Buying low and selling high is simpler stated than can be done, particularly when emotion and volatile financial markets are tossed in to the mix. In the past speaking, the very best deals should be found when there’s “blood around the roads,” but the possibility of catching a falling knife usually keeps most investors grown around the sidelines.

The month of May continues to be especially challenging for crypto holders because Bitcoin (BTC) dropped to some low of $26,782, and a few analysts are actually predicting a sub-$20,000 BTC cost soon. It’s occasions such as these when fear is running rampant the contrarian investor looks to determine positions in promising assets prior to the broader market involves its senses.

Here’s a glance at several indicators that contrarian-minded investors may use to place opportune moments for opening positions in front of the next marketwide rally.

The Crypto Fear & Avarice Index

The Crypto Fear & Avarice index is really a well-known way of measuring market sentiment that many investors use to crowd-forecast the long run from the market. If viewed purely at face value, an “extreme fear” studying, like the current sentiment, is supposed to signal to avoid the market and preserve capital.

The index can really be utilized for an industry indicator, a place noted by analysts in the cryptocurrency intelligence firm Jarvis Labs.

Among the greatest factors that will help the index rise is a rise in cost. Jarvis Labs backtested the thought of buying once the index falls below a particular threshold after which selling if this reaches an established high.

With this test, a catalog score of 10 was selected for that low threshold, while lots of 35, 50 and 65 were selected as sell points.

If this method was backtested, results demonstrated the shorter time-frame choice of selling when the index surpassed 35, as symbolized through the yellow line within the chart above, provided the greatest results. This process provided a yearly average return of 14.6% along with a cumulative return of 133.4%.

On May 10, the index hit 10 and ongoing to join up a score of 10 or below on six from the 17 days that adopted, using the cheapest score of 8 happening on May 17.

While it’s possible the marketplace will still mind lower soon, history signifies that both cost and also the index will ultimately go above their current levels, presenting a possible investment chance for contrarian traders.

Whale wallet accumulation

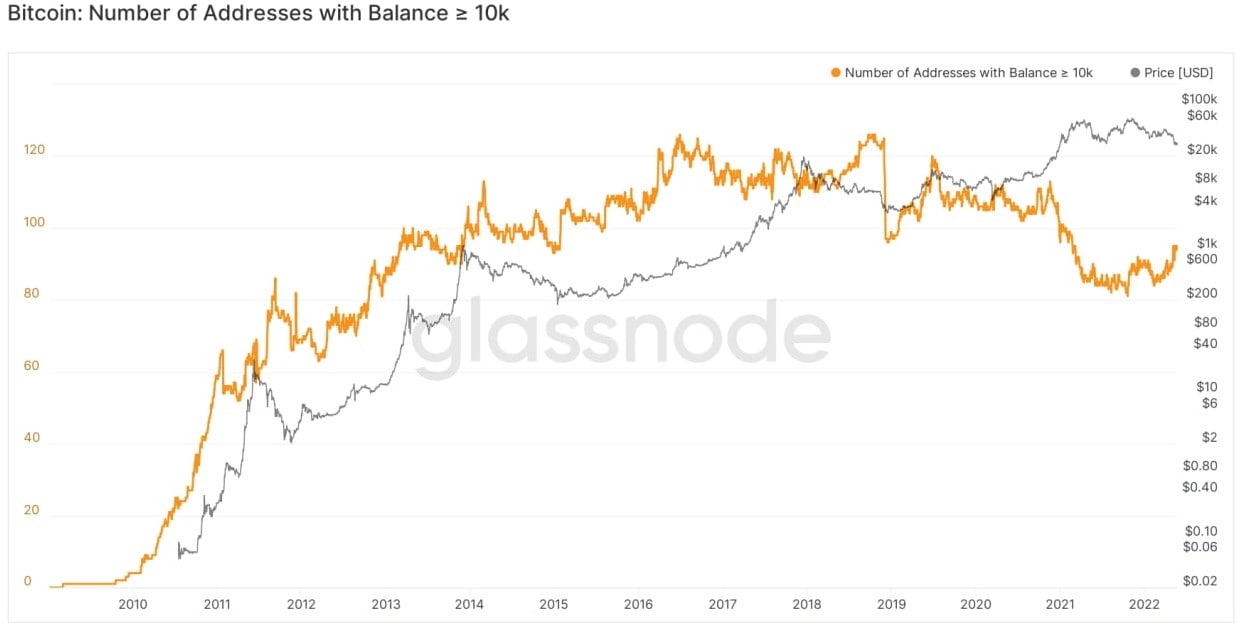

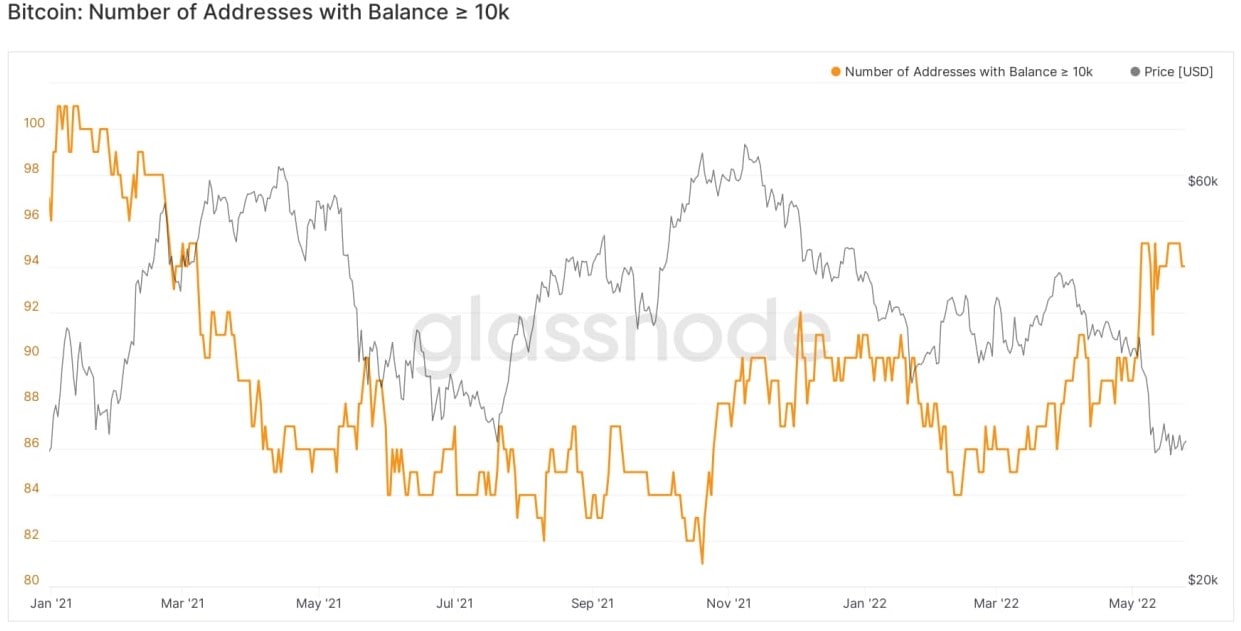

Following Bitcoin whale wallets having a balance of 10,000 BTC or even more is yet another indicator that signals when purchasing possibilities arise.

A detailed consider the past three several weeks implies that as the market continues to be selling off, the amount of wallets holding a minimum of 10,000 BTC continues to be climbing.

The amount of whale wallets of the dimensions are now at its greatest level since Feb 2021, when Bitcoin was buying and selling above $57,000, which wallets were selling into strength close to the market top.

Even though many analysts on Crypto Twitter are with another 30-plus percent stop by the cost of BTC, whale wallets are betting on the positive future.

Related: three reasons why Bitcoin is regaining its crypto market dominance

Some traders buy when Bitcoin cost drops below your buck of production

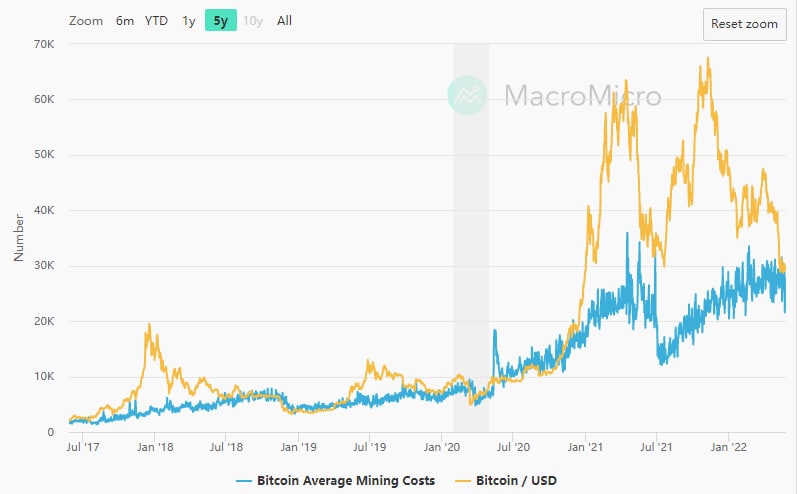

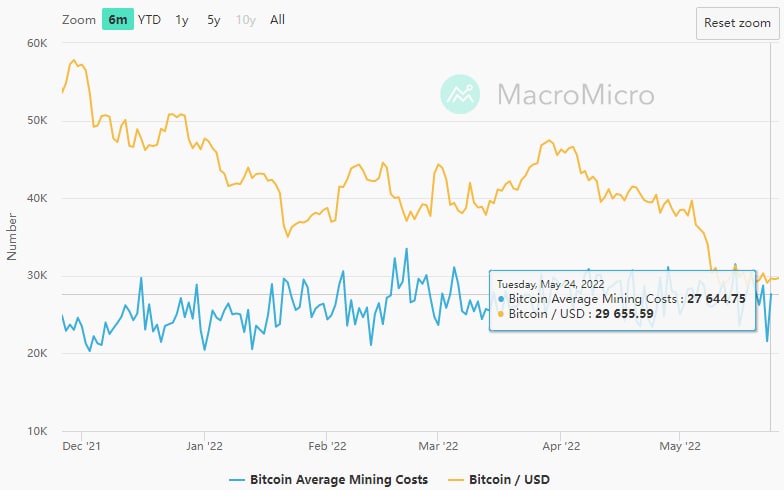

Another metric that may provide understanding of where and when to purchase is Bitcoin’s average mining cost, that is how much money it is a miner to mine 1 BTC.

As seen around the chart above, the cost of Bitcoin has traded at or over the price of production for most time since 2017, indicating the metric is a great indicator of when generational purchasing possibilities arise.

A closer inspection in the current studying implies that the typical mining cost sits at $27,644, around $2,000 below where BTC is buying and selling during the time of writing.

Further analysis implies that in past instances in which the market cost of BTC fell underneath the average mining cost, it tended to remain within 10% from the cost to mine and usually were able to get back parity within a few several weeks.

Bitcoin mining difficulty also lately hit a brand new all-time high, and also the market is constantly on the see an upward trend as increasing numbers of industrial-sized mining operations come online. What this means is it’s unlikely the average cost to mine will discover a significant decline in the near future.

Taken altogether, the present cost to mine compared to the marketplace cost of BTC presents an engaging situation for that contrarian investor the prevalent fear dominating the marketplace presents an chance to become greedy when other medication is fearful.

Want more details about buying and selling and purchasing crypto markets?

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.