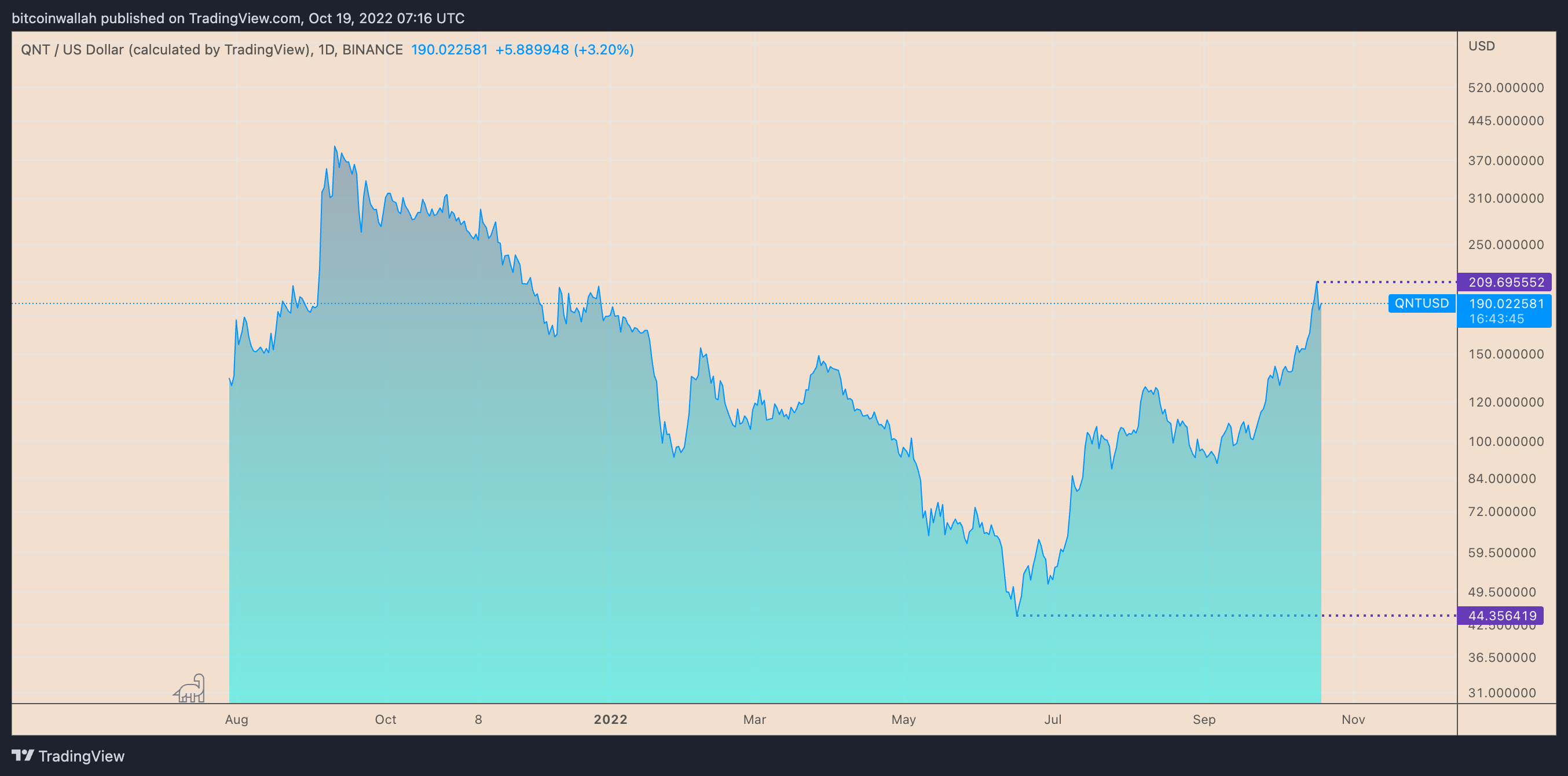

The cost of Quant Network (QNT) eyes a clear, crisp reversal after a remarkable 450% rally previously four several weeks.

QNT’s downside outlook takes cues from the flurry of technical as well as on-chain indicators, all suggesting that investors who backed its cost rally have likely arrived at the purpose of exhaustion.

Listed here are three good reasons why it may be happening.

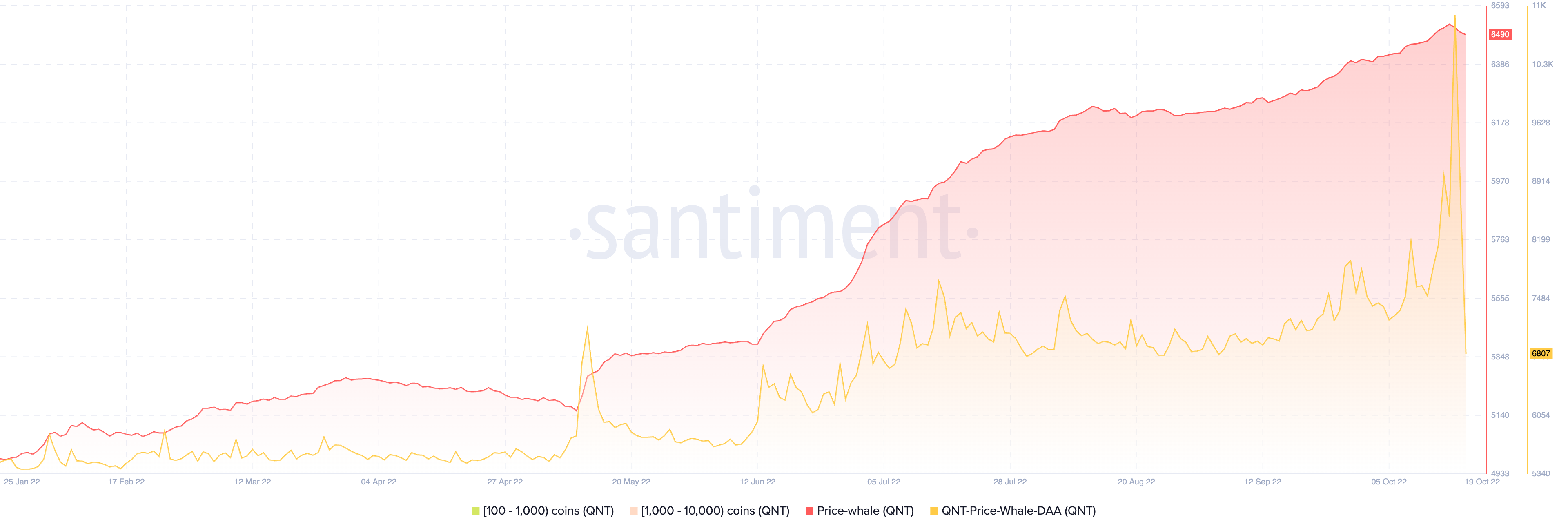

Quant’s daily active addresses drop

Interestingly, the time of QNT’s massive upward trend coincided concentrating on the same upticks in the quantity of daily active addresses (DAA). This metric represents the amount of unique addresses participating in the network like a sender or receiver.

By March. 17, the Quant Network’s DAA arrived at an exciting-time a lot of 10,949, up from around 5,850 four several weeks ago, data from Santiment shows. Its upsurge throughout the QNT cost upward trend shows traders were internet buyers.

However, the DAA readings dropped dramatically previously 2 days, reaching nearly 6,800 on March. 19. Concurrently, QNT’s cost fell by 25.5% to $171 within the same period, suggesting that lots of traders happen to be securing their profits.

QNT cost downside target

The net income-consuming the Quant Network market may come as its daily relative strength index (RSI) entered above 70 on March. 17, meaning the asset is overbought.

An overbought RSI doesn’t always mean a powerful bearish reversal, however. Rather, it implies that the cost has moved upward too rapidly and, thus, a correction has become more and more likely prior to the upward trend could resume.

QNT’s daily RSI remedied to 65 on March. 17. Concurrently, the token’s cost dropped toward $185, coinciding using its .236 Fib type of the Fibonacci retracement graph proven within the chart below.

The $185-level was instrumental as support in August 2021. But because of the existing profit-taking sentiment, the amount might not hold for lengthy, which could cause a long decline toward the $137-$150 support range.

The region falls between QNT’s .382 and .5 Fib lines and additional coincides using its 50-day exponential moving average (50-day EMA the red wave within the chart above), developing a strong support confluence. Therefore, a rest below $185 might have QNT bears eye $137, a 25% drop, because the ultimate downside target through the finish from the month.

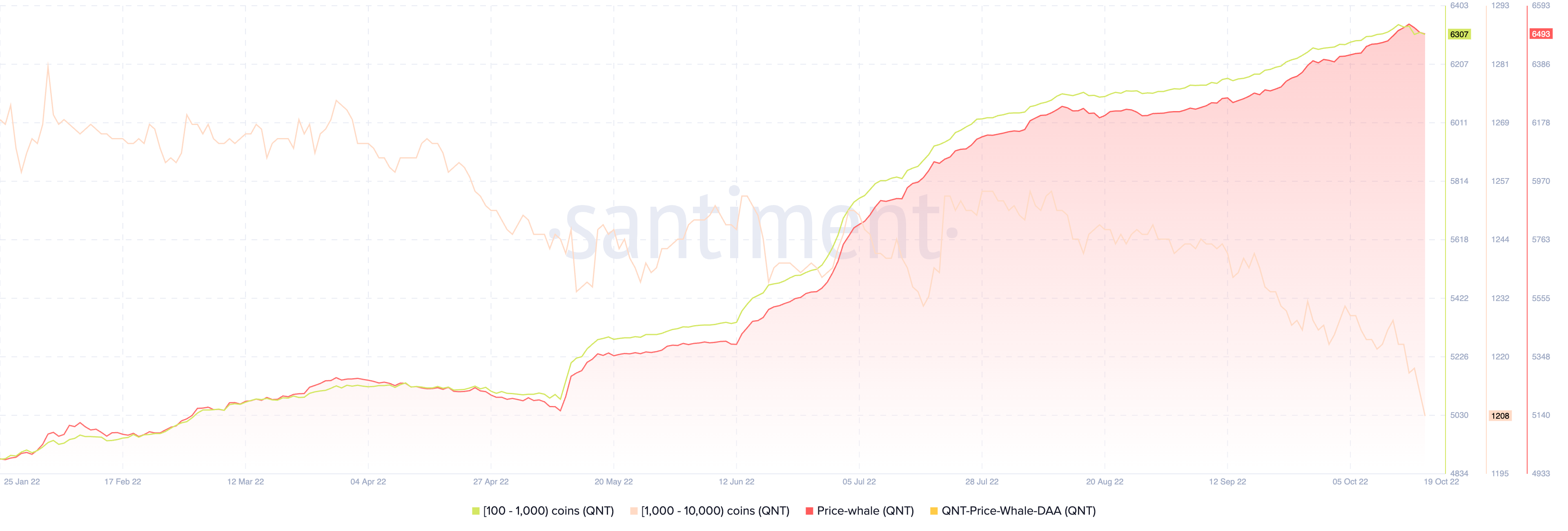

QNT whales diminish

The time of Quant Network’s 450% cost rally heavily coincided with the rise in the amount of addresses holding between 100 QNT and 1,000 QNT tokens, dubbed as “whales” by Santiment.

Related: Institutions ‘moving very, very fast’ into Crypto: Coinbase professional

However, the whale count began shedding on March. 16, each day before QNT’s cost and DAA capped out. Meanwhile, addresses holding between 1,000 QNT and 10,000 QNT tokens also fell, suggesting the plunge within the 100-1,000 QNT cohort was because of token distribution, not accumulation.

Quite simply, QNT whales have began selling their holdings close to the token’s potential cost top, raising options the decline could continue toward the technical targets, as pointed out above.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.