Bitcoin (BTC) investors are withdrawing funds from exchanges for a price not seen since April 2021 with nearly $3 billion in Bitcoin withdrawn in the last 7 days.

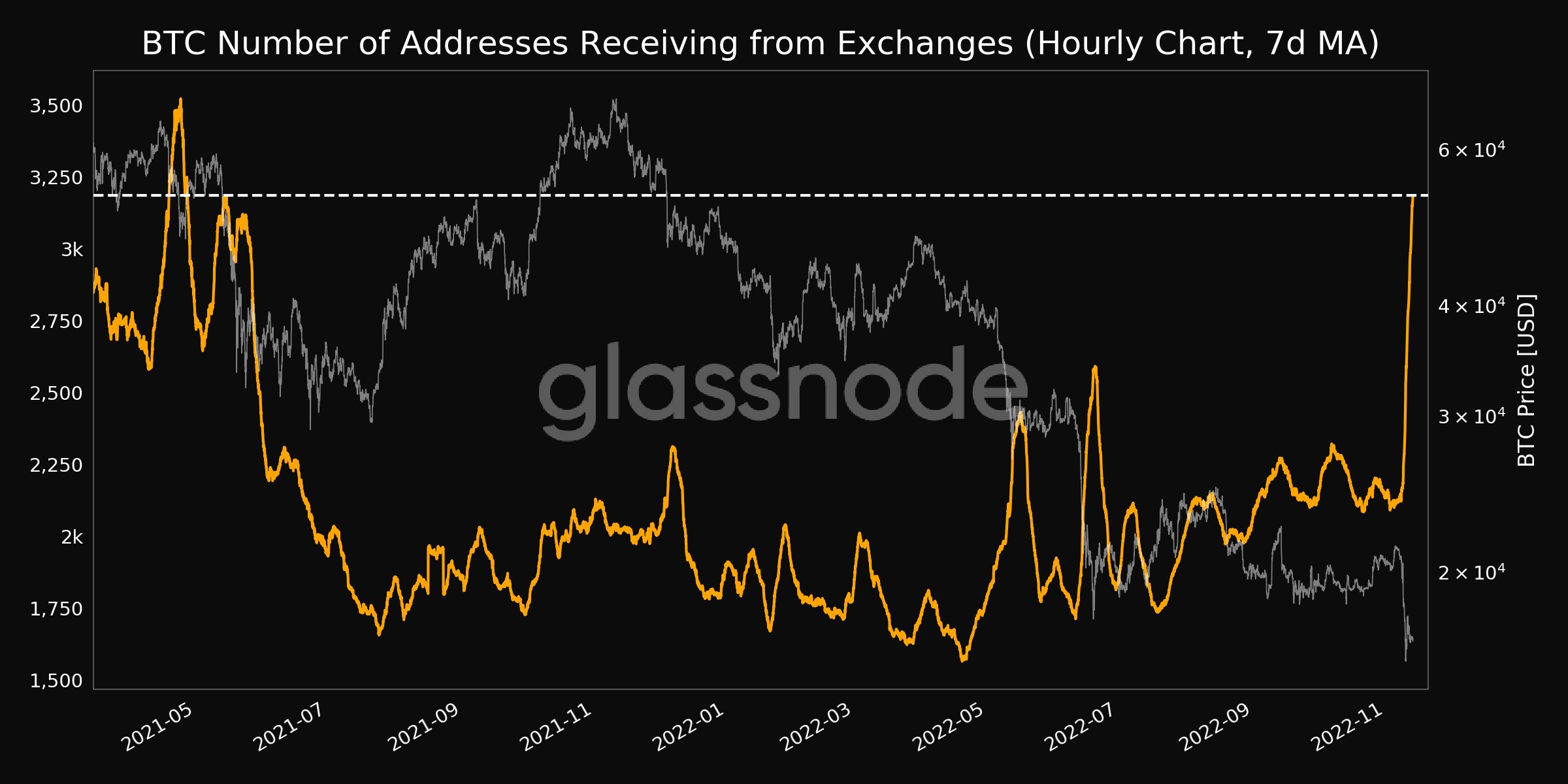

New data from on-chain analytics firm Glassnode shows the amount of wallets receiving BTC from exchange addresses hit almost 90,000 on November. 9.

Exchange users awaken to self-child custody

Among ongoing turmoil within the personal bankruptcy of major exchange FTX, concerns have increased among exchange users over security of funds.

Commentators have upped advice to prevent custodial wallets and seize control of cryptoassets, and regulators are growing scrutiny from the crypto industry en masse.

On-chain figures claim that a lot of hodlers have chosen non-custodial wallets in the last week.

The amount of withdrawing addresses saw an enormous spike on November. 9, this surpassing the daily highs for May and June this season when BTC cost action last saw significant downside pressure.

For November. 12, the most recent date that information is available, withdrawing addresses still totaled over 70,000.

Exactly the same Glassnode data gives per hour average well over 3,000 withdrawing addresses within the 7 days to November. 13.

Analysis: BTC reserves might not tell whole story

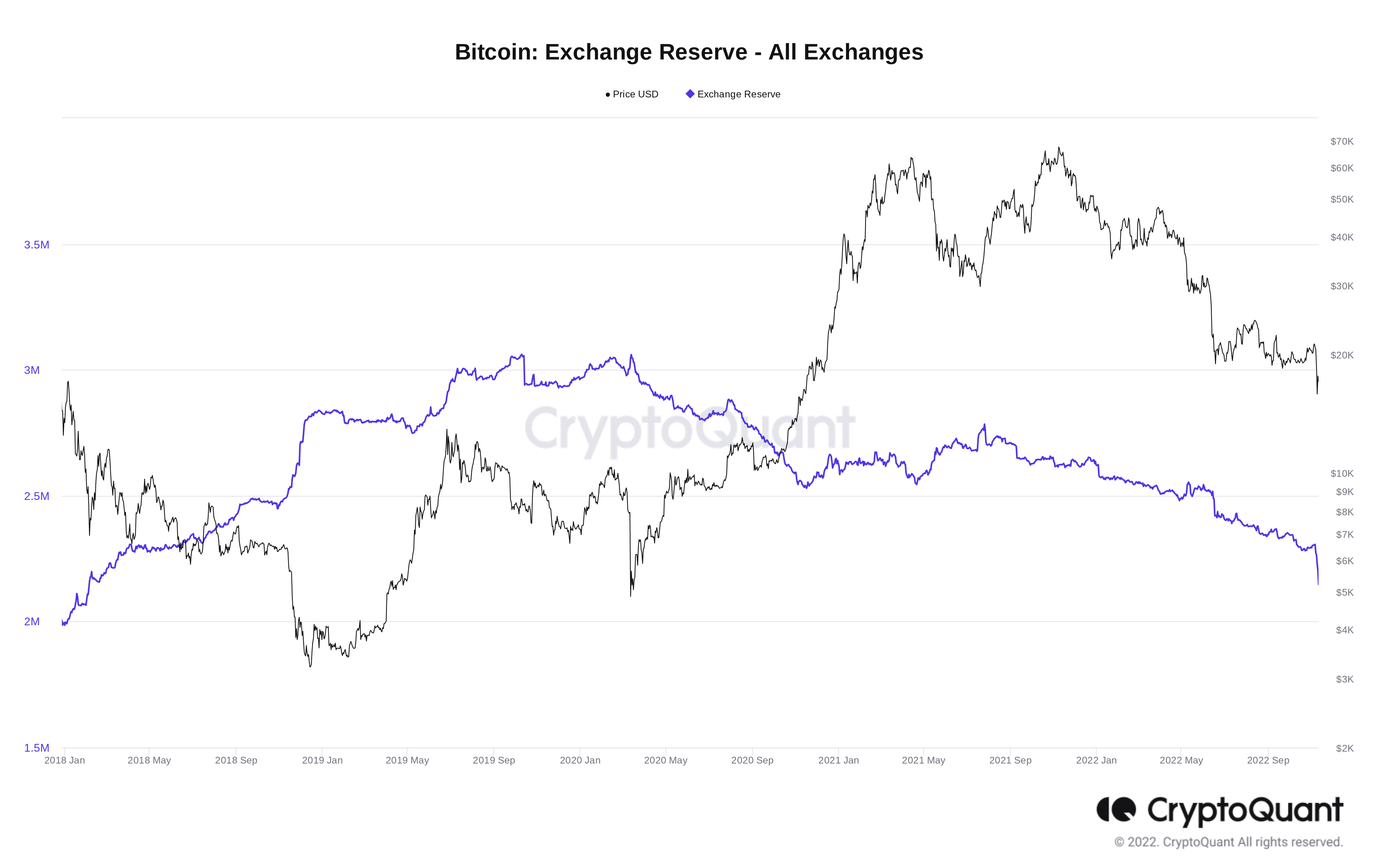

The figures match using what seems to become quickly-declining BTC reserves across major buying and selling platforms.

Related: Bitcoin will shrug off FTX ‘black swan’ much like Mt. Gox — analysis

As the velocity from the drop shows that the real balance tally might be hard to confirm at the moment, data from fellow on-chain analytics resource CryptoQuant puts overall exchange reserves in their cheapest since Feb 2018.

CryptoQuant tracks as many as 38 exchanges, including individuals with reported financial problems for example FTX and Kucoin.

Another chart, this time around from Coinglass, recommended 177,000 BTC in weekly withdrawals through November. 13 — a U.S. dollar worth of around $3 billion at today’s cost.

Glassnode senior analyst Checkmate nevertheless flagged three exchanges particularly using what he known as “particularly weird” Bitcoin balance readouts — Huobi, Gate.io and Crypto.com.

Concluding a dedicated thread in to the subject, he noted that “Exchange balances would be best estimate according to wallet clustering. They are more inclined to be considered a lower bound than an overestimate.”

“These fund flows between exchanges include both real customers + FTX/Alameda. Difficult to separate, thus searching as relative-to-balance,” he added.

Forecasting the way the current scenario may engage in, Michaël van de Poppe, founder and Chief executive officer of buying and selling firm Eight, meanwhile stated the worst was likely not over.

“Probably we’ll convey more difficulties with exchanges coming days, but most likely also a lot of gossip,” he told Twitter supporters in the weekend.

“Stay safe, stay calm out on another make emotional decisions. We’re in terrible territories, but crypto will emerge from this more powerful.”

BTC/USD was buying and selling around $16,500 during the time of writing, data from Cointelegraph Markets Pro and TradingView demonstrated.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.