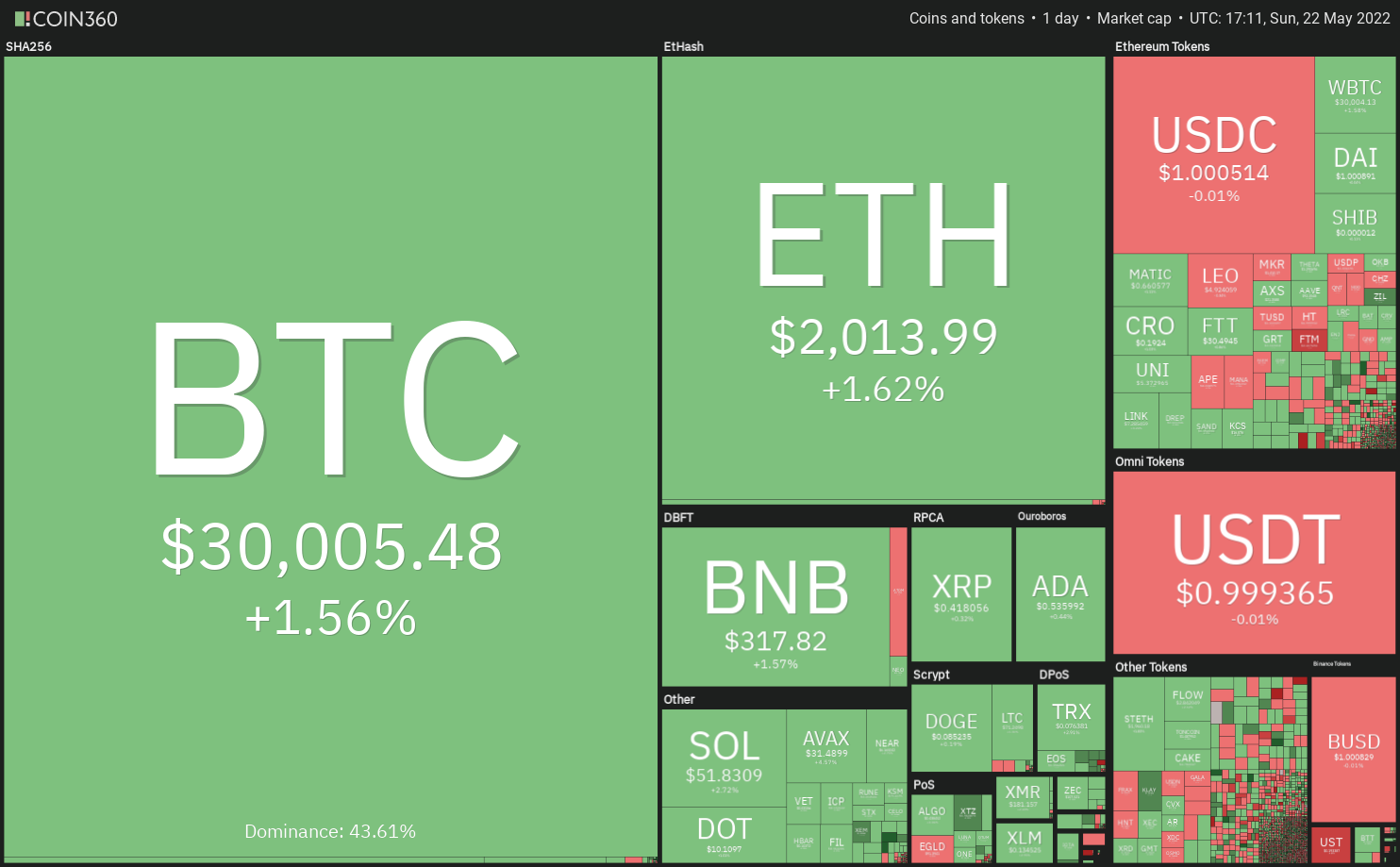

The Dow jones Johnson Industrial Average has declined for eight consecutive days, the very first such losing streak since 1923. On May 20, the S&P 500 briefly fell into bear market territory, indicating that traders still sell dangerous assets in anxiety about an economic depression.

Because of its tight correlation around equities markets, Bitcoin (BTC) has continued to be pressurized for a lot of days. The bulls are trying to push Bitcoin greater throughout the weekend and avert a level longer losing streak.

Bitcoin’s performance within the first five several weeks continues to be the worst since 2018, indicating that sellers have been in control. However, after several days of weakness, the crypto markets might be around the cusp of the bear market rally.

Do you know the critical levels that could signal the beginning of a sustained recovery? Let’s read the charts from the top-5 cryptocurrencies that could outshine soon.

BTC/USDT

Bitcoin rebounded from the crucial support at $28,630 on May 20, indicating strong buying near this level. The bulls are trying to push the cost over the downtrend line, which may be the first indication the selling pressure might be reducing.

Over the downtrend line, the BTC/Tether (USDT) pair could rise towards the 20-day exponential moving average (EMA) of $31,887. The bears will probably defend this level with vigor. When the cost turns lower in the 20-day EMA, the bears will once more attempt to sink the happy couple below $28,630.

When they manage to achieve that, the happy couple could drop to $26,700. It is really an important level to keep close track of just because a break and shut below it might open the doorways for any decline to $25,000 after which to $21,800.

On the other hand, if buyers thrust the cost over the 20-day EMA, the happy couple could chance a rally towards the 61.8% Fibonacci retracement level at $34,823. If the level is scaled, the happy couple could climb towards the 50-day simple moving average (SMA) of $37,289.

Some-hour chart implies that the cost gets squeezed between your downtrend line and $28,630. The 20-EMA and also the 50-SMA have flattened out and also the relative strength index (RSI) is simply over the midpoint suggesting an account balance between demand and supply.

This balance could tilt in support of buyers when they push and sustain the cost over the downtrend line. In the event that happens, the happy couple could start its northward march toward the 200-SMA.

On the other hand, when the cost turns lower in the current level, the bears will endeavour to sink the happy couple below $28,630 and gain top of the hands.

BNB/USDT

Binance Gold coin (BNB) retrieved dramatically in the critical support at $211 and it has arrived at the overhead resistance in the 20-day EMA of $323. It is really an important level for that bears to protect just because a break and shut above it might indicate that the bottom might be in position.

Over the 20-day EMA, the BNB/USDT pair could rally to $350 and after that towards the 50-day SMA of $376. This level could again behave as a stiff hurdle but when bulls thrust the cost above it, the happy couple could rally towards the 200-day SMA of $451.

Unlike this assumption, when the cost turns lower dramatically in the 20-day EMA, it’ll claim that bears haven’t yet quit plus they still sell at greater levels. The happy couple could then drop toward $211. When the cost rebounds off this level, the happy couple may consolidate between $211 and $320 for any couple of days.

The bulls are trying to push the cost over the overhead resistance at $320. When they succeed, the happy couple could rally toward $350. The bears will probably defend this level strongly. When the cost turns lower from $350, the happy couple could again drop to $320.

When the cost rebounds off this level, the happy couple could remain range-bound between $320 and $350 for a while. The bullish momentum could get over the 200-SMA and also the pair may rally to $380 and then to $400.

On the other hand, when the cost turns lower in the current level, the happy couple could drop to $286 after which to $272.

XMR/USDT

Monero (XMR) dropped underneath the strong support at $134 on May 12 however the bears couldn’t sustain the low levels. This means aggressive buying on dips. The cost has retrieved dramatically towards the 20-day EMA of $179.

If bulls push and sustain the cost over the 20-day EMA, the XMR/USDT pair could rise towards the overhead resistance zone between your 200-day SMA of $202 and also the 50-day SMA of $212. The bears are anticipated to mount a powerful defense within this zone

When the cost turns lower out of this zone, but bulls arrest the following decline in the 20-day EMA, it’ll advise a potential alternation in trend. On the other hand, when the cost turns lower in the current level, the bears will attempt to drag the happy couple to $150 and after that to $134.

Some-hour chart shows the development of greater lows and greater highs. The bears attempted to drag the cost underneath the 50-SMA however the bulls defended the amount effectively. This means a general change in sentiment from selling on rallies to purchasing on dips.

The happy couple could next rally towards the 200-SMA in which the bears offer a powerful resistance. If bulls overcome this barrier, the happy couple could rally to $225. Unlike this assumption, when the cost turns lower and breaks underneath the 50-SMA, the happy couple could slide to $150. A rest below this level could challenge the strong support at $134

Related: Dollar Cost Averaging or Lump-sum: Which Bitcoin strategy is most effective no matter cost?

ETC/USDT

Ethereum Classic (ETC) dropped dramatically from $52 on March 29 to $16 on May 12. The bulls are trying to begin a recovery that could face resistance in the 20-day EMA of $23.

When the cost turns lower in the 20-day EMA, the bears will again make an effort to resume the downtrend by pulling the ETC/USDT pair underneath the critical support at $16.

On the other hand, if buyers propel the cost over the 20-day EMA, it’ll suggest the beginning of a more powerful relief rally. The positive divergence around the RSI also suggests the potential of a recovery soon. The happy couple could then rise towards the 38.2% Fibonacci retracement level at $30, in which the bears may mount a powerful resistance.

The cost continues to be buying and selling between $19 and $23 for a while. This means the bulls are trying to form a greater low, however the bears still pose a powerful challenge at greater levels. The flattening 20-EMA and 50-SMA tendency to slack a obvious advantage with the idea to bulls or bears.

If buyers drive the cost above $23, it’ll suggest the beginning of a brand new up-move. The happy couple could first rally towards the 200-SMA after which to $33. Alternatively, when the cost turns lower and plummets below $19, the bears will gain top of the hands. They’ll then make an effort to sink the happy couple to $16.

MANA/USDT

Decentraland (MANA) switched lower in the 20-day EMA of $1.24 on May 16, however a positive sign would be that the bulls didn’t permit the cost to sustain underneath the mental degree of $1.00.

The buyers will once more make an effort to push the cost over the 20-day EMA. When they succeed, the MANA/USDT pair could rally towards the 50-day SMA of $1.72. The bears may again mount a stiff resistance only at that level but when bulls obvious this hurdle, the happy couple could start its northward march toward the 200-day SMA of $2.72.

Unlike this assumption, when the cost slips below $1.00, the bears will attempt to sink the happy couple towards the crucial support at $.60. A rest and shut below this level could start the following leg from the downtrend.

The happy couple is stuck between $.97 and $1.36, indicating that bulls are purchasing the dips below $1.00 and also the bears can sell on rallies. The 20-EMA and also the 50-SMA have flattened out, indicating the consolidation may go on for more time.

If buyers propel the cost over the 50-SMA, the happy couple could rise towards the resistance from the range at $1.36. The bullish momentum could get if buyers overcome this barrier. On the other hand, the bears could gain top of the hands when the cost turns lower and plummets underneath the support at $.97.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.