Bitcoin (BTC) continues to be consolidating within the $18,000-$20,000 cost range since mid-June, pausing a powerful bear market that started following the cost peaked at $69,000 in November 2021.

Many analysts have checked out Bitcoin’s sideways trend as an indication of a possible market bottom, drawing comparisons in the cryptocurrency’s previous bear markets that demonstrate similar cost behaviors preceding sharp, bullish reversals.

Here’re three strikingly similar trends that preceded past market bottoms.

2018 BTC cost sideways trend

The 2018’s Bitcoin bear market works as a major cue for any potential market bottom in 2022 if a person examines its eerily similar cost trends and indicators.

Among the key indicators is Bitcoin’s 200-week exponential moving average (200-week EMA nowhere wave within the chart below). In 2018 and 2022, Bitcoin joined a lengthy duration of sideways consolidation after closing below its 200-week EMA.

With the exception of 2018, Bitcoin’s sideways trend lasted for 19 days, using the cost reclaiming its 200-week EMA as support, adopted by moves toward roughly $14,000 in June 2019. In 2022, the sideways trend joined its 19th day on March. 28 but awaits a obvious breakout over the 200-week EMA near $26,000.

Furthermore, Bitcoin’s weekly relative strength index (RSI) shows a possible bottom formation. In 2018, the RSI’s drop into its oversold territory (below 30) was adopted through the BTC’s cost sideways trend and finally with a fully-fledged bullish reversal.

That’s midway much like Bitcoin’s RSI trend in 2022, trained with tucked below 30 in June and adopted track of Bitcoin’s sideways cost action between $18,000 and $20,000 levels. That may follow-up having a bullish reversal phase when the 2018 fractal is repeated.

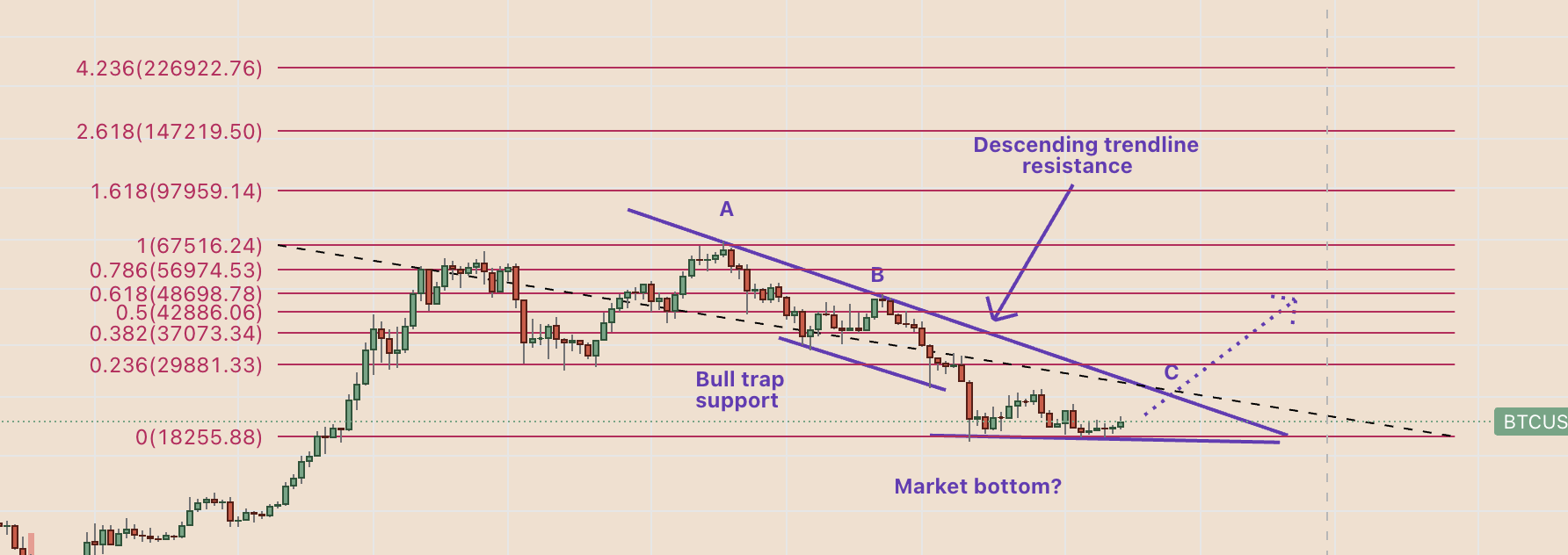

2013-15 bull trap support

Bitcoin’s 2022 bear market also shares similarities towards the cost trends observed in 2013-2015, comprising a climbing down trendline resistance, an inadequate bull trap support trendline, along with a horizontal support level.

BTC cost dropped 82% from the December 2013 surface of around $1,200.

By doing this, Bitcoin tried to close 3 times above its climbing down trendline resistance (marked having a, B, and C within the chart above). Concurrently, the cost came limited support from another climbing down trendline, leading to bull trap rallies.

Bitcoin eventually bottomed in a horizontal trendline support near $200, following up having a strong breakout over the climbing down trendline resistance, reaching the .236 Fib type of $429. By December 2017, its cost had arrived at nearly $20,000.

In 2022, Bitcoin’s cost has ticked all of the boxes regarding mirroring its 2013-15 bear market, aside from the breakout over the climbing down trendline resistance.

Thus, BTC/USD often see a rally toward $30,000, the .236 Fib line, at the begining of 2023 when the breakout occurs.

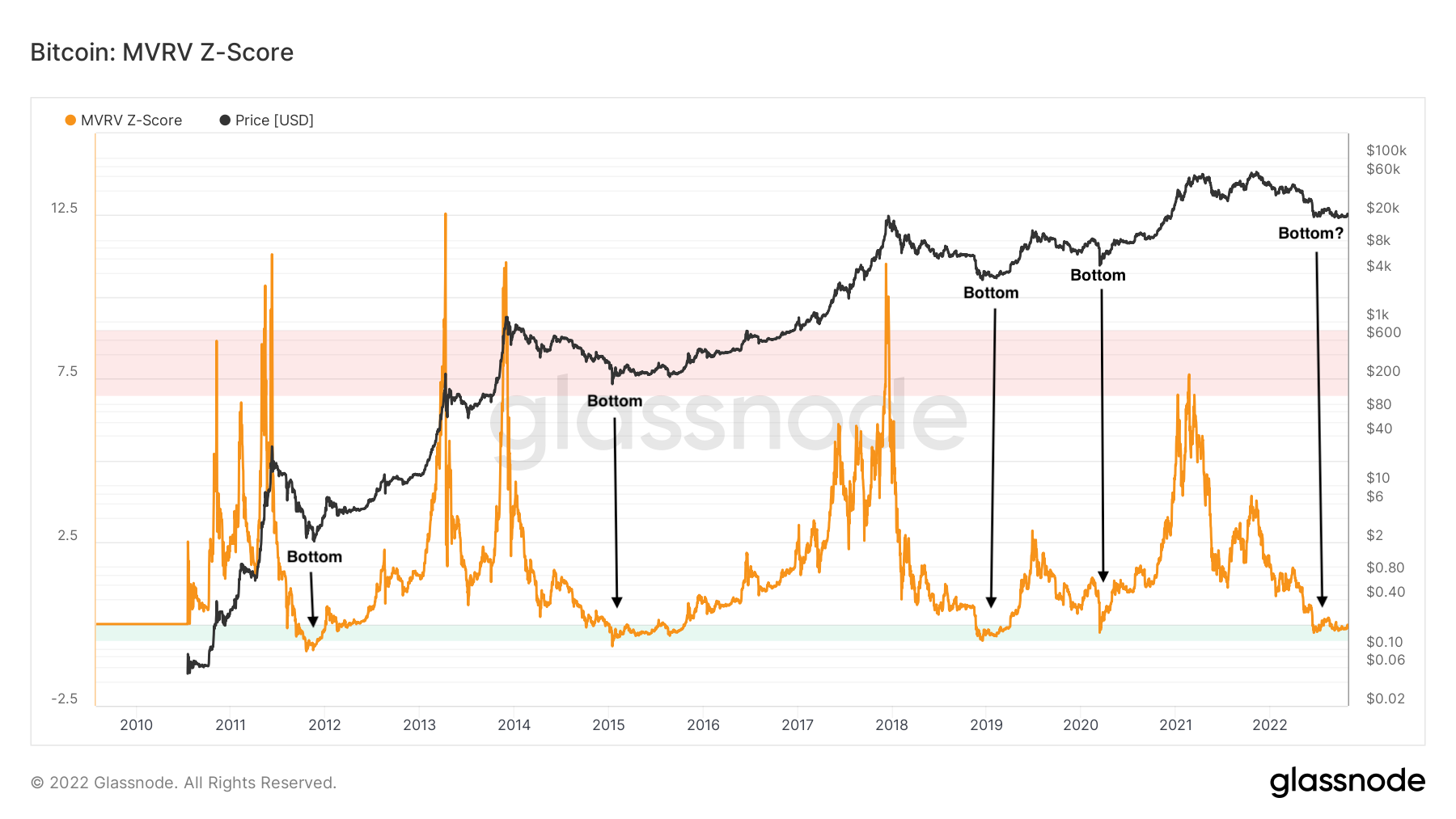

Bitcoin MVRV-Z score

From your on-chain analysis perspective, Bitcoin’s 2022 downtrend makes it as undervalued because it what food was in the finish of previous bear markets.

For example, Bitcoin’s Market Value-to-Recognized Value (MVRV) Z-score, which measures the coin’s over/undervalued in accordance with its “fair value,” has dropped in to the region which has coincided with previous bear market bottoms, as proven below.

The on-chain indicator increases Bitcoin’s possible ways to bottom within the $18,000-$20,000 region—in line using the two fractals discussed above.

Different this time around?

Unlike previous years, Bitcoin’s 2022 bear market happened mainly because of the Federal Reserve’s rate of interest hikes as a result of persistently greater inflation.

The U.S. central bank’s tightening measures removed excess cash in the economy, thus departing investors with little capital to take a position on risk-on assets. Consequently, Bitcoin fell alongside U.S. stocks having a strong correlation coefficient of .80 by March. 28.

Related: Bitcoin mirrors 2020 pre-breakout, but analysts at odds whether this time around differs

Formerly, the Bitcoin market retrieved days or several weeks after its correlation with U.S. stocks dropped below zero. The chart below shows four instances in the 2014-2016, 2017-2018, 2019-2020, and 2021.

Hence, Bitcoin carries perils of bearish continuation if it is correlation with U.S. stocks remains positive.

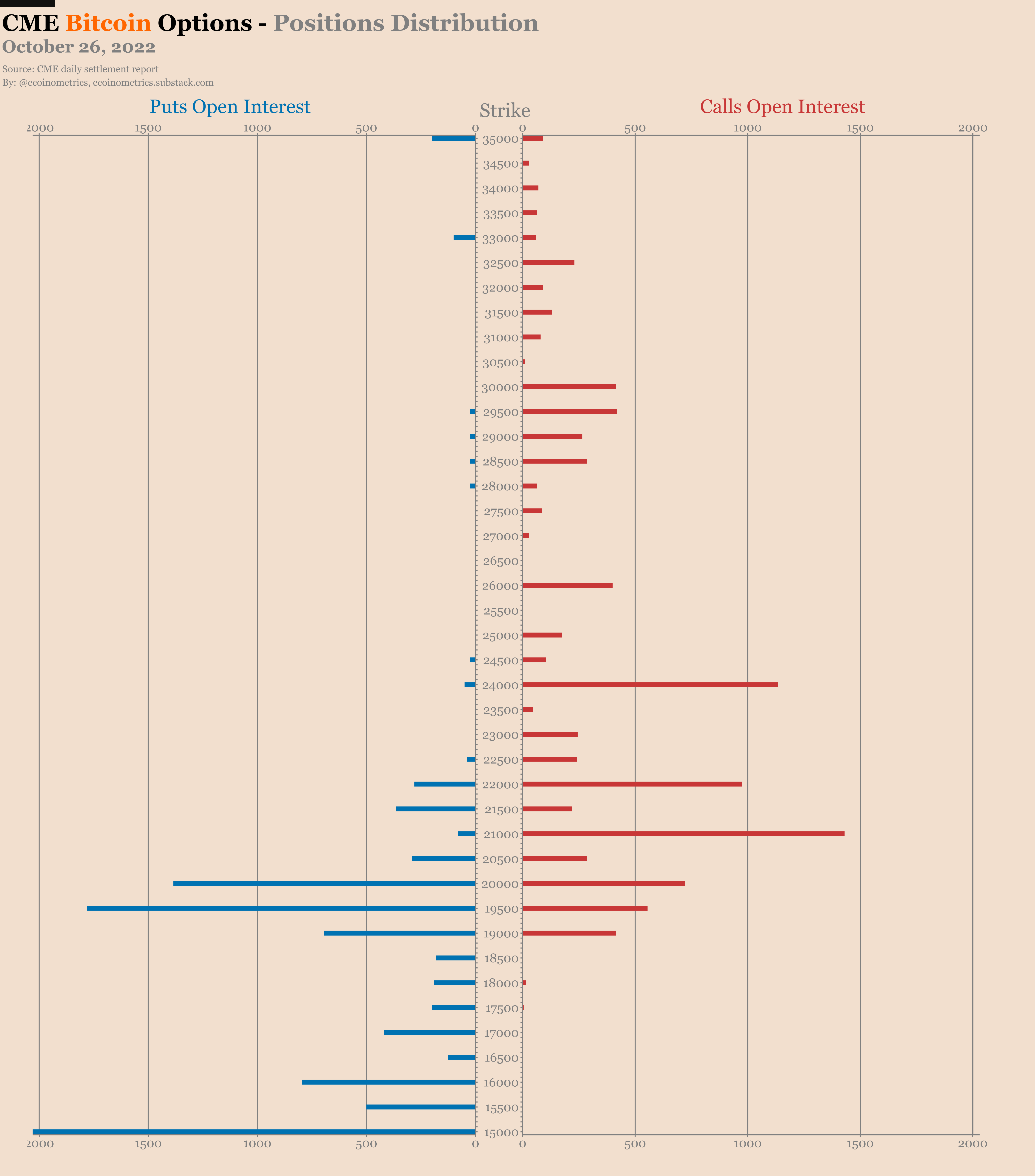

Meanwhile, over 2,000 CME Bitcoin options contracts expiring through the finish of the year show a internet bias toward put positions. Quite simply, traders happen to be anticipating more downside for BTC cost.

“Traders see the potential of Bitcoin sliding towards $10,000 to $15,000 but anything less than that’s given a minimal probability,” stated Nick, analysts at data resource Ecoinometircs.

As Cointelegraph reported, the $10,000-$14,000 area remains an market for any possible cost bottom if your breakdown is carried out in the present levels.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.