Ripple’s (XRP) ongoing upside retracement risks exhaustion since it’s cost tests a level of resistance with past triggering a 65% cost crash.

XRP cost rebounds 30%

XRP’s cost acquired nearly 30%, rising to $.36 on June 24, four days after rebounding from $.28, its cheapest level since The month of january 2021.

The token’s retracement rally could include $.41 next, based on its cup-and-handle pattern proven within the chart below.

Interestingly, the indicator’s profit target is equivalent to XRP’s 50-day exponential moving average (50-day EMA the red wave).

Major resistance hurdle

The cup-and-handle bullish reversal setup has a tendency to meet its profit target in a 61% rate of success, according to veteran analyst Thomas Bulkowski.

But, it seems XRP’s situation falls within the 39% failure spectrum due to a conflicting technical signal presented by its 200-4H exponential moving average (EMA).

XRP’s 200-4H EMA (nowhere wave within the chart below) has formerly offered like a strong distribution signal. Particularly, in April 2022, the token tried to break over the stated wave resistance multiple occasions, simply to face rejections on every check it out fell 65% to $.28 later.

The continuing cup-and-handle breakout has stalled halfway after XRP retested the 200-4H EMA as resistance on June 23. Now, the token awaits further bias confirmation while risking a cost decline much like what transpired after April.

XRP’s overbought relative strength index (RSI), now above 70, also raises the potential of an interim cost correction.

XRP LTF breakdown going ahead

The down-side scenario on XRP’s shorter-time-frame chart comes consistent with giant bearish setups on its longer-time-frame chart.

As Cointelegraph covered earlier, XRP has joined a failure stage after exiting its climbing down triangular structure at the begining of May.

Usually of technical analysis, its triangular breakdown must have it fall up to the structure’s maximum height, which puts its downside target near $1.86.

Quite simply, another 50% cost drop for XRP might happen through the finish of This summer this season.

50,000,000 #XRP (16,249,045 USD) transferred from Ripple to unknown wallethttps://t.co/FalGAzxNxg

— Whale Alert (@whale_alert) June 23, 2022

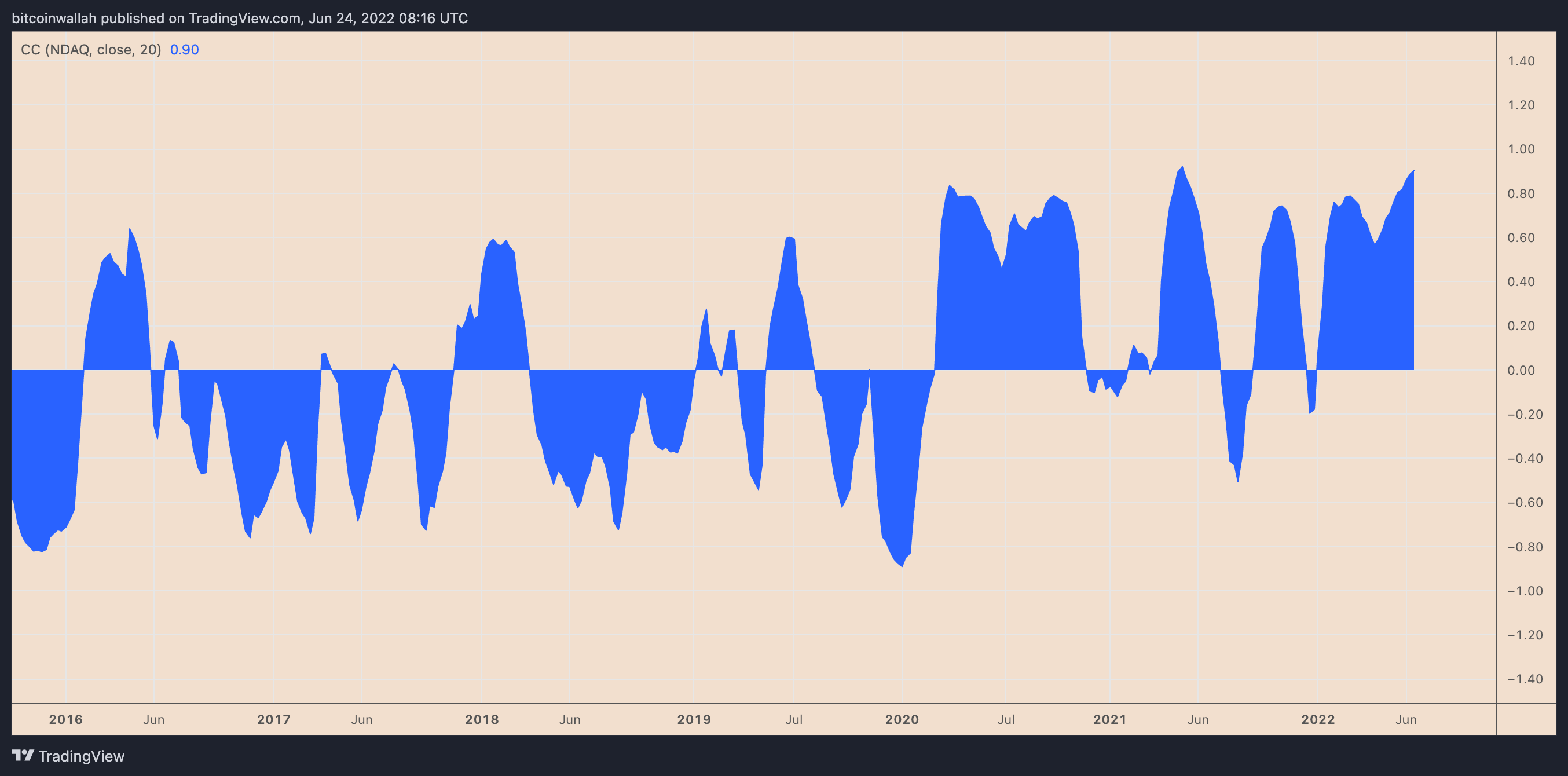

Macro risks brought through the Federal Reserve’s hawkish policy further strengthen XRP’s bearish bias. The XRP/USD pair has typically traded reduced tandem with riskier assets in 2022, having a correlation coefficient using the Nasdaq Composite, sitting at .90 by June 24.

A score of just one implies that the 2 assets moves in perfect sync.

Related: Almost $100M exits US crypto funds awaiting hawkish financial policy

On the other hand, anticipations that Ripple would win the suit filed through the U.S. Registration (SEC) for “allegedly” selling unregistered securities could negate the bearish setups.

I’ve mentioned for more than a year that lots of @Ripple and #XRP supporters underestimate the negative change up the SEC suit has already established. B/c Ripple has been doing well outdoors the U.S. and it is hiring, etc., people say otherwise. But XRP should be considered a non-security in america to satisfy its promise https://t.co/oBmiTQOWfJ

— John E Deaton (203K Supporters Beware Imposters) (@JohnEDeaton1) June 22, 2022

That being stated, XRP could rebound toward $.91 through the finish of the year when the ongoing retracement continues any more. Interestingly, the token has bounced after testing lengthy-term climbing trendline support, as proven below.

The bounce has additionally adopted XRP’s weekly relative strength index (RSI) decline below 30 — an oversold threshold, which signals a possible buying chance.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.