Bitcoin (BTC) cost is constantly on the fight in the $24,000 resistance and also the cost was rejected there on August. 10, however the rejection wasn’t enough to knock the cost from the 52-day-lengthy climbing funnel. The funnel includes a $22,500 support which bullish formation shows that the BTC cost will ultimately hit the $29,000 level by early October.

Bitcoin derivatives data demonstrates too little interest from leveraged longs (bulls), but simultaneously, it doesn’t cost greater likelihood of an unexpected crash. Strangely enough, the newest Bitcoin downturn on August. 9 was supported with a negative performance from U.S.-listed stocks.

On August. 8, nick and video video card maker Nvidia Corp (NVDA) announced that it is 2Q sales would present a 19% drop when compared to previous quarter. Furthermore, the U.S. Senate passed an invoice on August. 6 that may negatively impact corporate earnings. Despite freeing $430 billion to finance “climate, healthcare and tax,” the supply would impose singlePercent tax around the stock buyback by openly traded companies.

Our prime correlation of traditional assets to cryptocurrencies remains an enormous concern for many investors. Investors shouldn’t be getting in front of themselves even when inflationary pressure recedes since the U.S. Given monitors employment data very carefully. The most recent studying displayed a 3.5% unemployment usual for excessively heated markets, forcing the financial authority to help keep raising rates of interest and revoking stimulus debt purchase programs.

Reducing risk positions ought to be the norm until investors clearly indicate the U.S. Central Bank is nearer to easing the tighter financial policies. That’s the key reason why crypto traders are following macroeconomic figures so carefully.

Presently, Bitcoin lacks the force to interrupt the $24,000 resistance, but traders should study derivatives to gauge professional investors’ sentiment.

Bitcoin derivatives metrics are neutral-to-bearish

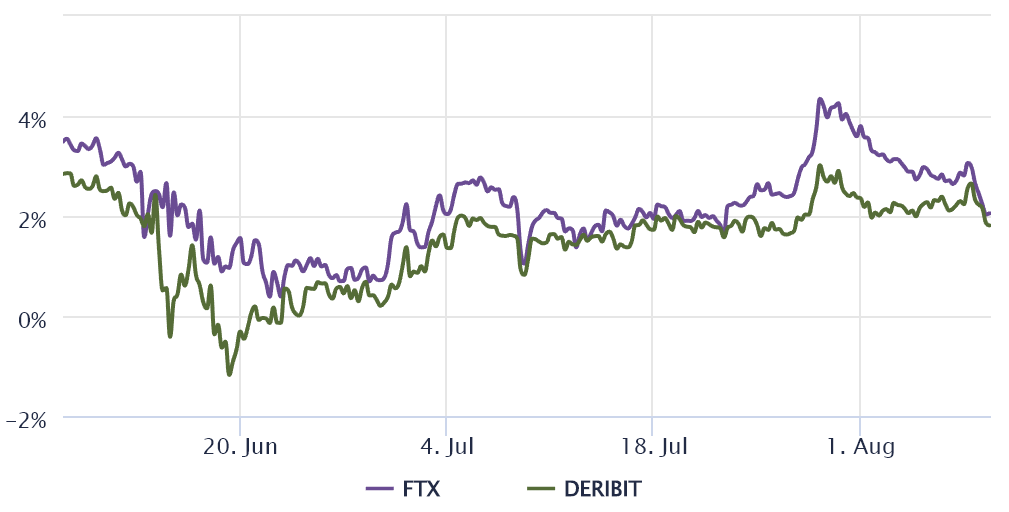

The Bitcoin futures annualized premium measures the main difference between longer-term futures contracts and also the current place market levels. The indicator should run between 4% to eightPercent to pay traders for “locking in” the cash before the contract expiry. Thus, levels below 2% are very bearish, as the figures above 10% indicate excessive optimism.

The above mentioned chart implies that this metric dipped below 4% on June 1, reflecting traders’ insufficient interest in leverage lengthy (bull) positions. However, the current 2% studying isn’t particularly concerning, considering that BTC is lower 51% year-to-date.

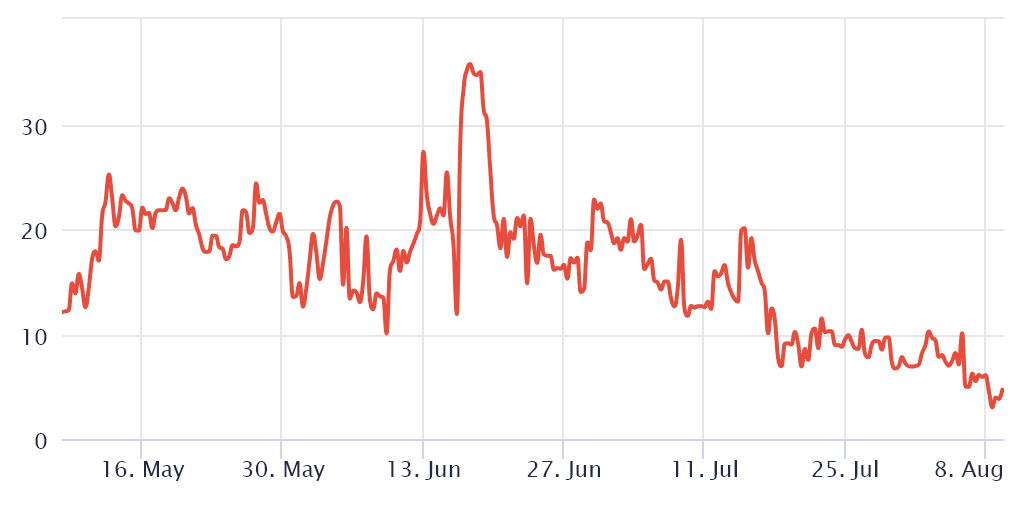

To exclude externalities specific towards the futures instrument, traders should also evaluate Bitcoin options markets. The 25% delta skew is really a telling sign whenever arbitrage desks and market makers overcharge for upside or downside protection.

Related: Bitcoin cost sees $24K, Ethereum hits 2-month high as US inflation shrinks

If individuals traders fear a Bitcoin cost crash, the skew indicator will move above 12%. However, generalized excitement reflects an adverse 12% skew.

Data implies that the skew indicator continues to be varying between 3% and 5% since August. 5, that is considered to become a neutral area. Options traders aren’t overcharging for downside protection, meaning they may lack excitement, but a minimum of they’ve abandoned the “fear” sentiment seen within the last couple of several weeks.

Thinking about Bitcoin’s current climbing funnel pattern, Bitcoin investors most likely shouldn’t worry an excessive amount of about the possible lack of buying demand, based on futures market data.

Obviously, there’s healthy skepticism reflected in derivatives metrics, but the road to a $29,000 BTC cost remains obvious as lengthy as inflation and employment statistics they are under control.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision