Around 13% from the American population — or 43 million people — have held cryptocurrency at some stage in their lives, new information from JPMorgan Chase has revealed.

Based on a 12 ,. 13 report entitled “The Dynamics and Census of U.S. Household Crypto-Asset Use,” the dpi has risen dramatically since before 2020, once the figure was just around 3%.

The most recent data from JPMorgan originates from analyzing bank account transfers from the sample well over 5 million customers. It discovered that 600,000 customers within this sample group transferred cash to crypto accounts sooner or later during period from 2020 to 2022.

The research also noted that cryptocurrency holders typically made their first crypto purchases during spikes in crypto prices. During this period, the quantity of cash being sent into crypto exchange accounts typically far over-shadow the money being removed. Quite simply, many people were possessing their crypto in those times.

This altered at the begining of 2022 as crypto prices fell, based on JPMorgan. In recent several weeks, cash transfers into crypto exchanges only have slightly exceeded cash transfers from them.

JPMorgan states this is because of both cost declines in crypto along with a broader trend from the savings rate declining within the U . s . States because the pandemic:

“We see the fall and rise of crypto use because the start of COVID as in conjuction with the joint relationship between retail flows and market prices observed in prior research. Furthermore, the popularity in crypto flows also tracks dynamics of household savings, which spiked to historic highs at the start of the pandemic but has started to reverse.”

Who’s buying?

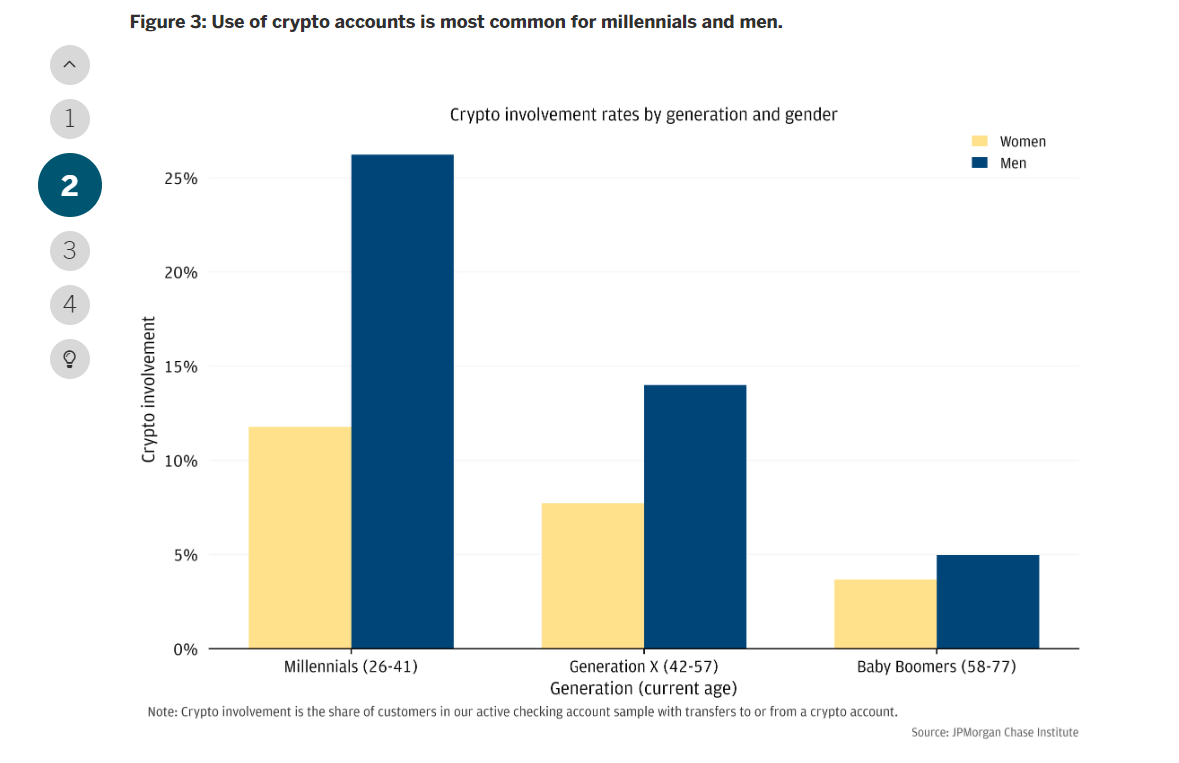

The report also considered in on whether certain demographic groups are more inclined to buy crypto. It discovered that men of every age group buy considerably more crypto than women, which more youthful use considerably greater than seniors. For instance, the report discovered that over 25% of millennial guys have bought crypto, whereas only around 12% of millennial ladies and 5% of male seniors have.

The study also discovered that crypto holdings were relatively minor for many individuals, with median flows comparable to under one week’s price of take-home pay.

However, about 15% of crypto proprietors had greater than a month’s pay committed to crypto.

Related: Arthur Hayes states Bitcoin has bottomed as “everyone who may go bankrupt went bankrupt”

The crypto market went via a dramatic fall in 2022. Bitcoin (BTC) has fallen from the 2022 a lot of $47,459 in March to $17,208 during the time of writing, while Ether (ETH) has fallen from $3,521 in April to $1,273 during the time of writing.

This fall within the crypto market continues to be caused by market shocks for example TerraUSD (UST) stablecoin losing its peg in May and crypto exchange FTX going bankrupt in November.

Buying and selling charges have fallen on the majority of crypto exchanges, and Coinbase has mentioned that it is revenue has fallen by nearly 50%.

But regardless of this loss of crypto prices and buying and selling activity, this latest report signifies that crypto possession has still elevated during the period of the final couple of years.