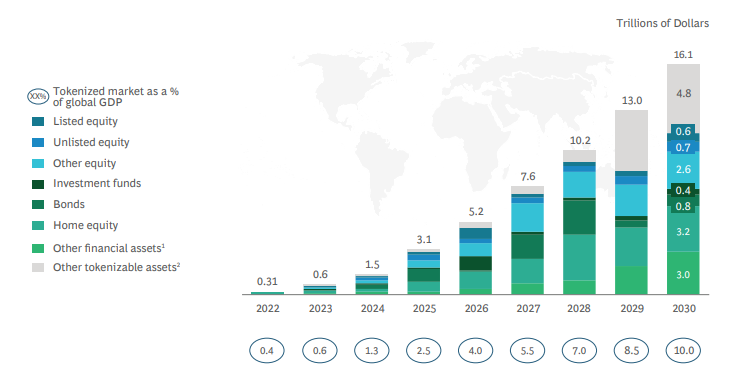

The entire size tokenized illiquid assets, including property and natural sources could achieve $16.1 trillion by 2030, based on the Boston Talking to Group (BCG).

Inside a recently released report from BCG and digital exchange web hosting markets ADDX, authors including BCG md Sumit Kumar and ADDX co-founder Darius Liu noted that “a large slice of the world’s wealth today is kept in illiquid assets.”

Based on the report, illiquid assets include pre-dpo (IPO) stocks, property, private debt, revenues from medium and small companies, physical art, exotic beverages, private funds, wholesale bonds and much more.

Causes of this asset illiquidity are related to factors for example limited affordability for mass investors, insufficient wealth manager expertise, limited access for example when assets are limited to elite cliques (within the situation of proper art and vintage cars), regulatory hurdles along with other scenarios by which users have a problem obtaining or buying and selling a good thing.

On-chain asset tokenization could solve this issue, an industry that surpassed $2.3 billion in 2021 and it is likely to achieve $5.6 billion by 2026, based on the report.

The authors added that in only the final 2 yrs, global digital asset daily buying and selling volume has soared from 30 billion euros in 2020 to 150 billion euros in 2022, noting it “is still minuscule as compared to the total potential of illiquid tokenizable assets on the planet.”

By 2030, the authors forecast the on-chain asset tokenization chance to achieve $16.1 trillion — composed largely of monetary assets (for example insurance plans, pensions, and alternative investments), home equity, along with other tokenizable assets, for example infrastructure projects, vehicle fleets and patents.

The authors also noted this would be a “highly-conservative forecast” which inside a best-situation scenario, the tokenization of worldwide illiquid assets could achieve $68 trillion.

However, the potential for tokenized assets will differ across countries because of various regulatory frameworks and asset class sizes.

In Singapore, the Financial Authority recently launched Project Protector, a blockchain-based asset tokenization pilot which will explore decentralized finance (DeFi) applications in wholesale funding markets by creating a liquidity pool of tokenized bonds and deposits to complete borrowing and lending processes on-chain.

Additionally to Singapore, tokens issuance is controlled in Hong Kong, Japan, the Eu, the Uk, the U . s . States, the Uae, Germany, Austria and Europe.

Other authors within the report include BCG’s project leader Rajaram Suresh, affiliate director Bernhard Kronfellner and consultant for BCG Aaditya Kaul, noting:

“On-chain asset tokenization presents an chance to obviate a number of these barriers of asset illiquidity along with the current modality of traditional fractionalization.”

Property might be one of the illiquid assets that may need tokenization, with investors searching for investments supported by real-world assets in DeFi.

Cointelegraph Research Terminal says property assets take into account upward of 40% from the pipeline for several technology providers, which makes it one of the greatest sectors for security token choices.

Earlier this year, digital asset investment platform Zerocap announced that companies around the Australian Securities Exchange (ASX) could have the ability to trade tokenized bonds, equities, funds or carbon credits following a effective proof-of-concept trial.