Polkadot (Us dot) cost ticked greater previously 24 hrs on anticipations that it is new cross-chain communications protocol would solve a lengthy-standing issue in the blockchain sector.

Us dot cost gains 12% on XCM launch

Bulls pressed DOT’s cost to $16.44 on May 5 from $14.72 each day before, gaining just a little over 12% because they assessed the launch of XCM, a messaging system that enables parachains — individual blockchains that be employed in parallel within the Polkadot ecosystem — to talk with one another.

As Cointelegraph reported, future updates within the XCM protocol would see parachains exchanging messages without counting on Polkadot’s central blockchain, the Relay Chain. That expects to get rid of bridge hacks which have cost the greater than $1 billion each year.

Other bullish catalysts

DOT’s gains also made an appearance consistent with similar upside moves elsewhere within the cryptocurrency market.

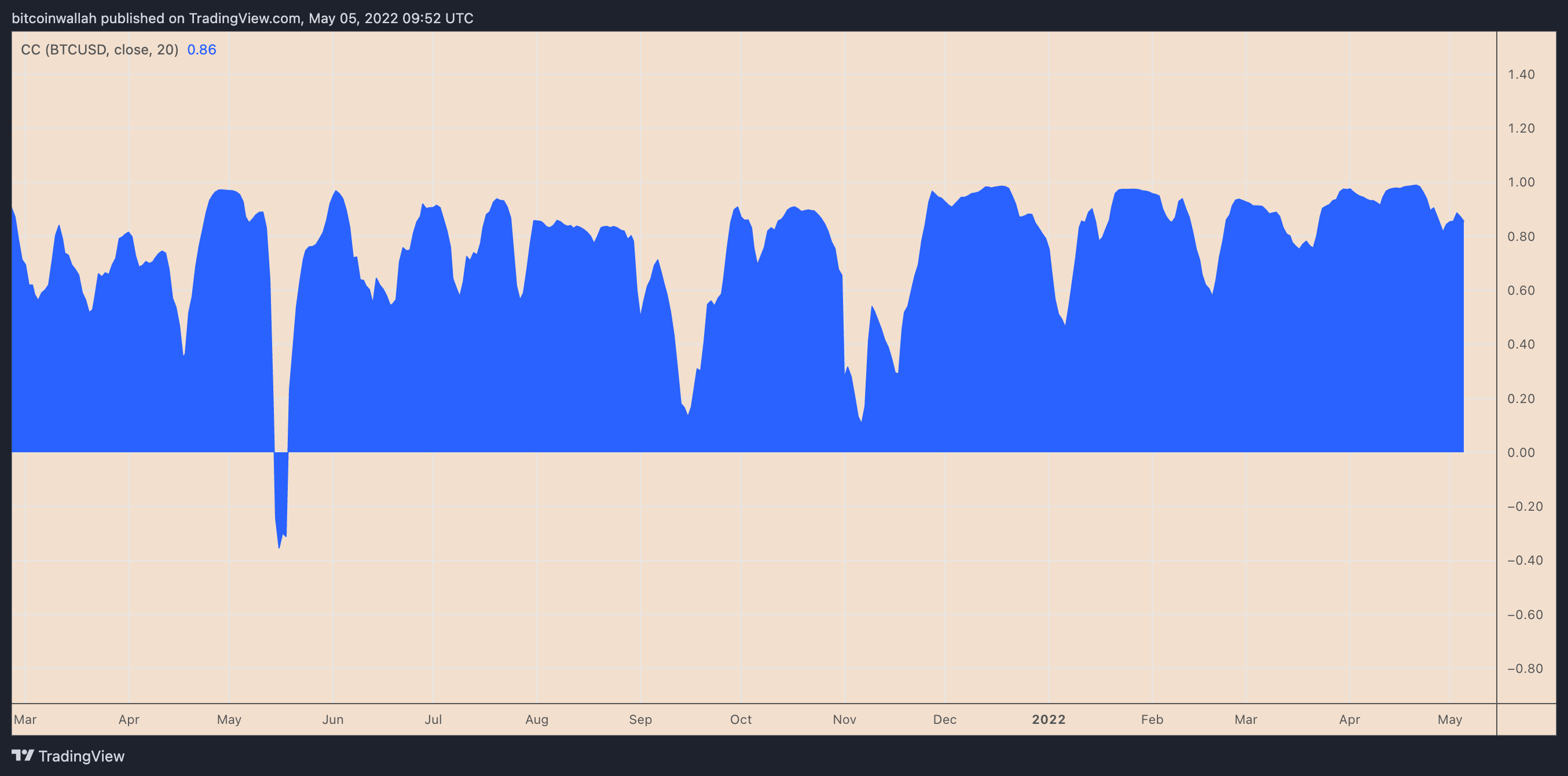

For example, Bitcoin (BTC) rallied nearly 6% within the same period Us dot rose 12% using their correlation coefficient at .87 by May 5, suggesting that BTC and DOT’s costs are moving almost in lockstep in recent days.

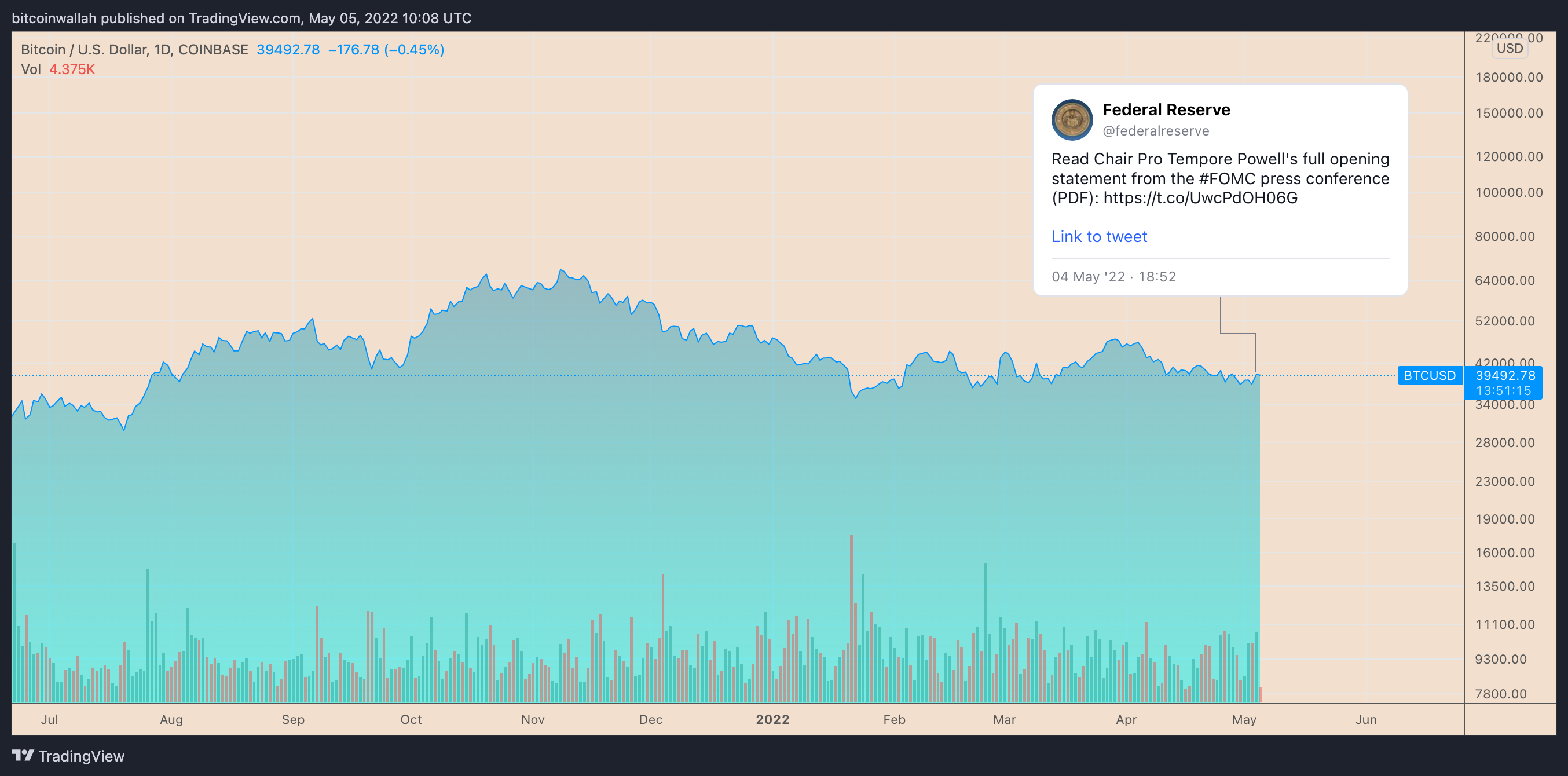

The crypto market acquired after Fed clarified that it wouldn’t increase benchmark rates with a 75 basis point, as propagated by certainly one of its presidents, James Bullard, in April 2022. The S&P 500 index, too, rallied by nearly 3%, and bond yields fell.

Nevertheless, the U.S. central bank continued to be on its road to cutting rates of interest, hoping to obtain close to the 2-3% “neutral” in planning for any “softish” landing, i.e., curbing inflation without excessively impacting the U.S. economic growth.

On May 4, it started having a 50 bps cut, with chairman Jerome Powell promising more .5% increments.

Because of this hawkish tone, Bitcoin’s current cost rebound could fizzle out once again lacking $40,000, taking lower all of those other crypto market by using it, Us dot incorporated.

Polkadot cost risks 35% decline

Polkadot technicals place it vulnerable to a correction for the short term because it breaks below a mind-and-shoulders (H&S) pattern.

H&S patterns appear once the cost forms three peaks while gaining support from the common support level, known as a neckline. Meanwhile, the center peak (mind) involves be taller compared to other two (right and left shoulder), for or fewer of same heights.

H&S typically resolve following the cost breaks below its neckline. Usually of technical analysis, a H&S breakdown transmits the cost to level in a length comparable to the utmost distance between your head’s peak and neckline.

Related: Bitcoin trader keeps $40.8K BTC cost target among warning over risk asset ‘pain trade’

Us dot is incorporated in the breakdown stage of their prevailing H&S setup, using its recent bounce testing the neckline as support to reconfirm the bearish pattern.

Meanwhile, the neckline area coincides using the 50-day exponential moving average (50-day EMA the red wave within the chart below) at $18.20, which creates a possible pullback scenario following a next upside attempt.

Polkadot’s H&S downside target is near $11 when the breakdown continues, almost 35% less than today’s cost.

On the other hand, a decisive breakout over the neckline area and also the 50-day EMA might have Us dot eye its 200-day EMA (nowhere wave) near $22.75 because the upside target.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.