Bitcoin (BTC) continues to be buying and selling near $16,500 since November. 23, dealing with a dip to $15,500 as investors feared the imminent insolvency of Genesis Global, a cryptocurrency lending and trending company. Genesis mentioned on November. 16 it would “temporarily suspend redemptions and new loan originations within the lending business.”

After causing initial mayhem within the markets, the firm refuted speculation of “imminent” personal bankruptcy on November. 22, even though it confirmed difficulties in raising money. More to the point, Genesis’ parent company Digital Currency Group (DCG) owns Grayscale — the asset manager behind Grayscale Bitcoin Trust, which holds some 633,360 BTC.

Contagion risks in the FTX-Alameda Research implosion still exert negative pressure around the markets, however the market is trying to improve transparency and insolvency risks. For instance, on November. 24, crypto derivatives exchange Bybit launched a $100 million fund to assist market makers and-frequency buying and selling institutions battling with financial or operational difficulties.

More lately, on November. 25, Binance printed a Merkle Tree-backed evidence of funds because of its Bitcoin deposits. Furthermore, the exchange outlined how users may use the mechanism to ensure their holdings. There isn’t any doubt that centralized institutions must embrace transparency and insurance mechanisms to get back investors’ trust.

First, however, you have to evaluate Bitcoin derivatives markets to completely know how professional traders are digesting such news.

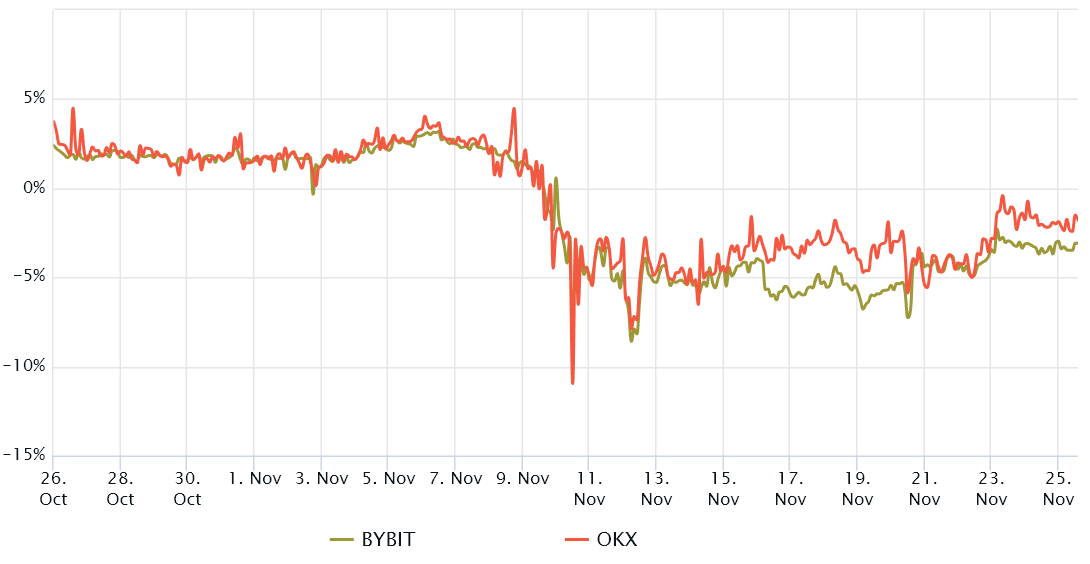

Futures market discount improved slightly but remains not even close to bullish

Fixed-month futures contracts usually trade in a slight premium to regular place markets because sellers require more money to withhold settlement for extended. Technically referred to as contango, this case isn’t only at crypto assets.

In healthy markets, futures should trade in a 4% to eightPercent annualized premium, which is sufficient to make amends for the potential risks plus the price of capital. The alternative, once the interest in bearish bets is extremely high, leads to a discount on futures markets — referred to as backwardation.

Thinking about the information above, it might be apparent that derivatives traders flipped bearish on November. 9, because the Bitcoin futures premium flipped negative. Yet, based on futures markets, the $15,500 dip on November. 21 wasn’t enough to instill additional interest in leveraged short positions.

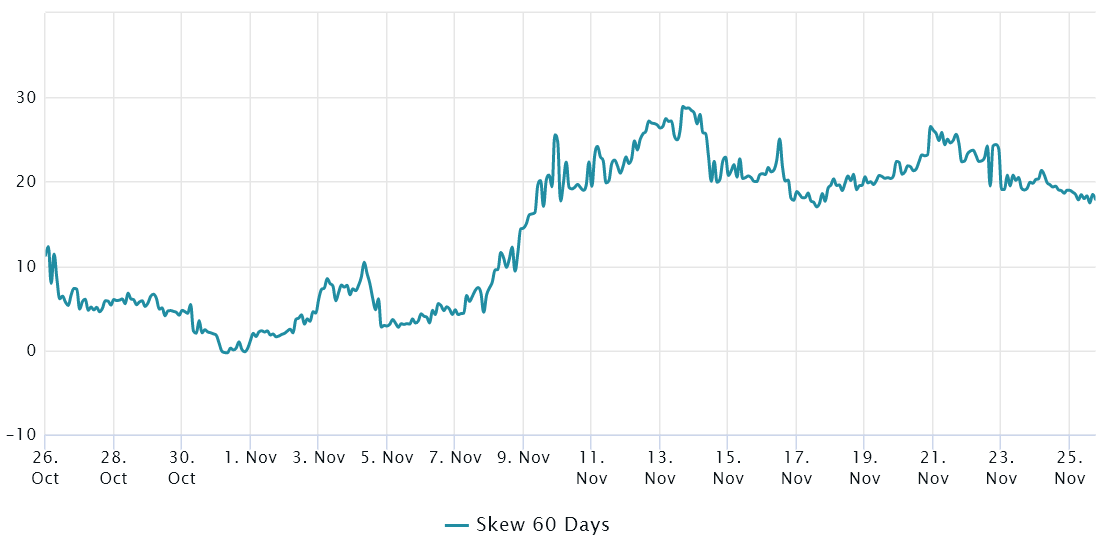

Option markets read the bearishness

Traders should evaluate options markets to know whether Bitcoin will probably retest the $15,500 support. The 25% delta skew is really a telling sign whenever arbitrage desks and market makers are overcharging for upside or downside protection.

The indicator compares similar call (buy) and set (sell) options and can turn positive when fear is prevalent since the protective put options fees are greater than risk call options.

The bottom line is, the skew metric will move above 10% if traders fear a Bitcoin cost crash. However, generalized excitement reflects an adverse 10% skew.

As displayed above, the 25% delta skew continues to be over the 10% threshold since November. 9, indicating options traders are prices a greater chance of unpredicted cost dumps. Presently at 18%, it signals investors are fearful and reflects too little curiosity about offering downside protection.

Related: How bad may be the current condition of crypto? On-chain analyst explains

An unexpected pump will probably cause more impact

Thinking about that both Bitcoin futures and options financial markets are presently prices greater likelihood of a drawback, there’s pointless to think that the eventual retest from the $15,500 bottom would cause massive liquidations.

In addition, the slight decrease in the futures discount shows bears don’t have the confidence to spread out leverage shorts at current cost levels. Despite the fact that Bitcoin derivatives data remains bearish, the surprise of the eventual bull go to $18,000 will probably cause more havoc. But, for the time being, bears stay in control based on BTC futures and options data.

The views, ideas and opinions expressed listed here are the authors’ alone and don’t always reflect or represent the views and opinions of Cointelegraph.