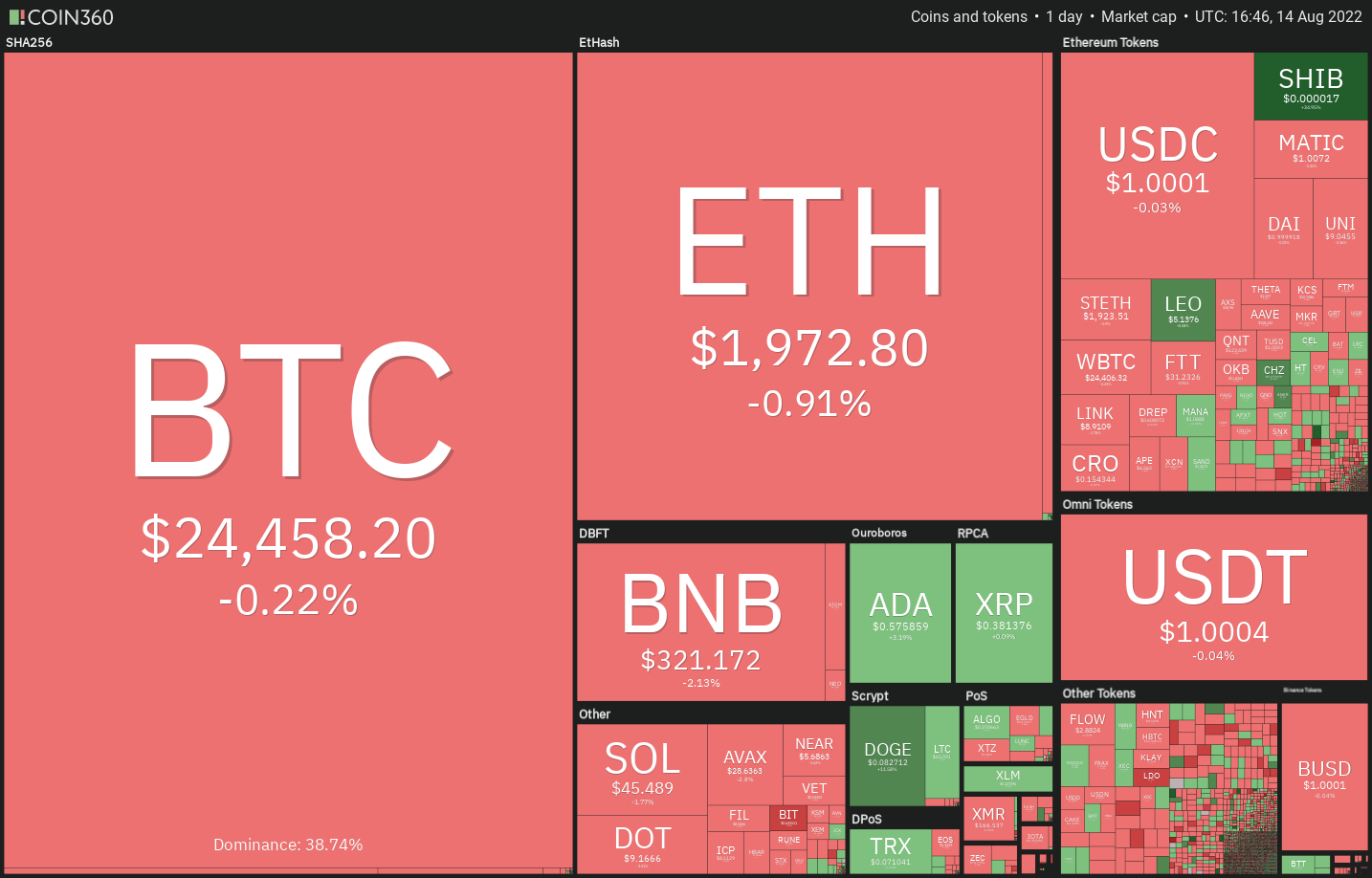

The S&P 500 rose for that 4th successive week as investors cheered on signs that inflation might have peaked. Bitcoin (BTC) and choose altcoins also extended their recovery, suggesting that investors are growing their contact with risk assets.

An identical trend has performed in the cryptocurrency markets. Altcoins, brought by Ether (ETH), have outperformed Bitcoin after clearness on Ethereum’s Merge, based on analysts at Glassnode.

However, buying and selling firm QCP Capital is careful concerning the momentum within the altcoin market. They highlighted the open interest on Ether options had surged to $8 billion, exceeding Bitcoin option OI that was at $5 billion. Glassnode recommended that traders happen to be booking profits around the spread between their place lengthy Ether in comparison to the quarterly short Ether futures positions.

Could Bitcoin and also the altcoins extend their recovery within the next couple of days? Let’s read the charts from the top-5 cryptocurrencies that could outshine soon.

BTC/USDT

Bitcoin rose over the overhead resistance of $24,668 on August. 13 and August. 14 however the bulls couldn’t sustain the greater levels. This signifies that bears can sell on rallies but repeated breach of the overhead resistance has a tendency to weaken it.

The progressively upsloping 20-day exponential moving average of $23,414 and also the relative strength index (RSI) within the positive territory indicate the road to least resistance would be to the upside. If bulls sustain the cost above $25,000, the momentum could get further and also the BTC/Tether (USDT) pair could rally to $28,000.

This level may behave as a stiff resistance but when bulls obvious this hurdle, the rally could include $32,000. The critical level to look at on however the 20-day EMA. A bounce off it’ll indicate the sentiment remains positive and traders are purchasing on dips.

On the other hand, when the cost turns lower in the current level and breaks underneath the 20-day EMA, it’ll claim that bears remain active at greater levels. The happy couple could then drop towards the 50-day simple moving average of $21,976.

The $24,668 level is witnessing a difficult fight between your bulls and also the bears. The upsloping moving averages indicate benefit to buyers however the negative divergence around the RSI suggests the momentum might be weakening.

When the cost breaks underneath the 20-EMA, it’ll signal a small benefit to the bears. The happy couple could then decline towards the 50-SMA and then to $23,600. Alternatively, when the cost appears in the 20-EMA and increases above $25,050, the up-move may resume.

ADA/USDT

Cardano (ADA) broke and closed over the overhead resistance at $.55 on August. 13. This signifies the uncertainty has resolved in support of the bulls.

The increasing 20-day EMA of $.52 and also the RSI within the positive territory indicate that bulls possess the upper hands. The ADA/USDT pair could rally to $.63 after which towards the strong overhead resistance at $.70. This level will probably attract strong selling through the bears.

Unlike this assumption, when the cost turns lower in the current level and breaks underneath the 20-day EMA, it’ll claim that the break above $.55 might have been a bull trap. The happy couple could then decline towards the 50-day SMA of $.49 and then to $.45.

The happy couple completed an climbing triangular pattern away and shut over the overhead resistance at $.55. This pressed the RSI around the 4-hour chart to overbought levels, who have enticed short-term traders to reserve profits.

The cost may drop towards the breakout degree of $.55. If bulls switch this level into support, the happy couple may continue its up-proceed to the pattern target at $.65. This positive view could invalidate soon when the cost plummets underneath the upward trend line.

UNI/USDT

Uniswap (UNI) continues to be consolidating between $8.11 and $9.83 within the last couple of days. This means the bulls are purchasing the dips however the bears are protecting the overhead resistance.

The more the cost remains within the range, the more powerful the breakout is going to be from this. The 20-day EMA of $8.54 is sloping up and also the RSI is incorporated in the positive territory, indicating a benefit to buyers. If bulls thrust the cost above $9.83, the UNI/USDT pair could get momentum and rally toward $10.55 and then to $12.

Alternatively, when the cost turns lower in the current level and breaks underneath the 20-day EMA, it’ll claim that the happy couple may continue its range-bound action for many additional time. The bears will need to sink and sustain the cost below $8.11 to achieve top of the hands.

Some-hour chart implies that the bears are protecting the zone between $9.50 and $9.83. When the cost breaks below $8.74, the sellers will endeavour to sink the happy couple towards the strong support at $8.11. The buyers are anticipated to purchase the dip for this level.

The flattening moving averages and also the RSI close to the midpoint claim that the number-bound action may go on for more time. The following trending move could start away above $9.83 or on the close below $8.11.

Related: Bitcoin hits $25K as bearish voices call BTC cost ‘double top’

LINK/USDT

Chainlink (LINK) continues to be buying and selling in a wide range between $5.50 and $9.50 within the last several days. The bulls tried to push the cost over the range on August. 12 however the bears held their ground.

The 20-day EMA of $8.00 is sloping up and also the RSI is incorporated in the positive territory, indicating that bulls possess the upper hands. When the cost rebounds from the 20-day EMA, the bulls can make yet another make an effort to obvious the overhead hurdle at $9.50. When they succeed, the hyperlinkOrUSDT pair could rally to $12.30 after which to $13.50.

Rather, when the cost breaks underneath the 20-day EMA, it’ll indicate that traders are booking profits close to the resistance. That may sink the happy couple towards the 50-day SMA of $7.00 while increasing the stay within the range for any couple of more days.

The cost switched lower in the overhead resistance at $9.50 and broke underneath the 20-EMA around the 4-hour chart. This means that traders might be booking profits. The happy couple could drop towards the 50-SMA, which might behave as a powerful support.

When the cost rebounds from the 50-SMA, the bulls will again attempt to push the happy couple above $9.50. When they succeed, the happy couple could start the following leg from the up-move. However, when the cost slips underneath the 50-SMA, the happy couple could decline to $8.29.

CHZ/USDT

Chiliz (CHZ) has been around a powerful recovery within the last couple of days however the lengthy wick around the August. 14 candlepower unit shows that bears are protecting the overhead resistance at $.19.

Even though the rising 20-day EMA of $.14 signifies a benefit to buyers, the RSI within the overbought territory suggests a small correction or consolidation for the short term. When the cost turns lower in the current level, the very first critical level to look at on however the 20-day EMA.

A powerful rebound off this level will claim that the bulls are viewing the dips like a buying chance. Which will enhance the prospects of the break over the overhead resistance. In the event that happens, the CHZ/USDT pair could rally to $.22 after which to $.24.

Alternatively, when the cost slips underneath the 20-day EMA, the happy couple could slide towards the 50-day SMA of $.12. This type of move will claim that the happy couple may form a variety soon.

The sharp rally within the pair pressed the RSI deep in to the overbought territory around the 4-hour chart, indicating that the correction or consolidation was possible. Exactly the same might have began and also the pair could decline towards the 20-EMA, which is a vital level to keep close track of.

When the cost rebounds from the 20-EMA, it’ll claim that the positive sentiment remains intact. The buyers will on the other hand attempt to resume the up-move. This bullish view is going to be negated soon when the cost breaks and sustains underneath the 50-SMA.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.