Bitcoin (BTC) continues to be posting greater lows within the last eight days, but during this period, BTC is not in a position to switch the $24,000 potential to deal with support on a minimum of three different possibilities. This really is the key reason why the $475 million Bitcoin options expiry on August. 12 may well be a game-changer for bulls.

Thinking about the present regulatory pressures in play, there appears to become a adequate rationale for staying away from bullish bets, especially following the U.S. Registration pressed charges against a former Coinbase manager for illegal securities buying and selling on This summer 21.

The extra impact in the Terra (Luna) — now renamed Terra Classic (LUNC) — ecosystem imploding and subsequent crypto investment capital firm Three Arrows Capital (3AC) subscribing to personal bankruptcy still weigh around the markets. The most recent victim is crypto lending platform Hodlnaut, which suspended user withdrawals on August. 8.

Because of this, most traders are holding back their bets above $24,000, but occasions outdoors from the crypto market may have also negatively impacted investors’ expectations. For instance, based on regulatory filings released on August. 9, Elon Musk offered $6.9 billion price of Tesla stock.

Furthermore, on August. 8, Ark Investment manager Chief executive officer Cathie Wood described the 1.41 million Coinbase (Gold coin) shares offered in This summer were brought on by regulatory uncertainty and it is potential effect on the crypto exchange’s business design.

Most bearish bets are below $23,000

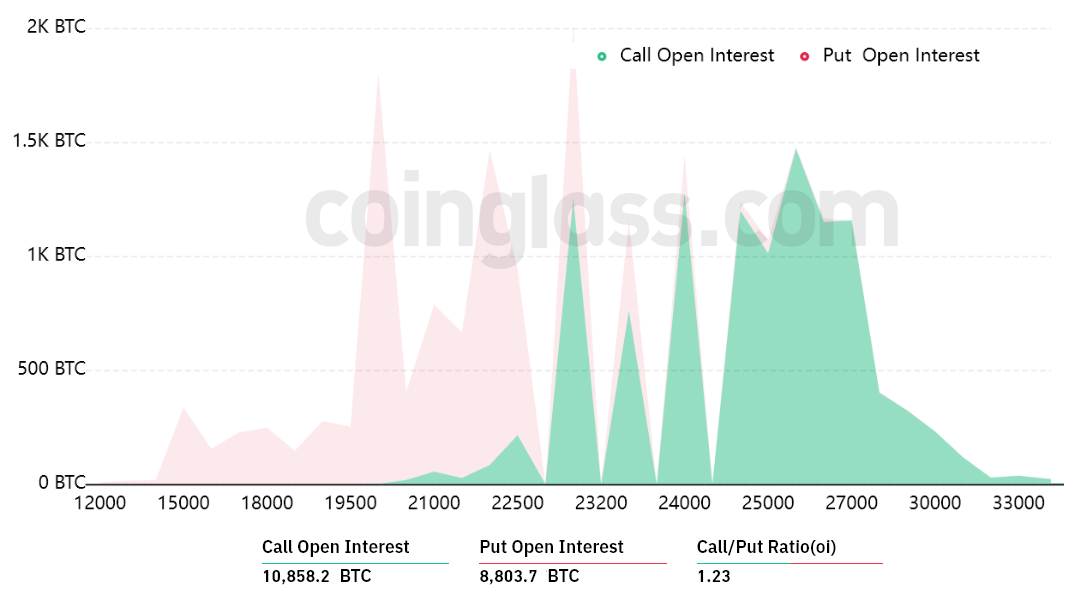

Bitcoin’s failure to interrupt below $21,000 on This summer 27 surprised bears since 8% from the put (sell) choices for August. 12 happen to be placed above $23,000. Thus, Bitcoin bulls be more effective positioned for that $475 million weekly options expiry.

A wider view while using 1.23 call-to-put ratio shows more bullish bets since the call (buy) open interest is $262 million from the $212 million put (sell) options. Nonetheless, as Bitcoin presently stands above $23,000, most bearish bets will probably become useless.

If Bitcoin’s cost remains above $23,000 at 8:00 am UTC on August. 12, only $16 million price of these put (sell) options is going to be available. This difference is really because there’s no use within the authority to sell Bitcoin at $23,000 whether it trades above that much cla on expiry.

Bulls could pocket a $150 million profit

Here are the 4 probably scenarios in line with the current cost action. The amount of options contracts on August. 12 for call (bull) and set (bear) instruments varies, with respect to the expiry cost. The imbalance favoring both sides constitutes the theoretical profit:

- Between $21,000 and $22,000: 70 calls versus. 4,200 puts. The internet result favors bears by $90 million.

- Between $22,000 and $24,000: 1,600 calls versus. 1,460 puts. The internet outcome is balanced between bulls and bears.

- Between $24,000 and $25,000: 3,700 calls versus. 120 puts. The internet result favors bulls by $90 million.

- Between $25,000 and $26,000: 5,900 calls versus. 30 puts. Bulls improve their gains to $150 million.

This crude estimate views the phone call options utilized in bullish bets and also the put options solely in neutral-to-bearish trades. Nevertheless, this oversimplification disregards more complicated investment opportunities.

Related: Bitcoin braces for all of us inflation data as CPI nerves halt BTC cost gains

Futures markets show bulls are less inclined to exhibit strength

Bitcoin bears have to pressure the cost below $24,000 on August. 12 to balance the scales and steer clear of a possible $150 million loss. However, Bitcoin bulls got $265 million price of leverage lengthy futures positions liquidated between August. 8 and 9, so that they are less inclined to push the cost greater for the short term.

With this stated, probably the most probable scenario for August. 12 may be the $22,000 to $24,000 range, supplying a well-balanced outcome between bulls and bears. Thinking about Bitcoin’s negative 50% performance year-to-date, a small $90 million win for bulls might be considered like a victory, however that will need sustaining BTC above $24,000.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.