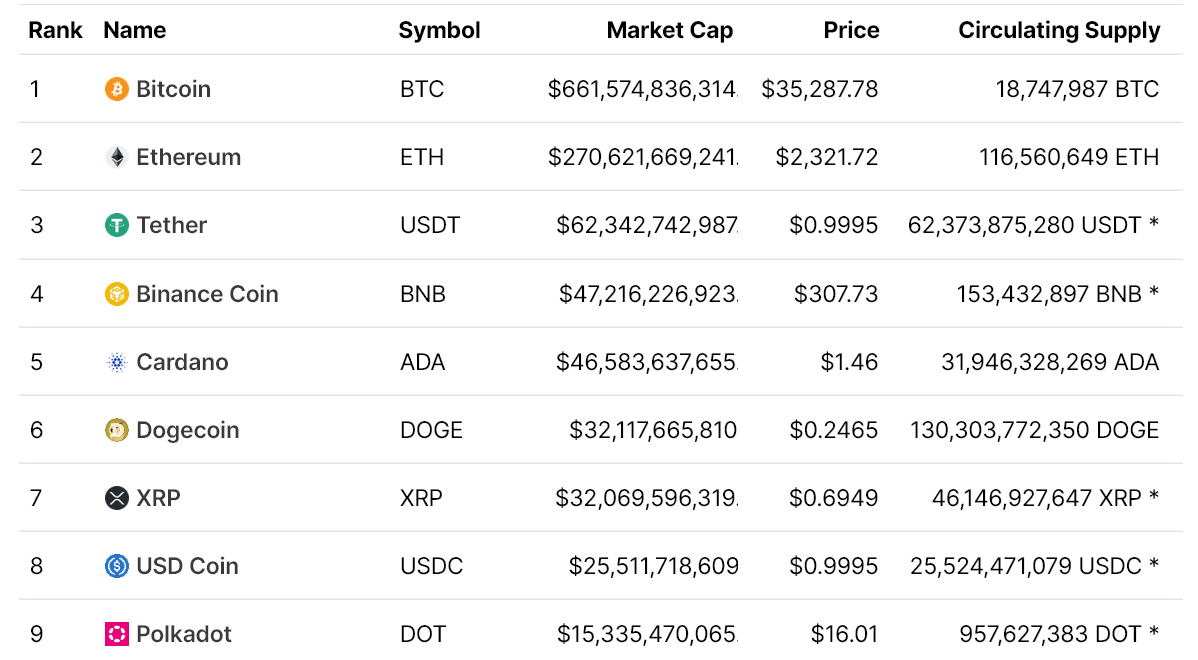

In This summer 2021, the altcoin market capital was 21% greater at $740 billion. Bitcoin (BTC) and Ether (ETH) had old themselves because the management, however the dispute for that third position was not even close to settled, a minimum of with regards to the total value.

Despite still to be the third largest cryptocurrency, BNB’s market cap was $47 billion, while Cardano (ADA) held a $46 billion valuation. Presently, no altcoin remotely matches its dominance and also the gap has widened by greater than $30 billion.

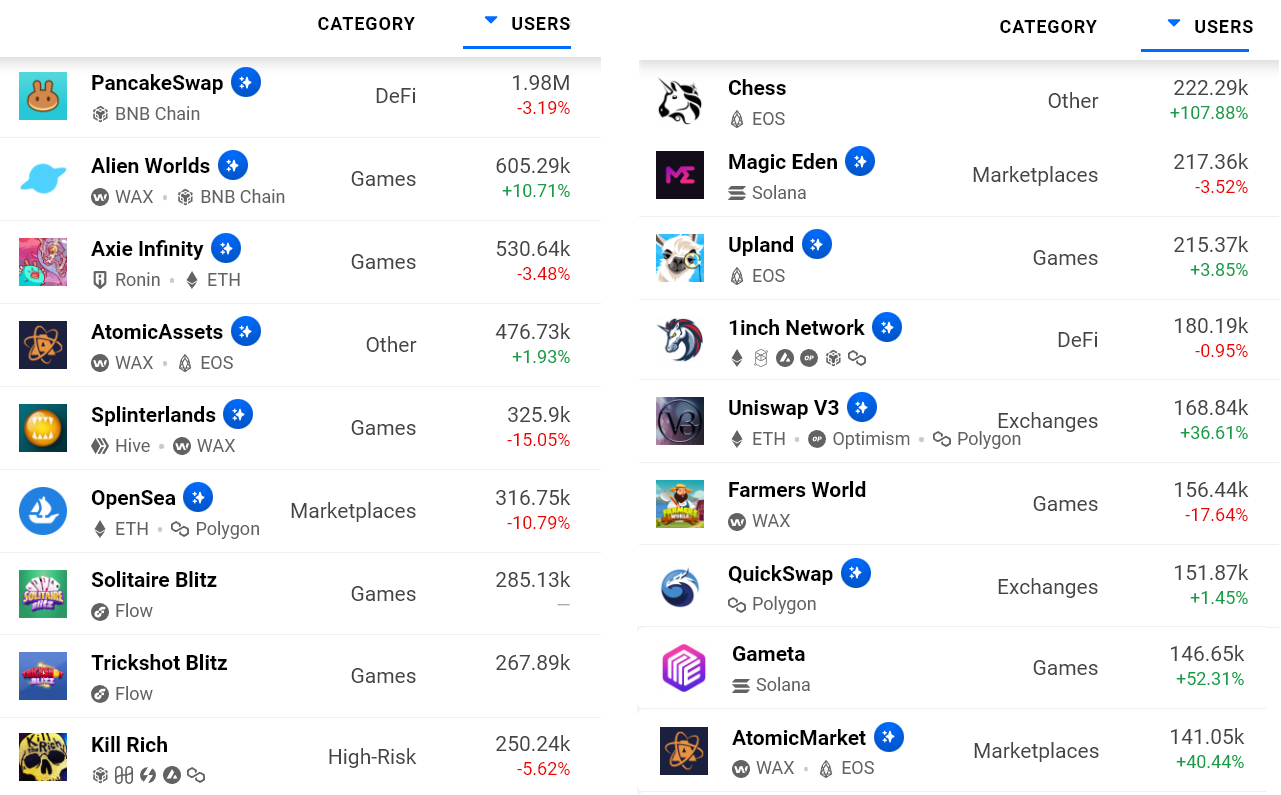

Smart contracts make up the first step toward all decentralized applications (DApps), including decentralized finance, gaming, marketplaces, social systems and lots of other use cases. What exactly other success metrics exist besides the amount of active users using addresses like a proxy?

PancakeSwap, BNB Chain’s decentralized exchange, has 1.98 million active addresses. The amount is really massive that aggregating the following four competitors isn’t enough to complement it. Based on the data, the runner-as much as BNB Chain is 1inch Network, which holds 91% less users.

For individuals questioning whether BNB Chain is really a one-trick pony, the network holds a few games which have 83,000 or even more active addresses each and 78,450 which use the 1inch Network. Asking whether PancakeSwap really holds that lots of users is really a valid question, however the Ethereum network only holds three DApps surpassing 30,000 active addresses, namely Uniswap, OpeanSea and MetaMask Swap.

Smart contract deposits set BNB Chain aside from its competitors

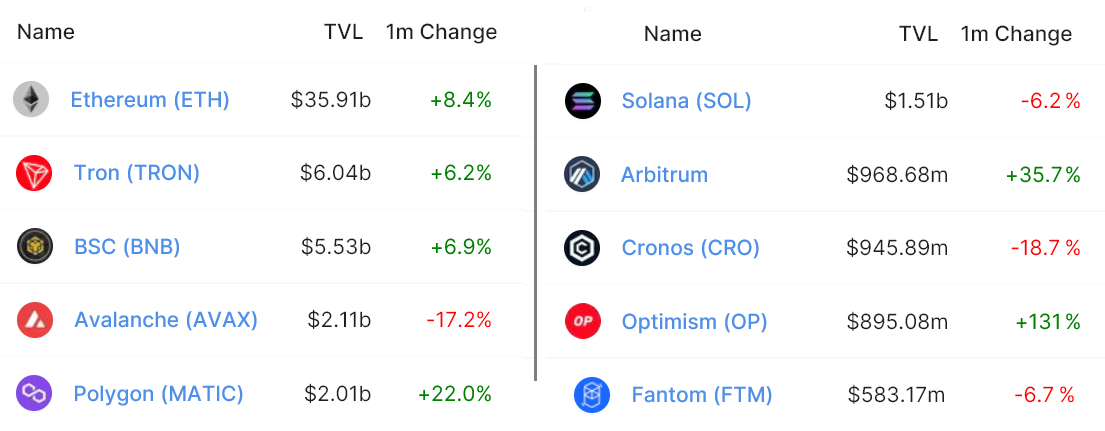

One might reason that the entire worth of users’ deposits in smart contracts are important to figuring out a network’s success. However, even though it is highly valid for finance applications, there is not much reason behind marketplaces, games, collectibles and social systems to carry large deposits.

Presently, Ethereum is absolutely the leader and also the DApp hosting the algorithmic-backed DAI stablecoin has $8.25 billion price of deposits. Still, this really is greater than justified by Ether’s $208 billion market capital, that is over four occasions greater than BNB with $50 billion.

Data shows a consolidated third spot for BNB Chain with $5.5 billion in TVL, that is greater than double Avalanche (AVAX) and Polygon (MATIC).

Binance leads in buying and selling volumes

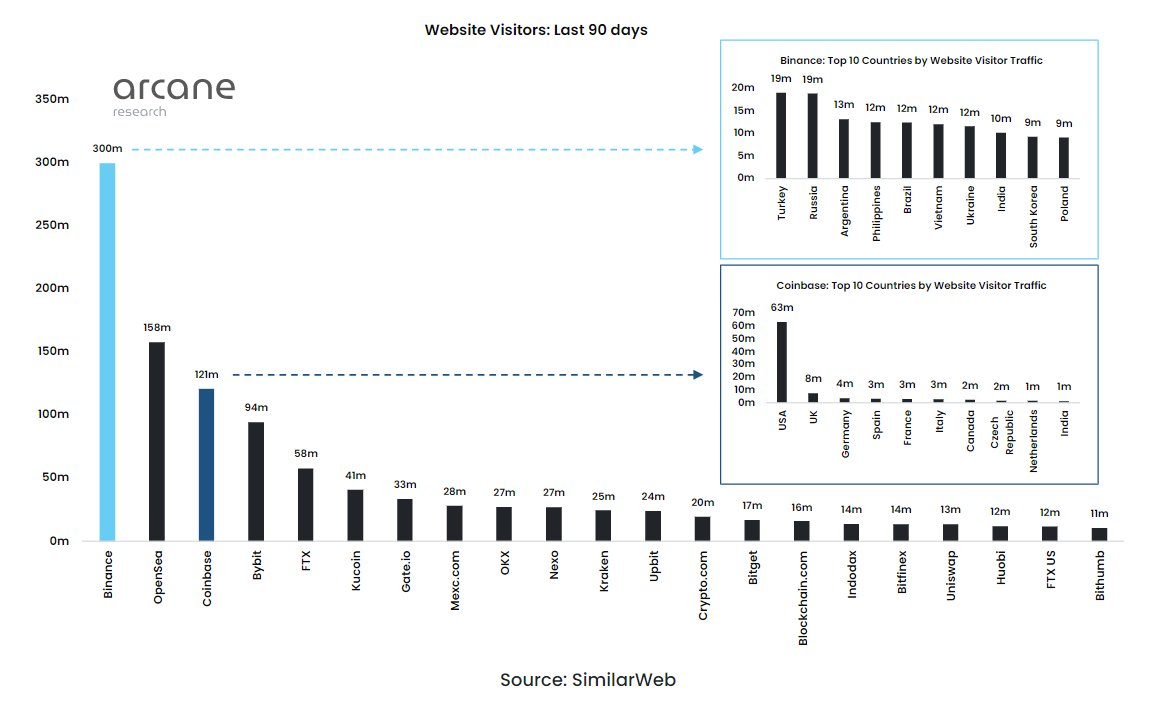

When comprising the BNB’s valuation, especially compared to smart contract blockchains, there should be another methodology since the token has additional utility around the Binance exchange. In addition, supplying discounted buying and selling charges, possibilities in the token sales launchpad and exclusive staking possibilities allow BNB to stick out among its competitors.

Related: Coinbase eyes lengthy-term development of subscription revenue, NFTs still an emphasis

Data from SimilarWeb shows Binance had 300 million readers in thirty days versus 121 million from Coinbase. Consequently, if FTX Token (FTT) holds a $5 billion market cap, BNB ought to be five occasions bigger exclusively from Binance’s utility offer.

Therefore, when creating a valuation comparison with smart contract platforms, analysts should discount up to 50 % of BNB’s $50 billion market cap to have an equivalent metric. BNB token appears fairly priced because of its third place (when stablecoins are removed) in global market capital ranking, its leadership in DApps users, third place status when it comes to TVL deposits and absolute dominance of exchange volumes.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.