Regardless of the latest market downturn, greater than 50% of India’s survey respondents plan to expand their investments in crypto within the coming six several weeks – indicating an positive method of the marketplace, based on a study by crypto exchange KuCoin.

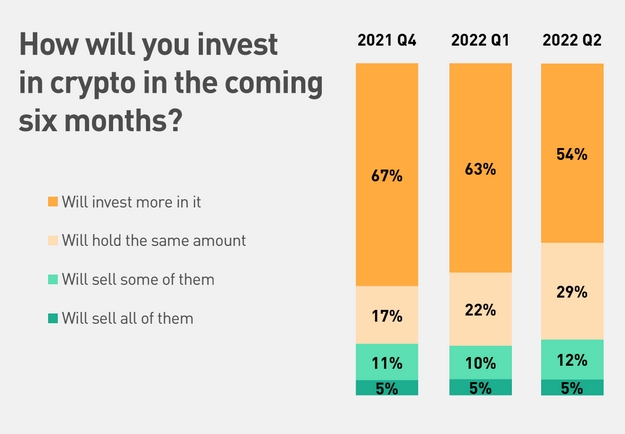

Data in the report implies that, within the second quarter of 2022, 54% of Indian investors were intending to invest much more of their in crypto within the coming six several weeks. This stated, the figure was less than the main one reported within the preceding quarter when 63% from the polled expressed exactly the same position.

One of the respondents in the second quarter of 2022, 29% stated they meant to preserve their existing crypto holdings, 12% responded they planned to market a number of them, and just 5% desired to sell these, based on the report.

As “of June 2022, you will find roughly 115 million crypto investors in India who either presently hold crypto and have traded crypto previously six several weeks, which take into account 15% from the Indian population aged 18 to 60,” KuCoin stated.

An additional 10% of Indian adults comprise crypto-curious consumers who’re aiming to purchase crypto within the next six several weeks, based on the report.

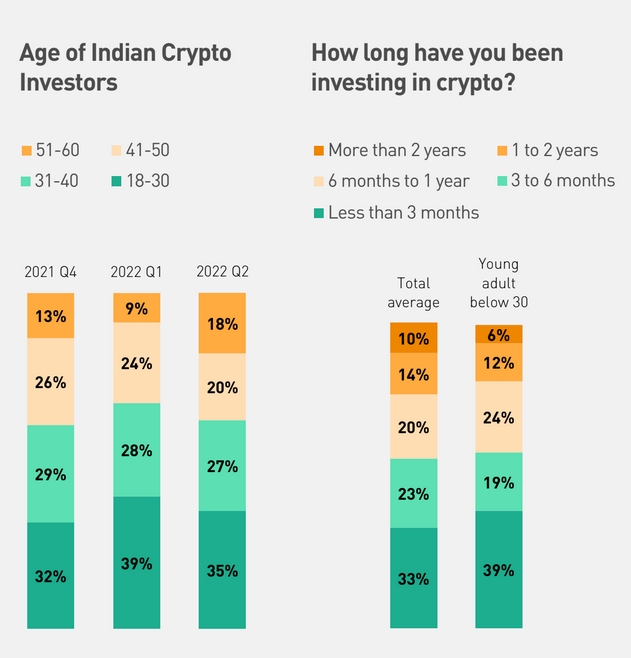

India’s crypto landscape is covered with youthful investors, with 39% of these below age 30. Per the report, youthful Indian crypto investors think that crypto is much more of the lengthy-term investment than the usual hype, contributing to 26% of these investors intend to launch a company by using their crypto gains.

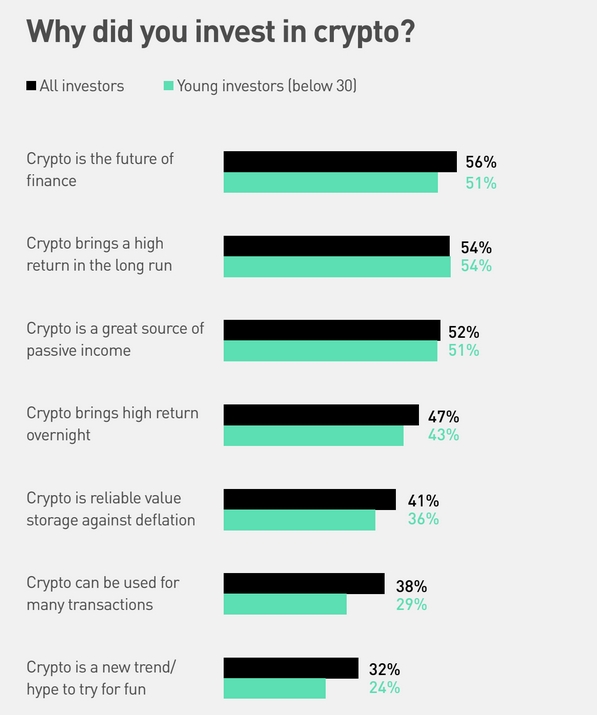

In addition, a lot of the respondents stated they committed to crypto since it is “the way forward for finance,” it “brings high return over time,” and it is “a great resource of passive earnings.”

The Indian crypto marketplace is forecast to achieve some USD 241m by 2030, and it is growth isn’t likely to be hampered through the latest fiscal decisions taken through the Indian government bodies, the exchange stated.

“Despite the ambiguity in rules and extreme volatility, youthful Indian investors choose to buy crypto as assets over gold,” based on KuCoin. “In April 2022, the Indian government enforced a 30% tax on earnings from virtual digital assets, which many skillfully developed required like a sign that crypto buying and selling will not be banned in the end. The federal government also stated it might launch an electronic rupee within the coming several weeks, that is set to provide a large boost towards the digital economy.”

It’s significant that, for a price of 30%, the tax on cryptoasset gains is greater compared to nation’s tax rate on stock buying and selling which varies from % to fifteenPercent. The government’s method of crypto may be the primary reason deterring potential investors, with 33% insisting that government regulation is an origin of concern when thinking about investing in cryptocurrencies.

Per KuCoin, the report is dependant on a complete sample of two,042 Indian adults aged 18 to 60. Laptop computer respondents were polled from October 2021 to June 2022 and incorporated 1,541 self-identifying crypto investors (who presently own crypto and have traded crypto previously six several weeks and continuously exchange the approaching six several weeks) and 501 crypto-curious consumers (who have been thinking about purchasing crypto within the coming six several weeks).

____

Find out more:

– Bollywood-like Drama Erupts as CZ Moves to Distance Binance from India’s WazirX Exchange

– One Exchange Sticks Out as Indian Crypto Buying and selling Drops Following New Tax

– One out of Seven Wealthy People Now Owns ‘Digital Assets’ – Survey

– 40% of Surveyed Lower-earnings Individuals Desire to use Bitcoin – Not to earn money

– 7 in 10 Retail and Institutional Investors Intend to Buy More Crypto, Bitstamp Survey Finds

– About 50% of Surveyed Crypto Proprietors Made Their First Buy in 2021 – Gemini