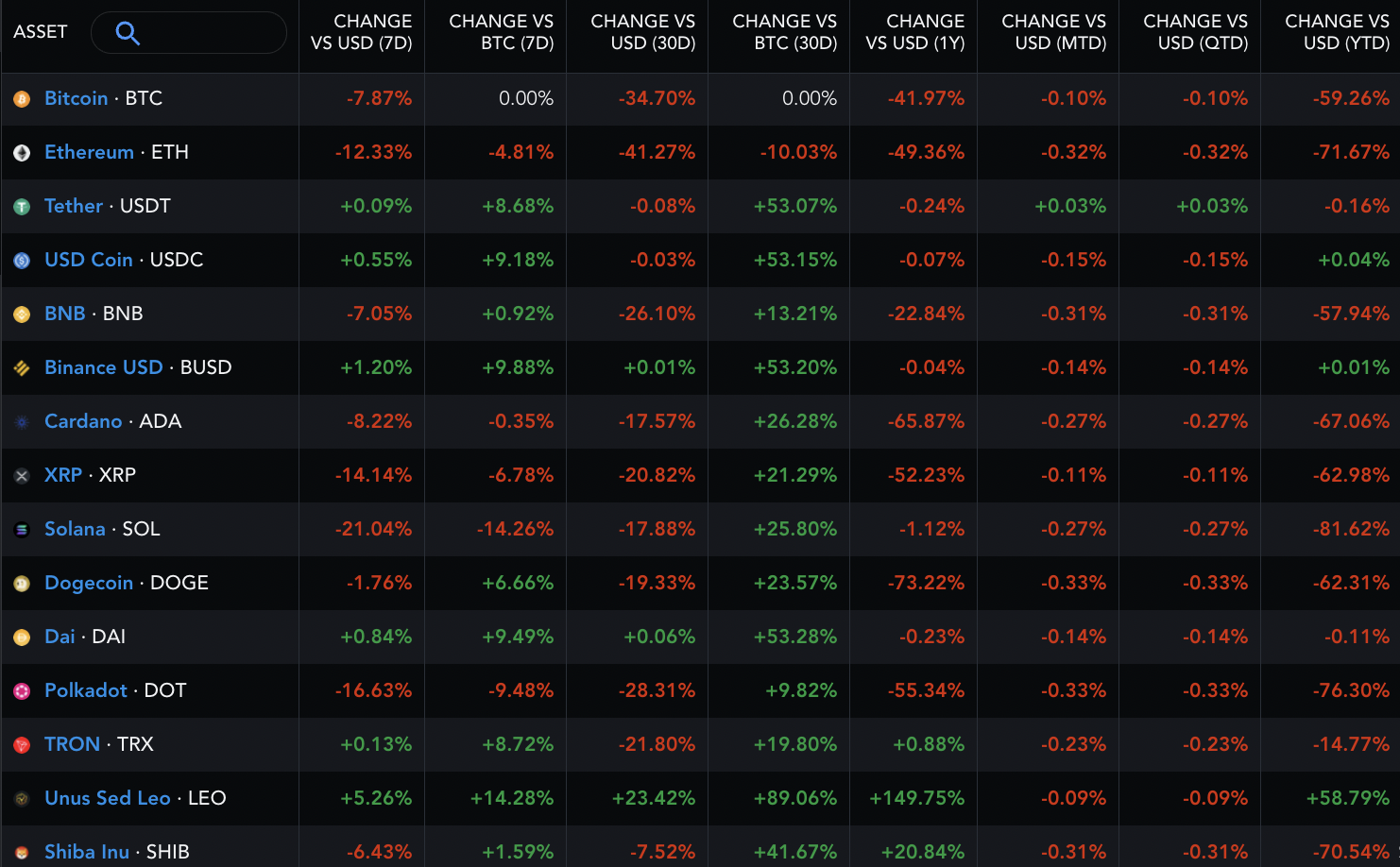

Unus Sed Leo (LEO) hasn’t only survived the crypto market bloodbath within the first 1 / 2 of 2022 but has really published major gains, bucking the large crypto crash.

LEO beats crypto kingpin Bitcoin

LEO, a software application token used over the iFinex ecosystem, finished the very first 1 / 2 of 2022 against Bitcoin at 32,793 satoshis, up almost 300%.

The token also rallied 55% from the U.S. dollar within the same period, hitting $5.80 the very first time since Feb 2022. In comparison, Bitcoin (BTC) and Ether (ETH), the very best two crypto assets by market cap, fell by over 60% and 70%, correspondingly.

That makes it the best-performing crypto asset within the top ranks to date into 2022.

What’s driving LEO cost greater?

The crypto market easily wiped greater than $2 trillion off its valuation within the first 1 / 2 of 2022, brought by rate hikes, the collapse of Terra (LUNA) — now formally Terra Classic (LUNC), and systemic insolvency troubles across leading cryptocurrency lending platforms and hedge funds.

LEO’s cost also endured a 25% decline after hitting its all-time a lot of $8.14 in Feb 2022. Nonetheless, it fared much better than all of those other crypto market, which fell nearly 60% within the same period.

The explanation for this outlier token might be its starkly different attributes when compared with other digital assets.

IFinex, parents company of Bitfinex, launched LEO in 2018 inside a private purchase round to boost $1 billion. In exchange, the firm dedicated to employing 27% of their revenues in the previous month to purchase back LEO until all tokens are taken off circulation.

Also, iFinex promised to purchase back LEO tokens using funds it’d lost throughout the August 2016 Bitfinex hack.

In Feb 2022, the U.S. Department of Justice retrieved 94,000 BTC from 119,754 BTC. That coincided with LEO rallying to the record highs both in Bitcoin and also the dollar-based markets.

Overheated rally?

LEO’s run-facing Bitcoin risks exhaustion because of its price’s growing divergence with momentum.

At length, LEO’s cost continues to be making greater lows while its daily relative strength index (RSI) prints lower highs. Usually of technical analysis, this divergence shows too little upside conviction among traders.

The RSI can also be above 70, a typically “overbought” area along with a sell indicator.

LEO now maintains its bullish bias while holding above its interim support level at 26,220 sats, coinciding using the .236 Fib type of the Fibonacci retracement graph attracted from 4,382-swing low to 32,965-swing high.

A decisive close below 26,220 sats might have LEO eye a run-lower toward the 38.2 Fib line near 22,046 sats, lower 25% from Jul’s cost.

Interestingly, the amount is near another support level — the 50-day exponential moving average (50-day EMA the red wave within the chart above).

LEO/USD bearish rejection

LEO’s ongoing cost run-up been with them briefly close over a critical level of resistance around $6.24, as proven within the chart below.

The amount was instrumental in capping the token’s upside attempts between Feb and April captured. It again motivated traders to secure profits on This summer 1, departing LEO having a large upside wick and therefore meaning at bearish rejection.

LEO’s recent cost trends are filled with bearish rejection candle lights, including its 57% intraday cost rally on February. 8 that preceded a 28.5% correction through the finish of this quarter.

On the other hand, the token’s bullish rejection candle on June 18 led to a 50% cost recovery, as discussed above.

Related: Around the edge of recession: Can Bitcoin survive its first global financial crisis?

When the given fractal plays out, then LEO will risk a cost reversal to the interim support degree of $5.52, which, coincides using the token’s 50-day exponential moving average (50-day EMA the red wave). That will mean a modest 9%-10% decline from This summer 1’s cost.

However, if the support does not hold, because it been on late April, LEO cost then risks testing its 200-day EMA (nowhere wave) near $5, a 17% decline overall.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.