Bitcoin (BTC) might be while bottoming after gaining 25%, according to several market signals.

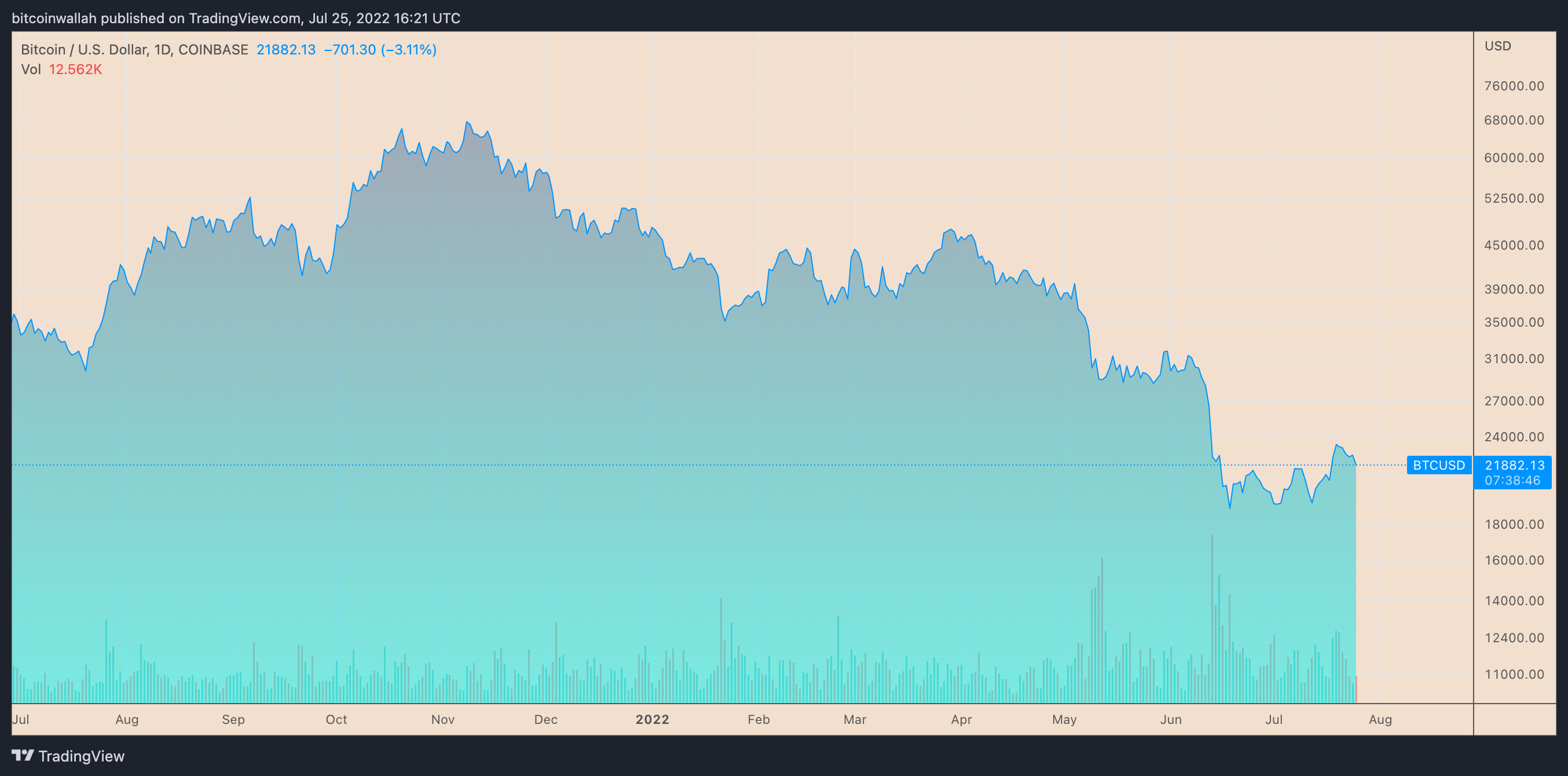

BTC’s cost has rallied roughly 25% after shedding close to $17,500 on June 18. The upside retrace came following a 75% correction when measured from the November 2021 a lot of $69,000.

The recovery appears modest, however, and carries bearish continuation risks because of prevailing macroeconomic headwinds (rate hike, inflation, etc.) and also the collapse of numerous high-profile crypto firms such as Three Arrows Capital, Terra yet others.

However, many broadly-tracked indicators paint another scenario, suggesting that Bitcoin’s downside prospects from current cost levels are minimal.

That big “oversold” bounce

The very first manifestation of Bitcoin’s macro bottom originates from its weekly relative strength index (RSI).

Particularly, BTC’s weekly RSI grew to become “oversold” after shedding below 30 within the week of June 13. That’s the very first time the RSI has tucked in to the oversold region since December 2018. Interestingly, Bitcoin had ended its bear market rally within the same month and rallied over 340% within the next six several weeks to $14,000.

In another instance, Bitcoin’s weekly RSI dropped toward 30 (otherwise below) within the week beginning March 9. Which coincided with BTC’s cost bottoming below $4,000 and after that rallying to $69,000 by November 2021, as proven below.

Bitcoin cost has rebounded similarly since June 18, opening the doorway to potentially repeat its good reputation for parabolic rallies after an “oversold” RSI signal.

Bitcoin NUPL jumps above zero

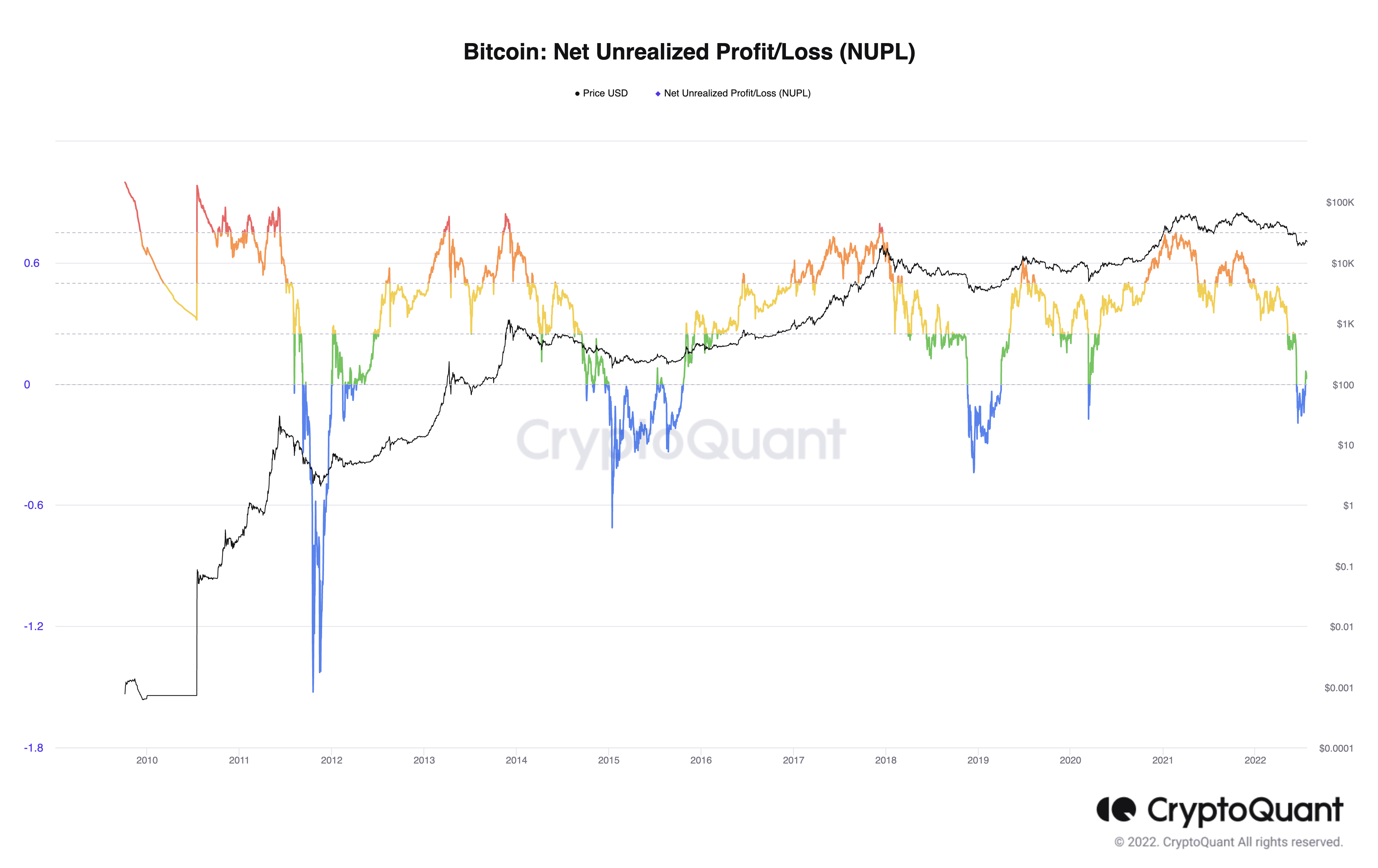

Another manifestation of a possible Bitcoin macro bottom originates from its internet unrealized profit and loss (NUPL) indicator.

NUPL is the main difference between market cap and recognized cap divided by market cap. It’s symbolized like a ratio, in which a studying above zero means investors have been in profit. The greater the amount, the greater investors have been in profit.

Related: Bitcoin must close above $21.9K to prevent fresh BTC cost crash — trader

On This summer 21, Bitcoin NUPL rose above zero once the cost wobbled around $22,000. In the past, this type of switch has adopted track of major BTC cost rallies. The chart below illustrates exactly the same.

Mining profitability

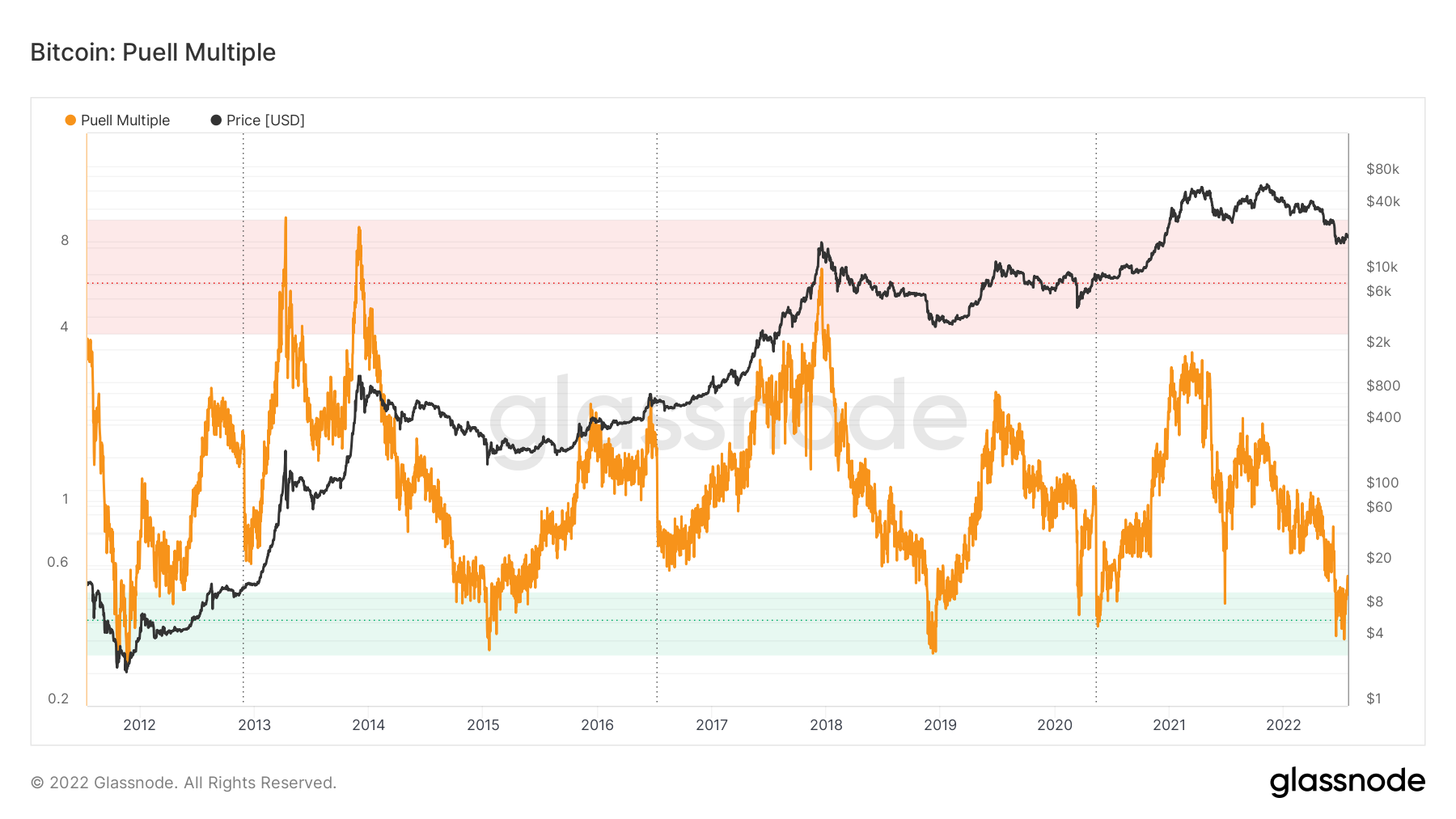

The 3rd manifestation of Bitcoin developing a macro bottom originates from another on-chain indicator known as the Puell Multiple.

The Puell Multiple examines mining profitability and it is impact of market prices. The indicator will it by measuring a ratio of daily gold coin issuance (in USD) and also the 365 moving average of daily gold coin issuance (in USD).

A powerful Puell Multiple studying implies that mining profitability is high when compared to yearly average, suggesting miners would liquidate their Bitcoin treasury to maximise revenue. Consequently, a greater Puell Multiple is renowned for coinciding with macro tops.

On the other hand, a lesser Puell Multiple studying means the miners’ current profitability is underneath the yearly average.

Thus, rigs with break-even or below-zero revenue from mining Bitcoin will risk shutting lower, quitting share of the market to more competitive miners. The ousting of less strong miners in the Bitcoin network has in the past reduced selling pressure.

Interestingly, the Puelle Multiple studying by This summer 25 is incorporated in the eco-friendly box and other alike to levels observed throughout the March 2020 crash, 2018 and 2015 cost bottoms.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.