A minimum of three market catalysts reveal that Dogecoin (DOGE) could climb by a minimum of 50% through the finish of Q3 2022.

Falling wedge breakout in play

Dogecoin continues to be painting a “falling wedge” pattern on its longer-time-frame charts since May 2021, meaning at the opportunity of a bullish reversal within the coming several weeks.

Falling wedges appear once the cost trends lower in the range based on two climbing down, converging trendlines. Their occurrence coincides with declining trade volumes, suggesting that buying and selling activity slowed lower because of the narrowing cost range.

A rest from the wedge towards the upside, along with a boost in buying and selling volumes, suggests the asset is breaking out. Usually of technical analysis, a falling wedge breakout can push the cost upward up to the utmost distance between your structure’s lower and upper trendline.

Using the classic theory to Dogecoin shows that it might rise toward $.40 when the breakout occurs close to the $.14 level, or about 190% above today’s cost.

At its worst, the falling wedge breakout might have DOGE’s cost rally just a little 50 plusPercent to $.21, given its breakout point involves be close to the apex around $.75.

Elon Musk’s Twitter acquisition

The 2009 week, Twitter announced it had recognized Elon Musk’s bid to buy its social networking platform for $4 billion. Dogecoin’s cost reacted bullishly to the chance that Musk would integrate DOGE among the official payment mediums for Twitter’s subscription services, according to his recent recommendations towards the company’s board.

Noelle Acheson, mind of market insights at Genesis Global Buying and selling, noted that DOGE’s cost rally will get its cues from “very much speculation,” given Musk continues to have to verify whether he’d give a Dogecoin payment option on Twitter.

“But the chance, even if it’s remote, is sufficient to get traders looking forward to the possibility grow in DOGE adoption,” she told Bloomberg.

DOGE investors are becoming excited

Musk’s Twitter acquisition announcement on April 25 and it is subsequent positive effect on Dogecoin prices, which rose by nearly 20% on the day that, coincided having a spike in retail and institutional interest.

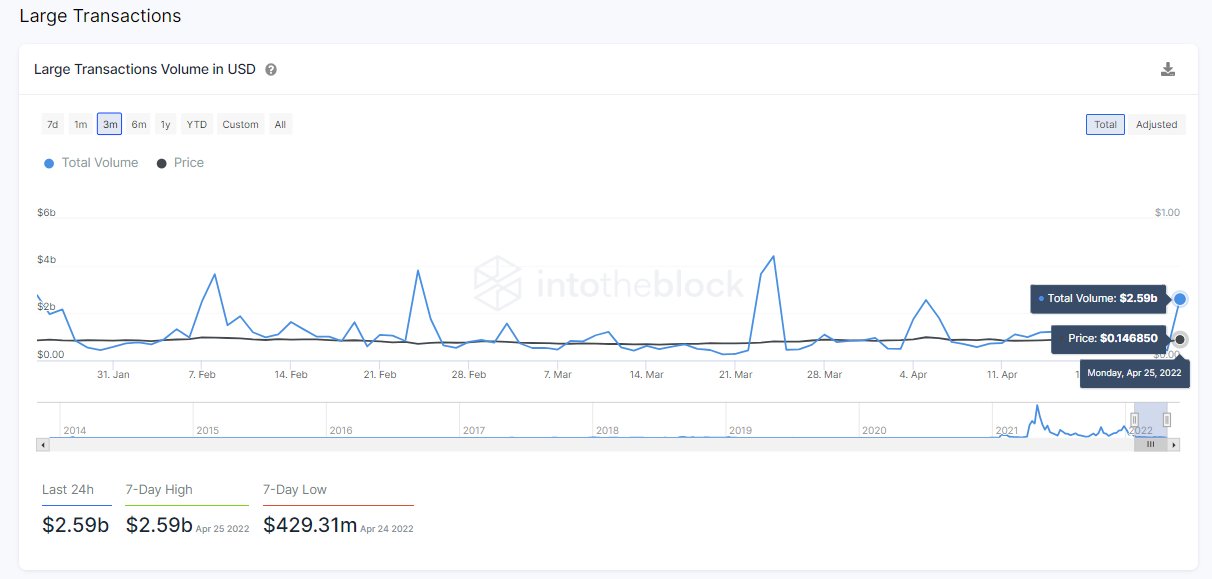

For example, internet queries for that keyword “buy Dogecoin” increased by 392% on April 25, based on Google Trends. Meanwhile, the level of on-chain DOGE transactions having a value exceeding $100,000 arrived at $2.59 billion on the day that.

“This may be the greatest volume since March 24, and symbolized 94% from the total volume,” data analytics platform IntoTheBlock noted.

CryptoWallet, a cryptocurrency card service, also confirmed exactly the same within an email statement to Cointelegraph, noting that “the online curiosity about buying Dogecoin skyrocketed to just about four occasions the typical volume in a single day because of Musk obtaining full possession of Twitter.”

Related: Dogecoin Jesus? Roger Ver resurfaces on Twitter, backs DOGE over BTC

DOGE’s cost fell by greater than 12% on April 26. Nevertheless, the decline supported lower volumes than the day before, suggesting less strong profit-taking sentiment.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.