The FTX collapse is constantly on the stoke fears of the contagion within the cryptocurrency space as investors wait to listen to about companies that could face heat. Among the marquee names in the future underneath the circle of suspicion may be the Grayscale Bitcoin Trust (GBTC), that has seen its discount to Bitcoin’s (BTC) cost achieve record amounts of about 50%.

Traders hate uncertainty and be put off by investing over these periods. That may be a primary reason for too little buying curiosity about Bitcoin despite the sharp fall in the cost. The Stock-to-Flow (S2F) model, which in fact had seen its recognition soar throughout the bull phase, is originating under growing critique following the deviation between Bitcoin’s cost and it is forecasted cost hit levels never witnessed before.

Performs this claim that the pessimism has arrived at a serious or perhaps is it simply the S2F model is problematic?

Throughout a bear phase, the overall trend is lower but there will always be pockets of strength that could offer buying and selling possibilities to lengthy-only investors. However, rallies during bear financial markets are short-resided, hence traders may consider booking profits near strong resistance levels.

Let’s consider the charts of 5 cryptocurrencies that could chance a rally soon.

BTC/USDT

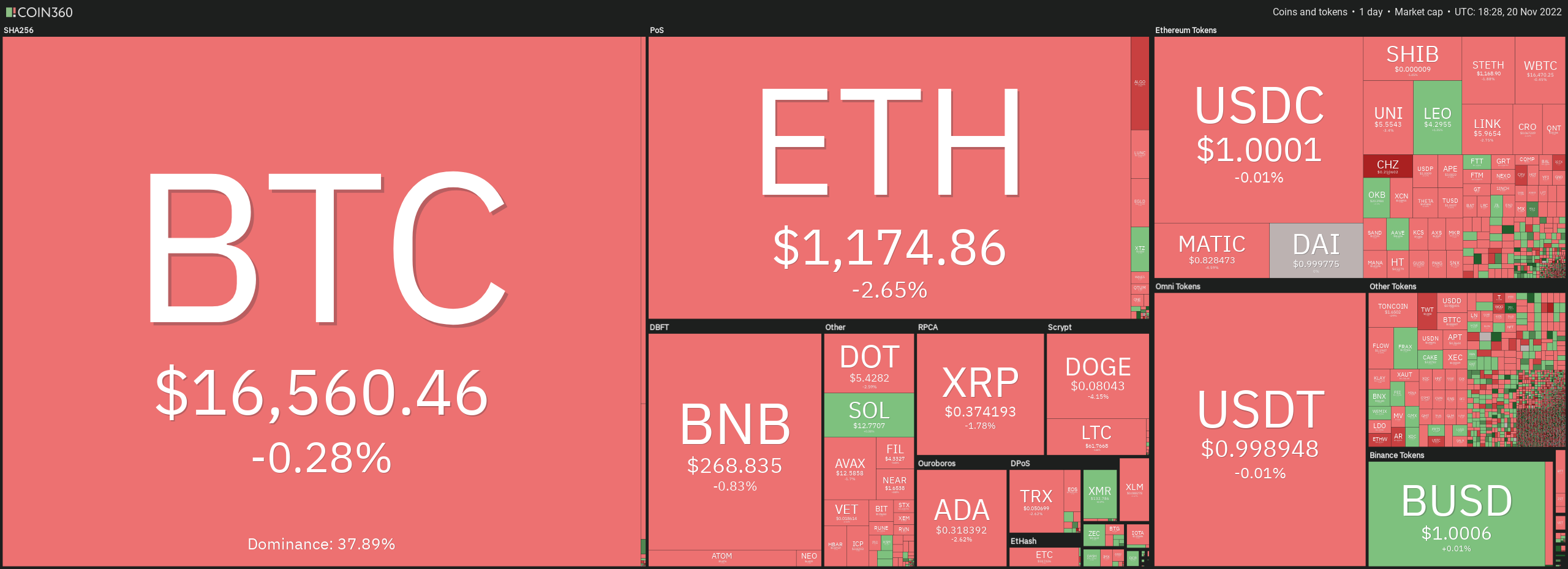

Bitcoin is constantly on the trade within the tight range from $16,229 and $17,190. Generally, periods of tight consolidation are adopted by a rise in volatility.

The downsloping moving averages and also the relative strength index (RSI) within the negative zone indicate the road to least resistance would be to the down-side. When the cost breaks below $16,229, the November. 9 intraday low of $15,588 might be threatened. A rest and shut below this support could signal the resumption from the downtrend. The following support on however $12,200.

If bulls wish to avoid an additional decline, they’re going to have to push and sustain the cost over the breakdown degree of $17,622. This type of move will suggest strong demand at ‘abnormal’ amounts. The happy couple could then climb towards the mental degree of $20,000.

The BTC/USDT pair continues to be buying and selling close to the moving averages, that have flattened out. This means the pair has joined a condition of equilibrium as both consumers are puzzled by the following directional move.

However, this uncertainty is not likely to carry on for lengthy. When the cost plummets below $16,229, the selling pressure could get momentum and also the pair may drop to $15,588. If the support gives way, the happy couple may begin the following leg from the downtrend.

On the other hand, when the cost increases and breaks above $17,190, it’ll claim that the present tight range was utilized through the bulls to amass. The happy couple could then rally to $18,200 and then to $18,730.

TON/USDT

Toncoin (TON) has retrieved dramatically from the June low and were able to keep most from the gains. This means that traders have been in no hurry to dump their positions at greater levels.

The TON/USDT pair has created a symmetrical triangular, which often functions like a continuation pattern. Both moving averages are progressively sloping up and also the RSI is incorporated in the positive territory, indicating a small benefit to the bulls.

When the cost rebounds from the 20-day exponential moving average ($1.65), the bulls will attempt they are driving the cost over the triangular. Whether they can accomplish it, the happy couple could rally to $2.15 and after that climb toward the prospective purpose of $2.87.

Alternatively, when the cost slips underneath the 20-day EMA, the happy couple could drop towards the 50-day simple moving average ($1.50) after which towards the support line.

The happy couple is facing stiff resistance at $1.80. Repeated failure to sustain the cost above this level might have enticed short-term traders to reserve profits. The bears are attempting to take advantage of this case and sink the cost underneath the 50-SMA. If the support cracks, the happy couple could dive to $1.55.

On the other hand, when the cost rebounds from the current level, the bulls will again attempt to scale the wall at $1.80. The repeated retest of the level of resistance has a tendency to weaken it. A detailed above this resistance could open the doorways for any possible rally to $2.

CHZ/USDT

Chiliz (CHZ) is trying to form an inverse mind and shoulders pattern, that will complete away and shut over the neckline. In the event that happens, it might signal the beginning of a brand new upward trend.

The pattern target from the reversal formation is $.54 however the bears are unlikely to stop easily. They’re strongly protecting the neckline. When the cost breaks underneath the 50-day SMA ($.21), the CHZ/USDT pair could decline to $.18 and subsequently to $.14.

Alternatively, when the cost bounces from the current level, buyers will again make an effort to propel the happy couple over the neckline and gain control.

The flattening moving averages and also the RSI just beneath the midpoint tendency to slack a obvious advantage with the idea to the bulls or even the bears. Hence, it is best to wait for a cost to breakout before creating fresh positions.

The happy couple switched lower dramatically from $.27 and also the bears have pulled the cost underneath the moving averages. When the cost sustains underneath the 50-SMA, the happy couple could drop to $.20. That may place the bears within the driver’s seat.

However, when the cost appears in the current level and increases over the 20-EMA, it’ll claim that traders are viewing the dips like a buying chance. The happy couple could then rise to $.26 and then to $.28. Buyers will need to drive the cost above this level to challenge the resistance at $.30.

Related: FTX funds on the go as crook converts a large number of ETH into Bitcoin

QNT/USDT

Although Quant (QNT) has remedied dramatically previously couple of days, it is trying to take support and bounce from the support line. This signifies demand at ‘abnormal’ amounts.

The downsloping 20-day EMA ($128) signifies benefit to bears however the RSI is attempting to create a positive divergence. This means the selling pressure might be easing.

Buyers will need to propel and sustain the cost over the 20-day EMA to point the corrective phase might be over. The QNT/USDT pair could then rise towards the 50-day SMA ($151) and after that to $180.

This positive view could invalidate soon when the cost continues lower and breaks underneath the upward trend line. The happy couple could then drop to $87 and then to $79.

The recovery within the pair is facing selling close to the downtrend line. This means that bears are active at greater levels. The bears have pulled the cost underneath the moving averages and can attempt to extend the decline to $105 after which to $94.

To invalidate this negative view, the bulls will need to kick and sustain the cost over the downtrend line. The happy couple could then rise to $125 in which the bears may mount a powerful defense. If buyers overcome this barrier, the up-move may achieve $136.

TWT/USDT

Some major cryptocurrencies extended their downtrend previously couple of days, Trust Wallet Token (TWT) has moved within the other direction and risen dramatically. This signifies outperformance soon.

The TWT/USDT pair soared from $1.03 on November. 10 to $2.73 on November. 14, a 165% rally within a short while. That pressed the RSI deep in to the overbought territory, suggesting a small correction or consolidation soon and that’s what happened.

The happy couple is finding support close to the 50% Fibonacci retracement degree of $1.88 however the bulls are battling to push the cost above $2.45. This means the happy couple may consolidate between $1.81 and $2.45 for any couple of days.

Both moving averages are sloping up and also the RSI remains within the positive territory, indicating that bulls possess the advantage. If buyers drive the cost over the $2.45 to $2.73 resistance zone, the happy couple could resume its upward trend. This positive view could invalidate away and shut underneath the 20-day EMA ($1.70).

The bears pulled the cost underneath the 50-SMA but they’re battling to help keep the happy couple lower. This means strong buying at ‘abnormal’ amounts. If buyers push the cost over the 20-EMA, the happy couple could rise towards the downtrend line.

A rest above this level could obvious the road for any possible rally to $2.45. This continues to be the key hurdle for that bulls to beat. When they flourish in breaking it, the happy couple may retest $2.73.

Around the downside, a slide below $1.92 could cause a decline to $1.81. It is really an important level to keep close track of just because a break below it might tilt the benefit in support of the bears.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.