The entire crypto market capital has ranged from $1.19 trillion to $1.36 trillion within the last 23 days, that is a relatively tight 13% range. During the same time frame, Bitcoin’s (BTC) 3.5% and Ether’s (ETH) 1.6% gains for that week are not even close to encouraging.

Up to now, the entire crypto marketplace is lower 43% in only two several weeks, so investors are unlikely to celebrate whether or not the climbing down triangular formation breaks towards the upside.

Regulation worries still weigh investor sentiment, an excellent example being Japan’s quick decision to enforce new laws and regulations following the Terra USD (UST) — now referred to as TerraUSD Classic (USTC) — collapse. On June 3, Japan’s parliament passed an invoice to limit stablecoin issuing to licensed banks, registered cash transfer agents and trust companies.

A couple of mid-cap altcoins rallied, but overall sentiment was unaffected

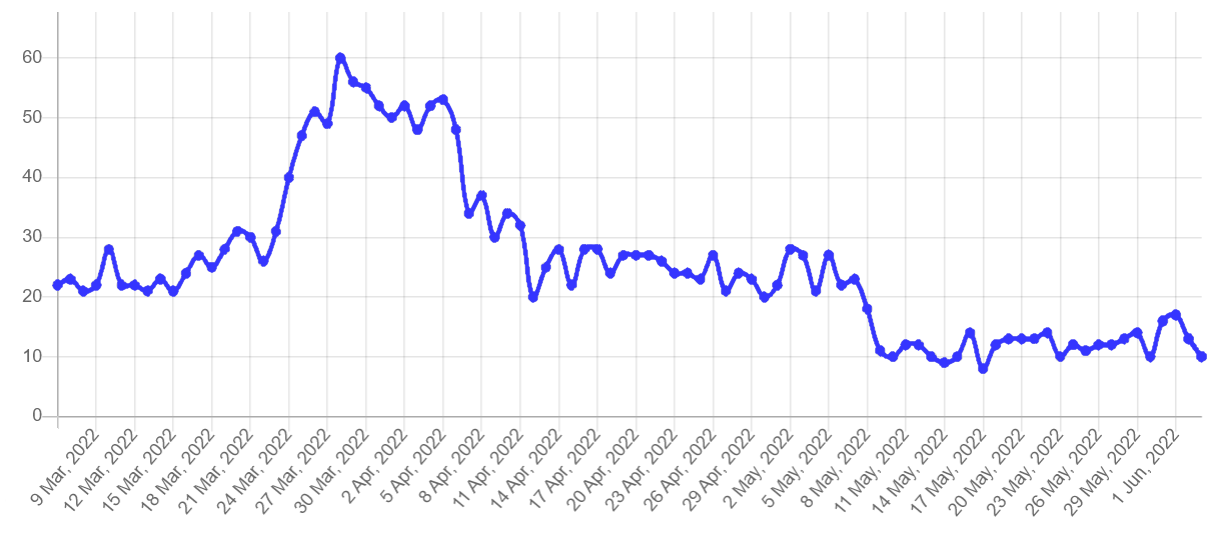

The bearish sentiment was clearly reflected in crypto markets because the Fear and Avarice Index, an information-driven sentiment gauge, hit 10/100 on June 3. The indicator continues to be below 20 since May 8, because the total crypto capital lost the $1.7 trillion level to achieve the cheapest level since The month of january 27.

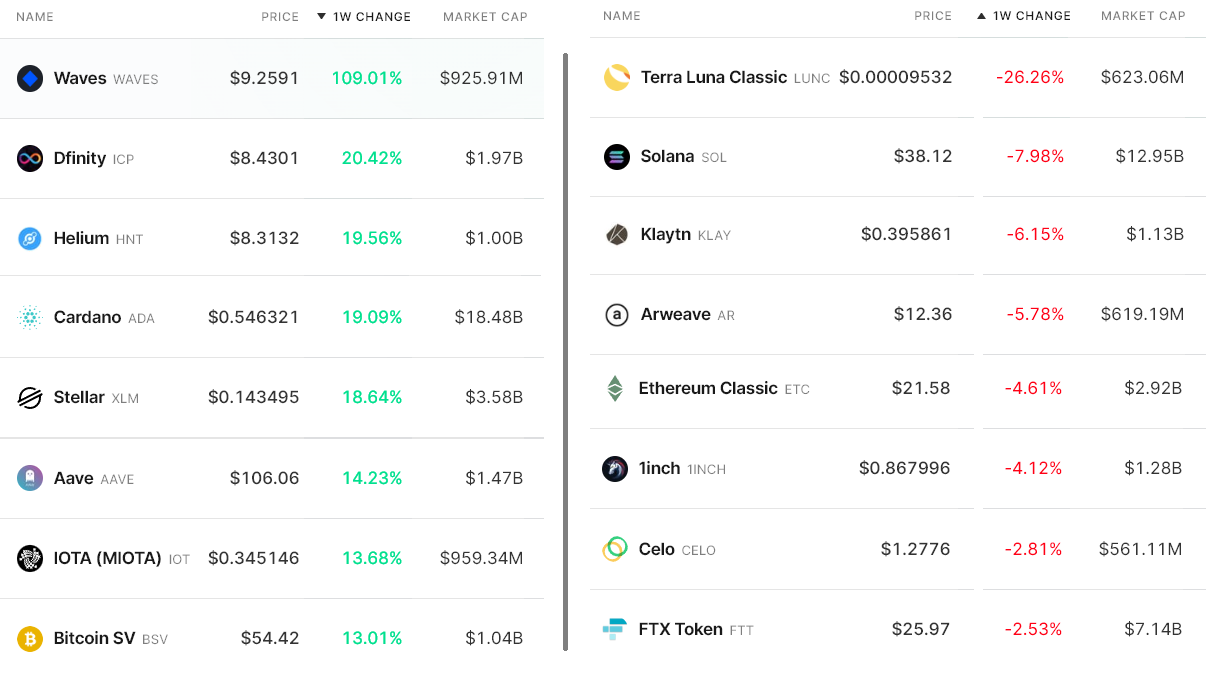

Here are the winners and losers in the past 7 days. As the two leading cryptocurrencies presented modest gains, a number of mid-capital altcoins rallied 13% or greater.

Waves rallied 109% after liquidity was introduced to Vires Finance and also the Neutrino Protocol USDN stablecoin re-established its $1.00 peg following a $1,000 daily withdrawal limit was enforced on USDT and USDC.

Cardano (ADA) acquired 19% as investors expect the “Vasil” hard fork scheduled for June 29 to enhance scalability and smart contract functionality, incentivizing deposits towards the lengthy-hyped decentralized finance applications around the network.

Stellar (XLM) hiked 18.6% following the remittance giant MoneyGram partnered using the Stellar Development Foundation, launching something that enables its users to transmit and convert stablecoins into fiat currencies.

Solana (SOL) lost 8% because of an unpredicted block production halt on June 1, requiring validators to coordinate another mainnet restart after four hrs of outage. The persistent issue has negatively impacted the network on seven occasions in the last 12 several weeks.

Data suggests further cost pressure

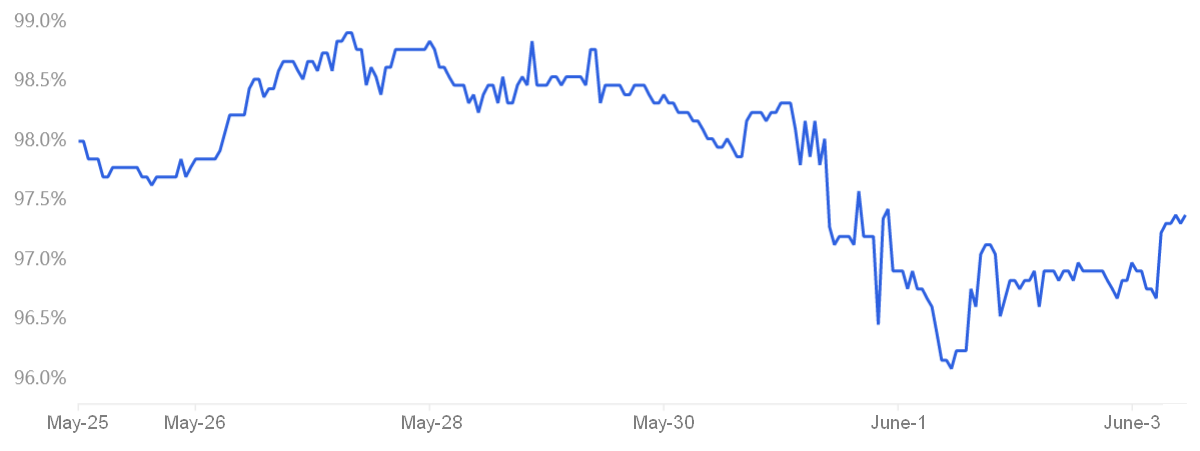

The OKX Tether (USDT) premium is a great gauge of China-based retail crypto trader demand. Its dimensions are the main difference between China-based peer-to-peer (P2P) trades and also the U . s . States dollar.

Excessive buying demand has a tendency to pressure the indicator above fair value at 100% and through bearish markets, Tether’s market offers are flooded and results in a 4% or greater discount.

Tether continues to be buying and selling in a 2% or greater discount in Asian peer-to-peer markets since May 30. However, the indicator demonstrated a modest degeneration because it bottomed in a 4% discount on June 1. This data leaves without doubt that retail traders were caught off-guard because the total crypto capital unsuccessful to interrupt the $1.3 trillion resistance.

Perpetual contracts, also referred to as inverse swaps, come with an embedded rate that’s usually billed every eight hrs. Exchanges make use of this fee to prevent exchange risk imbalances.

An optimistic funding rate signifies that longs (buyers) require more leverage. However, the alternative situation takes place when shorts (sellers) require additional leverage, resulting in the funding rate to show negative.

Perpetual contracts reflected mixed sentiment as Bitcoin and Ethereum held a rather positive (bullish) funding rate, but altcoin rates were opposite. Solana’s negative .20% weekly rate equals .8% monthly, which isn’t an enormous concern for many derivatives traders.

Based on derivatives and buying and selling indicators, the marketplace is vulnerable to seeing more downside. Proof of this are visible in the marginally greater interest in bearish positions on altcoins and also the apparent insufficient buying appetite from Asia-based retail markets.

Bulls have to display strength and contain the $1.19 trillion market capital support to prevent a rise in leveraged sellers, bearish bets and also the subsequent negative cost pressure.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.