Bitcoin (BTC) along with other riskier assets tucked on March. 21 as traders scrutinized macro indicators that suggest the Fed would still hike rates. Nevertheless, the BTC/USD pair remains rangebound within the $18,000–$20,000 cost range, showing a powerful bias conflict on the market.

BTC cost holding above $18K since June

Particularly, BTC’s cost continues to be not able to dive much deeper below $18,000 because it first tested the support level in June 2022. Consequently, some analysts believe the cryptocurrency is bottoming out, trained with has remedied by over 70% from the record a lot of $69,000, established several months ago.

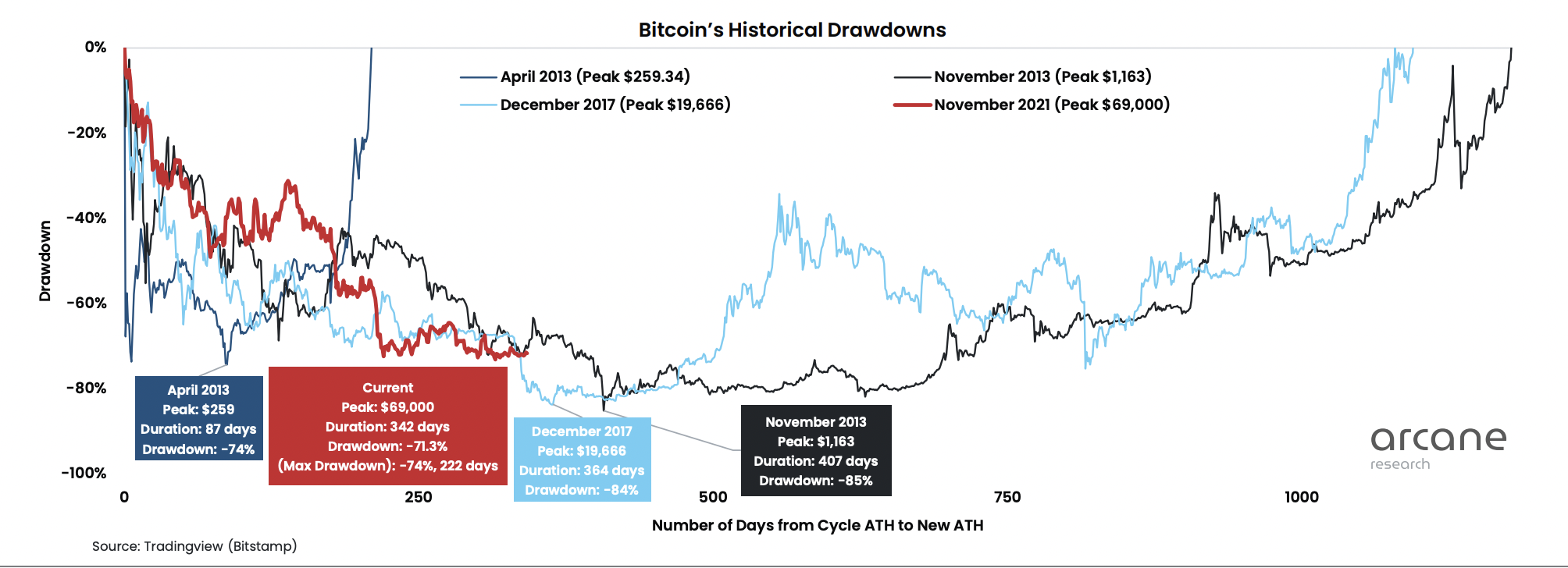

“Throughout the 2018 bear market, BTC saw a max drawdown from peak to trough of 84%, lasting 364 days, as the 2014 cycle lasted longer, bottoming after 407 days,” noted Arcane Research in the weekly crypto market report, adding:

“Both bottoms were adopted by abnormally low volatility.”

Additionally, a flurry of broadly-viewed on-chain Bitcoin indicators also shows a possible bullish reversal ahead. Let us take a look at probably the most in the past significant metrics.

Bitcoin MVRV-Z Score

The MVRV-Z Score assesses Bitcoin’s overbought and oversold statuses according to its market and fair value.

In the past, when Bitcoin’s market price crosses the fair value, it signifies an industry top (the red zone). Conversely, it signifies an industry bottom (the eco-friendly zone) once the market price crosses underneath the fair value.

The MVRV-Z Score has developed in the eco-friendly zone since late June, suggesting Bitcoin is bottoming out.

Reserve Risk

Bitcoin’s Reserve Risk assesses the arrogance from the token’s lengthy-term holders in accordance with its cost in the time. In the past, a greater Reserve Risk (the red zone) has coincided with market tops, reflecting lower investment confidence at record-high Bitcoin prices.

On the other hand, greater confidence along with a lower Bitcoin cost mean a lesser Reserve Risk (the eco-friendly zone), or better risk/reward for investing.

Bitcoin’s Reserve Risk stepped in to the eco-friendly focus late June, suggesting that BTC may undergo a powerful bullish reversal eventually.

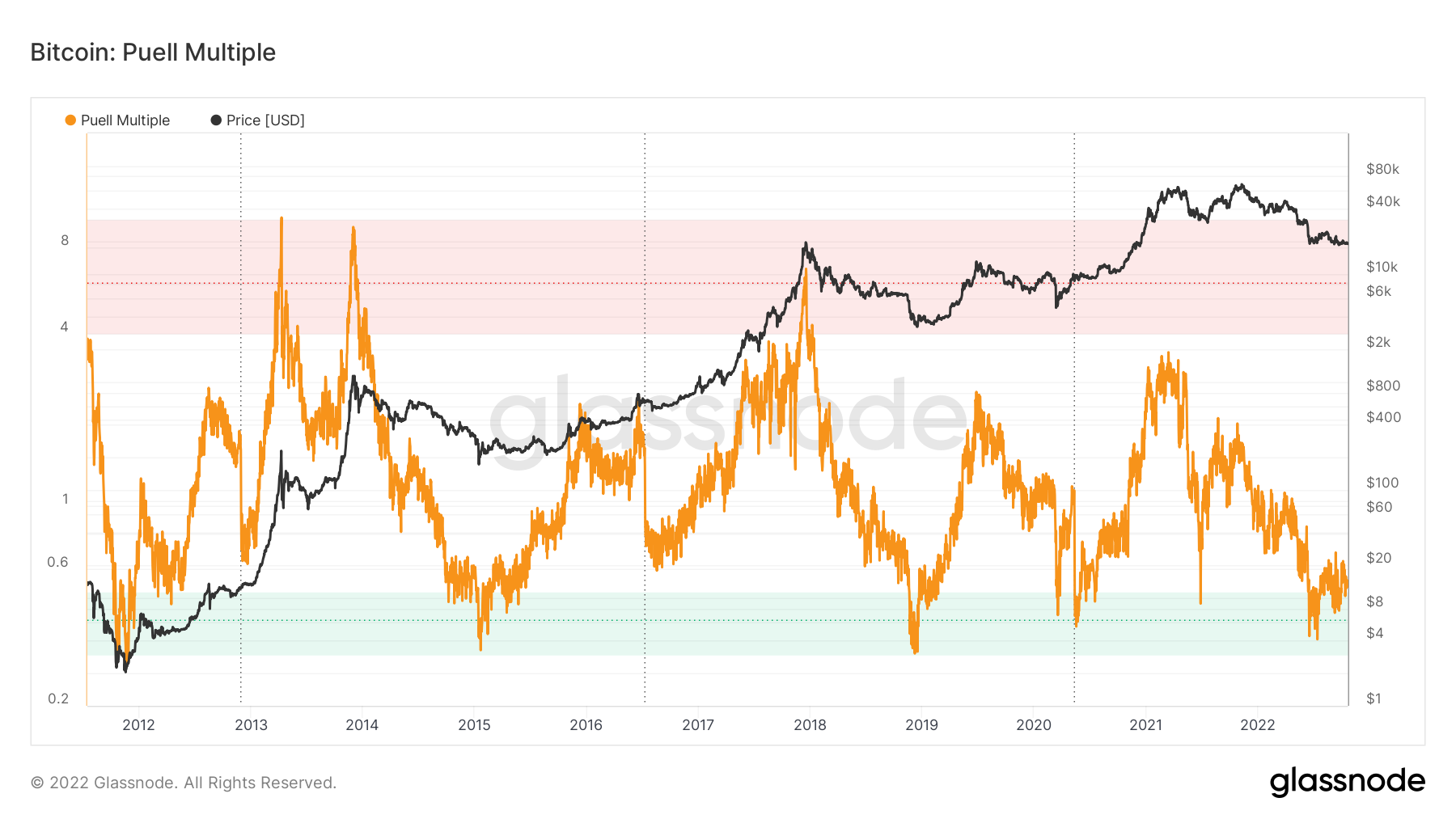

Bitcoin Puell Multiple

The Puell Multiple reflects the number of the daily Bitcoin issuance (in U.S. dollars) and also the 365-day moving average of daily issuance value.

Related: Bitcoin bear market can last ‘2-3 several weeks max’ — Interview with BTC analyst Philip Quick

Historic data shows the Bitcoin market bottoming out once the Puell Multiple drops in to the eco-friendly zone based on the .3–0.5 range. On the other hand, the marketplace peaks out once the ratio crosses in to the 4–8 red zone.

By October, Bitcoin’s Puell Multiple is within the eco-friendly zone, suggesting a possible cost reversal ahead towards the upside.

As Cointelegraph reported, the BTC balance on cryptocurrency exchanges has additionally fallen to multi-year lows in the fastest pace since June, suggesting that current cost levels have become an essential section of accumulation.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.