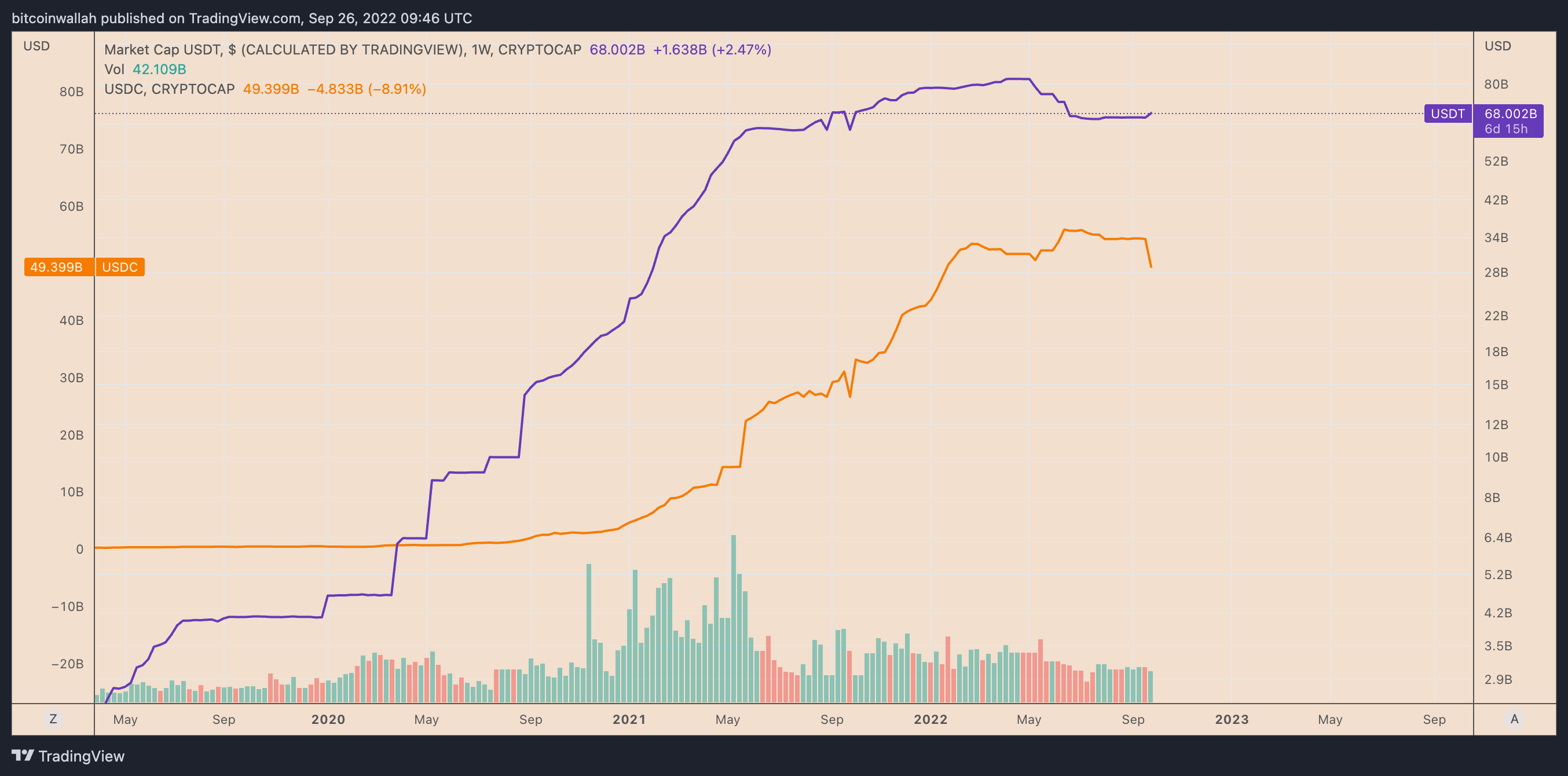

The marketplace capital of USD Gold coin (USDC), a stablecoin from U.S.-based payment tech firm Circle, has dropped below $50 billion the very first time since The month of january 2022.

Around the weekly chart, USDC’s market cap, which reflects the amount of U.S. dollar-backed tokens in circulation, fell to $49.39 billion on Sep. 26, lower almost 12% from the record a lot of $55.88 billion, established just three several weeks ago.

In comparison, the marketplace cap of Tether (USDT), which risked losing its top stablecoin position to USDC in May, entered above $68 billion on Sep. 26, although still lower 17.4% from the record a lot of $82.33 billion in May 2022.

The divergence between USDT and USDC shows investors’ restored preference for that former. Let us check out the standards boosting Tether because the top stablecoin.

Binance’s USDC suspension

Binance, the earth’s largest cryptocurrency exchange by volume, announced earlier in September that it might convert its users’ USDC balances because of its own stablecoin, Binance USD (BUSD). The conversion will commence on Sep. 29 and doesn’t affect USDT.

The exchange stated it really wants to “enhance liquidity and capital-efficiency for users” via what seems to become a forced conversion within an more and more competitive stablecoin sector. Consequently, Binance suspended place, future and margin buying and selling in USDC.

8/ 1. Binance’s forced “Auto-conversion” is blatantly monopolistic behavior of the FinTech company

They’re no much better than traditional banks which have the ability to freeze or seize control of user funds

Where’s the decentralized future that #Web3 users were guaranteed?

— Momentum 6 (@Momentum_6) September 21, 2022

USDC’s market cap has stepped by $9.5 billion because the announcement.

Following Binance’s actions, the India-based cryptocurrency exchange also stopped deposits of USDC beginning Sep. 26.

Related: Binance: No intends to auto-convert Tether, though that ‘may change’

Whales ditch USDC after Terra fiasco

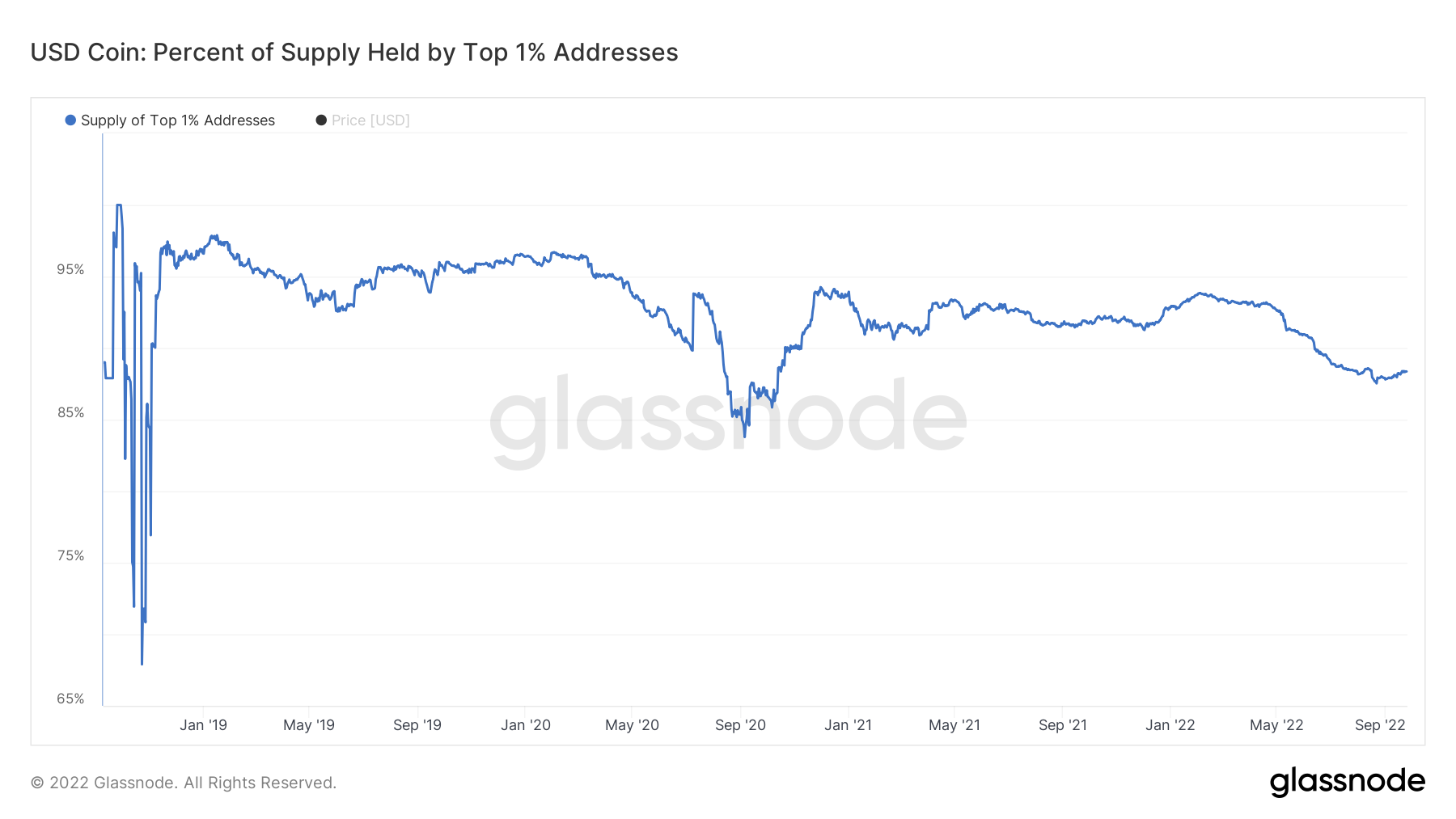

The USDC supply help by top 1% addresses (also known as whales) has dropped to 88.36% in September from the year-to-date a lot of 93.84% in Feb, based on data collected by Glassnode.

Interestingly, the plunge faster after Terra, a $40-billion “algorithmic stablecoin” project, collapsed in May, stirring an adverse sentiment toward the whole stablecoin industry.

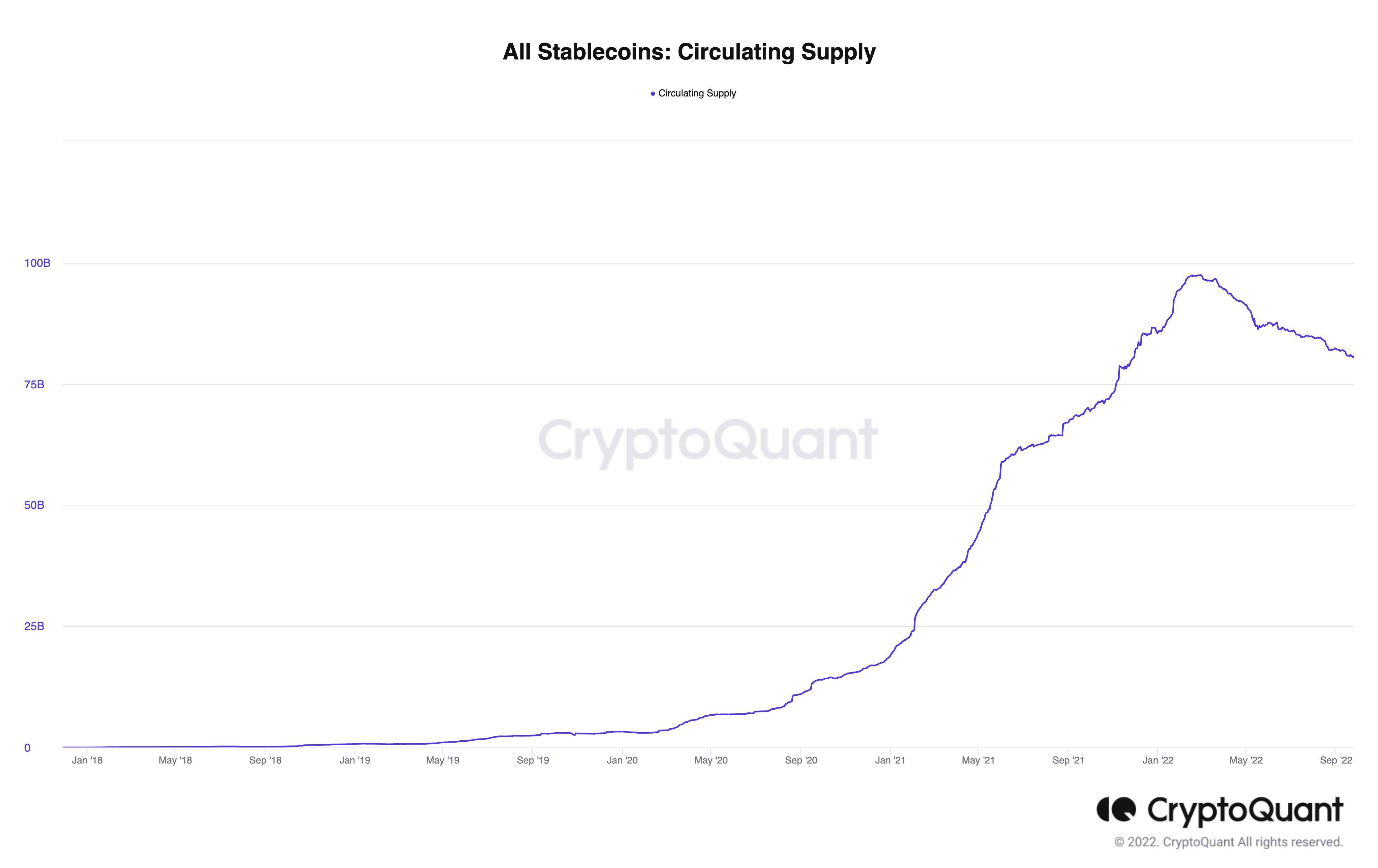

For example, the entire market cap of stablecoins saw the worst correction in 2022, shedding from the Feb a lot of $97.37 billion to $80.65 billion in September, based on CryptoQuant.

Tornado Cash sanctions

The USDC market cap plunge has additionally faster following the U.S. Treasury enforced sanctions on crypto mixing service Tornado Cash over money washing concerns.

Circle taken care of immediately the sanctions by freezing all USDC wallets of Tornado Cash. The firm also prevented addresses which may be connected using the banned mixing service by using USDC. In comparison, Tether prevented blacklisting Tornado Cash addresses.

Independent market analyst Geralt Davidson treated Circle’s reaction to the Tornado Cash sanction like a cue that holding USDC is riskier when compared with its stablecoin rivals.

“People are in possession of recognized there’s more risk holding USDC, Circle blacklisted all of the USDC on Tornado Cash addresses sanctioned by US Treasury,” he noted in August 2022, adding:

USDC appears such as the only token being blacklisted, while other ERC-20 tokens weren’t.

Davidson also treated Tornado Cash among the explanations why USDC whales happen to be dumping the stablecoin in recent several weeks.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.