Feb is ending, however the ‘Alameda Gap’ isn’t.

Because the second month of the year is overall, the costs within the crypto market have somewhat retrieved from last year’s crash. Still, the so-known as ‘Alameda Gap’ resists filling, because the liquidity remains not even close to the amount seen prior to the infamous FTX collapse.

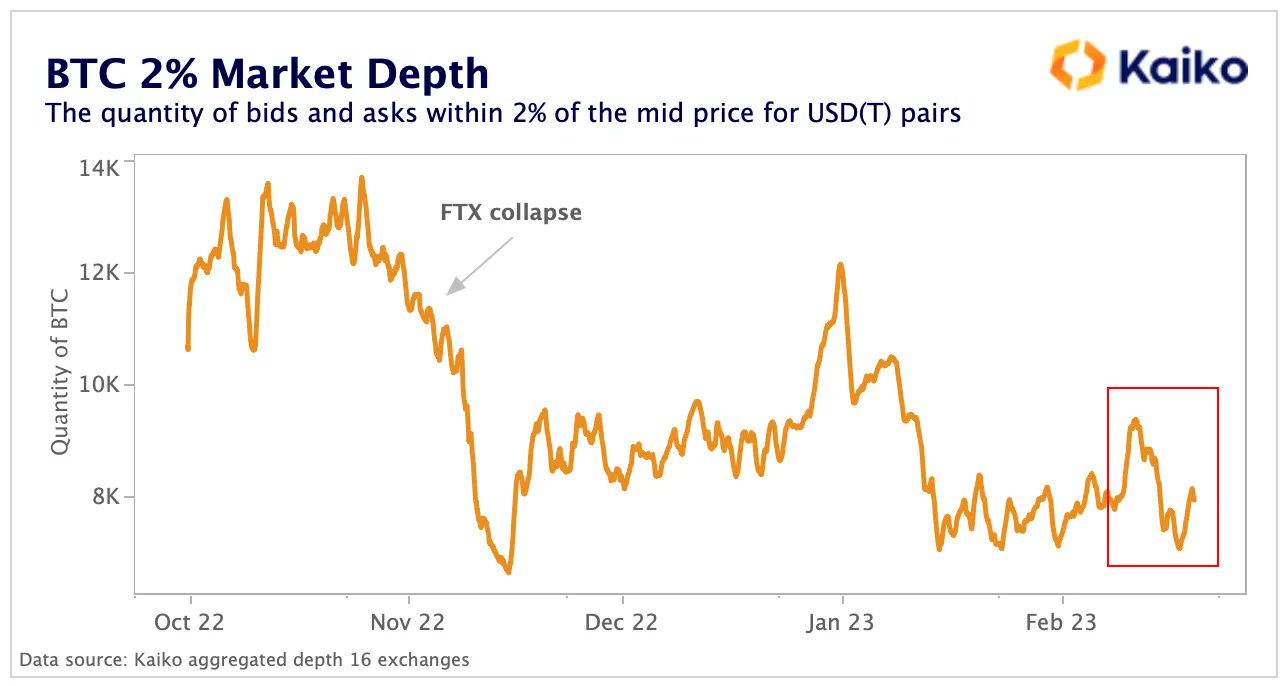

Investigator Kaiko tweeted this month too, the space persists, with bitcoin (BTC) “market depth still well below November levels.” It mentioned that,

“The amount of BTC-USD(T) bids and asks within 2% from the mid-cost aggregated on 16 exchanges hovered around 8k BTC in Feb — 40% under in October.”

Like a indication, the FTX exchange, and its parent company Alameda Research and numerous subsidiaries, declared personal bankruptcy in November this past year – which companies, combined with the founder Mike Bankman-Fried, happen to be coping with the regulatory and legal falout since (at the fee for you).

Kaiko noted the presence of the ‘Alameda Gap’ that exact same month, quarrelling that, typically, liquidity plunges occur in times of volatility as market makers hurry to handle risks.

“Crypto liquidity is covered with just a number of buying and selling firms, including Wintermute, Amber Group, B2C2, Genesis, Cumberland and (the now defunct) Alameda. With losing among the largest market makers, don’t be surprised a substantial stop by liquidity, which we’ll call the “Alameda Gap”,” it stated at that time.

Riyad Carey, research analyst at the organization, was quoted by Bloomberg on Friday as stating that,

“It isn’t just Alameda, even though they were among the greatest. Other market-makers required a success and therefore are being more careful. […] It truly depends upon the token, but I’d say there’s still a 20-40% gap from previous liquidity levels. When there’s less liquidity, we have a tendency to observe that costs are more volatile both in directions, that has been the situation previously couple several weeks.”

Strahinja Savic, mind of information and analytics at FRNT Financial, was quoted as stating that Three Arrows Capital (3AC), Celsius Network, “and various other crypto funds, both well-known and never,” have the effect of this gap. Therefore, the buying and selling volumes drop in the finish of 2022 can be tied to the “elimination” of those companies.

“These lenders might have policed spreads, keeping them away, and supported market depth,” however their fall led to “a rise in certain inefficiencies within the crypto market,” stated Savic.

“It is also caused by Genesis personal bankruptcy, and incurred losses for other market makers associated with both Genesis and FTX,” contended Vetle Lunde, senior analyst at K33 Research (formerly Arcane Research).

Traders aren’t back yet

Overall, based on Noelle Acheson, author from the “Crypto Is Macro Now” e-newsletter, thin liquidity shows that bigger traders aren’t during the market.

Acheson was quoted by Bloomberg as stating that,

“I’d expect the ongoing climb in volatility forever of the season to progressively lure a few of the large players into the market, because the lower levels in December-early The month of january might have made the marketplace simply not interesting enough to become worth time.”

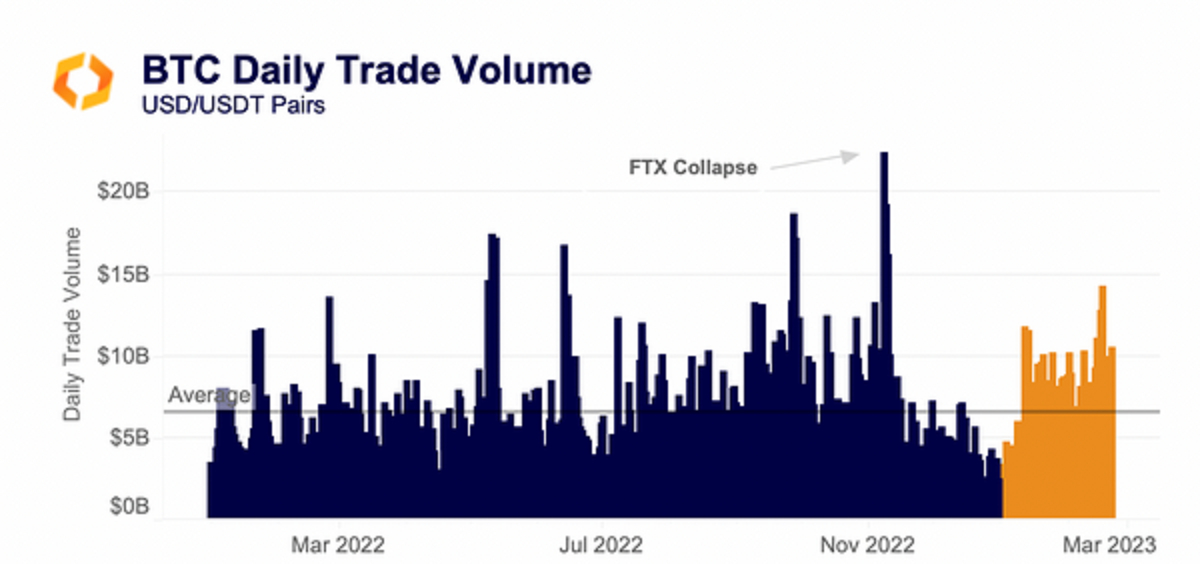

Meanwhile, in the weekly market overview, Kaiko mentioned that daily trade volume continues to be consistently greater this season. It fell to yearly lows in the finish of 2022, partially because of poor sentiment among retail after FTX’s collapse.

That stated, the sentiment appears to possess selected up “considerably” to date in 2023, with daily BTC volume crossing $14 billion during Feb, it stated.

The investigator added that,

“The general degree of volumes can also be greater compared to finish of 2022, apparently moored towards the $10bn daily volume number, instead of about 50 % that to shut this past year.”

Kaiko also noted that BTC and ETH market depth hit its cheapest point since May 2022. The “liquidity in native units ongoing falling a week ago, hitting its cheapest level because the Terra collapse,” it stated.

It added that BTC 2% market depth aggregated on 15 centralized exchages fell to six,800 BTC, lower almost three-fold since October’s highs. Market depth for ETH dropped close to 57,000 ETH, when compared with 139,000 ETH in October.

When it comes to prices, in November, BTC fell towards the $15,700 level, but has since rose to the current $23,283. At 10:00 UTC on Tuesday morning, it had been lower .5% per day and 6% previously week.

Simultaneously, ETC was buying and selling at $1,621, lower 1% during the last 24 hrs and 4.7% during the last seven days. This can be a significant rise since November 2022 if this had stepped to $1,095.

____

Find out more:

– FTX Founder Mike Bankman-Fried Faces More Criminal Charges – The Most Recent Twist inside a High-Profile Situation

– Report Claims Binance Commingled User Funds Much like FTX

– FTX Japan Crypto Exchange to Resume Withdrawals Today – Here’s What Is Happening

– $200 Million Galois Crypto Hedge Fund Shuts Lower as 1 / 2 of Assets Stuck on FTX Exchange – This is exactly what Happened