In April 2022, the Tron network launched USDD, an expression pegged towards the U . s . States dollar being an “over-collateralized stablecoin,” meaning its probability of sliding below $1 ought to be lower because of excessive reserves backing its valuation.

USDD stablecoin slips below $1 peg

But it wasn’t enough to help keep USDD’s cost moored to $1 on November. 8 when some whales dumped over 11 million USDD tokens to find exposure in rival stablecoins Tether (USDT) and USD Gold coin (USDC). Each day later, USDD’s cost fell to as little as $.96, adopted with a modest recovery to $.98 on November. 10.

The selling pressure was visible more broadly within the USDD liquidity pool on Curve’s decentralized finance protocol. By November. 10, the swimming pool was heavily imbalanced, holding nearly 82.50% in USDD and also the rest in USDT, USDC and Dai (DAI) stablecoins.

Tron founder Justin Sun speculates that Alameda Research, a crypto hedge fund headed by FTX’s Mike Bankman-Fried, may be the whale dumping its USDD holdings to avoid insolvency. Alameda’s balance sheet apparently was 50% FTX Token (FTT), FTX’s native token which has lately fallen greater than 90%.

I believe most likely Alemeda just offered their USDD to pay for the liquidity of ftx exchange. The swimming pool presently has returned having a healthy rate. pic.twitter.com/oSIzUNqE0Z

— H.E. Justin Sun (@justinsuntron) November 9, 2022

Miscalculated collateral reserves

USDD is disseminated by Tron DAO Reserve (TDR), that also can serve as the custodian of their collateral. TDR is mainly accountable for selling the collateral to keep USDD’s peg in case of a sell-side shock.

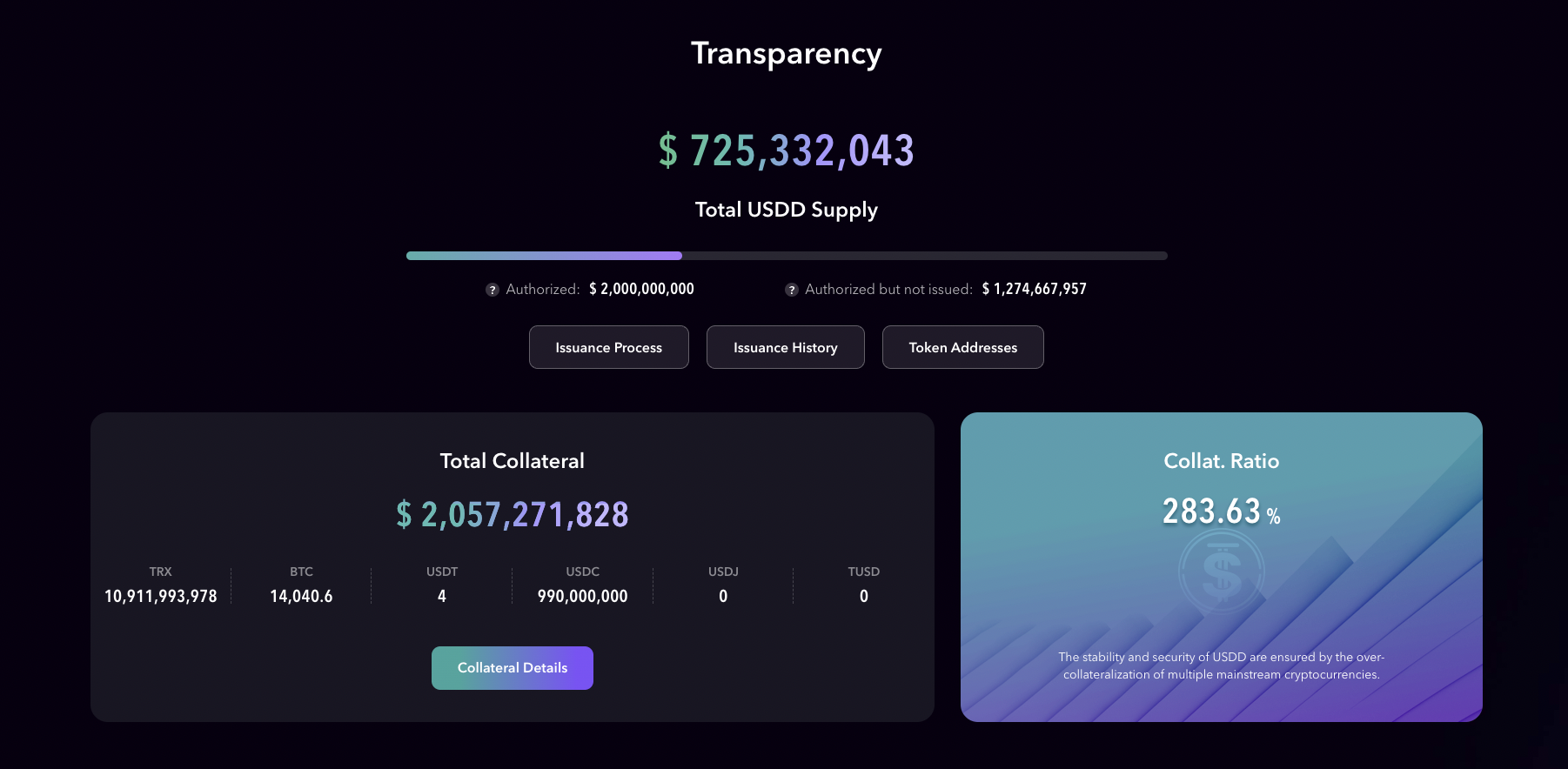

Theoretically, USDD seems sufficiently supported by a $2-billion pool of crypto collateral by means of Bitcoin (BTC), Tron (TRX) and USDC, using the reserves apparently outweighing the stablecoin supply by over 283%.

But there is a catch.

Presently, the majority of the stablecoin collateral worth in TDR’s reserve wallets are staked and earning yields in JustLend, the biggest lending protocol within the Tron ecosystem by total-value-locked (TVL). Meanwhile, 99% of TRX collateral is locked in the “staking governance” contract.

TDR also seems to become incorrect including burned TRX worth over $725 million as collateral. Overall, that leaves the DAO about $600 million price of USDC and $236 million price of BTC in the liquefiable reserves.

Quite simply, a nearly 113% collateral ratio in comparison to the 283% boasted.

Bitcoin, TRX prices slide

USDD’s collateral ratio could fluctuate further since it’s reserve assets, BTC and TRX, undergo cost declines.

Particularly, BTC’s cost has stepped by greater than 22% week-to-date close to $16,500 inside a crypto market meltdown brought through the Alameda-FTX fiasco. However, TRX easily wiped roughly 12% off its valuation within the same period, buying and selling around $.05 on November. 10.

The Tron token now eyes a rest below its support lengthy-standing support confluence, comprising its 200-week exponential moving average (200-week EMA nowhere wave) near $.052 and it is .236 Fib line near $.055.

This might push TRX with an extended decline toward the $.022-$.030 range (marked in red within the chart above). El born area was instrumental like a consolidation funnel from August 2020-The month of january 2021 and The month of january 2019-This summer 2021.

In addition, it offered as support between Feb and November 2018.

Related: Buying Bitcoin ‘will rapidly vanish’ when CBDCs launch — Arthur Hayes

Simultaneously, Bitcoin has joined the breakdown phase of their prevailing inverse-cup-and-handle pattern, now eyeing $14,000 since it’s primary downside target.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.