The similarity in cost action between your crypto and traditional markets remains very good on May 10 as traders enjoyed a relief bounce across asset classes following a May 9 rout, which saw Bitcoin (BTC) briefly dip to $29,730.

Market downturns typically mean heavier losses in altcoins as a result of number of factors, including thinly traded assets and occasional liquidity, however this also means bigger bounces when a recovery ensues.

Several projects notched double-digit gains on May 10, together with a 15.75% gain for Maker (MKR), the protocol accountable for issuing the DAI (DAI) stablecoin, which likely taken advantage of the fallout from Terra (LUNA) and it is TerraUSD (UST) stablecoin.

Other notable gainers include Persistence (XPRT) and it is liquid staking token pSTAKE (PSTAKE), which experienced gains of 16.4% and 39.8% after Binance Labs revealed a proper purchase of the liquid staking platform. Polygon (MATIC) also bounced back with a 14.59% gain.

Correlation with traditional markets remains

Regardless of the broadly held thought that the crypto market would behave as a hedge to TradFi volatility, the correlation between Bitcoin and the stock exchange has continued to be full of 2022.

Contrary, the volatility usually connected using the cryptocurrency market has started to rear its ugly mind in traditional markets, as evidenced through the cost action for that Dow jones Johnson Industrial Average on May 10, which rose greater than 500 points simply to hand back during the time of writing.

The Nasdaq and S&P 500 have fared just a little better, notching gains of .9% and 1.92%, correspondingly.

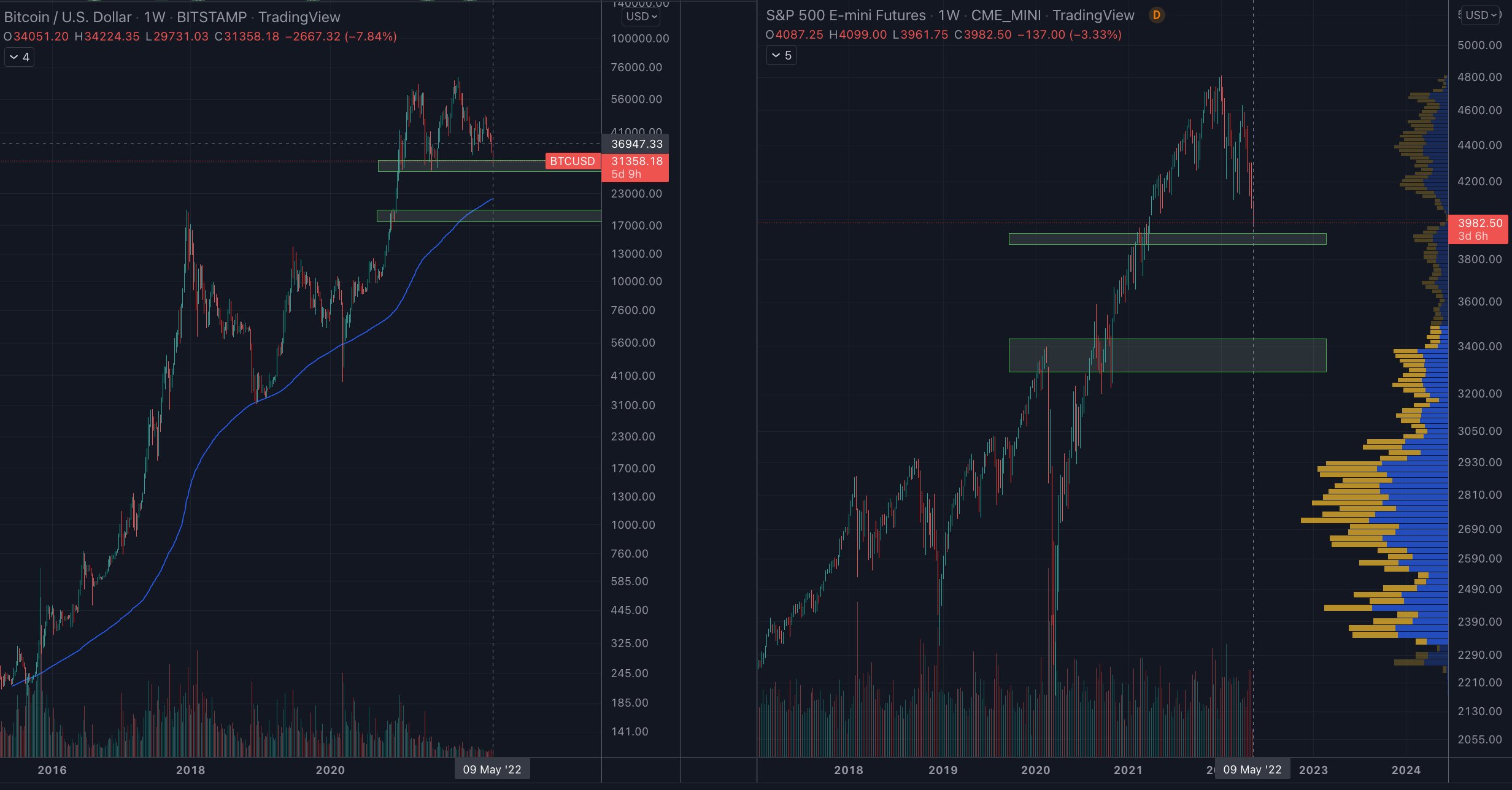

Further evidence to aid a correlation between crypto and traditional markets was supplied by Bitcoin analyst Willy Woo, who published the next chart noting that “Fundamentals [are] going for a back seat to fear driven buying and selling.”

Willy Woo stated,

“What I’m sure is we’re not buying and selling BTC, we’re buying and selling macro and equities. Right pane is SPX support, that will determine BTC directionality, left pane may be the equivalent BTC support.”

Related: Michael Saylor assuages investors after market slumps hurts $MSTR, $BTC

The S&P 500 could drop much further

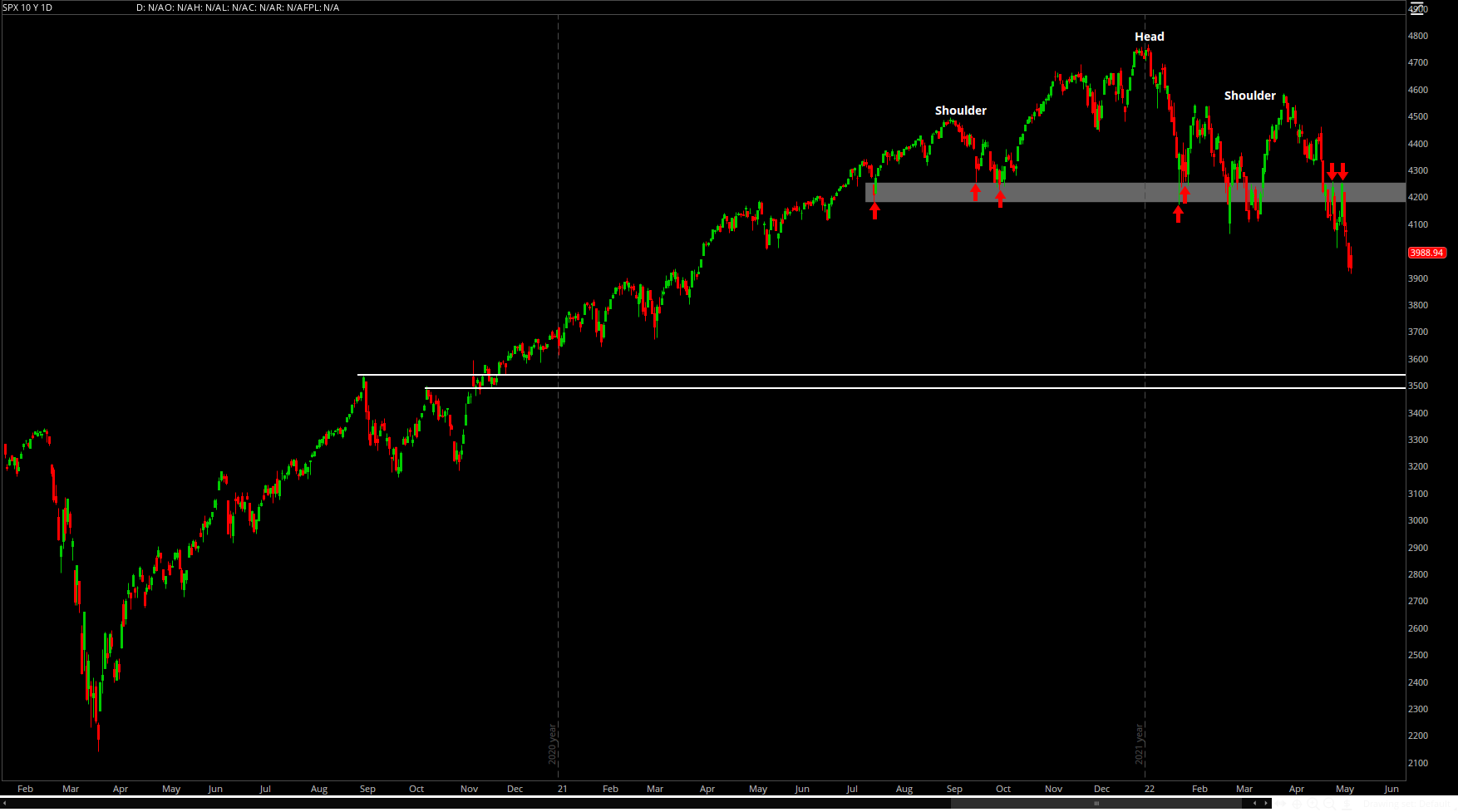

While May 10’s relief rally sent crypto and stock values greater, market analyst Caleb Franzen published the next chart warning in regards to a bearish mind and shoulders formation around the S&P 500 chart that could cause losing another 500 points.

Franzen stated,

“Hard to choose downside targets after my $4,000 call got hit, however i think probably the most LIKELY support zone is lower around $3,530–$3,590. This is actually the white-colored resistance vary from September–October 2020.”

The general cryptocurrency market cap now is $1.444 trillion and Bitcoin’s dominance rates are 41.5%.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.