Bitcoin (BTC) cost rallied toward $24,200 on This summer 28 following a near-10.5% surge that started each day earlier.

Increases made an appearance after Fed Chairman Jerome Powell signaled intentions to slow lower the Fed’s prevailing tightening spree. This motivated some Bitcoin analysts to calculate short-term upside continuation, with pseudonymous analyst CryptoHamster seeing BTC at $26,000 next.

It appears the downside breakout would be a false one, and also the bullish flag continues to be validated. Let us observe how fast $BTC can achieve individuals targets. #bitcoin $BTCUSD $ETH $ETHUSD #ビットコイン #биткойн #比特币 https://t.co/v6x4Ka23L7 pic.twitter.com/nKoEV8440X

— CryptoHamster (@CryptoHamsterIO) This summer 28, 2022

But BTC’s possibility to recover entirely from the ongoing bearish slumber seems low not less than three key reasons.

Bitcoin bulls happen to be duped before

Bitcoin established its record a lot of $69,000 in November 2022. Since that time, the cryptocurrency has declined by greater than 60% while undergoing several small pumps coming lower.

Around the daily chart, Bitcoin has rebounded a minimum of five occasions since November 2021, securing 23%-to-40% gains on every recovery. Nevertheless, it’s ongoing its correction each time after developing a nearby cost top around its exponential moving averages (EMA) after which falling to new yearly lows.

This time around looks exactly the same, with Bitcoin facing a bullish rejection in June and recovering nearly 17% per month later. Notably, BTC cost faces interim resistance in the 50-day EMA (the red wave) around $23,150, having a breakout clearing its way toward $27,000, coinciding using the 100-day EMA (black).

At $27,000, the cost would still form a lesser high when compared to previous local tops. So, that technically raises the potential of another bearish continuation move.

High selling, low buying volume

Interestingly, the amount behavior throughout the ongoing Bitcoin correction shows a larger curiosity about selling the gold coin at local tops.

The daily chart below illustrates this by highlighting the amount readings during downtrends and uptrends since November 2021. For example, the final two big cost declines in May and June coincided having a sharp rise in selling volumes.

Compared, the follow-up rebounds to individuals cost declines supported modest to reduce buying and selling volumes. The continuing volume behavior looks exactly the same, peaking throughout the downtrend and shedding because the cost recovers.

This means a weakening upside momentum, which can lead to another cost correction.

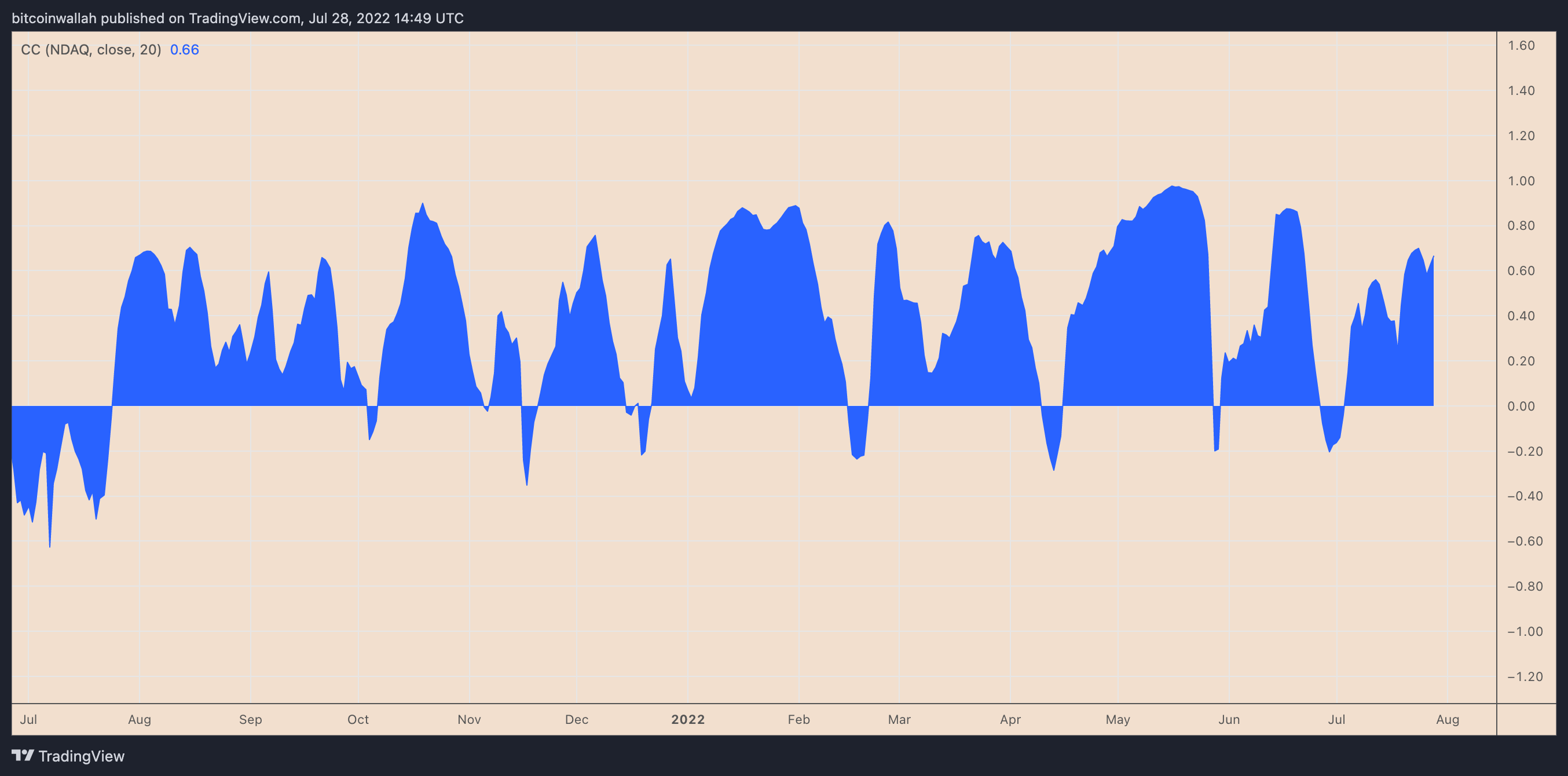

BTC to equities correlation flips to positive

Bitcoin is once more tailing stock exchange trends despite briefly decoupling from their store at the begining of This summer.

For example, on This summer 28, your day-to-day correlation coefficient between Bitcoin and also the tech-heavy Nasdaq Composite was near .66. Which includes declines both in markets following the U.S. gdp (GDP) plunged for another consecutive quarter.

That formally confirms the U.S. has joined a “technical recession,” that could weigh negatively on the stock exchange. Therefore, Bitcoin’s downside prospects appear high if it is positive correlation with the stock exchange continues.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.