Bitcoin (BTC) and altcoins lost big on August. 26 following the U . s . States Fed delivered hawkish remarks on economic policy.

Overall, risk assets required a significant hit — U.S. equities shed around $1.25 trillion in one session.

Analyst: Powell retiring “soft landing” rhetoric

As comments by Given Chair, Jerome Powell, recommended that bigger rate hikes remained as firmly up for grabs despite recent data meaning that inflation had been slowing, investors rushed to chop risk.

“Restoring cost stability will probably require maintaining a restrictive policy stance for a while. The historic record cautions strongly against prematurely loosening policy,” Powell stated in the annual Jackson Hole economic symposium.

The S&P 500 closed lower 3.4% at the time, hitting its cheapest levels since late This summer. The Nasdaq Composite Index copied the move and extended losses, shedding 4%.

Overall, the U.S. stock exchange lost more quality compared to entire market cap of Bitcoin and altcoins combined.

The entire crypto market cap itself fell from $1.029 trillion to $936.87 billion at some point overnight, representing a small amount of 8.95%, based on data from Cointelegraph Markets Pro and TradingView.

Although some contended that Powell’s words weren’t the fundamental place to consider when it comes to future Given policy, others noted that previous narratives were gradually being abandoned if this found the inflation outlook.

Stop concentrating on what JAYPOW states, and concentrate on which he is doing. pic.twitter.com/tGf82VPkGF

— Arthur Hayes (@CryptoHayes) August 26, 2022

Holger Zschaepitz, popular markets commentator for German media publication Die Welt, considered it to possess hit “all of the hawkish notes” with Powell “skipping the dovish ones.”

“The hawkish features were his acknowledgment from the discomfort that’s likely required to reduce inflation – forget about soft landing, the indication that rates will have to be taken above neutral,” he added partly of Twitter comments.

Powell also stated the decision over what lengths to increase key rates of interest in September would “rely on the totality from the incoming data and also the evolving outlook.”

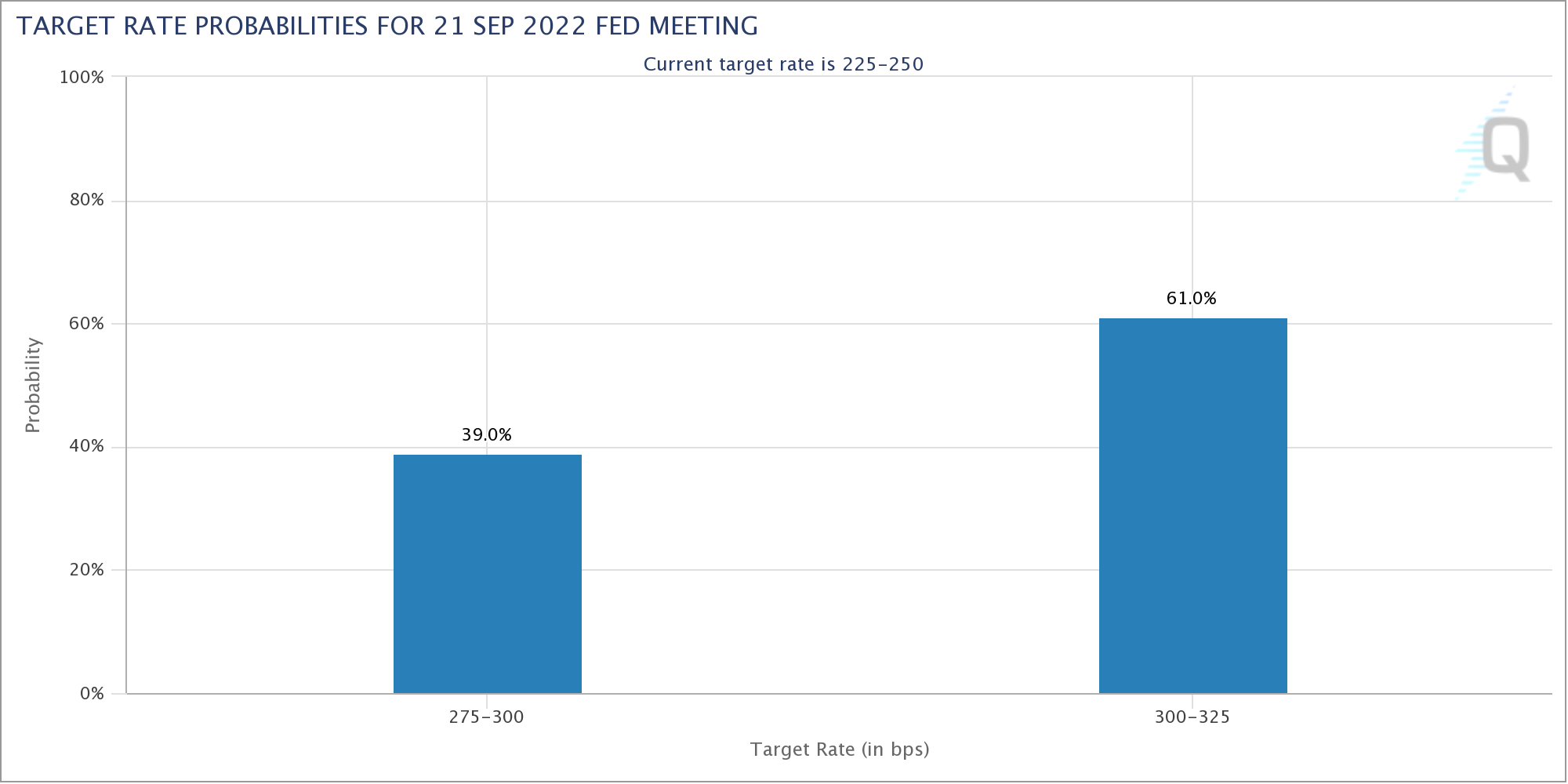

The most recent readings from CME Group’s FedWatch Tool meanwhile demonstrated majority consensus favoring a 75-basis-point hike in September, echoing the This summer move.

No hodler can hide the discomfort

For crypto investors, however, there wasn’t any staying away from the immediate impact from the risk asset rout.

Related: Cost analysis 8/26: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, Us dot, SHIB, MATIC

BTC/USD lost as much as 8.8% at some point, dipping underneath the $20,000 mark the very first time since This summer 14 before recovering to linger just over the significant line within the sand.

For altcoins, the image wasn’t any less dire. Ether (ETH), the biggest altcoin by market cap, saw intraday losses approaching 14%.

ETH/USD circled $1,500 during the time of writing on August. 27, eliminating a whole month’s gains. Among cost takes would be a fresh warning from popular trader Crypto Erectile dysfunction, who eyed a potential further leg lower next.

“Could drop to $1200-1300 before any bounce of significance,” a part of his latest Twitter read.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.