XRP price published a clear, crisp rally against Bitcoin (BTC) on ongoing optimism in regards to a potential settlement between Ripple, a Bay Area-based blockchain payment firm, and also the U.S. Registration (SEC).

Settlement rumors fuel XRP cost boom

On Sept. 23, the XRP/BTC pair surged to .00002877 — its best level in 13 several weeks — from .00002132, a 35% cost rally versus Bitcoin in a single day. Meanwhile, exactly the same time-frame saw XRP rising around 42% from the U.S. dollar.

The large cost leaps within the XRP market began appearing after Ripple and SEC filed motions for any summary judgment to the court on Sept. 12 regarding ongoing legal fight over allegations that Ripple hcommitted securities fraud.

Quite simply, Ripple and SEC agreed the court should make use of the available evidence to achieve a verdict on if the blockchain firm unlawfully elevated funds by selling XRP by December 2022, and therefore avoid an effort.

XRP’s cost has boomed roughly 75% and 60% versus Bitcoin and also the dollar, correspondingly, since Ripple’s court filing, fueled by optimism of the possible win for Ripple.

The buying faster further after Ripple Chief executive officer Kaira Garlinghouse recommended exactly the same in the recent interview with Fox Business on Sept. 22.

BREAKING: Ripple Chief executive officer @BGarlinghouse Seems on Fox Business Among $XRP Cost Surge Approaching $.50

— HeadlineHunter!U.S. (@HHunter_US) September 22, 2022

Garlinghouse:

“People understand that the SEC is actually overreaching and they’re not carrying out a faithful allegiance towards the law in pursuit to have an outcome […] The SEC has type of lost its way.”

XRP sharks and whales buying since 2020

The cost surge also comes among the consistent accumulation of XRP tokens by wealthy investors csince May.

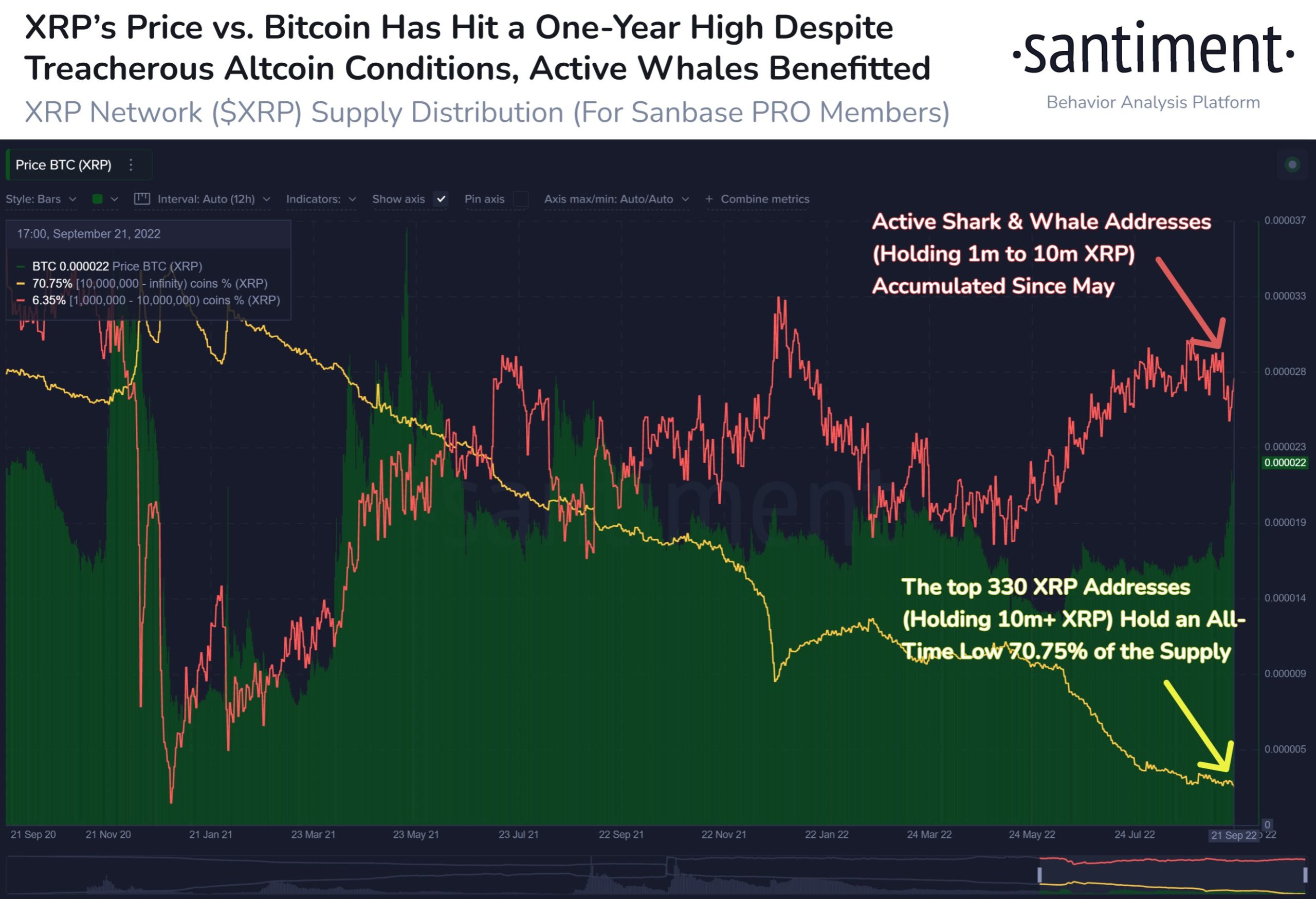

The proportion of entities holding between a million and ten million XRP tokens — referred to as sharks and whales — has risen in general to six.35% on Sept. 23, 2022, up from 5.43% on 12 ,. 31, 2020, according to data from Santiment, which noted:

“Active shark & whale addresses holding 1m to 10m $XRP will be in a build up pattern since late 2020.”

Meanwhile, the given period also observed entities with more than ten million XRP tokens reaching an exciting-time low 70.75% of the present supply.

Discomfort ahead?

It seems that traders have been purchasing the rumor in the run-to the Ripple versus. SEC verdict. But although it remains seen if the will become “sell this news,” with respect to the results of the ruling, XRP’s technicals are meaning in a potential correction.

Particularly, XRP has become an overbought asset versus Bitcoin and also the dollar.

Related: Total crypto market cap shows strength despite the Merge and Fed rate hike

The relative strength index (RSI) for XRP/BTC arrived at almost 85 on Sept. 23, way over the overbought threshold of 70 that typically precedes a powerful cost correction or consolidation.

XRP/BTC has remedied by nearly 10% from the 13-month peak, as proven within the chart below. The happy couple now tests .00002601 since it’s short-term support, which, if damaged towards the downside, might have it test .00002079 since it’s primary downside target or perhaps a 20% drop from current levels through the finish of the season.

Meanwhile, XRP eyes an identical sharp correction in comparison to the dollar after crossing pathways having a multi-month climbing down trendline resistance, as proven below.

A long pullback in the trendline resistance often see XRP test its near-term horizontal trendline support since it’s next downside target. Quite simply, the XRP/USD pair could drop to $.31 through the finish of 2022, lower almost 40% from Sept. 23’s cost.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.