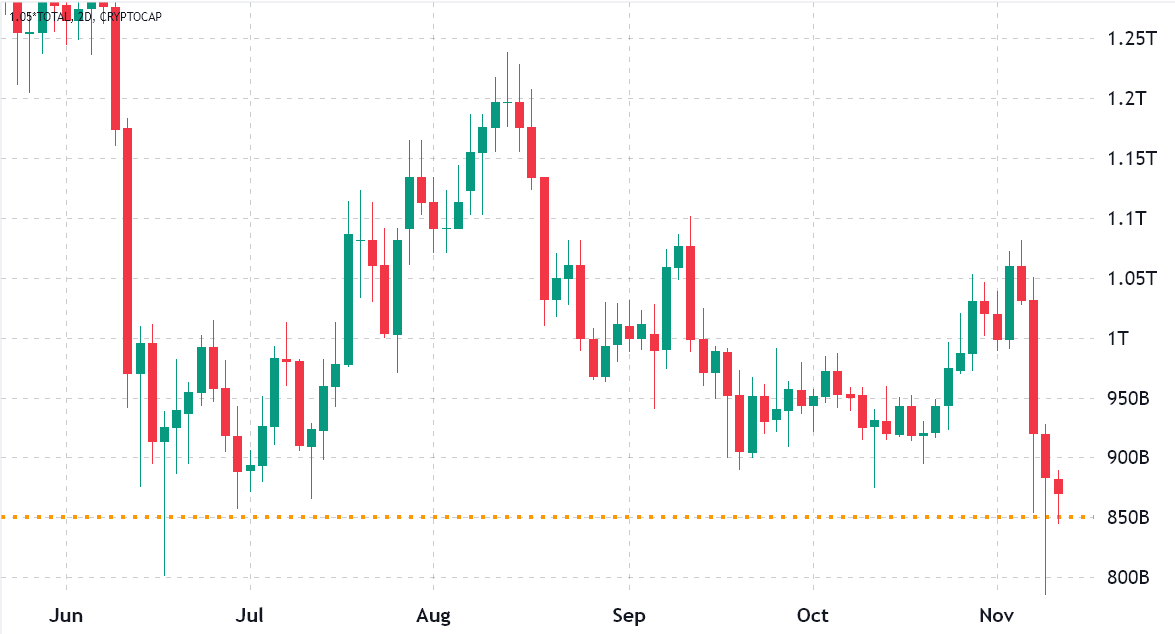

The entire cryptocurrency market capital came by 24% between November. 8 and November. 10, reaching a $770 billion low. However, following the initial panic was subdued and compelled future contracts liquidations weren’t any longer pressuring asset prices, a clear, crisp 16% recovery adopted.

This week’s dip wasn’t the market’s first rodeo underneath the $850 billion market capital level, along with a similar pattern emerged in June and This summer. In the two cases, the support displayed strength, however the $770 billion intraday bottom on November. 9 was the cheapest since December 2020.

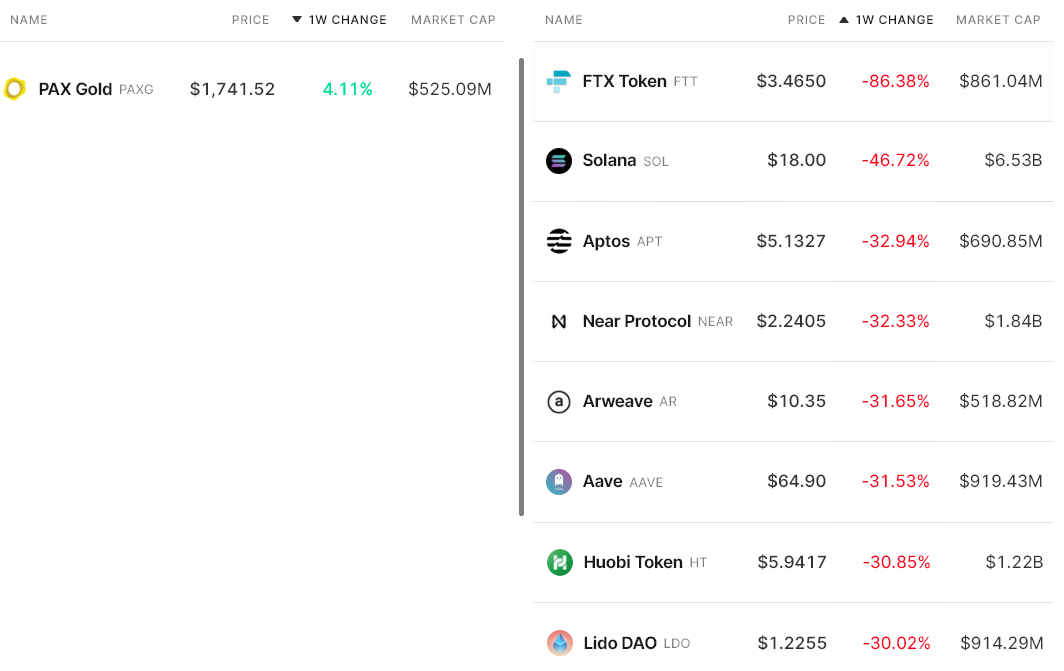

The 17.6% weekly stop by total market capital was mostly influenced by Bitcoin’s (BTC) 18.3% loss and Ether’s (ETH) 22.6% negative cost move. Still, the cost impact was more serious on altcoins, with 8 from the top 80 coins losing 30% or even more at that time.

FTX Token (FTT) and Solana (SOL) were seriously influenced by liquidations following a insolvency of FTX exchange and Alameda Research.

Aptos (APT) dropped 33% despite denying rumors that Aptos Labs or Aptos Foundation treasuries were held by FTX.

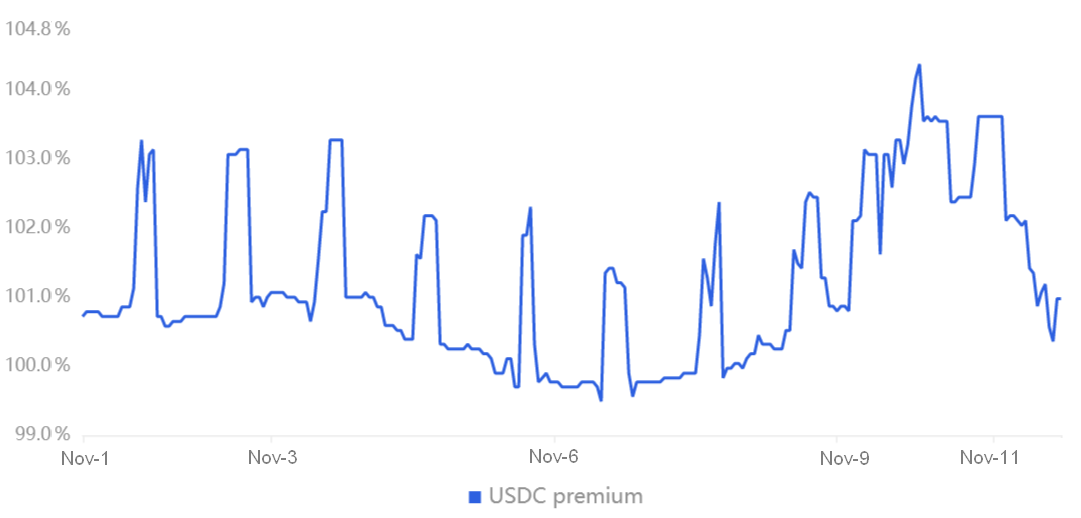

Stablecoin demand continued to be neutral in Asia

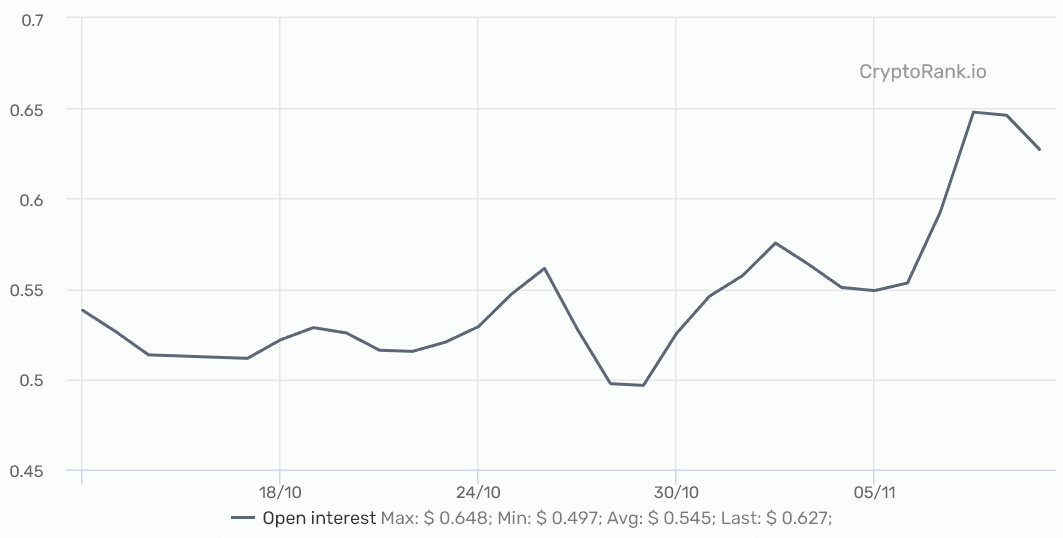

The USD Gold coin (USDC) premium is a great gauge of China-based crypto retail trader demand. Its dimensions are the main difference between China-based peer-to-peer trades and also the U . s . States dollar.

Excessive buying demand has a tendency to pressure the indicator above fair value at 100% and through bearish markets, the stablecoin’s market offers are flooded, creating a 4% or greater discount.

Presently, the USDC premium is 100.8%, flat in comparison to the previous week. Therefore, regardless of the 24% stop by total cryptocurrency market capital, no panic selling originated from Asian retail investors.

However, this data shouldn’t be considered bullish, because the USDC buying pressure signifies traders seek shelter in stablecoins.

Couple of leverage buyers are utilizing futures markets

Perpetual contracts, also referred to as inverse swaps, come with an embedded rate usually billed every eight hrs. Exchanges make use of this fee to prevent exchange risk imbalances.

An optimistic funding rate signifies that longs (buyers) require more leverage. However, the alternative situation takes place when shorts (sellers) require additional leverage, resulting in the funding rate to show negative.

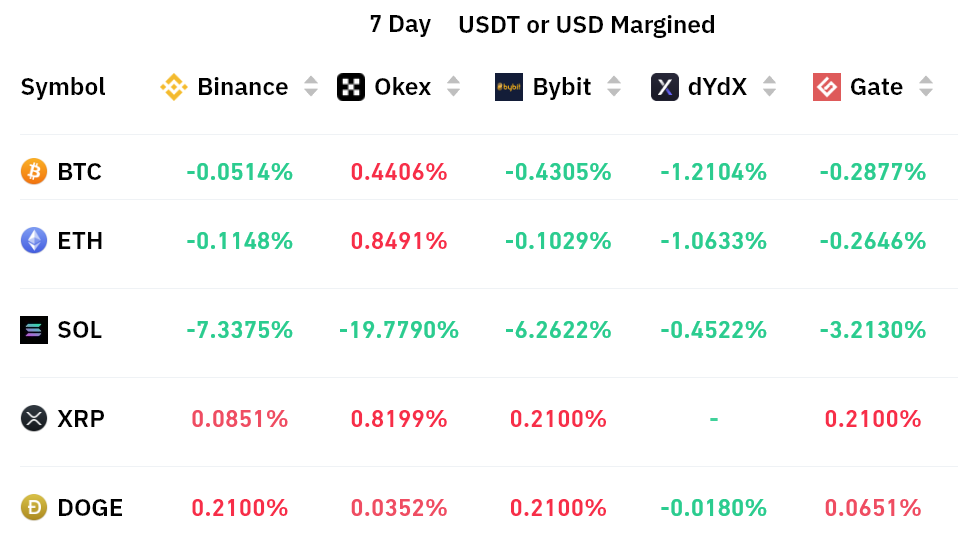

As portrayed above, the 7-day funding rates are slightly negative for that two largest cryptocurrencies and also the data suggests an excessive interest in shorts (sellers). Despite the fact that there’s a .40% weekly cost to keep open positions, it’s not worrisome.

Traders also needs to evaluate the choices markets to know whether whales and arbitrage desks have placed greater bets on bullish or bearish strategies.

The choices put/call ratio suggests worsening sentiment

Traders can gauge the general sentiment from the market by calculating whether more activity goes through call (buy) options or put (sell) options. In most cases, call options can be used for bullish strategies, whereas put choices are for bearish ones.

A .70 put-to-call ratio signifies that put options open interest lag the greater bullish calls by 30% and it is therefore bullish. In comparison, single.20 indicator favors put options by 20%, which may be considered bearish.

As Bitcoin cost broke below $18,500 on November. 8, investors rushed to find downside protection. Consequently, the put-to-call ratio subsequently elevated to .65. Still, the Bitcoin options market remains more strongly populated by neutral-to-bearish strategies, because the current .63 level signifies.

Mixing the lack of stablecoin demand in Asia and negatively skewed perpetual contract premiums, it might be apparent that traders aren’t comfortable the $850 billion market capital support holds soon.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.