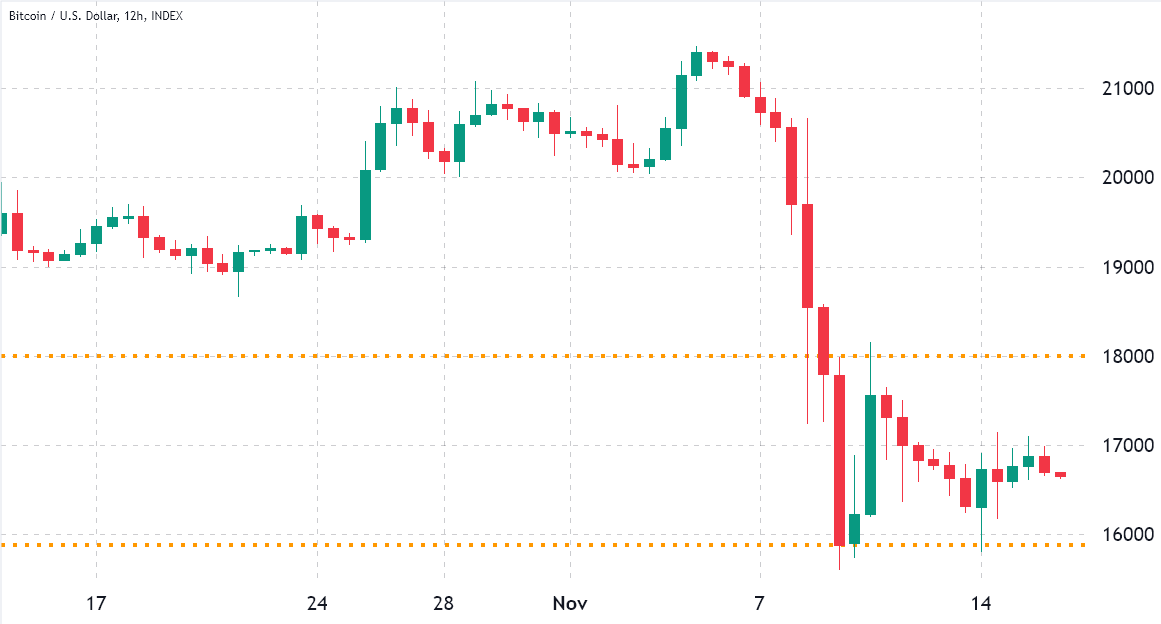

No-one can blame Bitcoin (BTC) bulls for putting bets at $20,000 and greater for that $600 million weekly options expiry on November. 18. In the end, this level had provided a good resistance since March. 25 and held for nearly two days.

However, the bottom scenario altered abruptly on November. 8 following a liquidity crisis stopped withdrawals around the FTX exchange. The movement surprised traders and also over a 48-hour timespan, over $290 million in leverage buyers were liquidated.

The marketplace rapidly adjusted towards the news, varying from $15,800 to $17,800 within the last 7 days. Right now, investors are scared that contagion risks might pressure other key players to market their cryptocurrency positions.

FTX held significant deposits from key industry players, so its demise meant other participants would also face substantial losses. For instance, BlockFi held a $400 million line of credit with FTX US. On November. 15, collateralized yield platform SALT disclosed significant losses in the FTX collapse and subsequently stopped withdrawals.

Similar occasions happened in the Japanese cryptocurrency exchange Liquid, growing the uncertainty level within the entire market.

The November. 18 options expiry is particularly relevant because Bitcoin bears can secure a $120 million gain suppressing BTC below $16,500.

Bulls placed their bets at $20,000 and greater

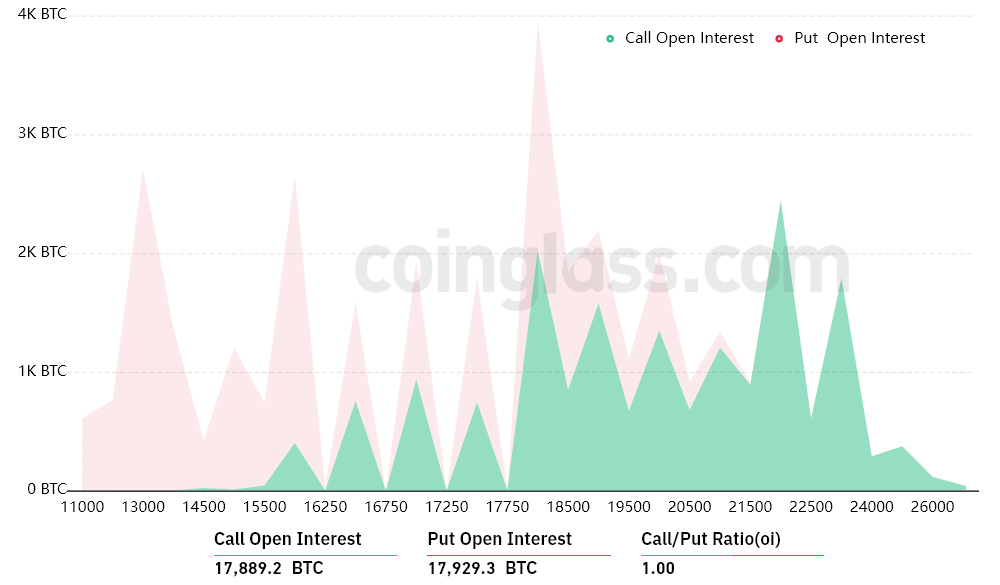

Outdoors interest for that November. 18 weekly options expiry is $600 million, however the actual figure is going to be lower since bulls were excessively-positive. These traders missed the objective, placing bearish bets at $18,000 and greater, while BTC was dumped following a FTX insolvency.

The Fir.00 call-to-put ratio shows the right balance between your $300 million put (sell) open interest and also the $300 million call (buy) options. Nonetheless, as Bitcoin stands near $16,500, most bullish bets will end up useless.

If Bitcoin’s cost remains below $17,500 at 8:00 am UTC on March. 21, only 10% of those call (buy) options is going to be available. This difference is really because the right to purchase Bitcoin at $18,000 or $19,000 is useless if BTC trades underneath the expiry cost.

Bulls require a pump above $18,000 to be released ahead

Here are the 4 probably scenarios in line with the current cost action. The amount of Bitcoin options contracts on November. 18 for call (bull) and set (bear) instruments varies, with respect to the expiry cost. The imbalance favoring both sides constitutes the theoretical profit:

- Between $15,500 and $16,500: 400 calls versus. 7,900 puts. The internet result favors the put (bear) instruments by $120 million.

- Between $16,500 and $17,500: 1,700 calls versus. 6,100 puts. The internet result favors the put (bear) instruments by $75 million.

- Between $17,500 and $18,000: 2,500 calls versus. 5,000 puts. The internet result favors the put (bear) instruments by $45 million.

- Between $18,000 and $18,500: 4,500 calls versus. 3,100 puts. The internet result favors the phone call (bull) instruments by $25 million.

This crude estimate views the put options utilized in bearish bets and also the call options solely in neutral-to-bullish trades. Nevertheless, this oversimplification disregards more complicated investment opportunities.

For instance, an investor might have offered a put option, effectively gaining positive contact with Bitcoin over a specific cost, but regrettably, there is no good way to estimate this effect.

Related: Bitcoin cost dips to $16.4K over Genesis woes as executives defend GBTC

BTC cost dips below $16,000 shouldn’t be surprising

Bitcoin bears have to push the cost below $16,500 to have a $120 million profit. The bulls’ best-situation scenario needs a 10% pump above $18,000 to switch the tables and score a $25 million gain.

Thinking about that Bitcoin margin and options instruments show low confidence in regaining the $18,500 support, probably the most likely outcome for Friday’s expiry favors bears. Bulls may be better offered by tossing within the towel and focusing on the November. 25 monthly options expiry.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.