Regardless of the myriads of condition and federal regulatory hurdles faced by crypto companies in the area, the U . s . States plays a significant role in preserving the Bitcoin (BTC) and crypto ecosystem. With China leaving the image carrying out a permaban on crypto, the U . s . States maintains the very best position when it comes to hash rate contribution and ATM installations worldwide.

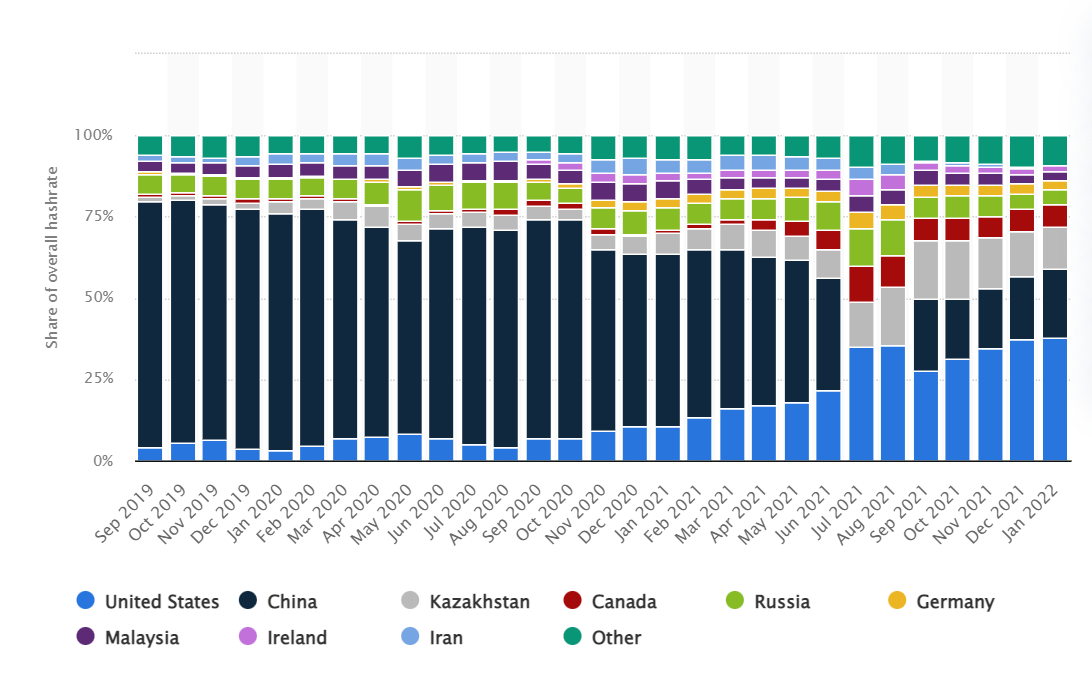

Just before cracking lower on BTC mining, China in the past symbolized 50 plusPercent from the total hash rate up to February 2021. With China from the competition, the united states selected in the slack to get the greatest BTC hash rate contributor — representing 37.84% from the total mining power by Jan 2022.

As proven above, Chinese miners started again operations in September 2021. However, the miners in america ongoing to dominate the area while growing their hash rate contribution month-over-month.

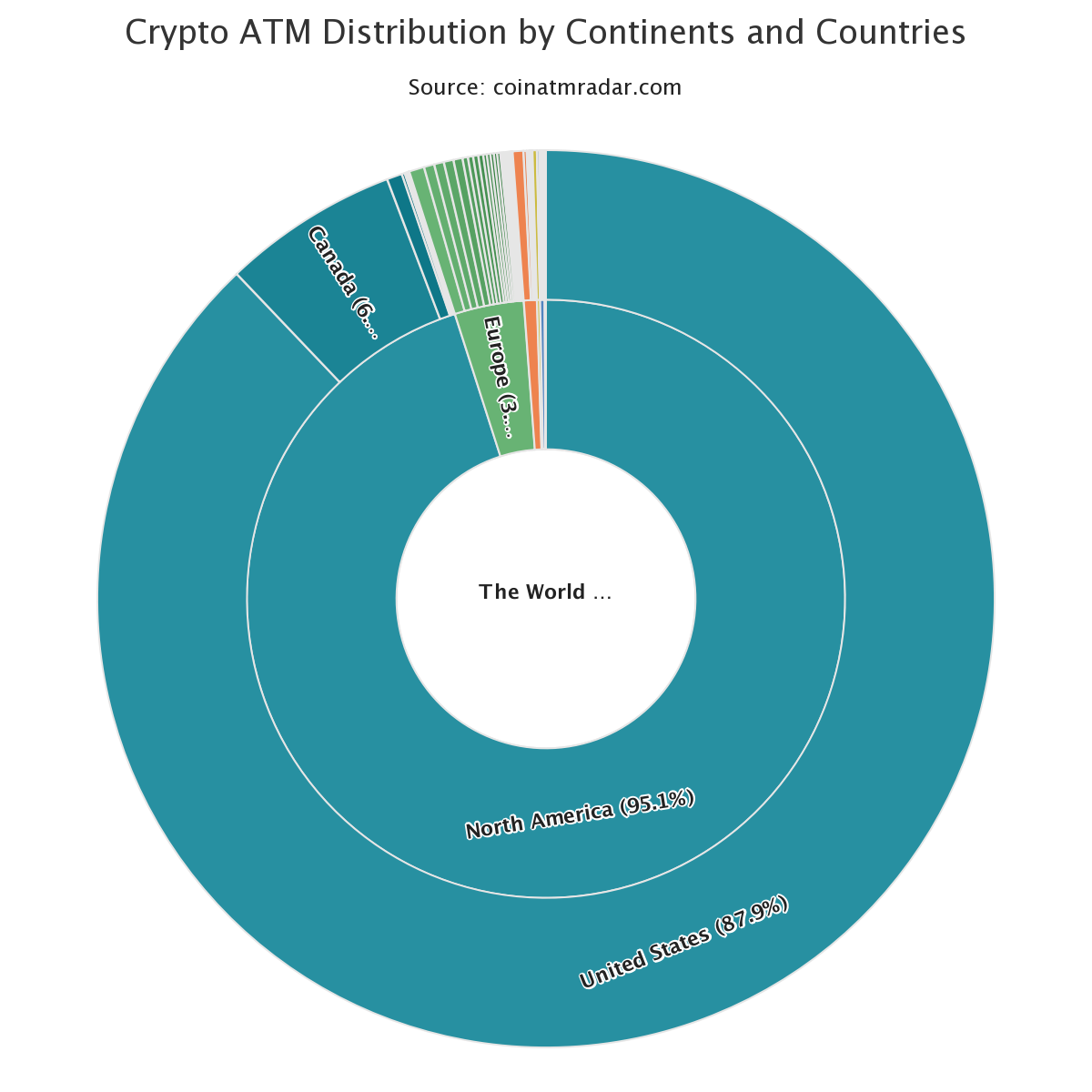

Additionally, the united states hosts the greatest quantity of ATM installations, representing nearly 88% from the total crypto ATM installations worldwide. Over 90% from the overall crypto ATMs installed in the last several several weeks have been in the U . s . States. Data from Gold coin ATM Radar confirms the trend is constantly on the This summer because the US saw installing 641 from the 710 Bitcoin and crypto ATMs set up in the very first ten days from the month.

Further strengthening North America’s position within the crypto ecosystem, Canada represents the 2nd-largest network of crypto ATMs following the U . s . States. Outdoors from the Americas, The country houses the greatest quantity of crypto ATMs, 210 or .5% from the total active ATMs.

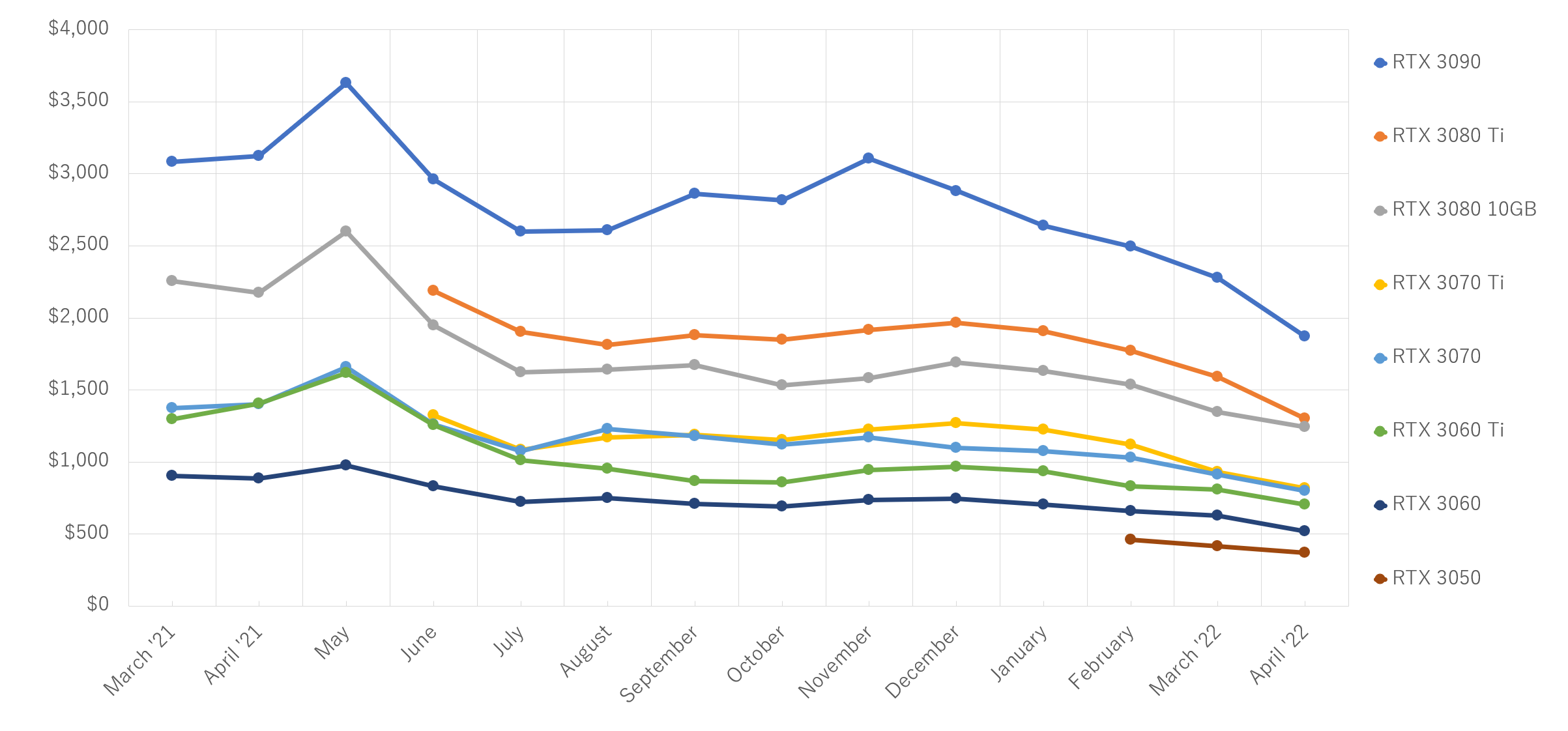

Related: Global GPU cost drops to pay for falling Bitcoin mining revenue

The confluence of the global nick shortage and also the coronavirus pandemic momentarily increased prices of the most basic a part of a mining rig — the graphics processing unit (GPU). However, with prices falling lower below MSRPs along with a hash rate that compliments the autumn, miners found themselves a window of chance to obtain their dream mining equipment.

In May alone, GPU prices dropped over 15% typically, furthermore forcing sellers around the secondary markets to create lower their exorbitant prices on used mining rigs.