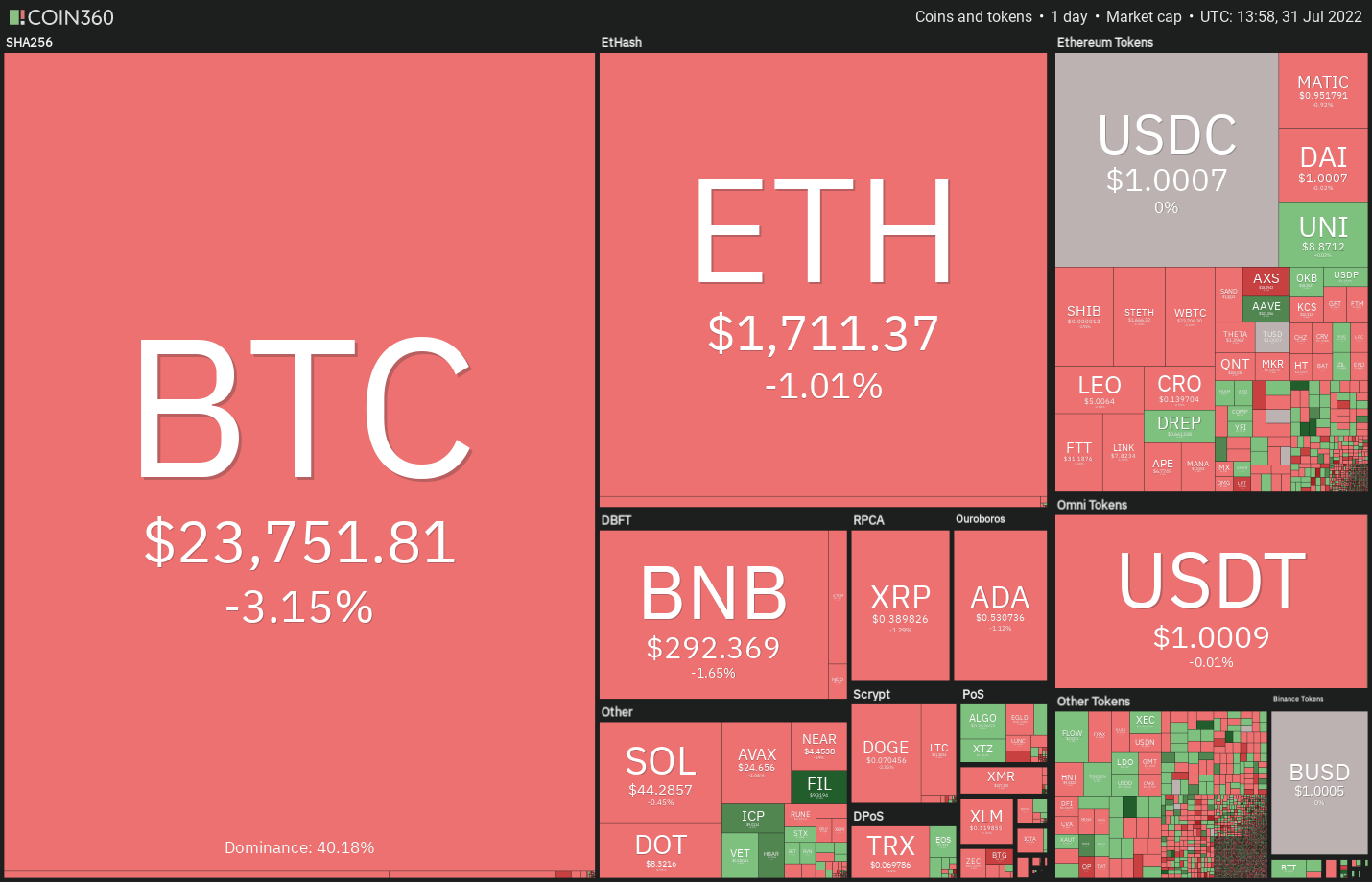

Bitcoin (BTC) makes a powerful comeback within the month of This summer and it is on the right track because of its best monthly gains since October 2021. The sharp recovery in Bitcoin and many altcoins pressed the Crypto Fear and Avarice Index to 42/100 on This summer 30, its greatest level since April 6.

Investors appear to become taking advantage of the depressed levels in Bitcoin. Data from on-chain analytics firm Glassnode implies that Bitcoin as a swap wallets has dropped to two.4 million Bitcoin in This summer, lower in the March 2020 amounts of 3.15 million Bitcoin. It has sent the metric to the cheapest level since This summer 2018.

Bloomberg Intelligence senior commodity strategist Mike McGlone highlighted the U . s . States Federal Reserve’s indication to think about rate hikes on the “meeting by meeting basis” may lay the research for Bitcoin to outshine most assets. He stated that Bitcoin’s “risk versus. reward tilted favorably for among the finest bull markets ever.”

Could Bitcoin extend its rally for the short term and may that trigger buying in select altcoins? Let’s read the charts from the top-5 cryptocurrencies that could outshine soon.

BTC/USDT

Attempts through the bulls to sustain the cost above $24,276 have unsuccessful previously 2 days, indicating the bears are protecting the amount with vigor. However, a small positive would be that the bulls haven’t ceded ground towards the bears.

This signifies the bulls aren’t booking profits in a rush because they expect a rest over the overhead resistance. When the cost breaks and closes above $24,276, the BTC/USDT pair could get momentum and rally toward $28,171. This level may behave as a resistance but when bulls overcome the barrier, the following stop might be $32,000.

The upsloping 20-day exponential moving average ($22,480) and also the relative strength index (RSI) within the positive territory indicate that bulls possess the upper hands.

To invalidate this bullish view for the short term, the bears will need to sink the cost underneath the 20-day EMA. That may obvious the road for any possible drop towards the 50-day simple moving average ($21,386) after which towards the support line. A rest below this level will claim that bears have returned in command.

Some-hour chart implies that bulls pressed the cost over the overhead resistance of $24,276 but tend to not build upon the breakout. The bears pulled the cost back underneath the level but they are battling to sink the happy couple underneath the 20-EMA. This signifies that bulls are purchasing on dips.

When the cost rebounds from the current level, the bulls may have another shot in the overhead zone between $24,276 and $24,668. If the zone is scaled, the bullish momentum could get further. On the other hand, if bears sink the cost underneath the 20-EMA, the happy couple could drop towards the 50-SMA.

BNB/USDT

Binance Gold coin (BNB) broke over the downtrend line on This summer 28, indicating a possible trend change. The up-move is facing resistance close to the mental degree of $300 however a positive sign would be that the buyers haven’t quit much ground. This means the bulls aren’t hastening to reserve profits.

The upsloping 20-day EMA ($263) and also the RSI within the positive territory indicate the road to least resistance would be to the upside. If buyers drive the cost above $300, the BNB/USDT pair could resume its upward trend toward the overhead resistance at $350.

Alternatively, when the cost turns lower and breaks below $285, the happy couple could drop towards the downtrend line. The 20-day EMA is positioned near to this level, hence it is really an important support to keep close track of. If bears sink the cost underneath the 20-day EMA, the happy couple could decline towards the 50-day SMA ($239).

The happy couple switched lower in the overhead resistance at $300 however the bulls are trying to defend the 20-EMA. This signifies buying on dips. The bulls may again make an effort to push the cost above $300. When they manage to achieve that, the upward trend could resume. The happy couple could rise to $311 after which to $322.

This positive view could invalidate for the short term when the cost turns lower and breaks underneath the 20-EMA. In the event that happens, the happy couple could slide towards the 50-SMA. The buyers are anticipated to protect this level strongly just because a break and shut below it might open the doorways for any decline to $239.

UNI/USDT

Uniswap (UNI) rebounded from the breakout degree of $6.08 on This summer 26, indicating strong buying on dips. The up-move arrived at close to the mental resistance at $10 on This summer 28 in which the bears are mounting a powerful defense.

The upsloping moving averages and also the RSI within the positive territory indicate benefit to buyers. When the cost rebounds off $8.11, it’ll claim that buyers are attempting to switch this level into support.

A powerful rebound off $8.11 could open the doorways for any retest at $10. The bulls will need to obvious this overhead hurdle to point the beginning of the following leg from the up-proceed to $12.

On the other hand, when the cost turns lower and breaks below $8.11, the UNI/USDT pair could drop towards the 20-day EMA ($7.48). A rest and shut below this level will claim that the bullish momentum has weakened.

Some-hour chart implies that the bulls are trying to defend the 20-EMA. When the cost appears in the current level and increases above $9.18, the happy couple could challenge the overhead resistance zone between $9.83 and $10.

Alternatively, when the cost breaks underneath the 20-EMA, it’ll claim that supply exceeds demand. The happy couple could then drop towards the zone between $8.11 and also the 50-SMA. It is really an important zone for that bulls to protect if they fail to achieve that, rapid-term momentum could tilt in support of the bears.

Related: Hong Kong college to inaugurate mixed reality classroom in Metaverse

FIL/USDT

After remaining inside a tight range for a few days, Filecoin (FIL) started dramatically on This summer 30, signaling a possible trend change. The RSI has risen in to the overbought territory that is another sign the downtrend might be ending.

The up-move may face resistance in the overhead resistance at $9.50 but when bulls tendency to slack much ground out of this level, the probability of an outbreak increases. In the event that happens, the FIL/USDT pair could start its northward march toward $16, which might again behave as a powerful resistance.

When the cost turns lower in the current level and breaks back below $6.55, it’ll claim that bears are active at greater levels. The happy couple may after that oscillate in a wide range between $5 and $9.50 for any couple of days.

The happy couple selected up momentum after breaking above $6.40. The bears attempted to stall the up-move at $8.89 however the bulls had other plans. They strongly bought the dip and also have pressed the cost close to the stiff overhead resistance at $9.50.

When the cost turns lower in the current level, the bulls will endeavour to arrest the pullback in the 38.2% Fibonacci retracement degree of $8.04. A powerful bounce off this level will raise the chance of a rest above $9.50. In the event that happens, the happy couple could rally to $10.82. This bullish view could invalidate below $7.70.

THETA/USDT

Theta Network (THETA) continues to be consolidating between $1 and $1.55 within the last a few days. The bulls attempted to push the cost over the overhead resistance on This summer 30 however the bears held their ground.

When the cost rebounds from the moving averages, the bulls can make another make an effort to obvious the overhead hurdle at $1.55. When they succeed, the THETA/USDT pair could begin a new upward trend. The rally could first achieve the pattern target of $2.10 and when this level is entered, the rally may include $2.60.

Unlike this assumption, when the cost breaks underneath the moving averages, the bears will attempt to drag the happy couple to $1. This type of move could indicate the range-bound action may go on for a couple of more days.

Some-hour chart implies that the happy couple switched lower from $1.50 and it is battling to rebound from the 20-EMA. This signifies that traders might be booking profits on every minor rise.

When the cost sustains underneath the 20-EMA, the happy couple could drop towards the 50-SMA. It is really an important level for that bulls to protect just because a break below it might sink the happy couple to $1.15.

Alternatively, when the cost rebounds from the moving averages with strength, it’ll claim that ‘abnormal’ amounts are attracting buyers. If bulls push the cost above $1.42, a retest from the $1.50 to $1.55 resistance zone can be done.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.