Ripple (XRP) price was wobbling between profits and losses on Sept. 19 despite hopes that Ripple would eventually win its lengthy-running legal fight from the U.S. Registration (SEC).

Ripple and also the SEC both decided to expedite the suit on Friday to obtain an answer on whether $XRP is really a security or otherwise.

In the updates from the situation, it may sound like it’s within the favor of @Ripple pic.twitter.com/SAyl4VLxdM

— Shaun Sekinger (@JeffSekinger) September 19, 2022

Given spoils SEC versus. Ripple excitement

The XRP/USD pair came by over 1% to $.35 while developing very sharp bullish and bearish wicks on its Sept. 19 daily candlepower unit. Quite simply, its intraday performance hinted in a growing bias conflict among traders.

The indecisiveness might be because of XRP’s contact with catalysts apart from the SEC versus. Ripple suit. Namely, the government Reserve’s possibility to increase its benchmark rates of interest by another 75 or 100 basis points within their policy meeting on Sept. 20.

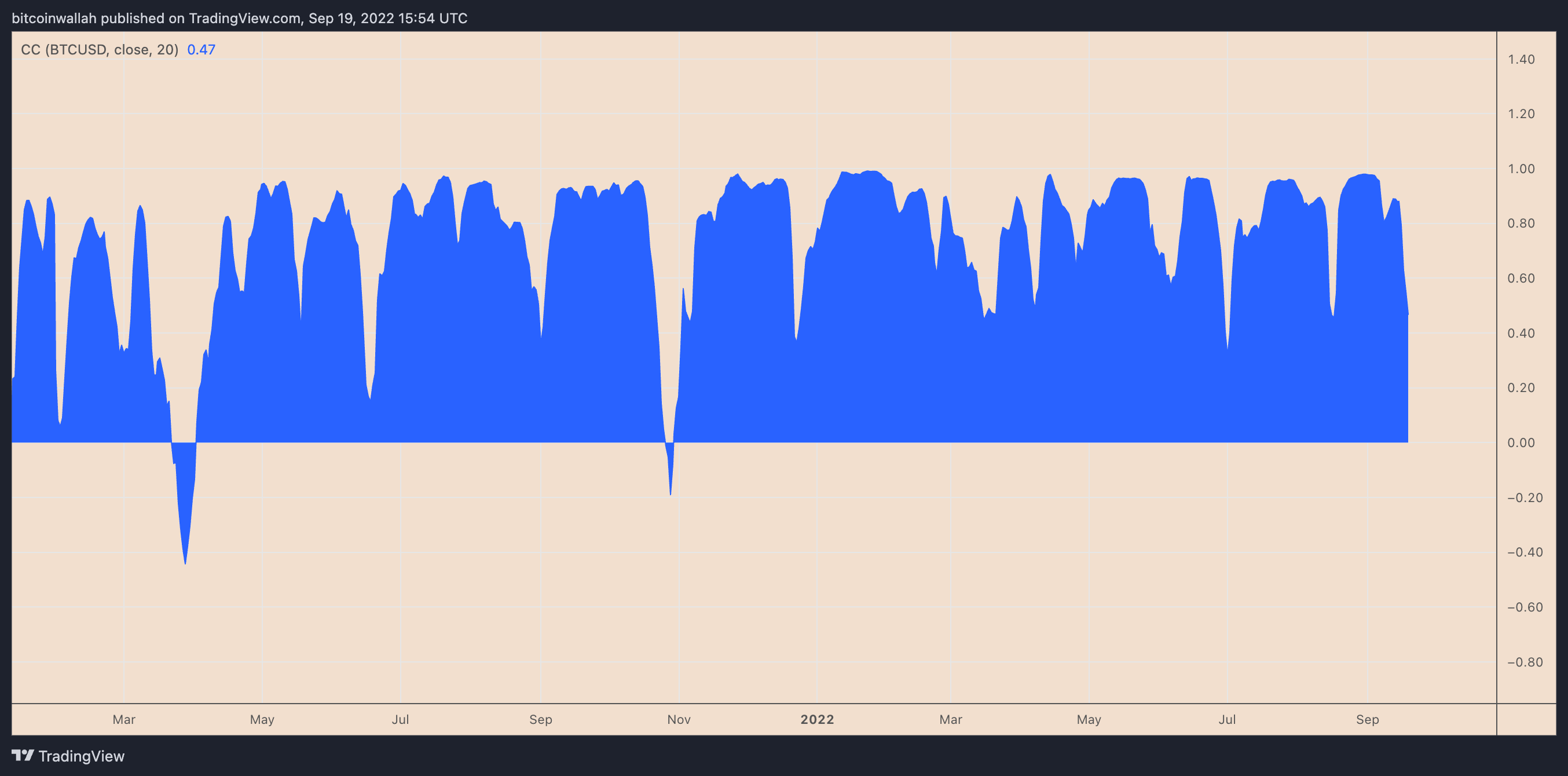

As Cointelegraph reported, fears of aggressive rate hikes have pressured the crypto market lower all year round, including Bitcoin (BTC) and Ether (ETH). XRP can also be not immune, because of the token’s consistently positive correlation with Bitcoin since October 2021.

For example, XRP’s daily correlation coefficient with Bitcoin on Sep. 19 was .47. A studying of just one implies that the 2 assets relocate lockstep.

XRP cost at risk of sinking $.25 in Q4

Independent market analyst Cheds highlighted that XRP continues to be fluctuating in the rectangular range since June, adding that “there is nothing to become looking forward to” at the moment.

The number is determined by $.38–$.40 serving as resistance and $.28–$.30 serving as support. XRP’s cost dropped after testing the resistance and, by Sep. 19, was heading toward the support area, as proven below.

Interestingly, moving toward the oblong range support may also trigger a vintage bearish reversal pattern known as the mind-and-shoulders, based on three consecutive peaks developing atop a typical support level, using the middle peak (mind) greater compared to other two (right and left shoulders).

Related: Ether staking might trigger securities laws and regulations — Gensler

A mind-and-shoulders pattern resolves following the cost breaks below its support line and falls up to the utmost distance between your middle peak and also the support. Employing this theory to XRP’s daily chart presents $.242 because the downside target.

Quite simply, XRP cost could lose another 30% through the finish of the year, driven mainly by macro catalysts.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.