If one thing in life is certain, it’s that we all have to pay taxes. Therefore, it’s important for cryptocurrency holders and investors to understand everything involved when it comes to crypto and taxes. This is becoming even more critical as digital assets gain mainstream adoption.

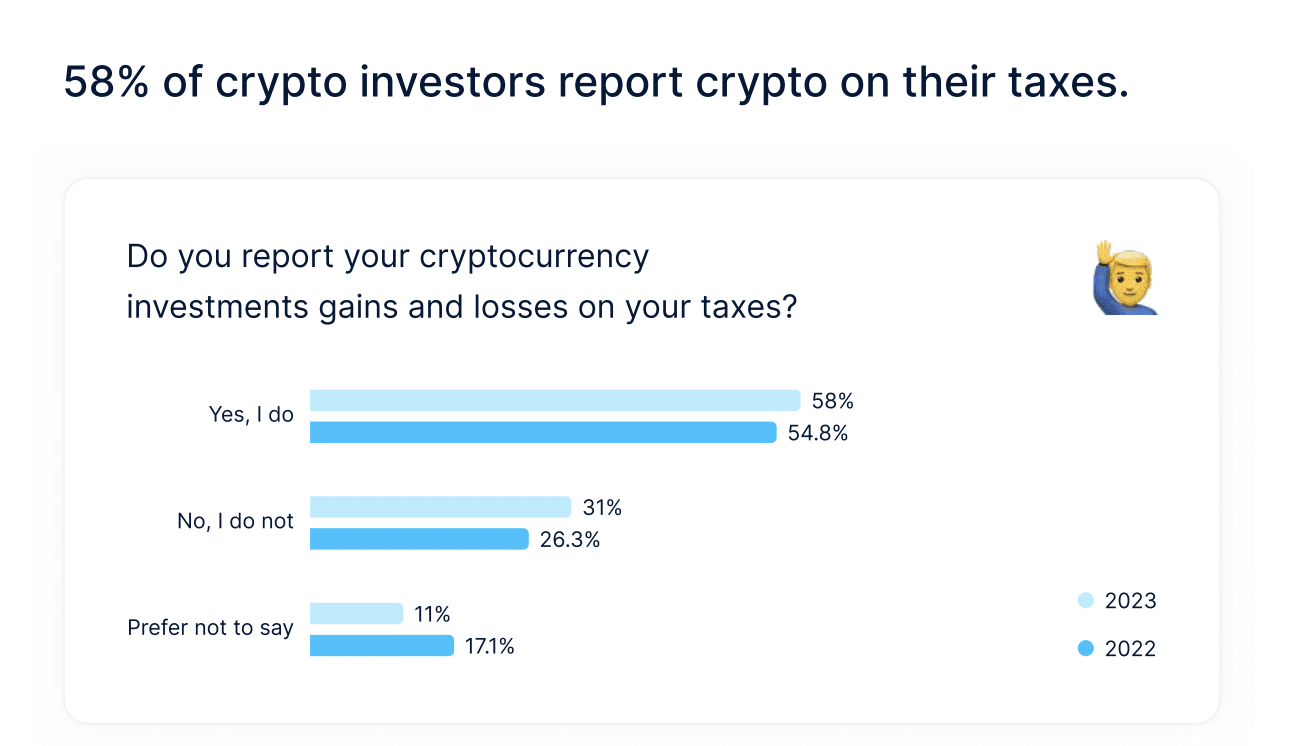

Unfortunately, a lot of confusion remains around cryptocurrency and taxes. To put this in perspective, a “2023 Annual Crypto Tax Report” from CoinLedger — a crypto tax software company — found that 31% of investors surveyed did not report their crypto on their taxes, with half not doing so because they didn’t make a profit and 18% not even knowing crypto was taxable.

While this remains problematic, Tony Tuths – principal of alternative investments and digital asset tax practice leader at KPMG – told Cryptonews that he is hopeful the United States Internal Revenue Service (IRS) will finalize regulations for 1099 tax reporting this year. “Once this happens, tax compliance will become easier,” he said. In the meantime, Tuths mentioned that individuals should be proactive when it comes to tracking their crypto gains and losses throughout the year.

Understanding Taxable Crypto Events

It’s important to understand that cryptocurrency is subject to both capital gains tax and income tax in the US. Dhiraj Nallapaneni, content manager at CoinLedger, told Cryptonews that cryptocurrency is categorized as property by the IRS, meaning that it is taxed similarly to stocks and equities. He said:

“When you dispose of your cryptocurrency, you’ll incur a capital gain or loss depending on how the price of your crypto has changed since you originally received it. In other words, when you sell your crypto or trade it for another cryptocurrency you’ll incur a capital gain or loss depending on how the price of your crypto has changed since you originally acquired it.”

For example:

Kathy buys $1,000 of Bitcoin (BTC)

Later, she sells her BTC for $1,500

Kathy incurs a capital gain of $500 ($1,500-$1,000)

Given this, it’s necessary for individuals to keep records of their cryptocurrency transactions. According to Nallapaneni, this includes when an individual acquired and disposed of cryptocurrency, as well as its price at receipt and disposal.

Other common taxable events related to cryptocurrency include exchanging one cryptocurrency for another and making purchases using cryptocurrencies.

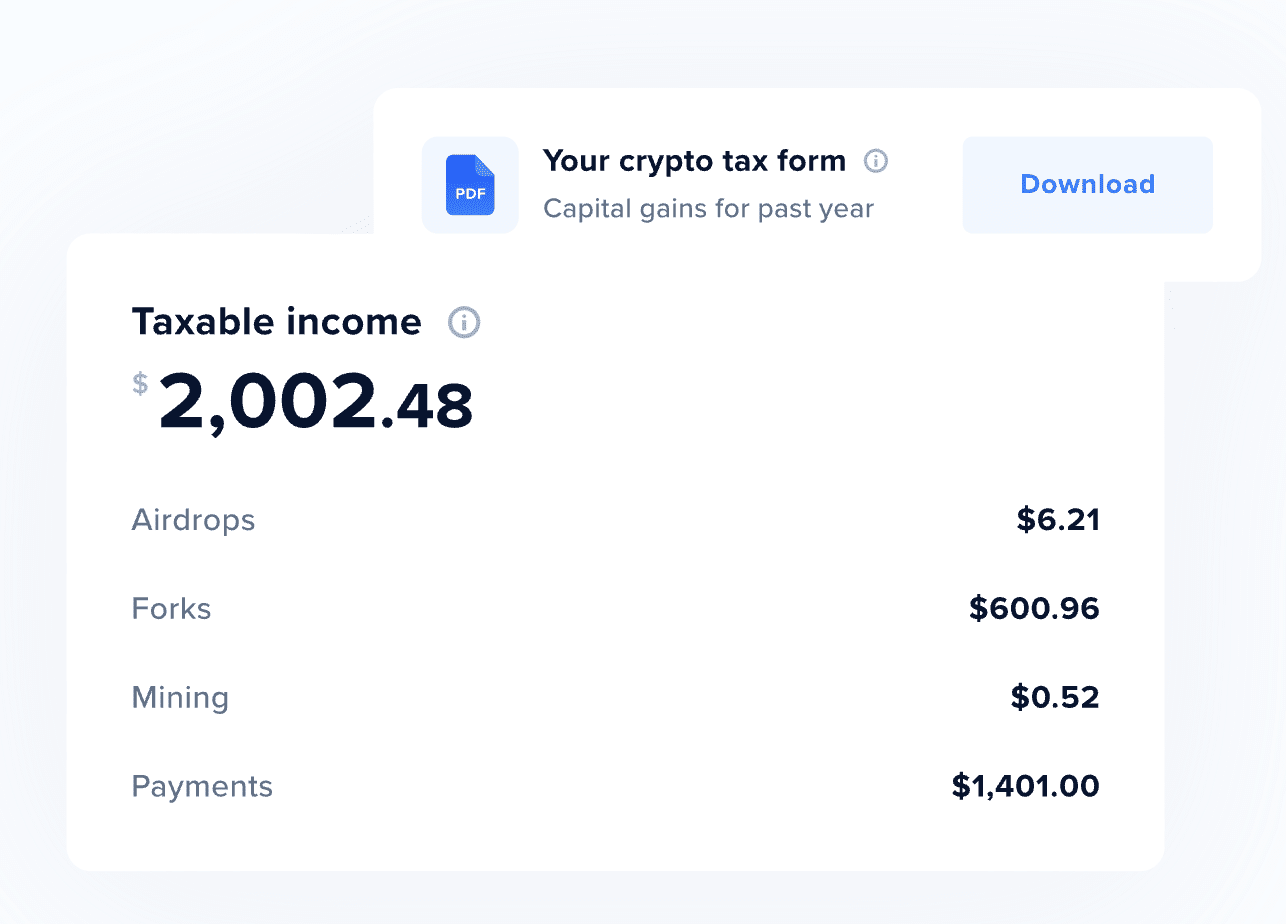

Jonathan Bander, managing partner and head of tax strategy at ExperityCPA – a tax and accounting firm specializing in crypto – told Cryptonews that apart from reporting capital gains and losses, certain transactions are deemed ordinary income, including:

- Receipt of airdropped tokens

- Acquisition of tokens from a hard fork

- Participation in staking cryptocurrency

- Engagement in yield farming and liquidity mining

- Receipt of referral bonuses

Bander pointed out that the rise of Decentralized Finance (DeFi) is primarily attributed to the ascent of decentralized exchanges like Uniswap and Sushiswap, alongside smart contract-based platforms such as Compound and AAVE. According to Bander, transactions executed on these decentralized platforms are equally subject to taxation, requiring taxpayers to fulfill their tax obligations using transaction histories.

Bander elaborated that in “Proof-of-Stake” (PoS) consensus staking, crypto assets are locked in a staking pool to earn additional tokens as rewards for aiding in blockchain transaction validation. “Staking not only secures the network but also generates passive income. Staking rewards are taxed at ordinary income rates; however, subsequent sales of these rewards necessitate recognition of capital gains or losses,” explained Bander.

Yield farming also allows crypto holders to lend their cryptocurrency assets to DeFi platforms, receiving returns in the form of interest, fees, or new tokens for providing liquidity. “Earnings, calculated as Annual Percentage Yield (APY), are taxed akin to staking rewards,” said Bander.

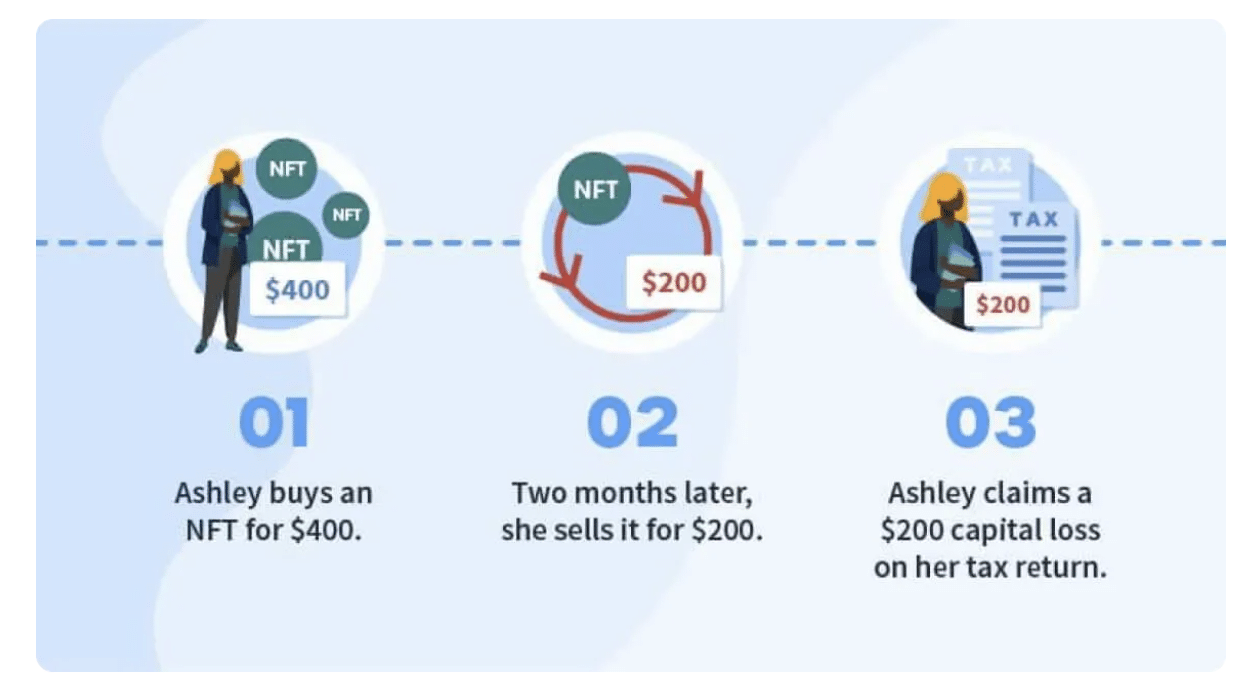

Additionally, Bander pointed out that artists’ earnings from non-fungible token (NFT) sales are taxed at ordinary income rates. “Investors in NFTs are subject to capital gains taxes on profits from sales or trades,” he said.

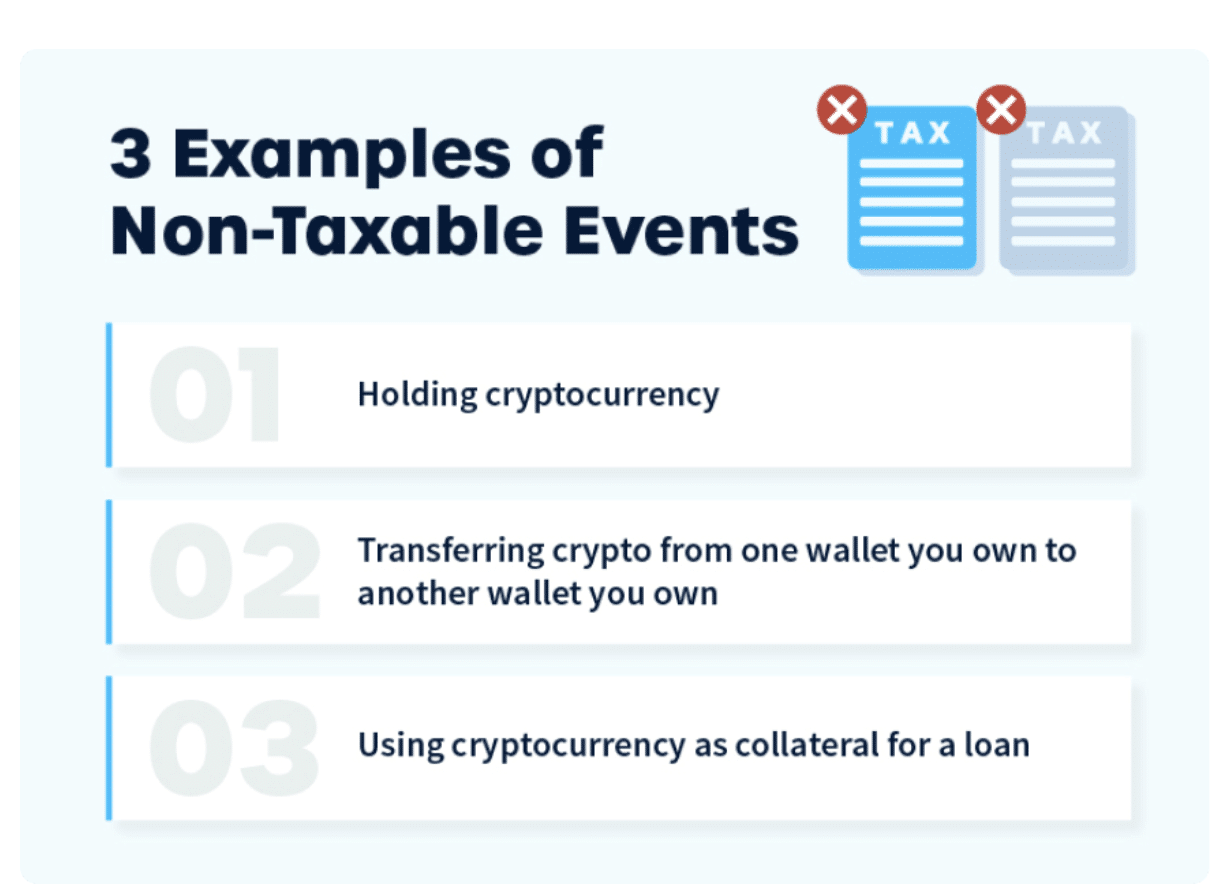

It’s also important to take note of tax-free cryptocurrency transactions. According to CoinLedger’s recent crypto tax guide, these include:

- Holding cryptocurrency

- Buying cryptocurrency with fiat currency and then holding it

- Transfering crypto from one wallet you own to another wallet you own

- Using cryptocurrency as collateral for a loan

How to Report and Record Crypto Transactions

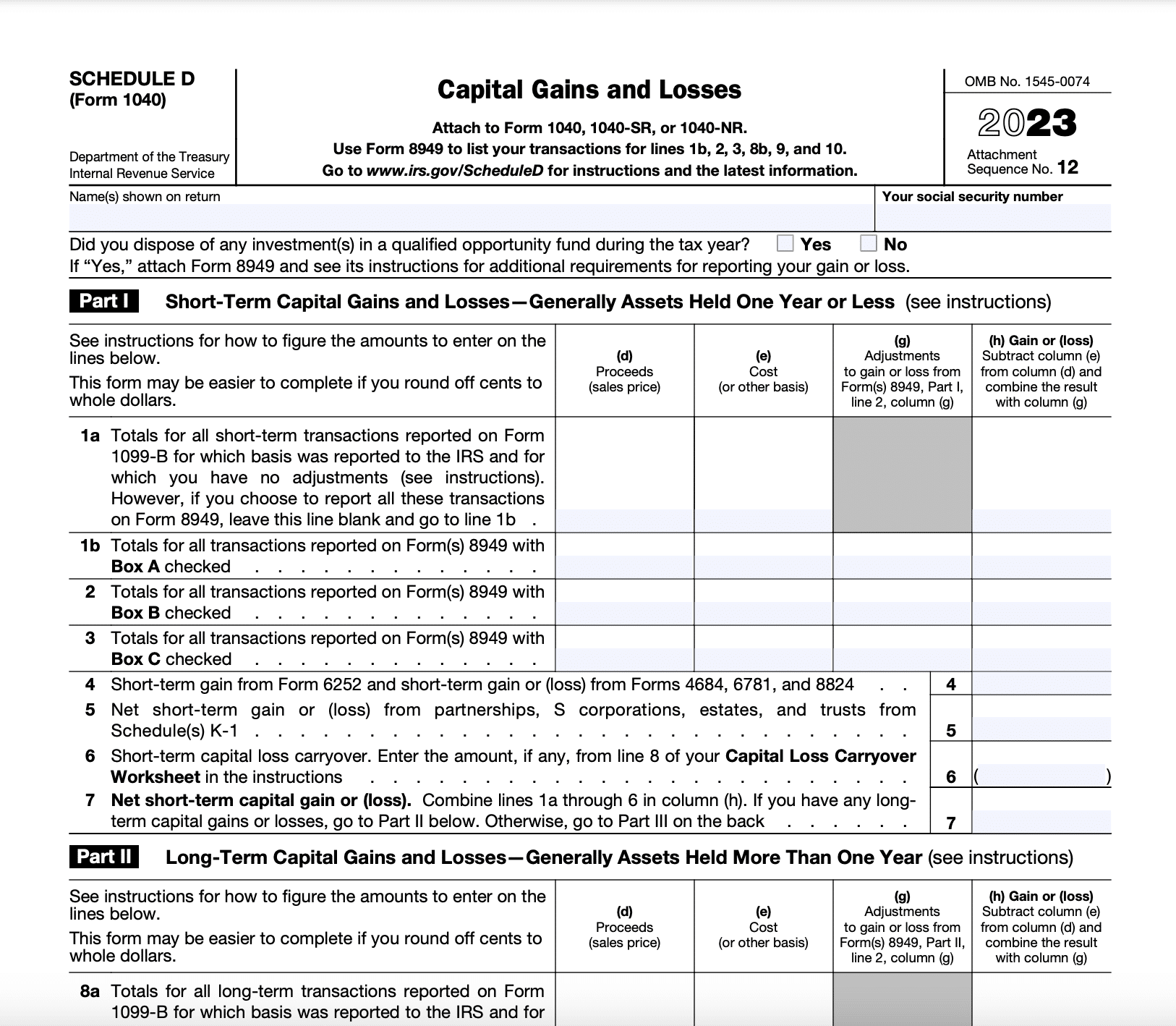

Since cryptocurrency is classified as property by the IRS, reporting of capital gains and losses happen using Schedule D and Form 8949, when applicable.

According to Bander, Form 8949 is used to report all cryptocurrency transactions involving sales, exchanges, or disposals of capital assets. He said:

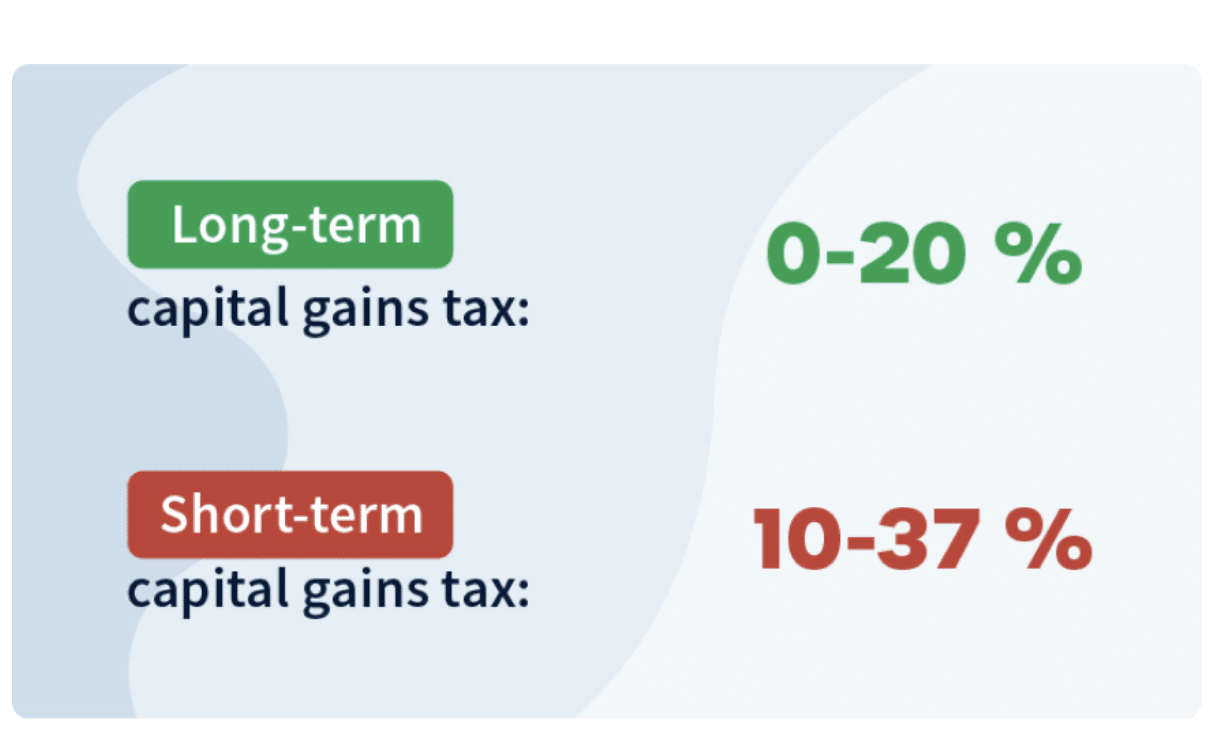

“This form allows you to detail each transaction separately, including the date of acquisition and sale, the proceeds from the sale, the cost basis, and the resulting gain or loss. You’ll need to categorize each transaction as short-term or long-term based on the holding period (for example, whether the asset was held for one year or less – short-term, or more than one year – long-term).”

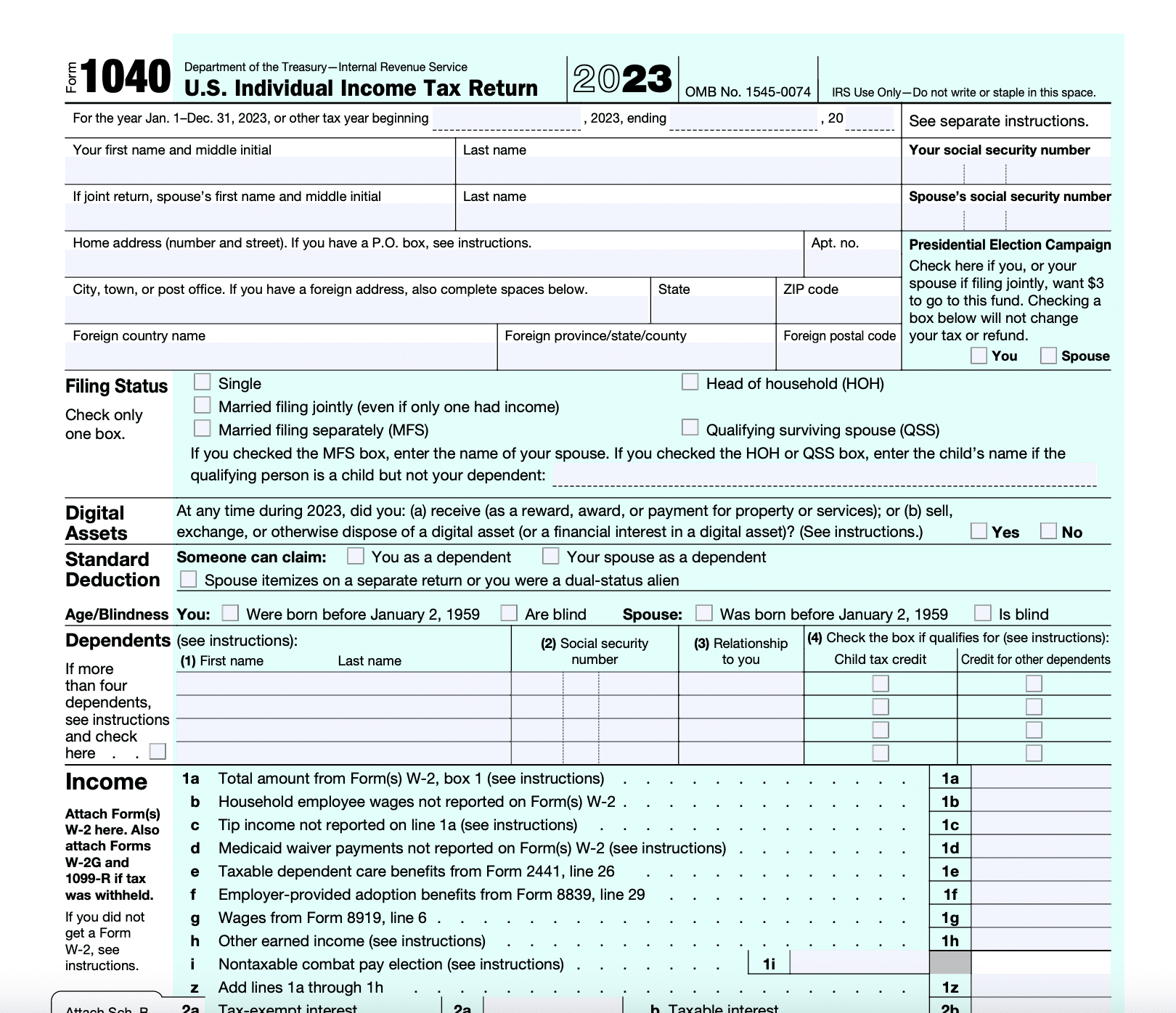

Bander explained that Form 8949 feeds into Schedule D, which is where taxpayers summarize total short-term and long-term capital gains and losses from all sources, including cryptocurrency transactions. The net capital gain or loss from Schedule D is then transferred to Form 1040.

Form 1040 is used for US individual income tax returns. “Any taxable income or losses from crypto transactions reported on Schedule D (capital gains and losses) will be incorporated into Form 1040,” said Bander. He added:

“For certain types of crypto income, such as airdrops, mining income, staking rewards, or other forms of earned cryptocurrency, the income needs to be reported on the appropriate sections of Form 1040 or related schedules, such as Schedule 1 for Additional Income and Adjustments to Income.”

While straightforward, Bander pointed out that a crypto wash sale rule does not currently exist in the US, making crypto wash sales technically legal. According to a recent blog post from TokenTax, a wash sale occurs when a holder sells crypto or a security for a loss and quickly rebuys the same or similar crypto or security to receive tax benefits. The post further notes that if US crypto users buy back their crypto assets immediately after a sale, this is considered to be a crypto wash sale.

Although wash sale rule doesn’t apply to crypto at the moment, there is proposed legislation aimed at banning crypto wash sales. Given this, taxpayers engaging in crypto wash sales should always be aware of changing regulations. “The wash sale rule prohibits selling securities at a loss and repurchasing them within 30 days, preventing taxpayers from creating ‘artificial’ losses to reduce tax liabilities,” said Bander.

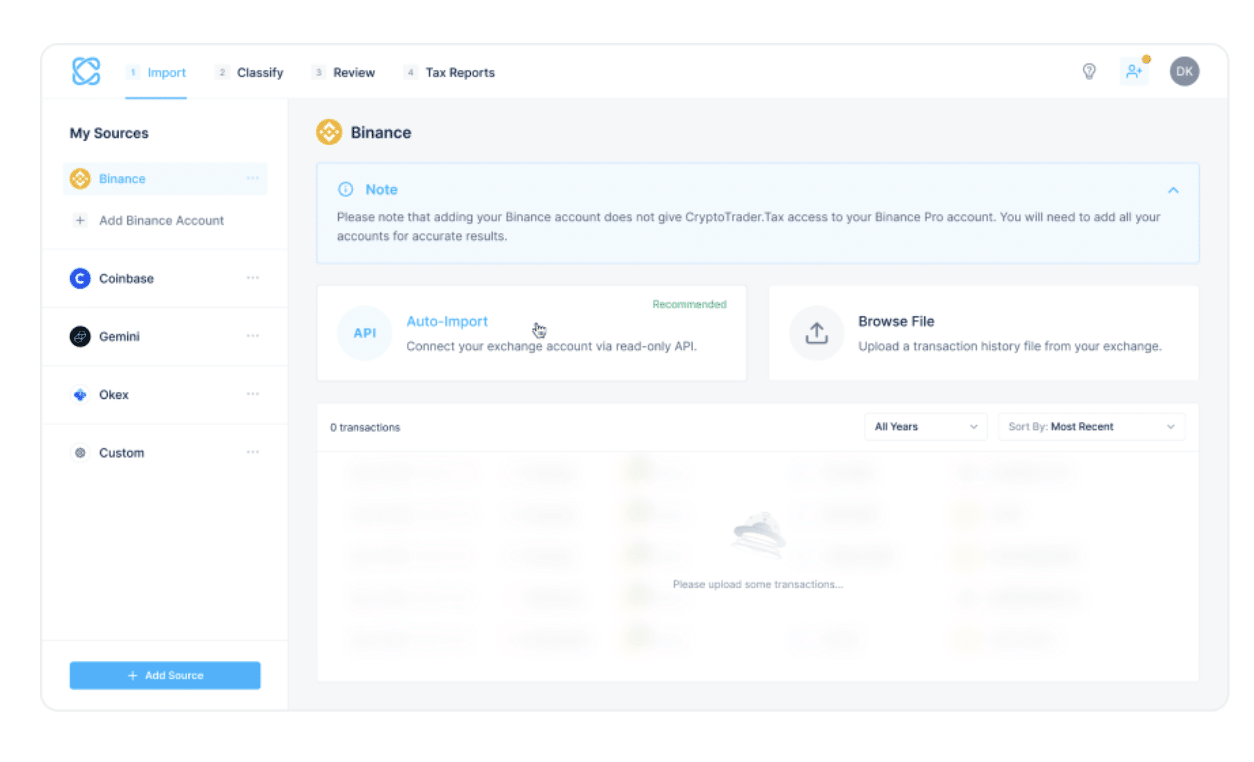

In terms of keeping track of crypto transactions, a number of crypto tax software solutions can be used to help in addition to having everything documented on a spreadsheet.

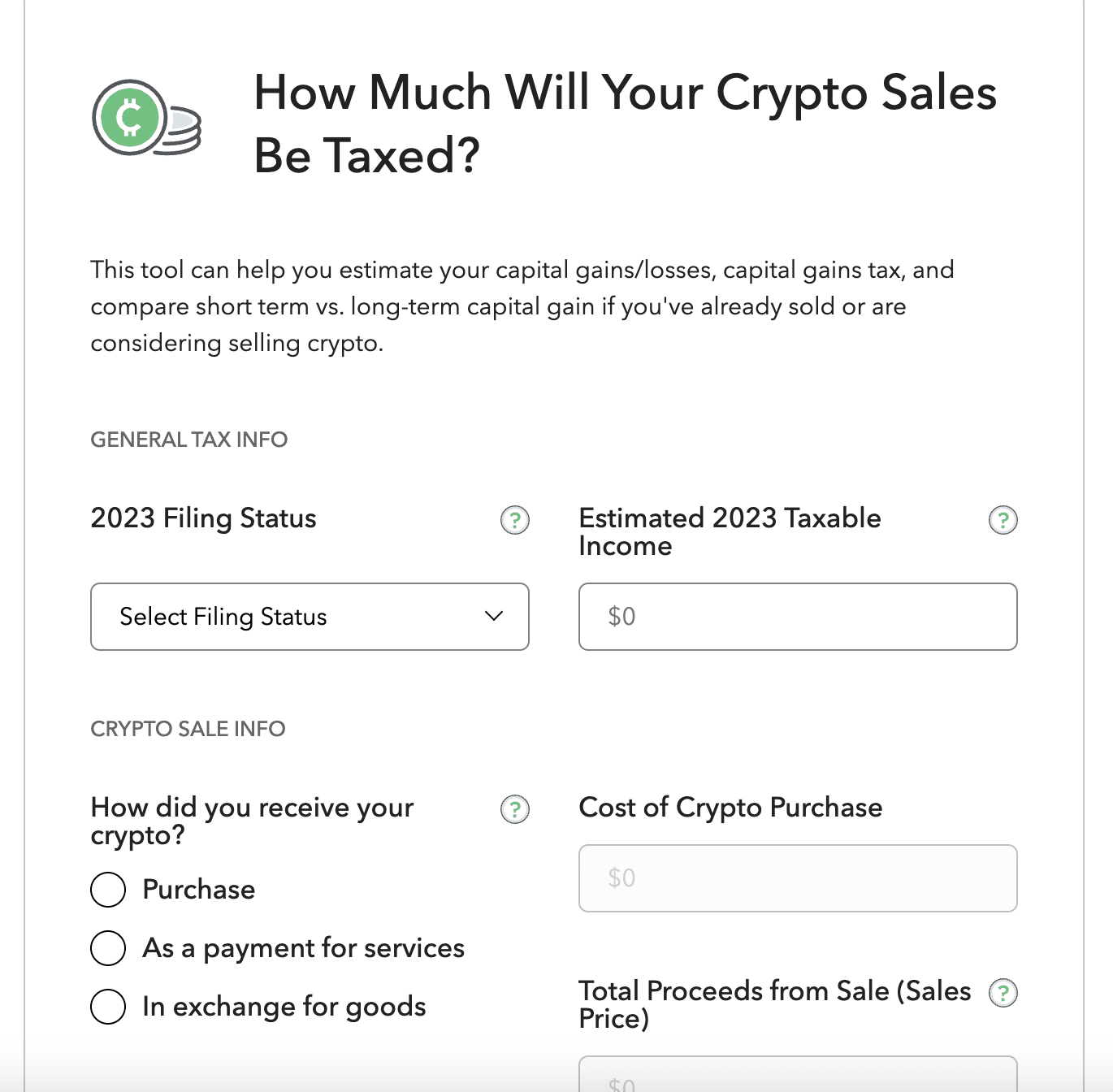

For example, CoinLedger allows users to get started with a free CoinLedger account. The free version of CoinLedger lets taxpayers easily import their transactions. A fee is required in order to generate a tax report.

CoinTracker is another solution that allows taxpayers to connect their digital asset exchanges and wallets directly to the platform to calculate their capital gains, losses and ordinary income items such as airdrops, mining, and staking.

Shehan Chandrasekera, head of tax strategy at CoinTracker, told Cryptonews that the platform’s core focus is producing accurate tax reports. “Since 2017, CoinTracker has produced over 1 million Form 8949s for taxpayers,” he said.

TurboTax is a traditional tax software that also has built in features to help with crypto transactions. TurboTax Premium can integrate with third-party crypto platforms, like Coinbase, allowing users to easily move information over without having to enter it manually. The software supports all major cryptocurrencies as well.

TaxBit is another accounting and tax compliance solution for digital assets. In addition to helping individual taxpayers, TaxBit recently announced a “Legal Entity Support” product that allows companies to set up multiple data sources, link wallets, and add exchange accounts for different entities.

Although tax software solutions can be helpful, Bander strongly recommends utilizing third party independent applications to further assist with the tabulation, accounting, and recognition of crypto transactions for tax purposes.

“The reporting feature on most crypto platforms needs a lot more development. Until this happens, it is best to use a technology platform designed specifically for tax reporting purposes. At experityCPA, we utilize several options depending on our client’s crypto activity,” said Bander.

Finally, it’s important to note that accurately keeping track of crypto transactions and reporting those on the correct tax forms is crucial for taxpayers to remain compliant and avoid paying additional fees or being subject to an audit by the IRS.

Preparing for the 2024 Tax Season

Crypto investors and holders should start to prepare for the 2024 tax season as soon as possible. This in mind, there are some important things to consider moving forward.

For example, one of the most controversial tax aspects for many crypto holders currently is a provision that was added a few years ago as part of the United States Infrastructure Investment and Jobs Act.

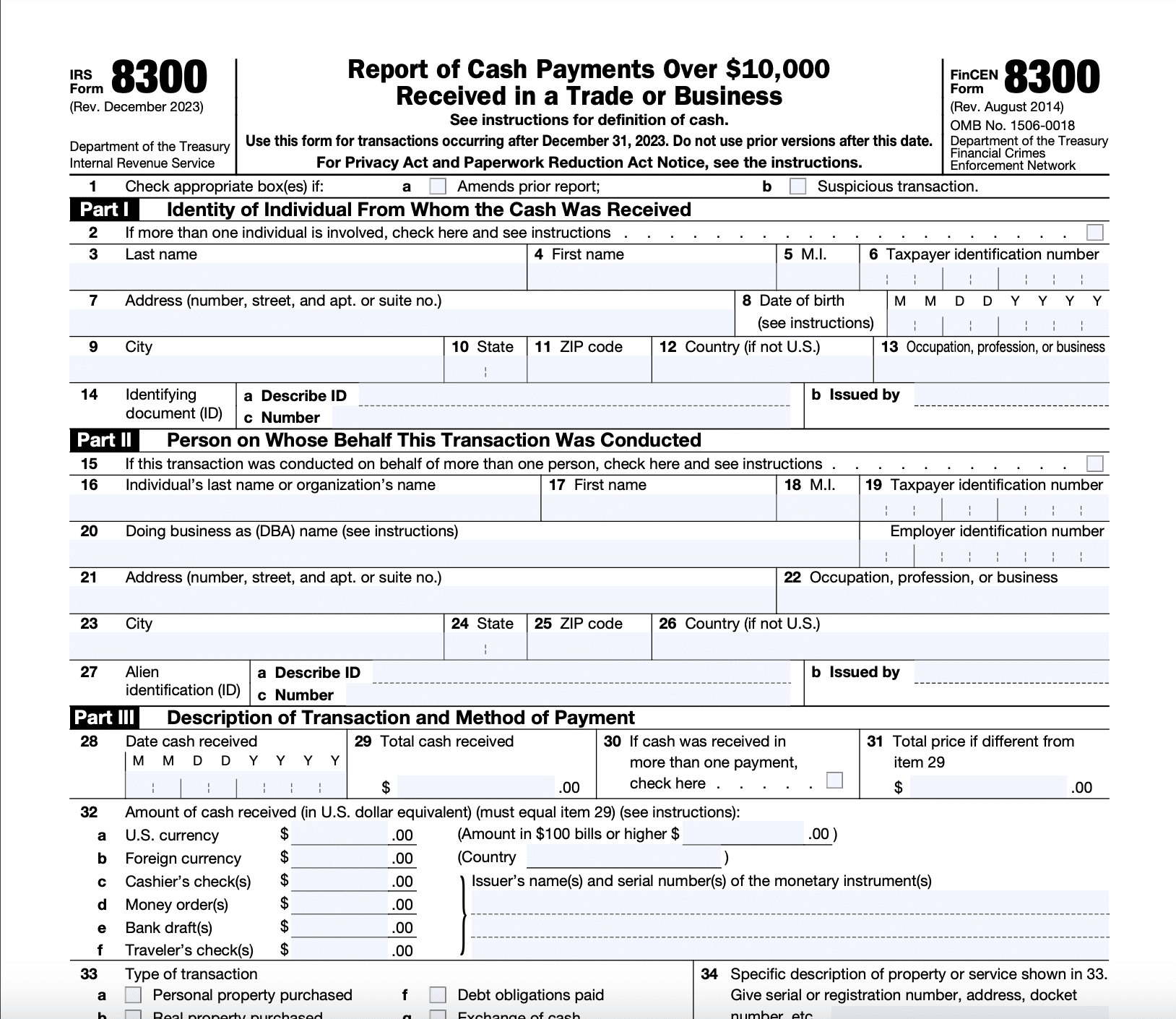

Starting on Jan. 1, 2024, a new US tax law mandates individuals and businesses to report cryptocurrency transactions over $10,000 to the IRS within 15 days (on Form 8300), detailing sender information and transaction specifics. Failure to comply could result in felony charges.

According to the Infrastructure Investment and Jobs Act, this regulation applies to both individuals and businesses involved in crypto-related trade or business. However, there is still a lack of clear Treasury guidance on compliance specifics, raising concerns among crypto-focused organizations and individual investors.

While this new law has created an enormous amount of concern within the crypto community, Tuths pointed out the statute is not self-executing. “It requires regulations which have not yet been proposed. So the law is not yet effective,” he said.

Given this, confusion around these new requirements remains. For instance, “Squeeze Taxes,” an accountant and president of Squeeze Financial, LLC, told Cryptonews that there is much confusion within the crypto community on how to fill out Form 8300. “In my professional opinion, I would wait for the Department of Treasury to issue additional guidance and information on how to fill out this form for crypto purposes,” he said.

In addition, tax requirements may be impacted by the recent approval of a spot Bitcoin ETF in the US. According to Bander, changes may occur in this case if crypto investors buy shares of a Bitcoin ETF and then later sell them for a profit. “You might need to pay taxes on that profit. The amount of tax you pay will depend on how long you held the shares before selling them.”

The spot BTC ETF is subject to regular capital gain taxes similar to any other stock. But, there are some nuances that can make compliance a bit harder.

A long thread coming up today.

— Shehan (@TheCryptoCPA) January 11, 2024

However, he pointed out that simpler tax reporting will likely result from the passing of a spot Bitcoin ETF. “Investing in a spot Bitcoin ETF might make it easier for retail investors to report gains or losses when it’s time to do your taxes. The ETF will provide investors with statements that can help report this information,” he said.

In any case, Bander noted that it’s best practice to speak with a tax expert or a financial advisor to understand how investing in a Bitcoin ETF might affect your taxes.

Resources and Guides for Crypto Taxpayers

Navigating the world of cryptocurrency and taxes is complex. This is being further complicated by new, unclear regulations from the SEC. Fortunately, education and planning ahead will likely help crypto holders and investors understand how to properly pay their taxes.

This in mind, Squeeze Taxes mentioned that the IRS has a considerable amount of information readily available to taxpayers. “They have a dedicated website and an FAQ section. I always urge every US crypto user to visit the IRS website and see what they are putting out,” he said.

In addition, CoinLedger has a helpful, up-to-date tax guide and YouTube channel aimed at helping taxpayers better understand how to handle crypto transactions. The TaxBit blog also contains current information on how crypto holders should go about paying taxes.

In addition to educational resources, Bander added that everyone involved in the crypto space should be working directly with a tax professional. He mentioned that ExperityCPA will help individuals get started with a free, tax strategy session. CryptoTaxAudit – a full-service crypto income tax preparation firm – also offers taxpayers consultations to discuss tax strategies.