Ether (ETH) rejected the $2,000 resistance on August. 14, however the solid 82.8% gain because the rising wedge formation began on This summer 13 certainly appears just like a victory for that bull market. Unquestionably, the “ultrasound money” dream will get closer because the network expects the Merge transaction to some proof-of-stake (PoS) consensus network on Sept. 16.

Some critics explain the transition from proof-of-work (Bang) mining continues to be delayed for a long time which the Merge itself doesn’t address the scalability issue. The network’s migration to parallel processing, also referred to as sharding, is anticipated to occur later in 2023 or early 2024.

When it comes to Ether bulls, the EIP-1559 burn mechanism introduced in August 2021 was necessary to drive ETH to scarcity, as crypto analyst and influencer Kris Kay illustrates:

~ 11% of $ETH supply now staked.

~ 2% of $ETH supply now burned

~ 100% of $ETH is ultra-seem money

+=

couple of

— Kris Kay DeFi Donut (@thekriskay) August 15, 2022

The long awaited proceed to the Ethereum Beacon Chain enjoyed lots of critique, despite eliminating the necessity to offer the costly energy-intensive mining activities. Below, DrBitcoinMD highlights the impossibility for ETH stakers to withdraw their coins, creating an unsustainable temporary offer-side reduction.

Anybody still putting their belief behind the gangly Russian pseudointellectual and also the Ethereum ponzi deserves what’s visiting them. pic.twitter.com/gjxHXdzuSK

— Doc (@DrBitcoinMD) August 11, 2022

Unquestionably, the decreased quantity of coins readily available for purchase caused a supply shock, especially following the 82.8% rally as Ether has lately gone through. Still, these investors understood the potential risks of Eth2 staking with no promises were created for immediate transfers publish-Merge.

Option markets reflect dubious sentiment

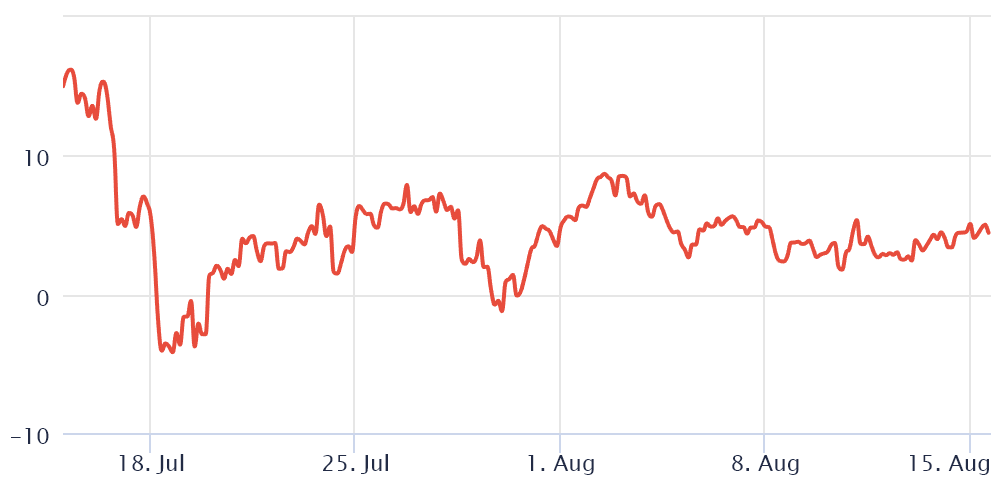

Investors need to look at Ether’s derivatives markets data to know how whales and arbitrage desks are situated. The 25% delta skew is really a telling sign whenever traders overcharge for upside or downside protection.

If individuals market participants feared an Ether cost crash, the skew indicator would move above 12%. However, generalized excitement reflects an adverse 12% skew.

The skew indicator continued to be neutral since Ether initiated the rally, even while it tested the $2,000 resistance on August. 14. The lack of improvement on the market sentiment is slightly concerning because ETH option traders are presently assessing similar upside and downside cost movement risks.

Related: Ethereum ICO-era whale address transfers 145,000 ETH days prior to the Merge

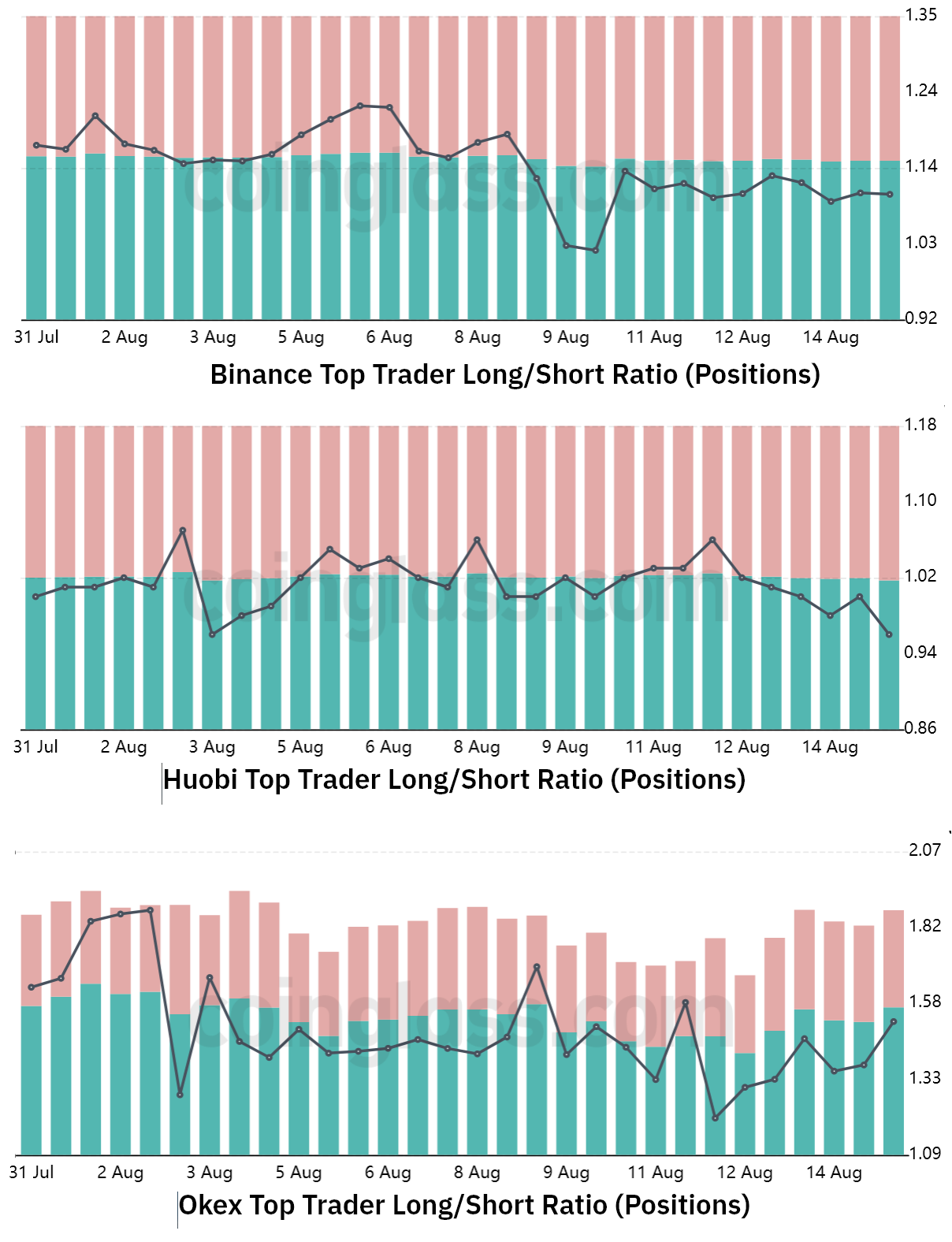

Meanwhile, the lengthy-to-short data shows low confidence in the $2,000 level. This metric excludes externalities that may have exclusively impacted the choices markets. Additionally, it gathers data from exchange clients’ positions around the place, perpetual and quarterly futures contracts, thus better informing about how professional traders are situated.

You will find periodic methodological discrepancies between different exchanges, so readers should monitor changes rather of absolute figures.

Despite the fact that Ether has rallied 18% from August. 4 to August. 15, professional traders slightly reduced their leverage lengthy positions, based on the lengthy-to-short indicator. For example, the Binance traders’ ratio improved somewhat in the 1.16 start but finished the time below its beginning level near 1.12.

Meanwhile, Huobi displayed a modest reduction in its lengthy-to-short ratio, because the indicator moved from .98 to the present .96 in eleven days. Lastly, the metric peaked at 1.70 for that OKX exchange only slightly elevated from 1.46 on August. 4 to at least one.52 on August. 15. Thus, typically, traders weren’t confident enough to have their leverage bullish positions.

There hasn’t been a substantial alternation in whales’ and market makers’ leverage positions despite Ether’s 18% gains since August. 4. If options traders are prices similar risks for Ether’s upside and downside moves, there’s likely grounds with this. For example, strong backing from the proof-of-work fork would pressure ETH.

One factor is without a doubt, right now, professional traders aren’t certain that the $2,000 resistance is going to be easily damaged.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.