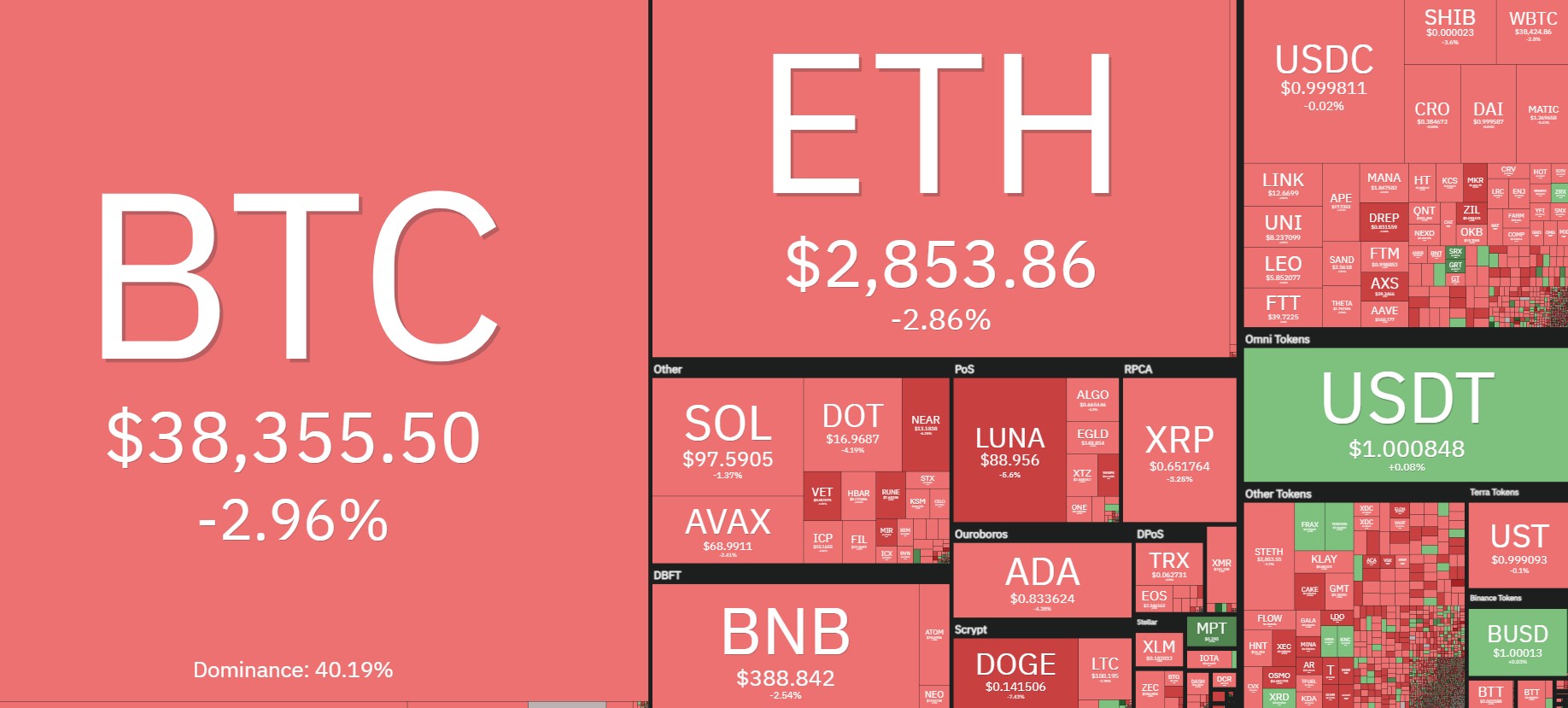

The cryptocurrency market and wider global markets fell pressurized on April 26 following the hype surrounding Elon Musk’s acquisition of Twitter started to fade and concerns concerning the condition from the global economy required the forefront again.

Tech-related stocks were a few of the hardest-hit assets on April 26 and this pullback was adopted by sharp declines in crypto prices as risk assets become persona non grata during these turbulent markets.

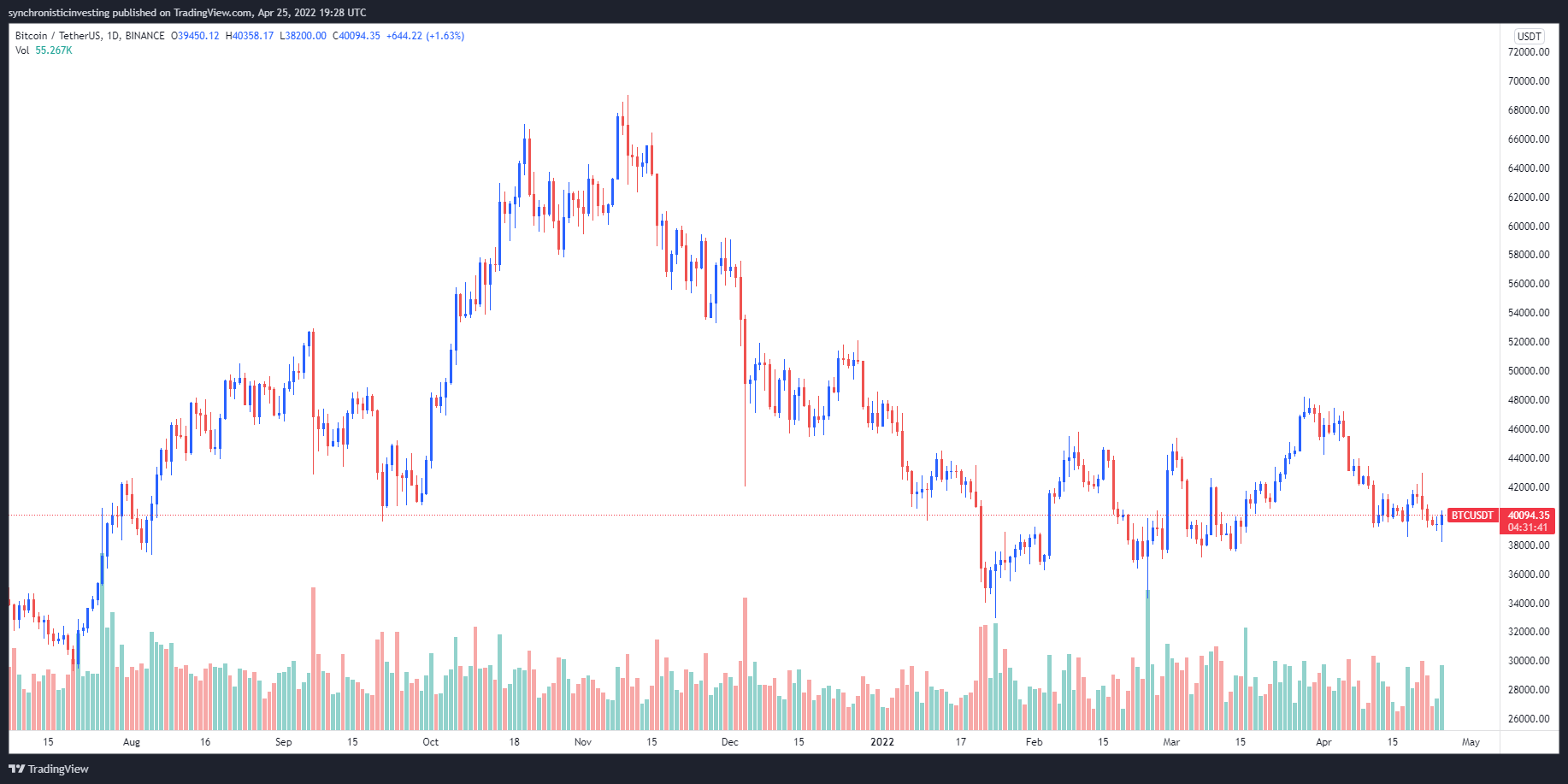

Data from Cointelegraph Markets Pro and TradingView implies that after holding support at $40,500 with the early buying and selling hrs on April 26, the cost of Bitcoin (BTC) dumped 6.21% in mid-day buying and selling hitting a minimal of $38,009.

April 26’s cost action looks to become a continuation from the weakness seen across markets this month, and month-to-date, the S&P 500 is lower by 7%, as the Nasdaq declined 11% and also the Dow jones is nursing a 3% loss.

The bearish trend in FAANG stocks has basically been fat loss which has pulled lower the broader market and also the recent 35% loss of the cost of Netflix on April 20 highlighted a significant kink within the “strong markets” narrative.

Bitcoin retests its macro range low

April 26’s sell-off within the cost of Bitcoin has brought many analysts to reiterate that we’re going to a bear market bottom, although not everybody has this type of dire outlook, including crypto analyst and pseudonymous Twitter user Rekt Capital, who published the next chart showing the cost retesting a significant support zone.

Rekt Capital stated:

“BTC is back in the lengthy-standing macro Greater Low support.”

Based on the analyst, BTC is constantly on the trade inside the range it’s been stuck in forever of the season and there’s still a powerful quantity of support within the lower $30,000 range.

Related: Bitcoin does not hold $40K with traders still wishing for any BTC cost relief bounce

Further understanding of the weakness across global markets are available by searching in the strong performance from the DXY, that is presently at its greatest cost in 2 years, according to crypto Twitter analyst Miles J Creative.

The analyst stated,

“Dollar entering the risk zone. Towards the moon or goblin town?”

The fate from the market will probably hinge about how the dollar performs continuing to move forward among rising inflation, ongoing logistics disruptions and also the global conflict in Europe.

The general cryptocurrency market cap now is $1.605 trillion and Bitcoin’s dominance rates are 45.5%.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.